The market fell four-tenth of a percent lower on June 8 after the Reserve Bank of India revised upwards its inflation projection for FY23 to 6.7 percent, from 5.7 percent earlier and hence raised the repo rate by 50 bps to 4.9 percent.

The BSE Sensex declined 215 points to 54,893, while the Nifty50 slipped 60 points to 16,356 and formed a bearish candle on the daily charts, continuing the downtrend for the fourth consecutive session, and adding more nervousness on the street.

"A reasonable negative candle was formed on the daily chart on Wednesday, which has placed beside the small negative candle of the previous session. This pattern indicates choppy movement in the market with negative bias," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He further said the current choppy movement could extend for another 1-2 sessions and the lows to be watched around 16,200 levels. However, strong overhead resistance is placed at 16,450-16,500 levels, the market experts added.

The correction was also seen in broader space as the market breadth was negative. The Nifty Midcap 100 and Smallcap 100 indices have fallen 0.5 percent and 0.3 percent respectively, as about three shares declined for every two rising shares on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,262, followed by 16,167. If the index moves up, the key resistance levels to watch out for are 16,483 and 16,609.

A moderate correction was also seen in Nifty Bank that fell 50 points to 34,946 on Wednesday. The important pivot level, which will act as crucial support for the index, is placed at 34,702, followed by 34,458. On the upside, key resistance levels are placed at 35,320 and 35,694 levels.

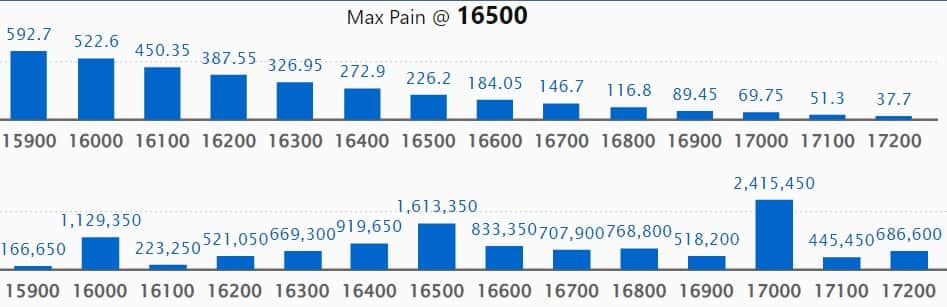

Maximum Call open interest of 24.15 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 17,500 strike, which holds 20.73 lakh contracts, and 18,000 strike, which has accumulated 17.08 lakh contracts.

Call writing was seen at 16,400 strike, which added 1.97 lakh contracts, followed by 16,300 strike which added 1.13 lakh contracts and 17,000 strike which added 93,400 contracts.

Call unwinding was seen at 17,500 strike, which shed 1.04 lakh contracts, followed by 16,500 strike which shed 89,150 contracts and 17,800 strike which shed 73,750 contracts.

Maximum Put open interest of 39.9 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 32.33 lakh contracts, and 15,000 strike, which has accumulated 22.93 lakh contracts.

Put writing was seen at 16,300 strike, which added 1.17 lakh contracts, followed by 15,900 strike, which added 57,900 contracts and 14,800 strike which added 53,050 contracts.

Put unwinding was seen at 16,500 strike, which shed 3.53 lakh contracts, followed by 15,700 strike which shed 79,100 contracts, and 16,600 strike which shed 54,600 contracts.

