The market reversed some of the previous day's gains due to selling pressure in the second half of the session and closed around half a percent down on March 23, dragged by banks, auto, and select FMCG and IT stocks.

The BSE Sensex fell more than 300 points to 57,685, while the Nifty50 corrected 70 points to 17,246 and formed a bearish candle on the daily charts.

"A long negative candle was formed on the daily chart after opening higher. Technically this indicates a presence of strong resistance around 17,500 levels. However, the pattern of the last four sessions signals formation of alternative candle pattern of positive and negative, which ideally indicates a broader range movement around 17,400-17,000 levels," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

According to Shetti, the short term uptrend status of the Nifty remains intact and the positive chart pattern like higher highs and lows is active as per daily timeframe chart.

Further, "weakness from here on could find strong support around 17,100-17,000 levels for the short term. A sustainable upmove above the immediate hurdle of 17,500 levels could pull the Nifty towards the next resistance of 17,650 and 17,800 levels respectively," he says.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,149, followed by 17,053. If the index moves up, the key resistance levels to watch out for are 17,392 and 17,539.

Bank Nifty declined 201.25 points to close at 36,147 on March 23. The important pivot level, which will act as crucial support for the index, is placed at 35,866, followed by 35,584. On the upside, key resistance levels are placed at 36,628 and 37,109 levels.

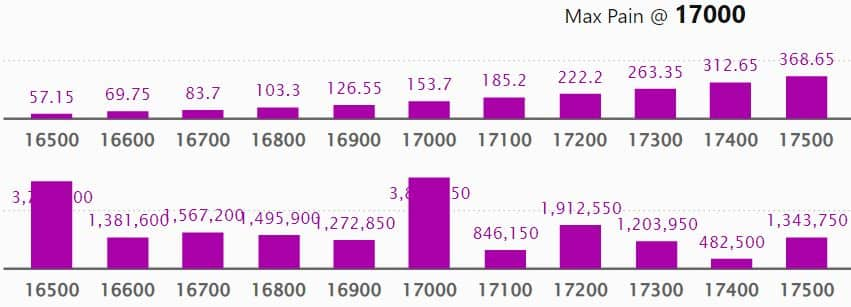

Maximum Call open interest of 37 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,500 strike, which holds 22.01 lakh contracts, and 17,300 strike, which has accumulated 15.57 lakh contracts.

Call writing was seen at 18,000 strike, which added 6.65 lakh contracts, followed by 17,700 strike which added 3.87 lakh contracts, and 17,400 strike which added 2.69 lakh contracts.

Call unwinding was seen at 17,000 strike, which shed 2.13 lakh contracts, followed by 17,200 strike which shed 93,950 contracts and 17,100 strike which shed 69,750 contracts.

Maximum Put open interest of 50.56 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 17,000 strike, which holds 38.76 lakh contracts, and 16,500 strike, which has accumulated 37.55 lakh contracts.

Put writing was seen at 17,300 strike, which added 3.34 lakh contracts, followed by 16,000 strike, which added 3.17 lakh contracts, and 16,200 strike which added 2.54 lakh contracts.

Put unwinding was seen at 17,400 strike, which shed 88,550 contracts, followed by 17,800 strike which shed 65,350 contracts, and 18,000 strike which shed 26,100 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in HDFC Bank, Godrej Consumer Products, Coromandel International, Marico, and Power Grid Corporation of India among others on Wednesday.

