The market rebounded smartly in late trade and closed higher for yet another session, continuing the higher-high formation on the Nifty50 for the fourth day in a row. Also, the index held above the downward-sloping resistance trendline. Hence, the index can possibly start marching towards the 19,700-19,750 area in coming sessions, with immediate support at 19,500-19,400 levels, experts said.

The BSE Sensex climbed 100 points to 65,881, while the Nifty50 rose 36 points to 19,611 amid volatility and formed a bullish candlestick pattern with a long lower shadow and minor upper shadow on the daily charts.

Technically, this pattern reflects high volatility in the market. The upside breakout of trend line resistance remains intact.

Hence, "the short-term trend of the Nifty continues to be positive. One may expect further upside in the coming sessions and any dips down to the support of 19,500 is likely to be a buy-on-dips opportunity," Nagaraj Shetti, technical research analyst at HDFC Securities said.

The next upside levels to be watched are around 19,800, he feels.

The broader markets saw consolidation after a recent sharp upside, but closed higher with moderate gains, while the volatility continued to slide, with the India VIX declining by 1.27 percent from 10.82 to 10.68 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,524 followed by 19,490 and 19,435. On the flip side, 19,635 can act as the key resistance followed by 19,669 and 19,725.

On September 6, the Bank Nifty closed yet another session on a negative note, falling 123 points to 44,409, but has taken a support at 44,200 and formed bearish candlestick pattern with long lower shadow & minor upper shadow on the daily scale, indicating heightened volatility.

"The prevailing sentiment leans towards a negative-to-sideways bias, with the index closing below a crucial moving average. The RSI (relative strength index) is on the verge of forming a bearish crossover, indicating potential weakness," Rupak De, senior technical analyst at LKP Securities said.

In the short term, he feels the index is expected to decline towards 44,000, with resistance at 44,600. Sustained trading above this level could propel the index towards 45,000 and beyond, he said.

Selling on rallies seems to be the favoured strategy for traders in the Bank Nifty, unless the index provides a clear and decisive breakout above 45,000, he advised.

As per the pivot point calculator, the Bank Nifty is expected to take support at 44,257 followed by 44,169 and 44,028. On the upside, the initial resistance is at 44,539 then 44,626 and 44,768.

As per the options data, the maximum weekly Call open interest (OI) stood at 19,700 strike, with 1.25 crore contracts, which can act as a key resistance for the Nifty. It was followed by 19,600 strike, which had 1.02 crore contracts, while 19,800 strike had 89.94 lakh contracts.

The maximum Call writing was seen at 19,700 strike, which added 47.59 lakh contracts, followed by 19,800 and 19,600 strikes, which added 24.26 lakh and 14.87 lakh contracts.

The maximum Call unwinding was at 19,500 strike, which shed 21.65 lakh contracts, followed by 19,400 strike and 20,500 strike, which shed 6.28 lakh contracts, and 4.16 lakh contracts.

On the Put side, the maximum open interest was at 19,500 strike, with 1.33 crore contracts. This can be an important support for Nifty in the coming sessions.

It was followed by 19,400 strike, comprising 1.27 crore contracts, and 19,600 strike with 84.59 lakh contracts.

The maximum Put writing was at 19,600 strike, which added 37.75 lakh contracts, followed by 19,400 strike and 19,200 strike, which added 23.89 lakh and 16.64 lakh contracts.

Meaningful Put unwinding was at 19,100 strike, which shed 13.5 lakh contracts followed by 18,900 and 18,600 strikes, which shed 7.3 lakh and 5.4 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Infosys, InterGlobe Aviation, Larsen & Toubro, Ashok Leyland, and Cholamandalam Investment & Finance were among the stocks with the highest delivery.

The long build-up was seen in 63 stocks including Lupin, United Spirits, Mahanagar Gas, Chambal Fertilisers, and Glenmark Pharma. An increase in open interest (OI) and price indicates a build-up of long positions.

