The market extended a sharp rally for the second consecutive session and registered more than 2 percent gains on March 9, supported by positive European cues and buying across sectors barring metal.

The BSE Sensex jumped 1,223 points to 54,647, while the Nifty50 rose 332 points to 16,345 and formed a bullish candle on the daily charts after a Bullish Engulfing pattern formation in the previous session.

"This chart formation indicates good buying action at lower levels," says Malay Thakkar, Technical Research Associate at GEPL Capital.

According to Thakkar, Wednesday's up move was backed by good action seen in the broader markets as well, as they moved in sync with the benchmark. "This up move should be seen as a short-term pullback which has potential to take the index to 16,480 followed by 16,780 mark," he noted.

However, he says the mid-term trend for the index remains weak till the index trades below the 16,850-16,950 zone which is a cluster of 20 and 200-day moving averages as well as the gap resistance.

The broader markets - Nifty Midcap 100 and Smallcap 100 indices - also gained more than 2 percent each.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,084, followed by 15,823. If the index moves up, the key resistance levels to watch out for are 16,512 and 16,679.

The Nifty Bank continued its uptrend, rising 657 points or 2 percent to 33,815. The important pivot level, which will act as crucial support for the index, is placed at 33,186, followed by 32,557. On the upside, key resistance levels are placed at 34,207 and 34,598 levels.

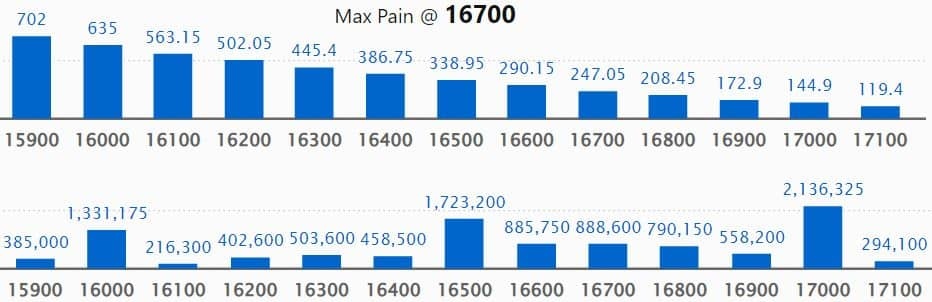

Maximum Call open interest of 21.36 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 16,500 strike, which holds 17.23 lakh contracts, and 17,500 strike, which has accumulated 16.70 lakh contracts.

Call writing was seen at 16,600 strike, which added 1.86 lakh contracts, followed by 17,000 strike which added 1.56 lakh contracts, and 16,900 strike which added 1.53 lakh contracts.

Call unwinding was seen at 15,800 strike, which shed 2.63 lakh contracts, followed by 16,000 strike which shed 2.54 lakh contracts and 16,100 strike which shed 2.36 lakh contracts.

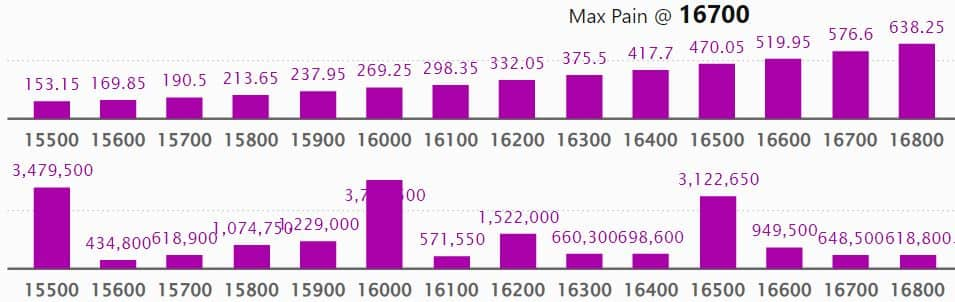

Maximum Put open interest of 37.81 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 15,500 strike, which holds 34.79 lakh contracts, and 16,500 strike, which has accumulated 31.22 lakh contracts.