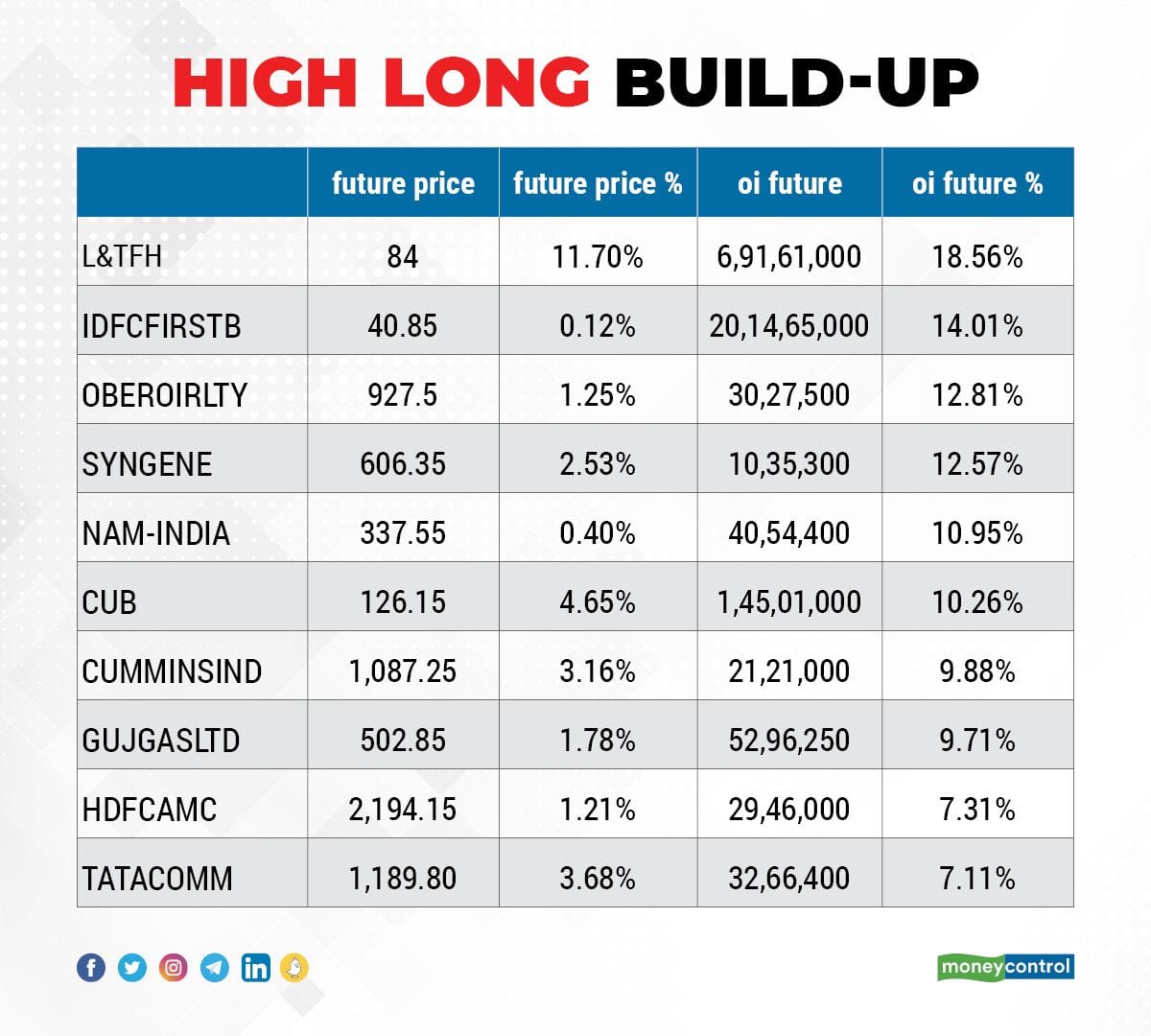

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including L&T Finance Holdings, IDFC First Bank, Oberoi Realty, Syngene International, and Nippon Life.

