The market started off the week on a negative note on October 26 as the benchmark indices as well as broader markets corrected more than 1 percent amid weak global cues, rising coronavirus infections in the United States and Europe, and delay in US stimulus package.

The Nifty Metal and Auto corrected the most, down 3.5 percent and 3.2 percent respectively, while Bank, IT and Pharma were down 1-1.65 percent.

The BSE Sensex plunged 540 points or 1.33 percent to close at 40,145.50, while the Nifty50 fell 162.60 points or 1.36 percent to 11,767.80 and formed a large bearish candle on the daily charts.

"A long bear candle was formed with minor lower shadow. Technically, this pattern reiterates a presence of key overhead resistance around 12,000 mark, but the market has managed to close above the immediate support of 20 period EMA at 11,736," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The formation of long-range negative candles have failed to show sharp follow-through weakness in the market in recent times. Hence, the formation of the long-range bear candle of Monday is expected to bring bulls back into action from current levels or from the lows as happened in the past. The important lower support is placed around 11,650-11,600 levels (intermediate trend line-weekly chart)," he said.

"The short term trend of Nifty seems to have reversed from the highs, but the near-term trend status of the market remains rangebound around 12,000-11,650 levels," he added.

On the broader markets front, the Nifty Midcap index was down 1.7 percent and Smallcap down 1 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,672.07, followed by 11,576.33. If the index moves up, the key resistance levels to watch out for are 11,903.17 and 12,038.53.

Nifty Bank

The Bank Nifty fell 402.80 points 1.65 percent to close at 24,075.50 on October 26. The important pivot level, which will act as crucial support for the index, is placed at 23,769.7, followed by 23,464. On the upside, key resistance levels are placed at 24,479.2 and 24,883.

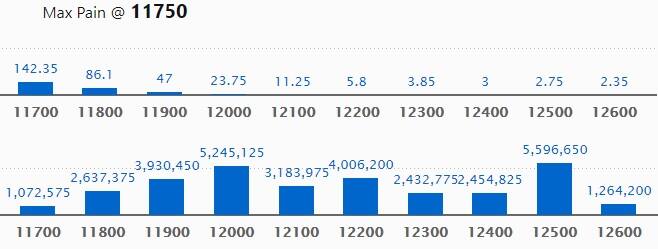

Call option data

Maximum Call open interest of 55.96 lakh contracts was seen at 12,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000 strike, which holds 52.45 lakh contracts, and 12,200 strike, which has accumulated 40.06 lakh contracts.

Call writing was seen at 11,900 strike, which added 19.19 lakh contracts, followed by 12,000 strike which added 14.62 lakh contracts and 11,800 strike which added 12.27 lakh contracts.

Call unwinding was seen at 11,500 strike, which shed 98,700 contracts, followed by 11,400 strike, which shed 40,875 contracts.

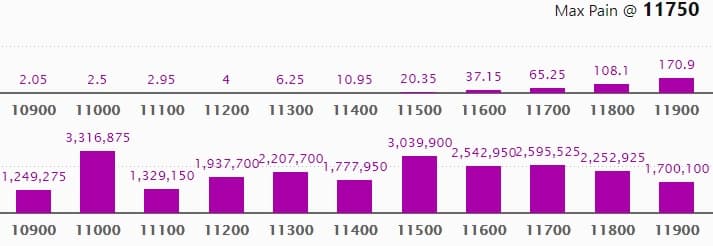

Put option data

Maximum Put open interest of 33.16 lakh contracts was seen at 11,000 strike, which will act as crucial support in the October series.

This is followed by 11,500 strike, which holds 30.39 lakh contracts, and 11,700 strike, which has accumulated 25.95 lakh contracts.

Put writing was seen at 11,400 strike, which added 3.26 lakh contracts, followed by 11,700 strike, which added 3.05 lakh contracts and 11,600 strike which added 1.97 lakh contracts.

Put unwinding was witnessed at 11,900 strike, which shed 7.22 lakh contracts, followed by 12,000 strike which shed 3.99 lakh contracts and 11,800 strike, which shed 3.63 lakh contracts.