Put writing was seen at 16,200 strike, which added 2.27 lakh contracts, followed by 16,600 strike, which added 1.8 lakh contracts, and 15,500 strike which added 1.17 lakh contracts.

Put unwinding was seen at 15,800 strike, which shed 2 lakh contracts, followed by 16,500 strike which shed 95,800 contracts, and 15,700 strike which shed 71,900 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Marico, Pfizer, ABB India, Colgate Palmolive, and Alembic Pharmaceuticals among others on Wednesday.

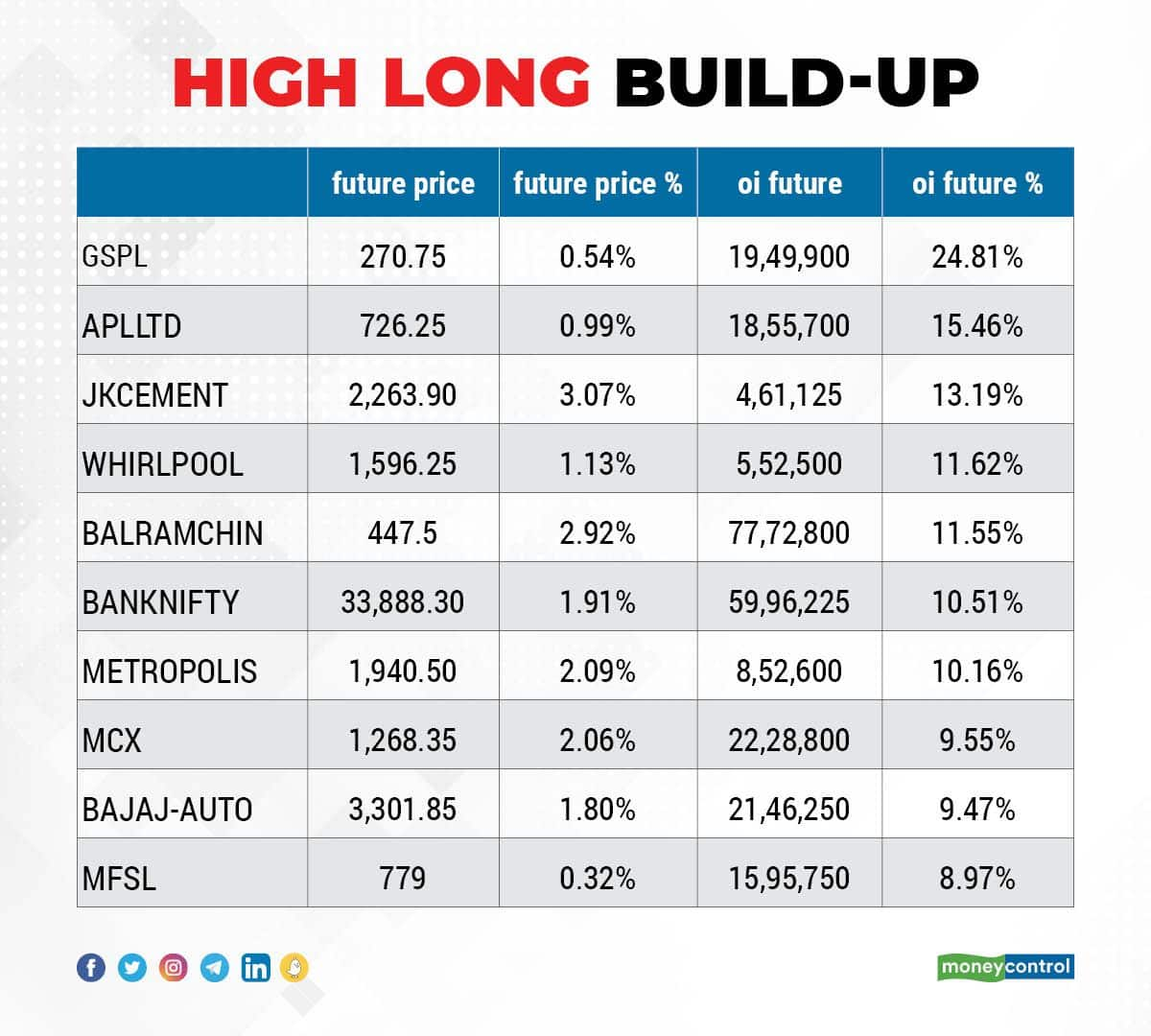

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen, including GSPL, Alembic Pharmaceuticals, JK Cement, Whirlpool, and Balrampur Chini Mills.

