It was a strong start to the week as the benchmark indices rallied a percent each on January 10, with the beginning of December 2021 quarter earnings season. The broader markets also joined the rally with the Nifty Midcap 100 and Smallcap 100 indices rising 0.84 percent and 1.28 percent, respectively.

The BSE Sensex jumped 650.98 points to close at 60,395.63, while the Nifty50 closed above crucial 18,000 mark, rising 190.60 points to 18,003.30, and formed bullish candle on the daily charts, backed by banking & financials, auto and select metals & IT stocks.

"A long bull candle was formed on the daily chart with gap up opening. Technically, this pattern indicate sharp upside bounce in the market after a small dip. The smaller degree of higher highs and higher lows continued on the daily chart and Thursday's swing low of 17,655 could now be considered as a new higher low of the sequence. The initial overhead resistance of 17,950 has been broken on the upside and Nifty closed above it," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the next upside levels to be watched around 18,200-18,350, which could be achieved in one week. "Immediate support is placed at 17,870 levels."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,915.87, followed by 17,828.43. If the index moves up, the key resistance levels to watch out for are 18,054.07 and 18,104.84.

Nifty Bank

The Nifty Bank jumped 608.30 points or 1.61 percent to 38,347.90 on January 10. The important pivot level, which will act as crucial support for the index, is placed at 38,051.4, followed by 37,754.9. On the upside, key resistance levels are placed at 38,522.4 and 38,696.9 levels.

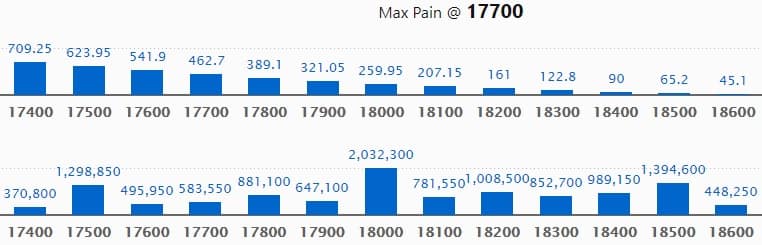

Call option data

Maximum Call open interest of 20.32 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the January series.

This is followed by 18500 strike, which holds 13.94 lakh contracts, and 17500 strike, which has accumulated 12.98 lakh contracts.

Call writing was seen at 18400 strike, which added 3.3 lakh contracts, followed by 18600 strike which added 1.55 lakh contracts, and 18700 strike which added 1.09 lakh contracts.

Call unwinding was seen at 18300 strike, which shed 3.12 lakh contracts, followed by 17800 strike which shed 1.11 lakh contracts and 17500 strike which shed 97,900 contracts.

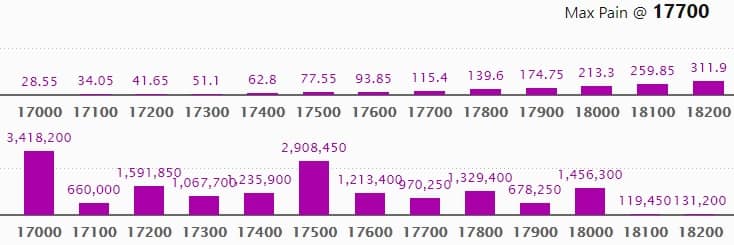

Put option data

Maximum Put open interest of 34.18 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the January series.

This is followed by 17500 strike, which holds 29.08 lakh contracts, and 17200 strike, which has accumulated 15.91 lakh contracts.

Put writing was seen at 18000 strike, which added 4.31 lakh contracts, followed by 17800 strike, which added 3.06 lakh contracts, and 17900 strike which added 2.71 lakh contracts.

Put unwinding was seen at 17500 strike, which shed 2.15 lakh contracts, followed by 17100 strike which shed 39,350 contracts.