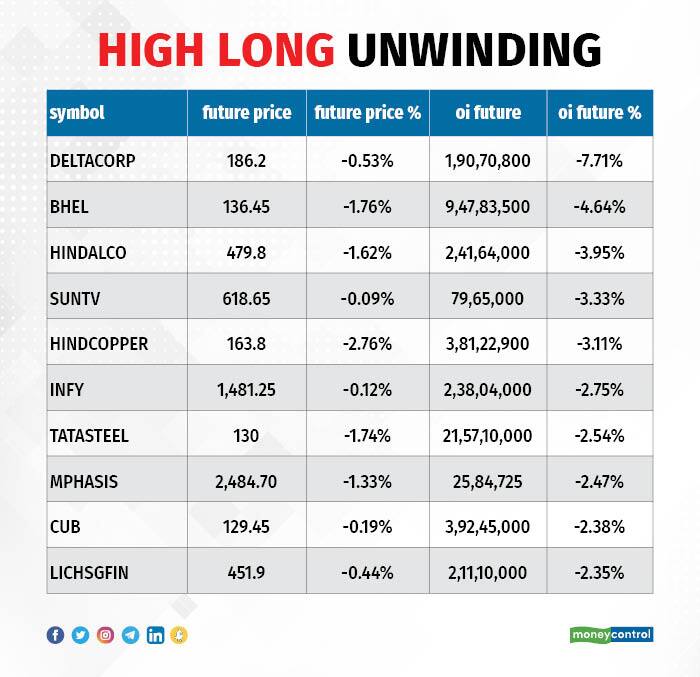

Based on the OI percentage, 30 stocks, including Delta Corp, BHEL, Hindalco Industries, Sun TV Network, and Hindustan Copper saw long unwinding. A decline in OI and price indicates long unwinding.

51 stocks see a short build-up

A short build-up was seen in 51 stocks, including L&T Technology Services, JK Cement, GNFC, Axis Bank, and Punjab National Bank. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 38 stocks were on the short-covering list. These included SRF, Balrampur Chini Mills, Oracle Financial, ABB India, and Bosch. A decrease in OI along with a price increase is an indication of short-covering.

(For more bulk deals, click here)

Investors meeting on September 7

Stocks in the news

Lupin: The pharma major has announced a collaboration with Mark Cuban Cost Plus Drug Company, and the COPD Foundation, dedicated to enhancing the lives of COPD patients. This collaboration aims to bolster access to healthcare by expanding the availability of Tiotropium Bromide Inhalation powder, 18 mcg/capsule, to COPD (chronic obstructive pulmonary disease) patients in the US. Lupin’s Tiotropium Bromide Inhalation Powder is currently the only generic product available that is therapeutically equivalent to Spiriva HandiHaler by Boehringer Ingelheim Pharmaceuticals, Inc.

Tata Consultancy Services: The country's largest IT services company has entered into a strategic partnership with the digital unit of JLR. TCS will help JLR build a new future-ready, strategic technology architecture that will support JLR's Reimagine strategy. The new partnership, valued at 800 million pounds over the next five years.

Biocon: Subsidiary Biocon Biologics has completed the integration of the acquired biosimilar business from Viatris in North America effective September 1. To further strengthen its leadership in the global biosimilars industry and provide complete end-to-end capabilities to patients and customers, Biocon Biologics recently acquired the global biosimilars business of its long-term partner Viatris.

Responsive Industries: The vinyl flooring manufacturer has bagged a contract for the Garib Rath initiative from Indian Railways. Last month, the company had secured orders from the Indian Railways for the Vande Bharat project.

REC: The state-run Maharatna company has signed a foreign currency term loan agreement for $100 million with Export-Import Bank of India (Exim Bank). The loan has been tied up for a 5-year tenor. The loan will be used towards refinance for on-lending to its borrowers in power, infrastructure and logistics sectors for importing capital equipment.

Reliance Industries: Subsidiary Reliance Retail Ventures has signed a joint venture with Alia Bhatt’s kids and maternity-wear brand, Ed-a-Mamma for a 51 percent majority stake. Further, the subsidiary received the subscription amount of Rs 8,278 crore from Qatar Holding LLC (QIA) and allotted 6,86,35,010 equity shares to QIA.

RHI Magnesita: The Competition Commission of India (CCI) has cleared Rhone Capital's proposed acquisition of a 29.9 percent stake in RHI Magnesita NV. Ignite Luxembourg Holdings is owned and controlled by US-based private equity firm Rhone Capital, which is an affiliate of Rhone Group.

Fund Flow (Rs Crore)

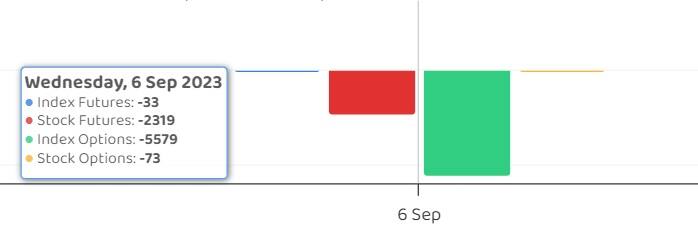

Foreign institutional investors (FII) sold shares worth Rs 3,245.86 crore, while domestic institutional investors (DII) offloaded Rs 247.46 crore worth of stocks on September 6, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Manappuram Finance, and SAIL to its F&O ban list for September 7, while retaining Balrampur Chini Mills, BHEL, Delta Corp, Hindustan Copper, Indiabulls Housing Finance, and India Cements on the list. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!