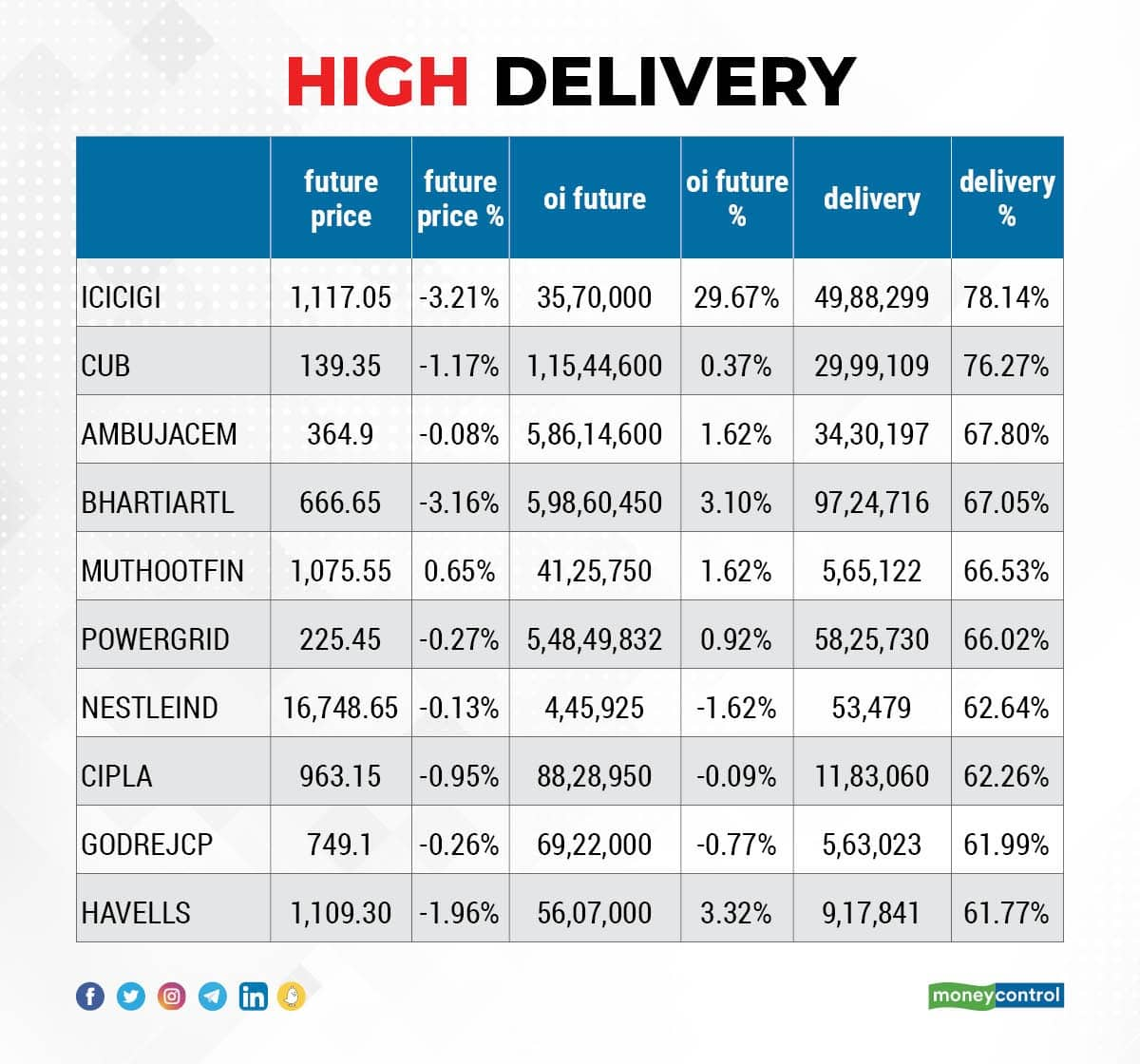

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ICICI Lombard General Insurance, City Union Bank, Ambuja Cements, Bharti Airtel, and Muthoot Finance, among others.