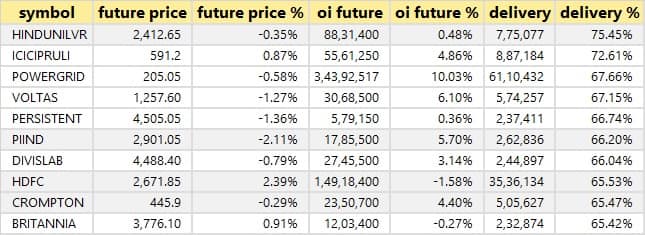

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

83 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

10 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

42 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

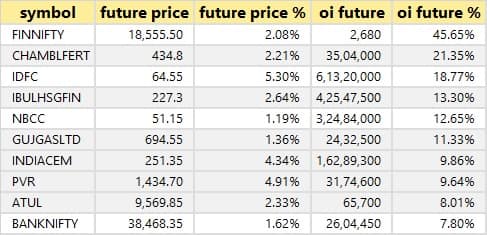

64 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

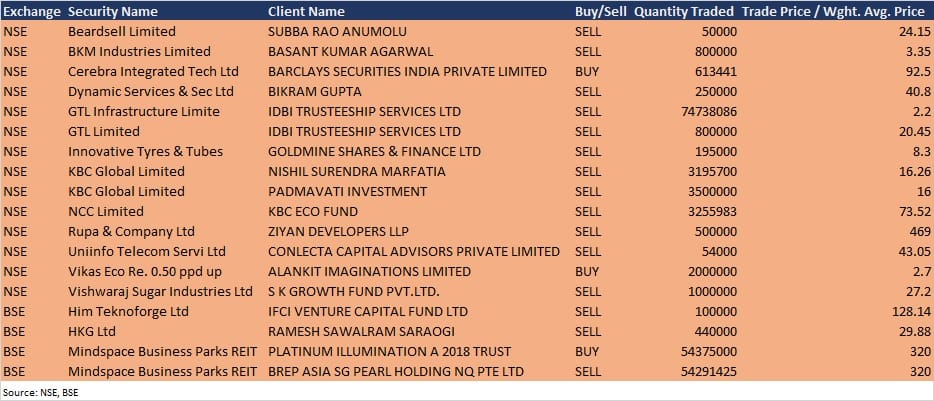

Bulk deals

Cerebra Integrated Technologies: Barclays Securities India acquired 6,13,441 equity shares in the company at Rs 92.5 per share on the NSE, the bulk deals data showed.

NCC: KBC ECO FUND sold 32,55,983 equity shares in the company at Rs 73.52 per share on the NSE, the bulk deals data showed.

Mindspace Business Parks REIT: Platinum Illumination A 2018 Trust bought 5,43,75,000 units in the REIT at Rs 320 per unit, however, BREP Asia SG Pearl Holding NQ Pte Ltd sold 5,42,91,425 units at Rs 320 per unit on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 11

Results on January 11: Delta Corp, Atharv Enterprises, Danube Industries, Earum Pharmaceuticals, Ganesh Housing Corporation, Gayatri Tissue & Papers, Hathway Bhawani Cabletel & Datacom, Integra Garments And Textiles, JTL Infra, Katare Spinning Mills, Madhusudan Industries, National Standard (India), NR International, Radhe Developers, Sanathnagar Enterprises, and Vikas Proppant & Granite will release quarterly earnings on January 11.

Renaissance Global: The company's officials will meet Wealthmills Securities on January 11.

Chemcon Speciality Chemicals: The company's officials will attend HDFC Conference on January 11.

Allcargo Logistics: The company's officials will meet Stewart Investors, and Dymon Asia on January 11.

Infibeam Avenues: The company's officials will meet Abakkus Asset Manager LLP, and Ashika Group on January 11.

Max Healthcare Institute: The company's officials will participate in the Global Healthcare Conference on January 12.

Amber Enterprises: The company's officials will attend Credit Suisse Conference on January 12.

Delta Corp: The company's officials will meet analysts and investors on January 12, to discuss financial results.

Camlin Fine Sciences: The company's officials will attend HDFC Conference on January 12-13.

Ceat: The company's officials will meet investors and analysts on January 20, to discuss financial results.

Polycab India: The company's officials will meet investors and analysts on January 21, to discuss financial results.

TeamLease Services: The company's officials will meet investors on January 25 to discuss Q3FY22 results.

Stocks in News

Unichem Laboratories: Porinju Veliyath-owned Equity Intelligence India Pvt Ltd acquired 54,850 equity shares in the company via open market transactions, increasing shareholding to 5.01% from 4.93% earlier.

Antony Waste Handling Cell: Total operating revenue (tipping revenue from C&T, mechanical power sweeping and waste processing) for Q3 FY22 has improved by approximately 22% YoY, and on a sequential basis, has remained stable.

Indo Count Industries: ICRA has upgraded credit rating for the company's long term bank facilities and reaffirmed credit rating for the short term bank facilities.

5paisa Capital: The compay reported consolidated profit at Rs 0.74 crore in Q3FY22 against Rs 3.18 crore in Q3FY21, revenue jumped to Rs 80.05 crore from Rs 49.56 crore YoY.

One 97 Communications (Paytm): Number of loans disbursed through its platform increased by 401% YoY to 0.44 crore loans in Q3FY 2022. In Q3 FY 2022, the value of loans disbursed through platform was Rs 2,180 crore (run-rate of $1.2 billion), an increase of 365% YoY. The company has seen stellar growth in each of the lending products, i.e. Paytm Postpaid (Buy-Now-Pay-Later), Personal Loans and Merchant Loans.

Gravita India: The company approved fund raising of Rs 300 crore.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 124.23 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 481.55 crore in the Indian equity market on January 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Indiabulls Housing Finance, Delta Corp and RBL Bank - are under the F&O ban for January 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!