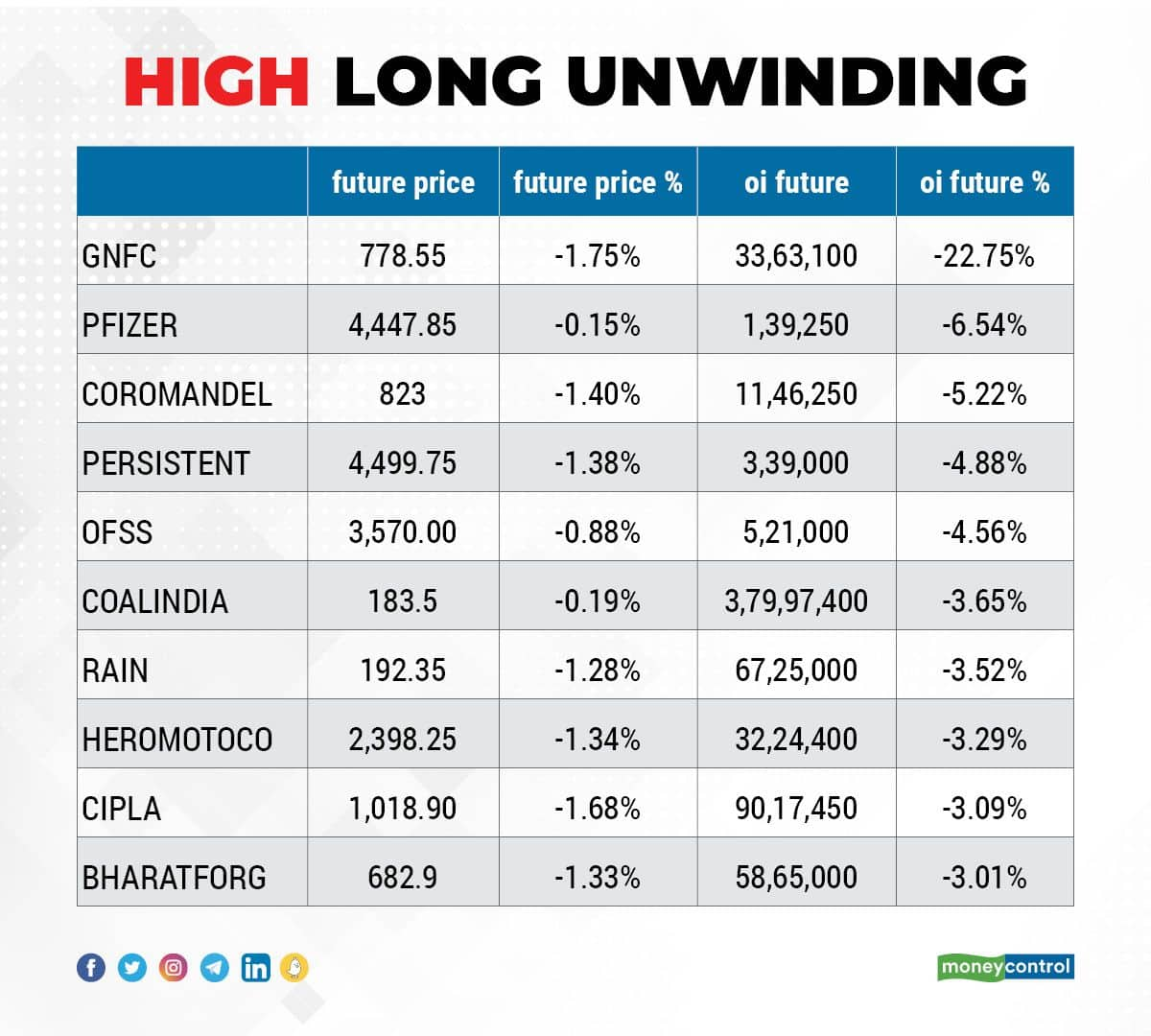

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including GNFC, Pfizer, Coromandel International, Persistent Systems, and Oracle Financial Services Software.