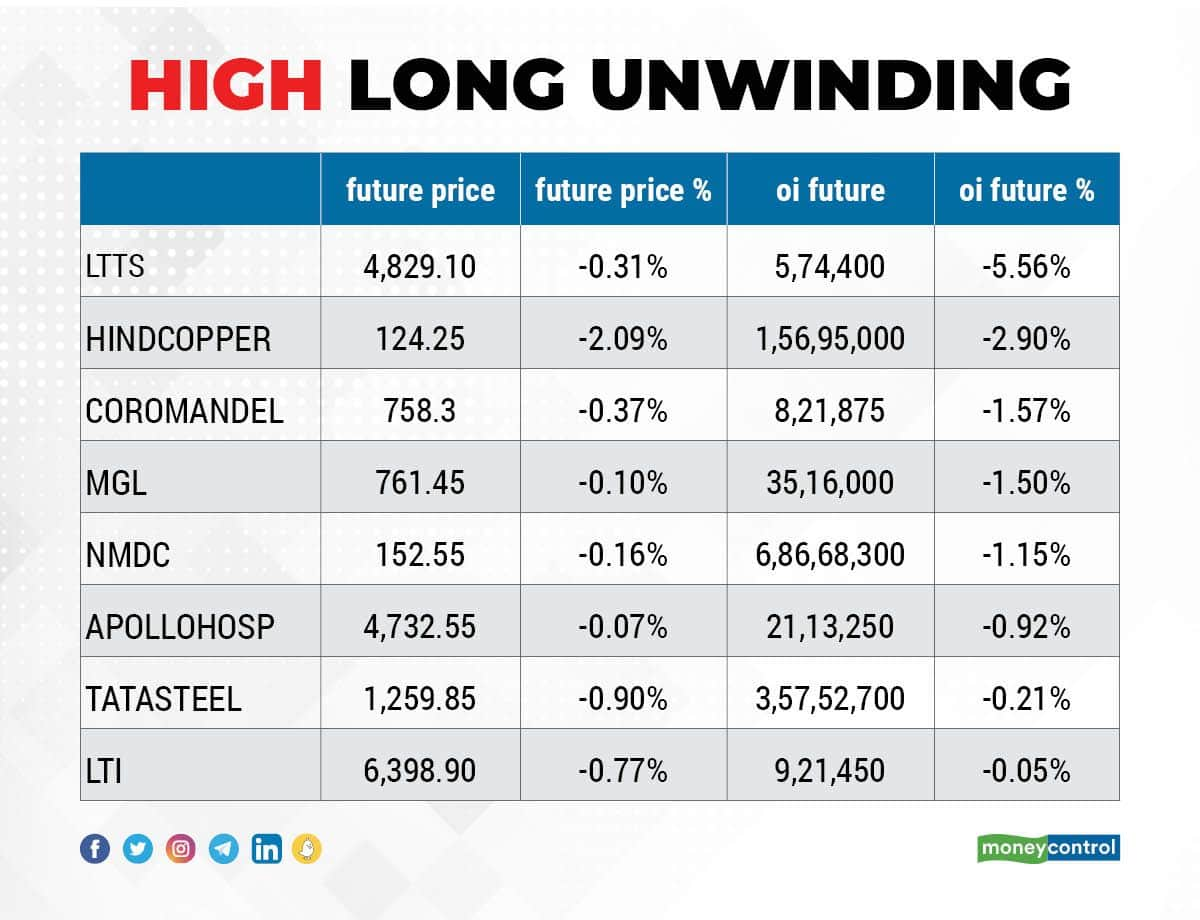

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 8 stocks in which long unwinding was seen, including L&T Technology Services, Hindustan Copper, Coromandel International, Mahanagar Gas, and NMDC.

