The market eked out small gains and extended its northward journey for the second consecutive session but overall it was a volatile and rangebound session on November 23, especially ahead of expiry of November futures & options contracts.

The BSE Sensex rallied 92 points to 61,511, while the Nifty50 rose 23 points to 18,267 and formed Bearish Opening Marubozu kind of pattern on the daily charts.

This pattern indicates profit booking or selling pressure at higher levels, which is a cause of concern for the short term.

"The momentum indicator RSI (relative strength index) moving around 60 levels indicating existence of bullish undertone in the index," said Vidnyan Sawant, AVP - Technical Research at GEPL Capital.

The Nifty has an immediate resistance levels placed at 18,325 (day high) followed by 18,442 (3-week high) and on the other side, it has strong support level placed at 18,139 (20-day SMA-simple moving average) followed by 18,000 (key support).

As per the overall price structure and evidence provided by indicators, the market expert feels that the Nifty is moving in a range of 18,000 – 18,500 levels for the short term.

The broader markets also closed higher with moderate gains on positive breadth. The Nifty Midcap 100 and Smallcap 100 indices rose third of a percent and half a percent, respectively.

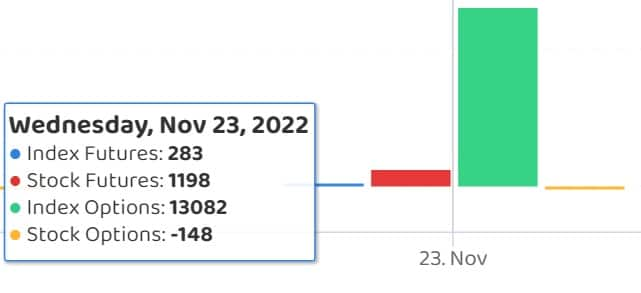

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 18,249, followed by 18,230 & 18,200. If the index moves up, the key resistance levels to watch out for are 18,310 followed by 18,329 and 18,359.

The Nifty Bank outperformed broader markets, rising 272 points to end at record closing high of 42,729, and formed Doji kind of pattern on the daily charts, indicating indecisiveness among bulls and bears for future market trend. The important pivot level, which will act as crucial support for the index, is placed at 42,599, followed by 42,527 and 42,411 levels. On the upside, key resistance levels are placed at 42,832 followed by 42,903 & 43,020 levels.

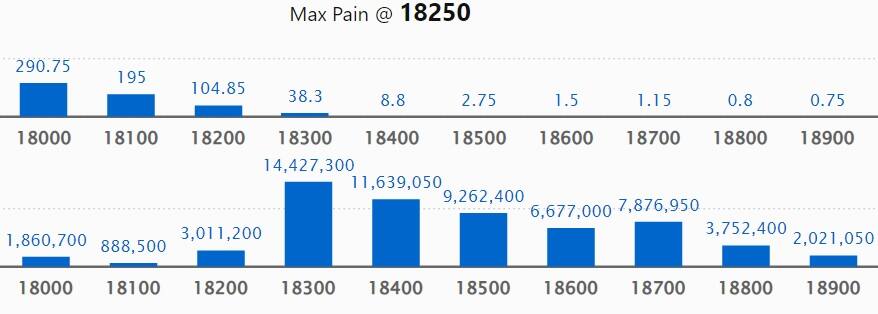

The maximum Call open interest of 1.44 crore contracts was seen at 18,300 strike, which can act as a resistance level in the November expiry week.

This is followed by 18,400 strike, which holds 1.16 crore contracts, and 18,500 strike, which have more than 92.62 lakh contracts.

Call writing was seen at 18,300 strike, which added 37.61 lakh contracts, followed by 18,700 strike which added 27.41 lakh contracts, and 18,400 strike which added 16.25 lakh contracts.

Call unwinding was seen at 18,200 strike, which shed 20.47 lakh contracts, followed by 18,500 strike which shed 4.93 lakh contracts and 18,100 strike which shed 4.28 lakh contracts.

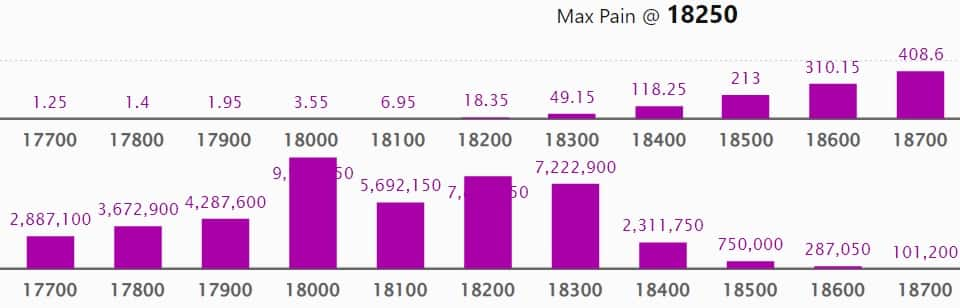

We have seen maximum Put open interest of 95 lakh contracts at 18,200 strike, which can act as a support level in the November expiry week.