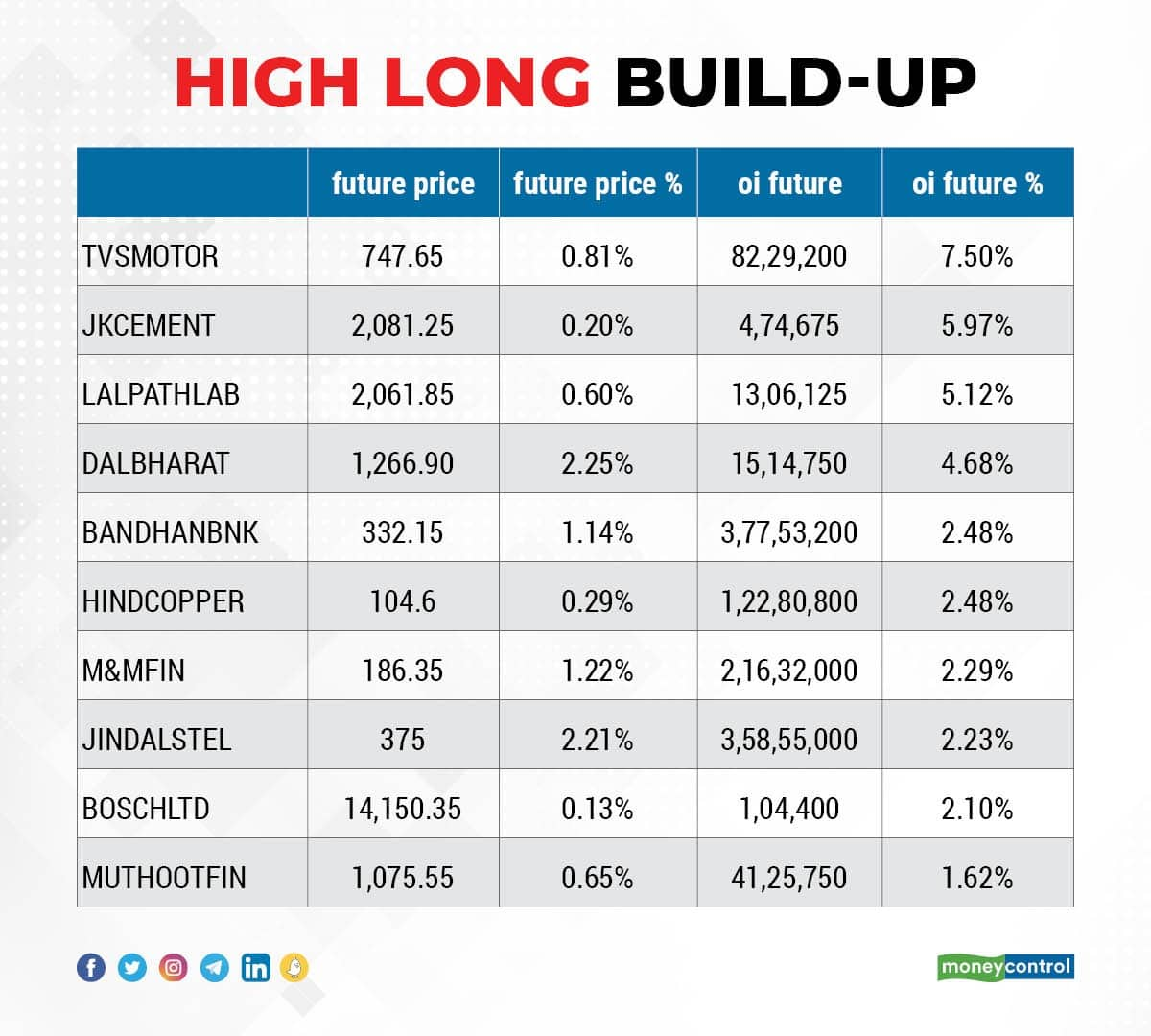

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including TVS Motor Company, JK Cement, Dr Lal PathLabs, Dalmia Bharat, and Bandhan Bank, in which a long build-up was seen.

