The market started off the week on a strong note as the benchmark indices rallied nearly 1 percent on October 4, after correction in previous four consecutive sessions. All sectors participated in the rally, with Metals, Pharma, Banking & Financials, and IT being leading drivers.

The BSE Sensex climbed 533.74 points to close at 59,299.32, while the Nifty50 jumped 159.30 points to 17,691.30 and formed bullish candle on the daily charts.

"After retreating sharply in the previous four sessions, buying resumed on the street on the back of mixed global market cues. Technically, one more time the Nifty took support near the 20-day SMA and reversed sharply. The index has formed a promising reversal formation which is broadly positive," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

He further said the 17,600 level or 20-day SMA would act as a crucial support level for the day trader. "Above the same, the uptrend momentum is likely to continue up to 17,800-17,850 levels, while below 17,600 the uptrend would be vulnerable."

The outperformance by broader markets continued with the Nifty Midcap 100 and Smallcap 100 indices rising 1.6 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,598.03, followed by 17,504.87. If the index moves up, the key resistance levels to watch out for are 17,767.63 and 17,844.07.

Nifty Bank

The Nifty Bank also joined the party, rising 353.80 points or 0.95 percent to 37,579.70 on October 4. The important pivot level, which will act as crucial support for the index, is placed at 37,399.9, followed by 37,220.2. On the upside, key resistance levels are placed at 37,715.0 and 37,850.4 levels.

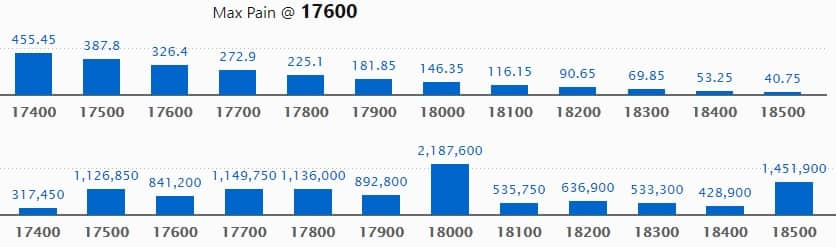

Call option data

Maximum Call open interest of 21.87 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the October series.

This is followed by 18500 strike, which holds 14.51 lakh contracts, and 17700 strike, which has accumulated 11.49 lakh contracts.

Call writing was seen at 18000 strike, which added 2.3 lakh contracts, followed by 18500 strike, which added 2.09 lakh contracts and 17700 strike which added 1.83 lakh contracts.

Call unwinding was seen at 17500 strike, which shed 1.26 lakh contracts, followed by 17600 strike, which shed 20,900 contracts, and 17300 strike which shed 15,300 contracts.

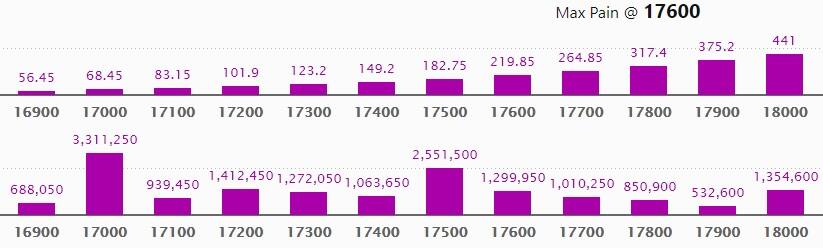

Put option data

Maximum Put open interest of 33.11 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the October series.

This is followed by 17500 strike, which holds 25.51 lakh contracts, and 17200 strike, which has accumulated 14.12 lakh contracts.

Put writing was seen at 17000 strike, which added 3.2 lakh contracts, followed by 17600 strike which added 2.9 lakh contracts and 17400 strike which added 1.48 lakh contracts.

Put unwinding was seen at 17900 strike, which shed 23,800 contracts, followed by 18100 strike which shed 6,700 contracts.