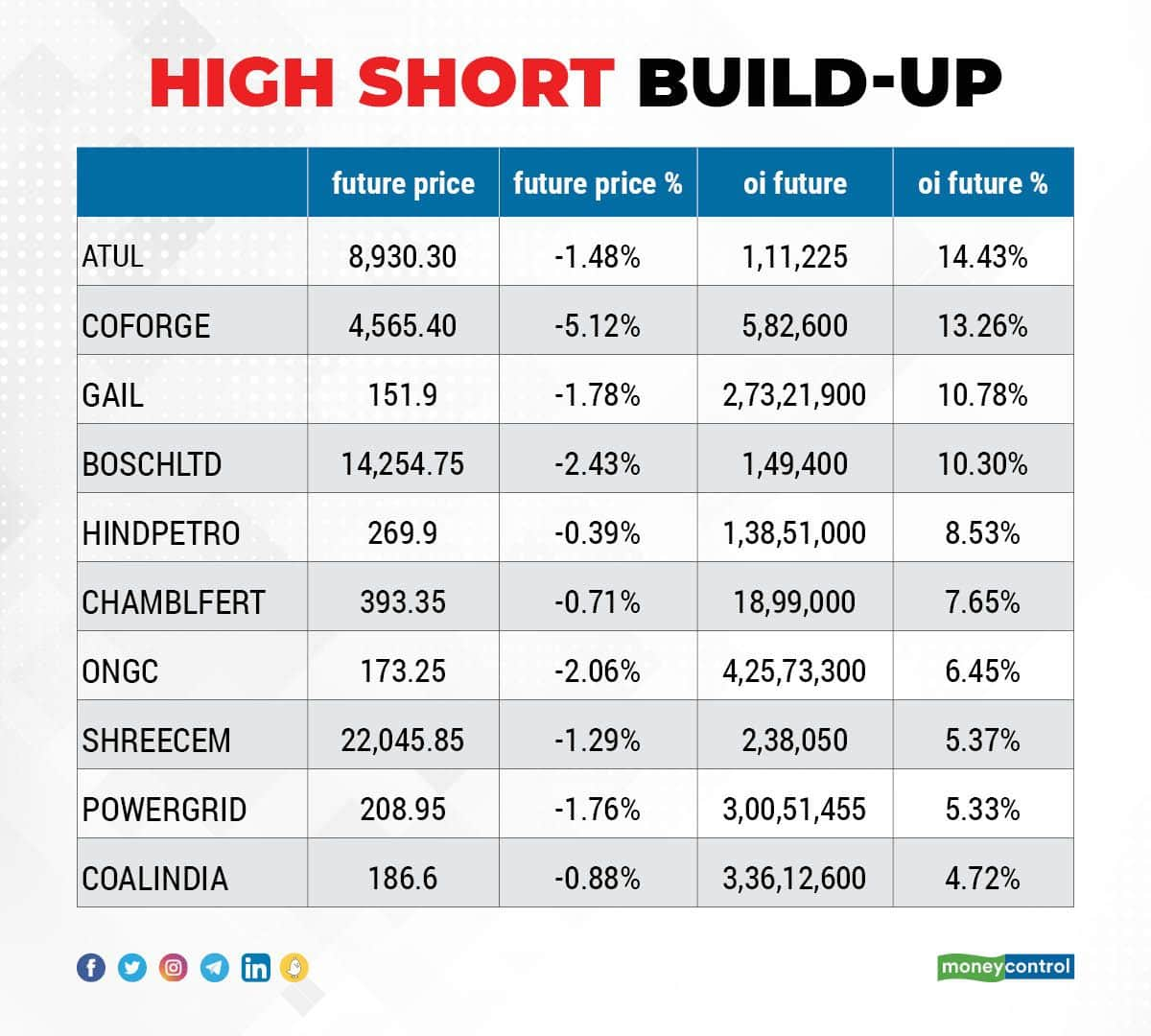

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen, including Atul, Coforge, GAIL India, Bosch, and HPCL.