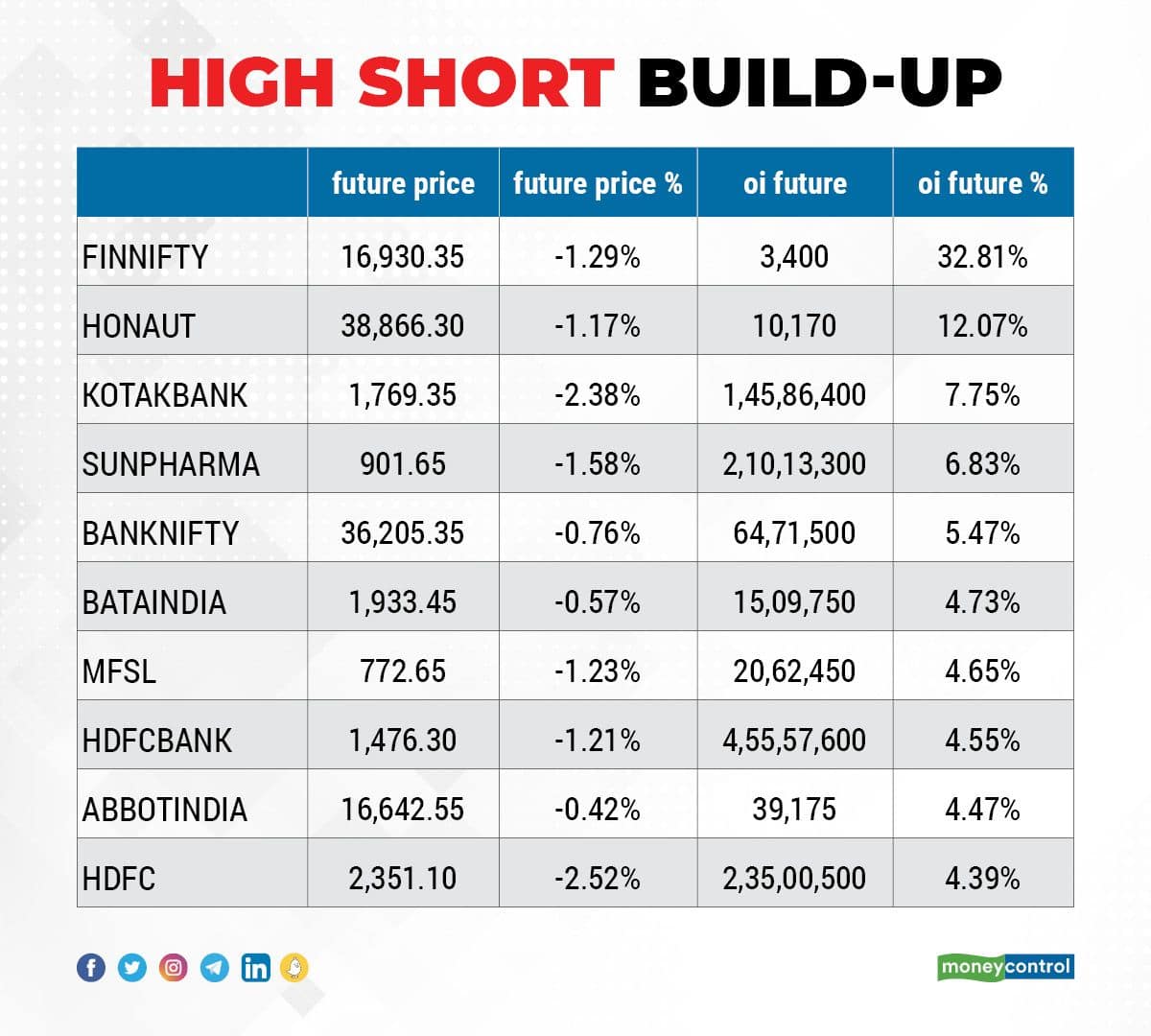

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Nifty Financial, Honeywell Automation, Kotak Mahindra Bank, Sun Pharma, and Bank Nifty.