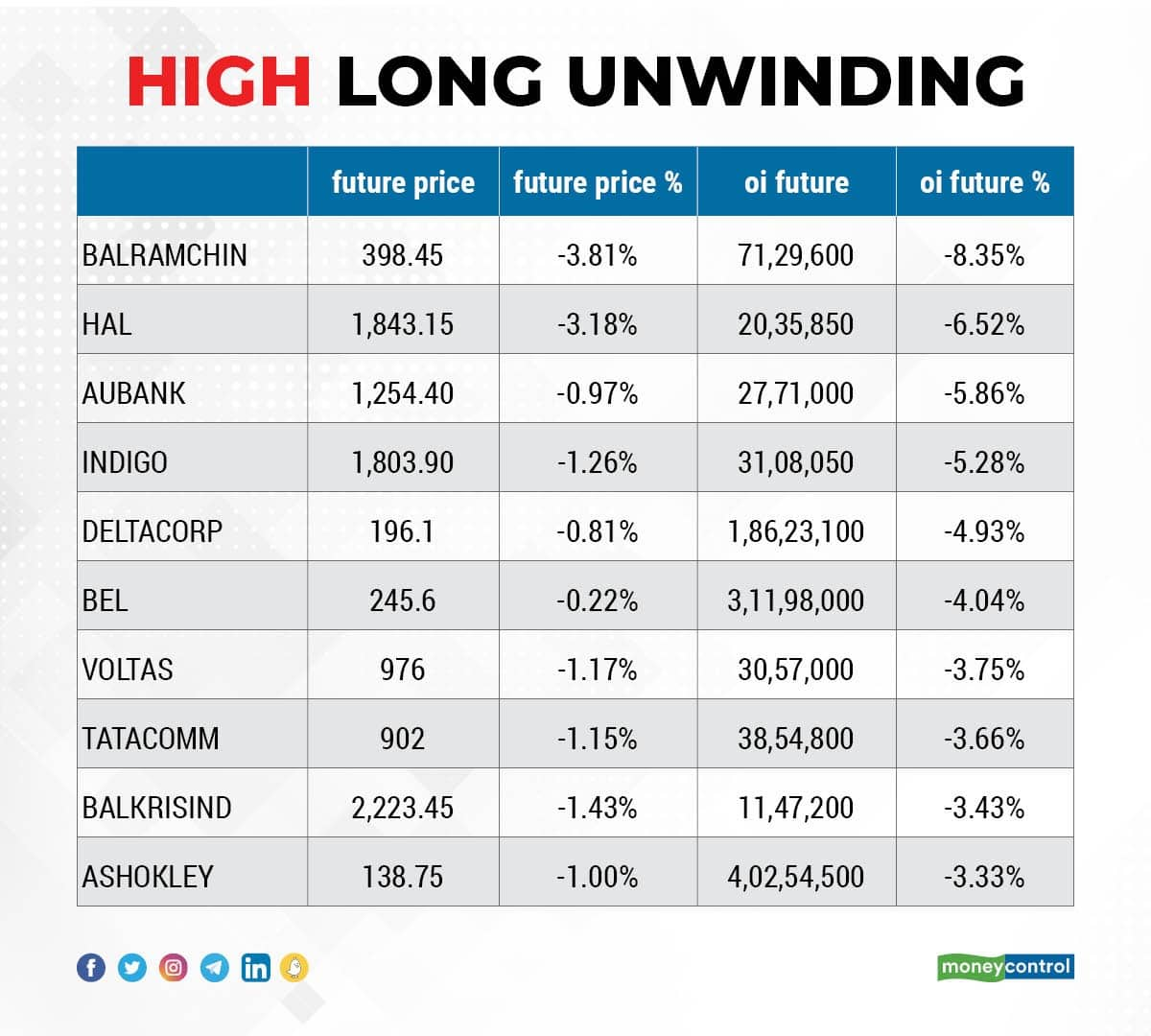

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Balrampur Chini Mills, Hindustan Aeronautics, AU Small Finance Bank, InterGlobe Aviation, Delta Corp, in which long unwinding was seen.