This is followed by 18,200 strike, which holds 78.68 lakh contracts, and 18,300 strike, which has accumulated 72.22 lakh contracts.

Put writing was seen at 18,000 strike, which added 9.54 lakh contracts, followed by 18,300 strike, which added 12.46 lakh contracts, and 18,100 strike which added 2.02 lakh contracts.

Put unwinding was seen at 18,200 strike, which shed 14.31 lakh contracts, followed by 17,400 strike which shed 7.84 lakh contracts and 17,000 strike which shed 7.76 lakh contracts.

STOCKS WITH A HIGH DELIVERY PERCENTAGE

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Marico, Dabur India, Nestle India, Colgate Palmolive, and ICICI Bank, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are top 10 stocks including Punjab National Bank, GMR Infrastructure, Coromandel International, Nifty Financial, and NMDC, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Gujarat State Petronet, Jubilant Foodworks, Indraprastha Gas, Dr Lal PathLabs, and Balrampur Chini Mills, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen include ICICI Prudential Life Insurance, Ipca Laboratories, Max Financial Services, Shriram Transport Finance, and Bharat Electronics.

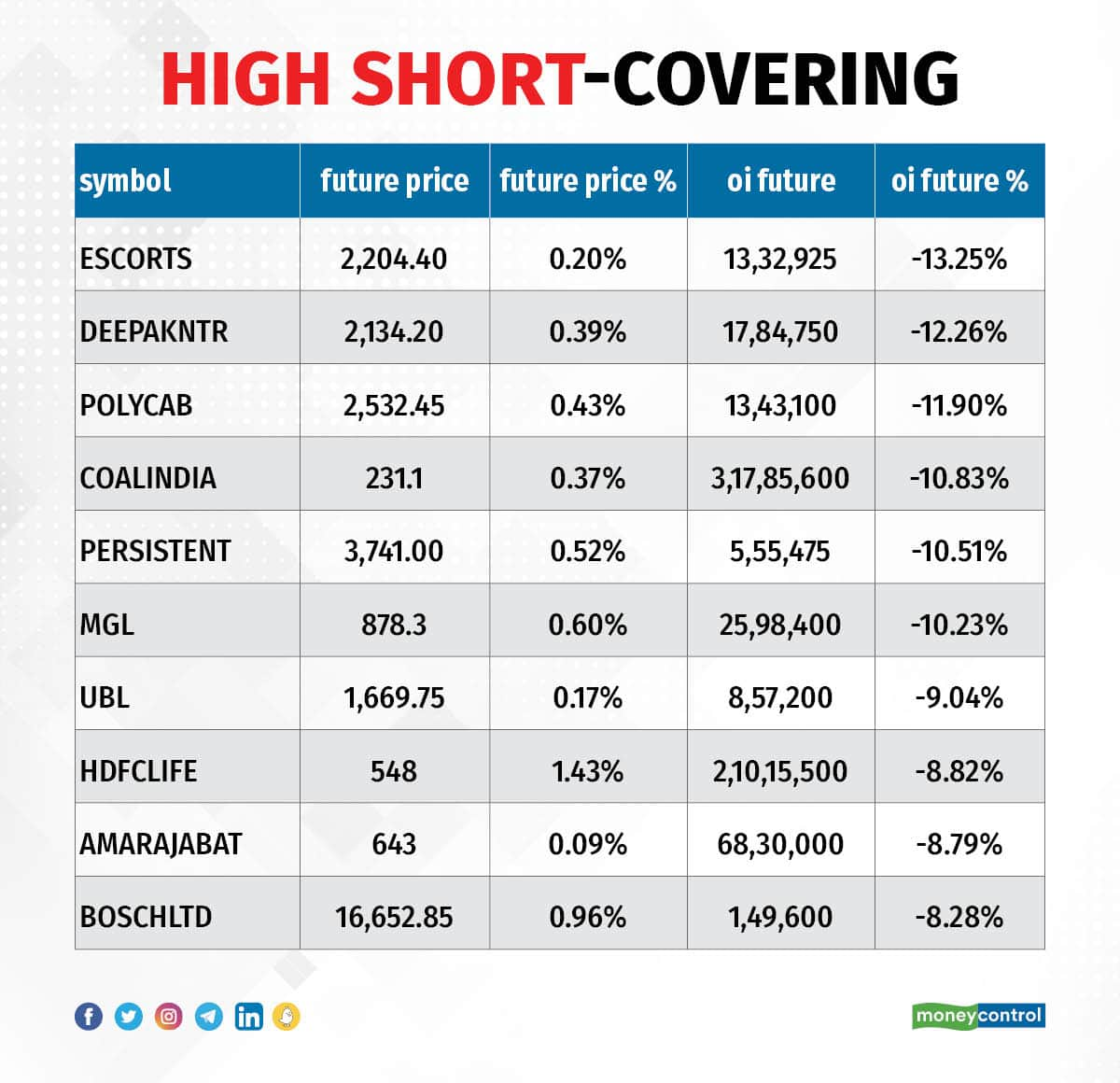

80 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks, in which short-covering was seen include Escorts, Deepak Nitrite, Polycab India, Coal India, and Persistent Systems.

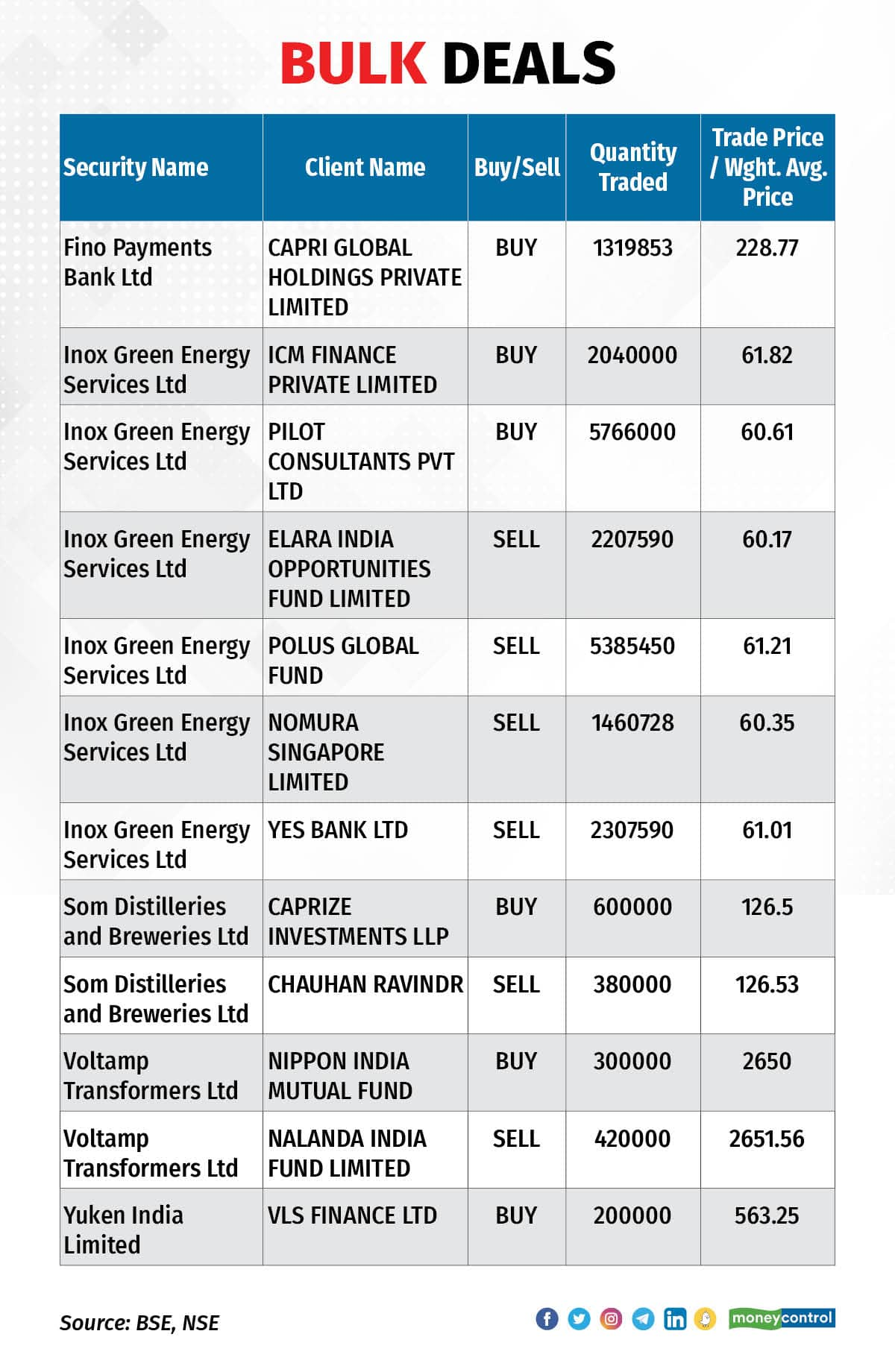

Fino Payments Bank: Investor Capri Global Holdings has picked 1.58 percent stake or 13.19 lakh shares in Fino Payments Bank via open market transactions. These shares were bought at an average price of Rs 228.77 per share.