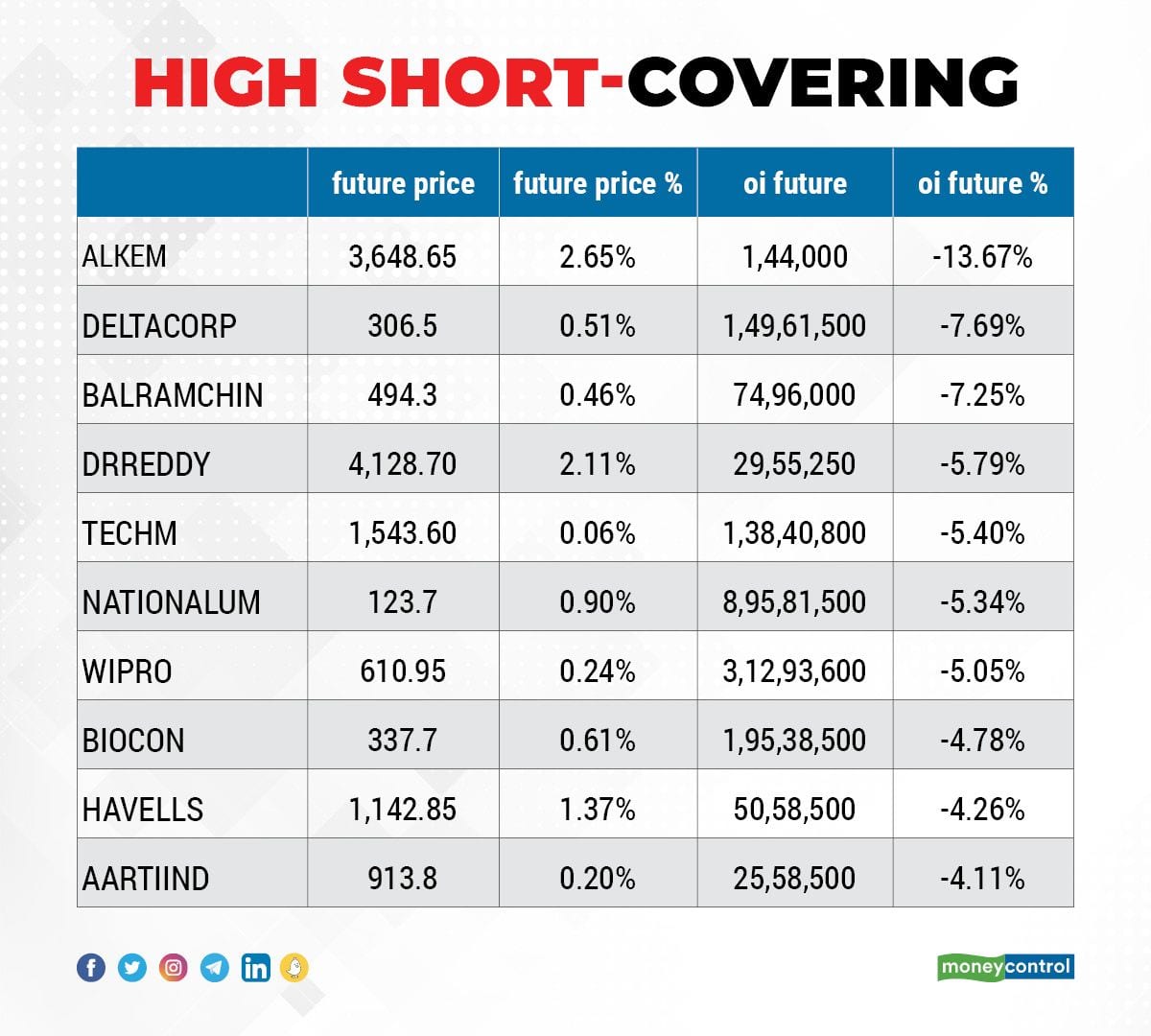

54 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including Alkem Laboratories, Delta Corp, Balrampur Chini Mills, Dr Reddy's Laboratories, and Tech Mahindra.