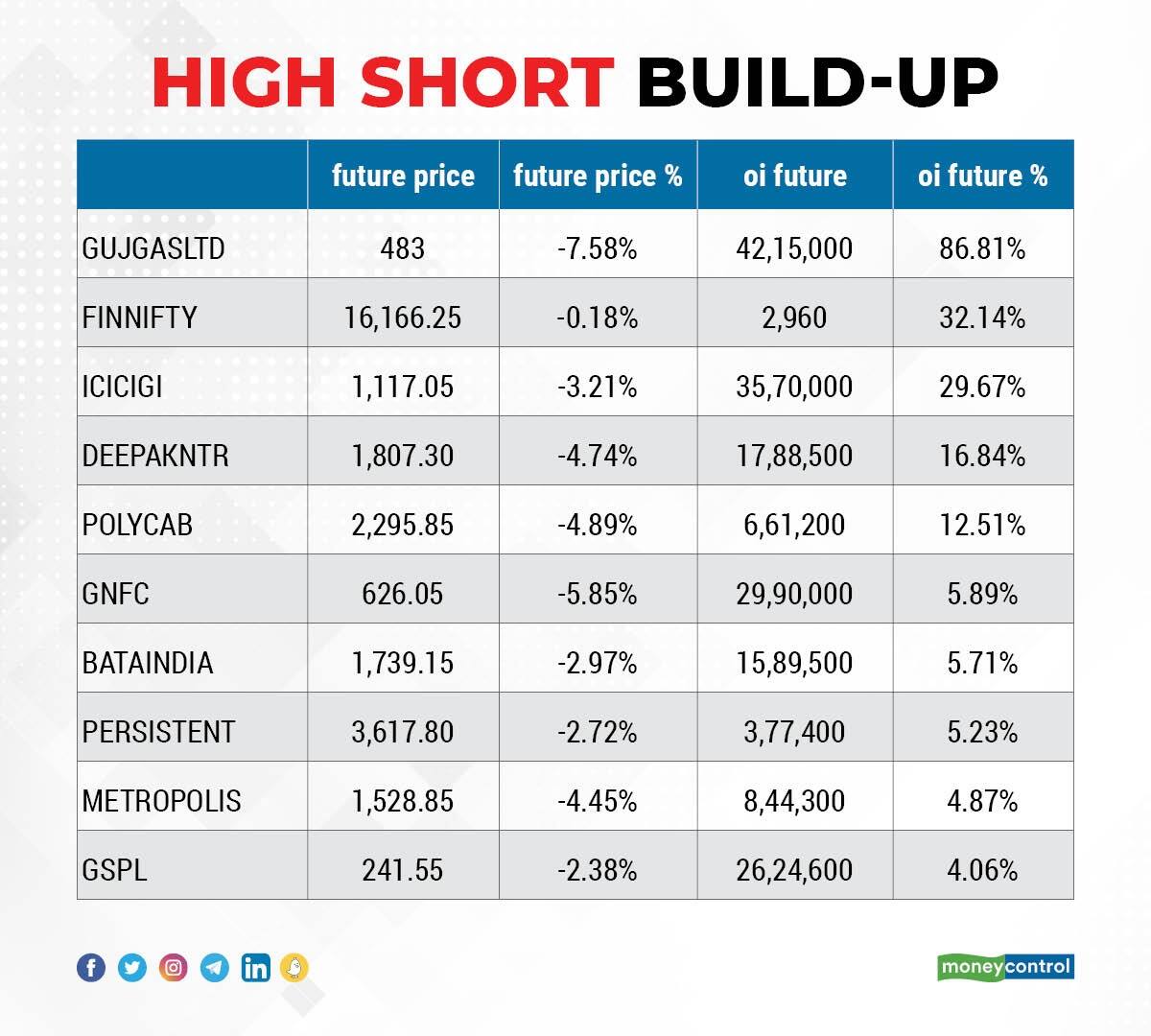

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Gujarat Gas, Nifty Financial, ICICI Lombard General Insurance Company, Deepak Nitrite, and Polycab India, in which a short build-up was seen.

63 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Apollo Tyres, REC, GAIL India, Ipca Laboratories, and Indraprastha Gas, in which short-covering was seen.