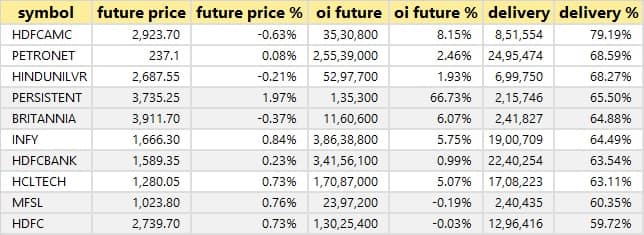

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

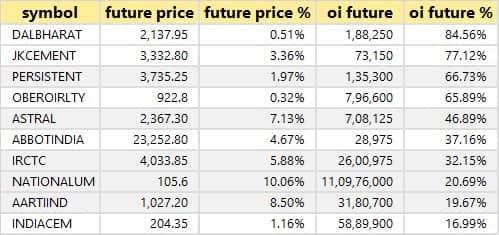

91 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

6 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 6 stocks in which long unwinding was seen.

31 stocks saw short build-up

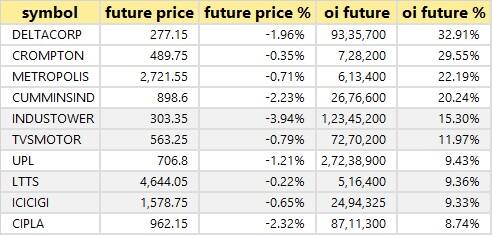

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

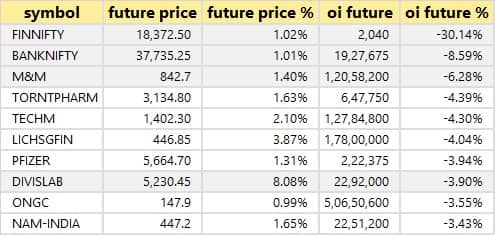

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Banswara Syntex: Cofipalux Invest SA acquired 1.7 lakh equity shares in the company at Rs 168.35 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Safari Industries India: The company's officials will meet Batlivala & Karani Securities India on October 5.

Clean Science and Technology: The company's officials will meet William Blair on October 5, and JP Morgan on October 7.

Stove Kraft: The company's officials will interact with analysts and investors on October 6.

Nazara Technologies: The company's officials will meet Napean Capital on October 7.

Angel Broking: The company's officials will meet analysts and investors on October 21, to discuss financial results.

Nippon Life India Asset Management: The company's officials will meet analysts on October 26 to discuss financial results.

Stocks in News

Rail Vikas Nigam: The company has entered into an Memorandum of Understanding with Tata Steel in connection with implementation of infrastructure projects either on nomination basis as a deposit work or through the special purpose vehicle (SPV) route subject to bankability of the SPV project, execution of definitive agreement and management approval.

Gokaldas Exports: The company launched its qualified institutional placement issue on October 4. The floor price has been fixed at Rs 194.58 per share.

Gufic Biosciences: The company has approved the proposal for increasing capital expenditure to the tune of Rs 200 crore out of which around Rs 180 crore is proposed to be utilized for setting up of the new manufacturing unit and balance Rs 20 crore for setting up the research & development facility, both in Indore, Madhya Pradesh.

Elpro International: MetLife International Holdings, LLC has entered into a share purchase agreement with IGE (India) and Elpro International to acquire their total combined shareholding of 15.27% in PNB MetLife India Insurance Company.

JSW Energy: The company has signed a contract with Senvion India, a leading manufacturer of wind turbines, for procurement of 591 MW of onshore wind turbines for the company's under-construction pipeline of renewable energy projects.

ICICI Lombard General Insurance: French insurance firm Axa S.A., to sell around 175 crore shares of ICICI Lombard via block deal on October 5.

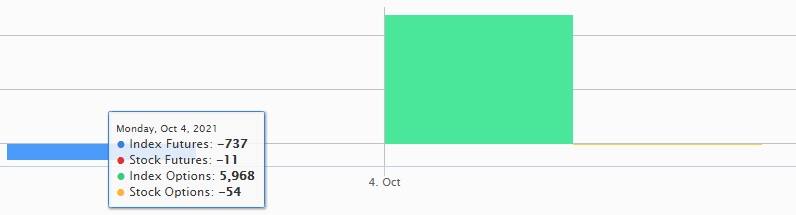

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 860.50 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 228.06 crore in the Indian equity market on October 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for October 5. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!