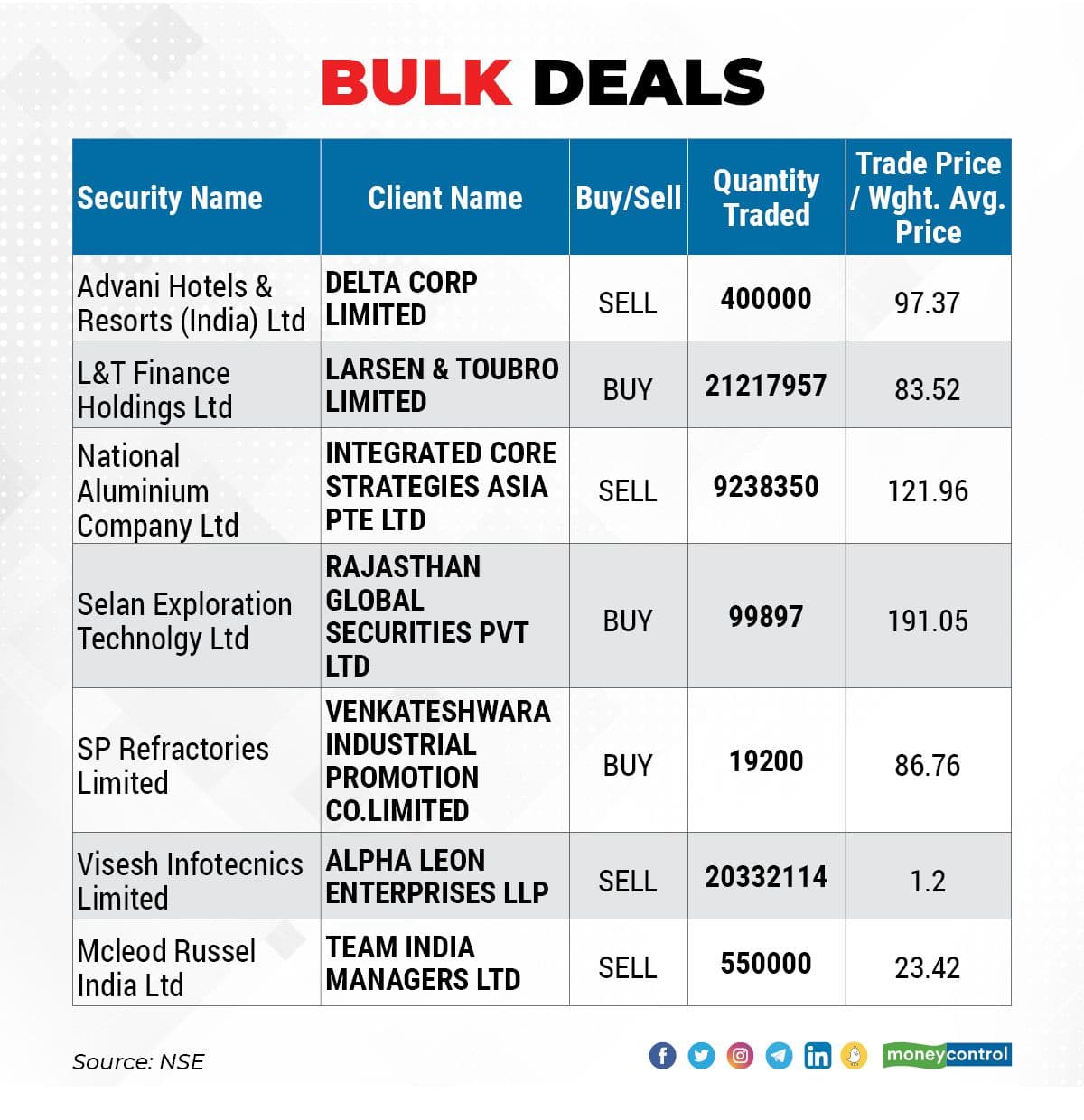

Advani Hotels & Resorts (India): Delta Corp sold 4 lakh equity shares in the company via open market transactions, at an average price of Rs 97.37 per share.

L&T Finance Holdings: Larsen & Toubro acquired 2,12,17,957 equity shares in the company via open market transactions, at an average price of Rs 83.52 per share.

National Aluminium Company: Integrated Core Strategies Asia Pte Ltd offloaded 92,38,350 equity shares in the company via open market transactions at an average price of Rs 121.96 per share.

(For more bulk deals, click here)

Analysts/Investors Meetings on March 24

Vijaya Diagnostic Centre: The company's officials will meet Aditya Birla Sun Life Insurance, UTI RSL and Valium Capital Advisors; and will attend Motilal Oswal Ideation Conference - 2022.

PSP Projects: The company's officials will meet Mahindra Manulife Mutual Fund.

Raymond: The company's officials will attend Motilal Oswal Financial Services Investors Conference.

KEI Industries: The company's officials will attend Motilal Oswal Financial Services Investors Conference.

Eicher Motors: The company's officials will attend Credit Suisse Investor Conference.

GOCL Corporation: The company's officials will meet Nirzar Securities, and Safe Enterprise.

Ajmera Realty & Infra India: The company's officials will meet Sharekhan.

Krishna Institute of Medical Sciences: The company's officials will attend Motilal Oswal Financial Services Investors Conference.

Stocks in News

Ruchi Soya Industries: Follow-on public offer will open for subscription on March 24.

Filatex India: The board on March 29 will consider the proposal for the buyback of fully paid-up equity shares of the company.

CSB Bank: The Reserve Bank of India has approved the appointment of Pralay Mondal as interim Managing Director and CEO of CSB Bank. The appointment will be for a period of three months with effect from April 1, 2022, or till the appointment of a regular Managing Director & CEO in the bank, whichever is earlier.

GPT Infraprojects: The company has bagged an order valued at Rs 118 crore. This contract is a joint venture of which GPT's share is 51 percent.

Triveni Turbine: Subsidiary Triveni Turbines DMCC has signed an agreement for the acquisition of 70 percent equity shares of TSE Engineering Pty Ltd (TSE). TSE is registered under the laws of South Africa and is engaged in high precision engineering repairs and servicing of machinery in sugar and other industrial plants in the South African Development Community (SADC) region.

Nelco: Nelco and Omnispace announced a strategic cooperation agreement to enable and distribute 5G non-terrestrial network (NTN), direct-to-device satellite services. The collaborative effort will expand the reach of 5G using satellite communication throughout India and South Asia.

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 481.33 crore, while domestic institutional investors (DIIs) have net sold shares worth Rs 294.23 crore on March 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Balrampur Chini Mills, Delta Corp, GNFC, Indiabulls Housing Finance, SAIL, and Sun TV Network - are under the F&O ban for March 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!