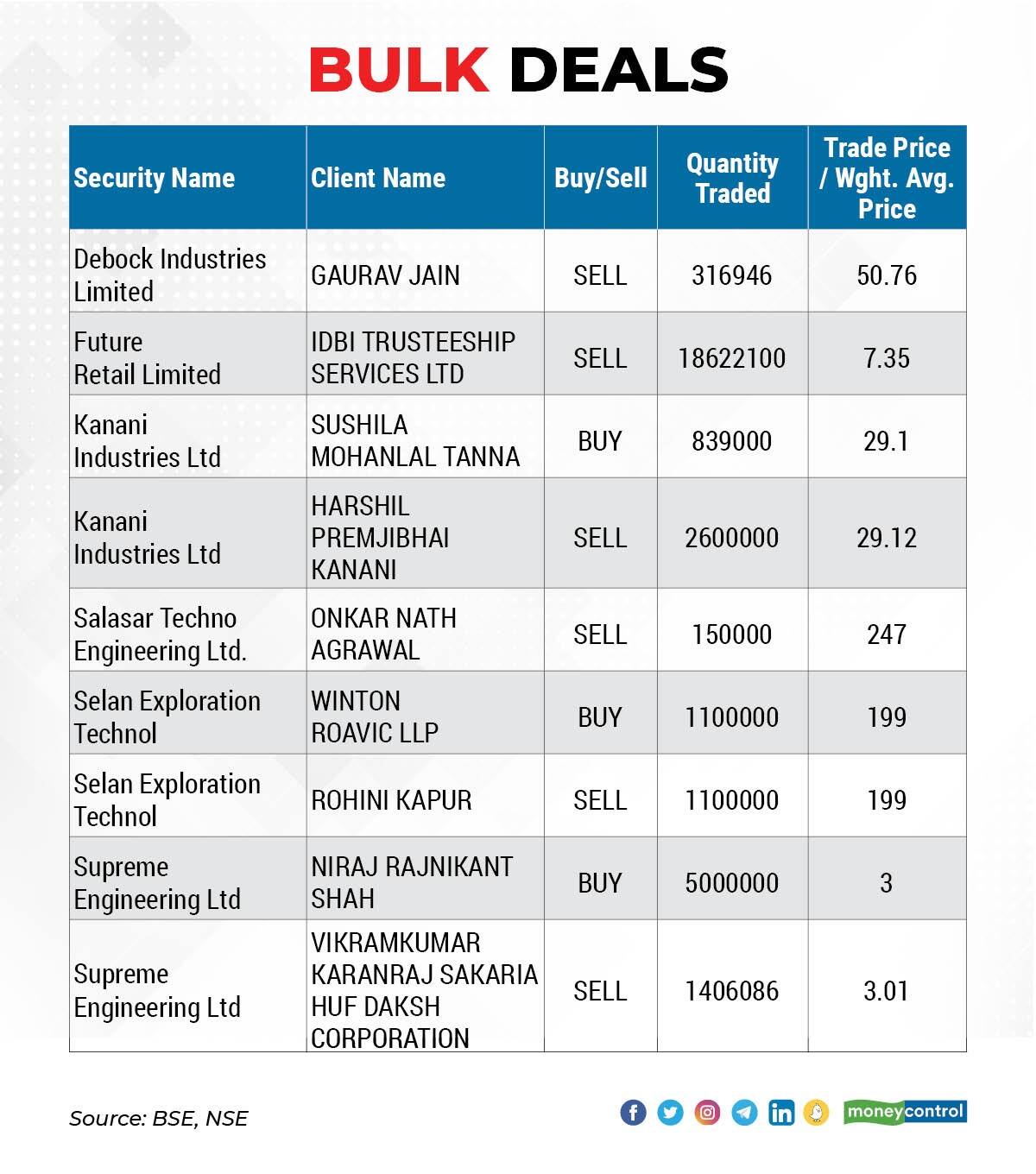

(For more bulk deals, click here)

Investors Meetings on June 9

Larsen & Toubro, Hindustan Unilever, Zomato, Sona BLW Precision Forgings, State Bank of India: Officials of these companies will participate in Jefferies India Forum.

Craftsman Automation, Raymond, Lemon Tree Hotels, Nuvoco Vistas Corporation, SKF India, Symphony, TTK Prestige, PG Electroplast, Rama Steel Tubes, Allcargo Logistics, IIFL Finance, Birlasoft, Welspun Corp, RateGain Travel Technologies, Apollo Tyres, Arvind Fashions, Vaibhav Global: Officials of these companies will attend Motilal Oswal Annual India Ideation Conference.

Tata Consumer Products, Grasim Industries, Vedanta, Sobha: Officials of these companies will attend Morgan Stanley's Virtual India Summit 2022.