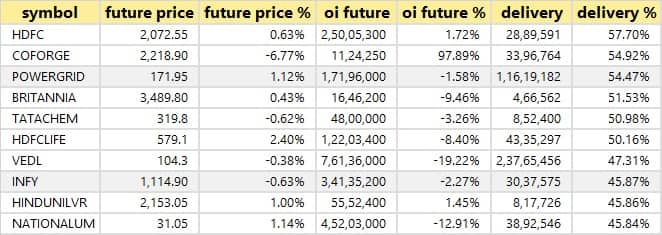

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

9 stocks saw long build-up

Based on the open interest future percentage, here are 9 stocks in which long build-up was seen.

58 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

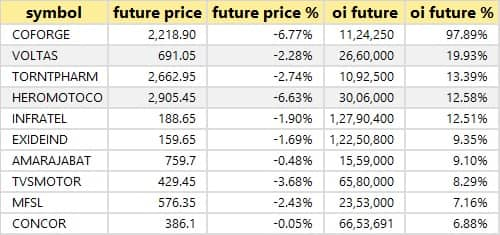

58 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

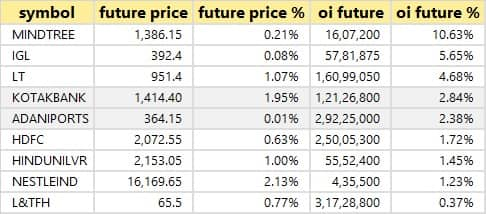

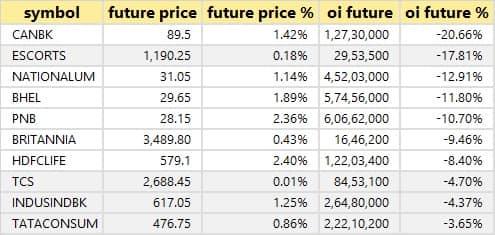

13 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

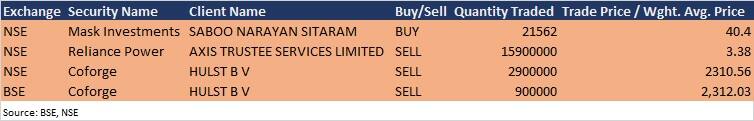

Bulk deals

(For more bulk deals, click here)

Results on October 27

Bharti Airtel, Tata Motors, Amara Raja Batteries, Castrol India, Ceat, ICICI Prudential Life Insurance Company, JM Financial, Man Industries, Mangalam Organics, Nippon Life India Asset Management, Sanofi India, SKF India, Suven Life Sciences and VST Industries are among 37 companies to announce quarterly earnings on October 27.

Stocks in the news

Finolex Industries: The company reported a higher profit at Rs 122.8 crore in Q2FY21 against Rs 102.3 crore, revenue increased to Rs 585.8 crore from Rs 576.7 crore YoY.

M&M Financial: The company reported a higher profit at Rs 303.5 crore in Q2FY21 against Rs 251.8 crore, AUM increased to Rs 81,682 crore from Rs 72,732 crore YoY.

Torrent Pharma: The company reported profit at Rs 310 crore in Q2FY21 compared to Rs 244 crore, revenue rose to Rs 2,017 crore from Rs 2,005 crore YoY.

NTPC: The company will consider share buyback on November 2.

Indian Railway Catering and Tourism Corporation: The government has appointed merchant bankers for a period of three years for disinvestment of stake in IRCTC through an offer for sale.

Angel Broking: The company reported profit at Rs 74.5 crore in Q2FY21 against Rs 19.2 crore, revenue jumped to Rs 309.8 crore from Rs 171.8 crore YoY.

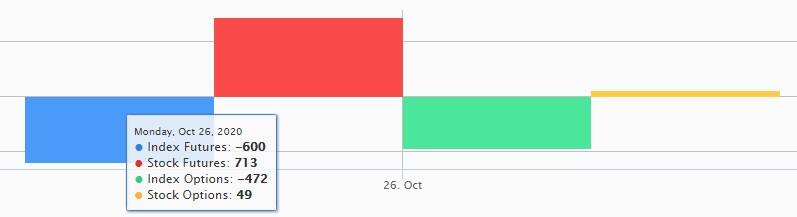

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 119.42 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 979.16 crore in the Indian equity market on October 26, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Five stocks - Coforge, Escorts, Vodafone Idea, NALCO and Vedanta - are under the F&O ban for October 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!