Inox Green Energy Services: Foreign portfolio investor Polus Global Fund exited the wind power operation and maintenance services provider by selling entire 53.85 lakh shares at an average price of Rs 61.21 per share. Elara India Opportunities Fund sold 22.07 lakh shares at an average price of Rs 60.17 per share, Nomura Singapore offloaded 14.6 lakh shares at Rs 60.35 per share, and Yes Bank sold 23.07 lakh shares at an average price of Rs 61.01 per share, which in total was 2 percent of paid-up equity shares. However, ICM Finance bought 20.4 lakh shares in Inox Green at an average price of Rs 61.82 per share, and Pilot Consultants acquired 57.66 lakh shares at an average price of Rs 60.61 per share.

Voltamp Transformers: Nippon India Mutual Fund bought additional 3 lakh shares in the company at an average price of Rs 2,650 per share, whereas Nalanda India Fund offloaded 4.2 lakh shares at an average price of Rs 2,651.56 per share. Nippon Life India already held 5.47 percent stake and Nalanda India Fund had 7.79 percent shareholding in the company as of September 2022.

(For more bulk deals, click here)

Investors Meetings on November 24

Tata Consumer Products: Officials of the company will interact with Nirmal Bang Institutional Equities.

Brigade Enterprises: Officials of the company will interact with Abu Dhabi Investment Authority, and Elara India Conference.

Greaves Cotton: Officials of the company will interact with EFGAM.

Metro Brands: Officials of the company will interact with Aviva Life Insurance, Nippon India Mutual Fund, InCred Wealth, Dalal & Broacha Portfolio, and Max Life Insurance.

Mahindra Holidays & Resorts India: Officials of the company will interact with Enam AMC and Monarch Networth.

Indian Energy Exchange: Officials of company will interact with Somerset Capital Management, and Amansa Holdings.

Latent View Analytics: Officials of company will interact with ValueQuest Investment Advisors.

Aptus Value Housing Finance India: Officials of the company will be meeting investors and analysts in London.

BLS International Services: Officials of company will interact with Sumitomo Asset Management, Greenfield Advisory, Kotak Offshore, Sundaram Asset Management, and Somerset Asset Management (Singapore Fund) in Singapore.

Tracxn Technologies: Officials of company will interact with Aditya Birla Sun Life Insurance Company, and JM Financial.

Maruti Suzuki India: Officials of company will participate in investor meeting.

V-Guard Industries: Officials of company will interact with SIMPL, and Capital Group.

Polycab India: Officials of company will interact with EFG Asset Management.

CARE Ratings: Officials of company will interact with PARI Washington.

Stocks in News

Keystone Realtors: The real estate development company under 'Rustomjee' brand will debut on the BSE and NSE on November 24. The issue price has been fixed at Rs 541 per share.

IIFL Wealth Management: Investor General Atlantic Singapore Fund Pte Ltd sold 15.12 percent stake in the company via off market transactions on November 22. With this, General Atlantic's shareholding in the company reduced to 5.84 percent, from 20.96 percent earlier.

HEG: Life Insurance Corporation of India offloaded more than 2 percent equity stake or 7.76 lakh shares in HEG via open market transactions. With this, LIC reduced its shareholding in the company to 4.84 percent, from 6.85 percent earlier.

Mahindra & Mahindra Financial Services: Life Insurance Corporation of India bought additional 2.01 percent shares in M&M Financial Services via open market transactions, increasing the shareholding to 7.02 percent from 5.01 percent earlier.

Can Fin Homes: The company said its board of directors will hold a meeting to consider a proposal for payment of 'interim dividend' for FY23, on November 28. They will also fix record date for payment of interim dividend, if any.

HG Infra Engineering: The company has received a letter from Adani Road Transport regarding declaration of appointed date as November 3, by Authority for project in Uttar Pradesh. The company will execute civil and associated works on engineering procurement & construction basis for development of an access-controlled six lane road project in Uttar Pradesh on DBFOT (toll) basis under PPP. The project will be completed within 820 days from appointed date.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 789.86 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 413.75 crore on November 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Punjab National Bank under its F&O ban list for November 24. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!