Sun Pharma: The company's officials will participate in Nomura Investment Forum Asia 2022.

FSN E-Commerce Ventures (Nykaa): The company's officials will meet JP Morgan Asset Management and Alliance Berstein.

Tata Steel: The company's officials will attend Citi Pan – Asia Regional Investor Conference 2022, and will meet Fidelity (FMR).

Mahindra & Mahindra: The company's officials will attend Nomura Virtual Investor Conference.

Tata Chemicals: The company's officials will meet Canada Pension Plan lnvestment Board.

India Pesticides: The company's officials will meet Antique Stock Broking.

Escorts: The company's officials will meet Enam AMC.

Asian Paints: The company's officials will meet BMO Global Asset Management and Blackrock Asset Management.

Axis Bank: The company's officials will attend the second Annual APAC EM ESG Conference.

Tata Motors: The company's officials will meet RWC Partners, Abu Dhabi Investment Authority, Ellerston Capital, Kotak Mahindra Old Mutual Life Insurance, L&T Investment, Nomura Site, Platinum Asset Management, Schroder Investment Management, Sephira Emerging Markets etc.

Stocks in News

Bank of India: The public sector bank has changed its Repo-Based Lending Rate (RBLR) to 7.75 percent with immediate effect, from 7.25 percent earlier. The revision is on account of the upward revision in repo rate announced by the RBI, on June 8 in its monetary policy.

Punjab National Bank: The state-run lender has revised its Repo-Linked Lending Rate (RLLR) to 7.40 percent w.e.f. June 9, from 6.90 percent earlier. The bank has taken this decision especially after the RBI hiked the repo rate.

Wipro: The IT services company and ServiceNow will help Petrobras, the largest publicly traded company in Brazil, to advance its digital journey. The project aims to raise the level of service for internal users and reduce costs by modernising and aligning IT infrastructure processes with the business through a modern cloud solution focused on automation and integration.

Tata Power Company: Subsidiary Tata Power Solar has commissioned an EPC project of 450 MWDC for Brookfield Renewable India in Rajasthan. The company has set up over 8 lakh modules and completed them within a record 7-month timeframe. The project will produce over 800GWh of clean energy annually and will help avoid up to 600,000 tons of annual CO2 emissions.

Rail Vikas Nigam: Rail Vikas Nigam (RVNL) has entered into an agreement with "Kyrgyzindustry" for the execution of infrastructure projects in Kyrgyz Republic. Particularly the company is going to execute a railway line network on mutually agreed terms and conditions in Kyrgyz Republic.

BLS International Services: The company has acquired Mumbai-headquartered Zero Mass Private (ZMPL) – the largest business correspondent in the country –for Rs 120 crore. With this all-cash acquisition from the company's internal accruals, BLS International becomes the largest business correspondent (BC) network in India. BLS International now owns an 88.26 percent equity stake in ZMPL, and State Bank of India continues to hold 6.83 percent equity stake in ZMPL. ZMPL has been operating the largest BC network for State Bank of India (SBI) with around 11,500 active CSPs (around 15 percent of all the SBI BCs). The company has a pan-India presence with CSPs located across all states and union territories of India. Apart from SBI, ZMPL has contracts with Utkal Grameen Bank and Karur Vysya Bank.

Crompton Greaves Consumer Electricals: The company's Board of Directors on June 13 will consider a proposal to raise funds by way of issuance of debt securities on a private placement basis up to Rs 925 crore.

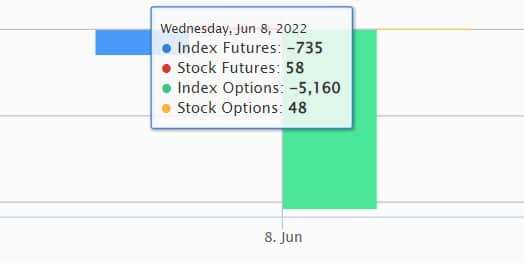

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 2,484.25 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 1,904.33 crore worth of shares on June 8, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Delta Corp - remains under the NSE F&O ban for June 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!