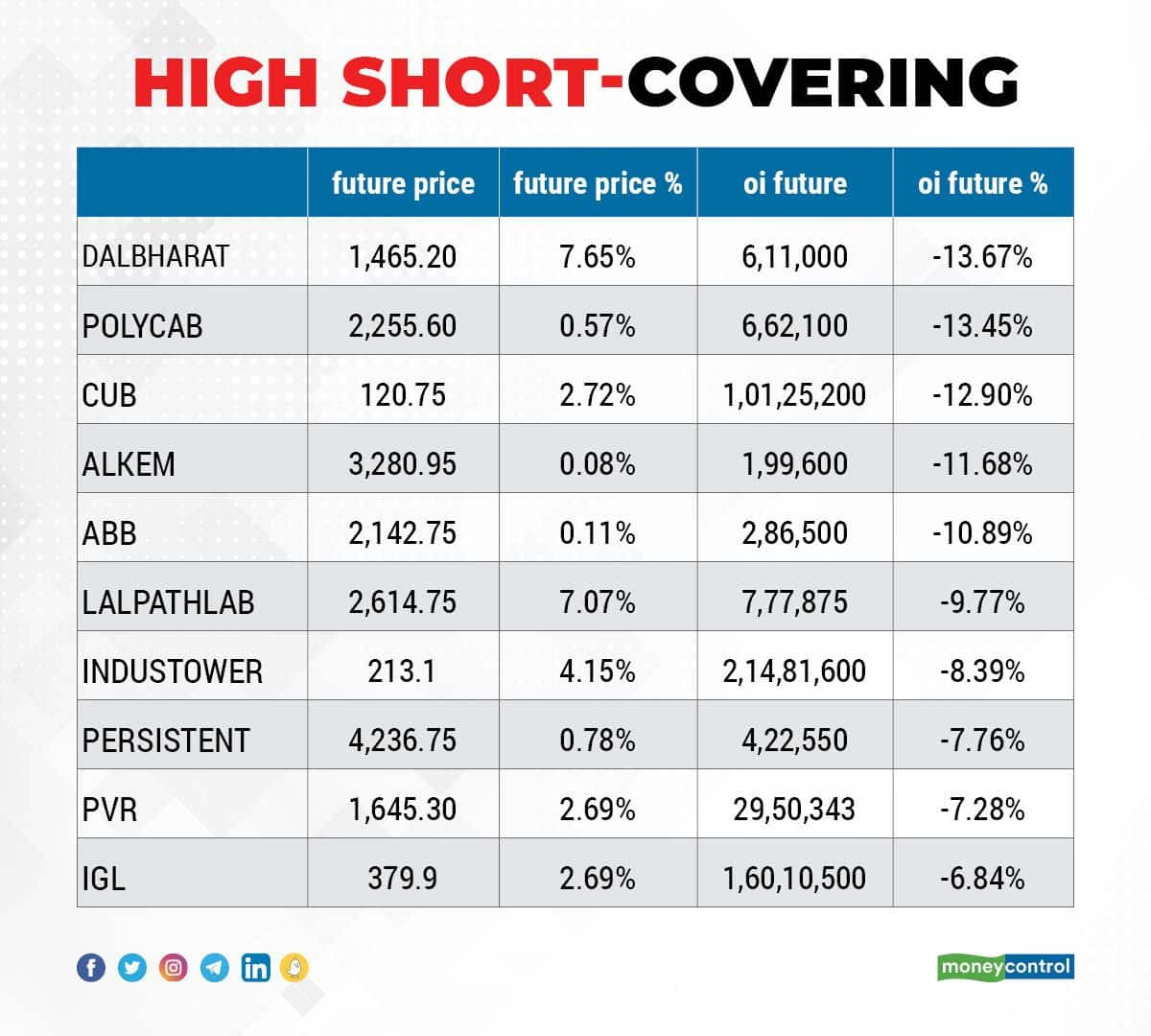

93 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen, including Dalmia Bharat, Polycab India, City Union Bank, Alkem Laboratories, and ABB India.

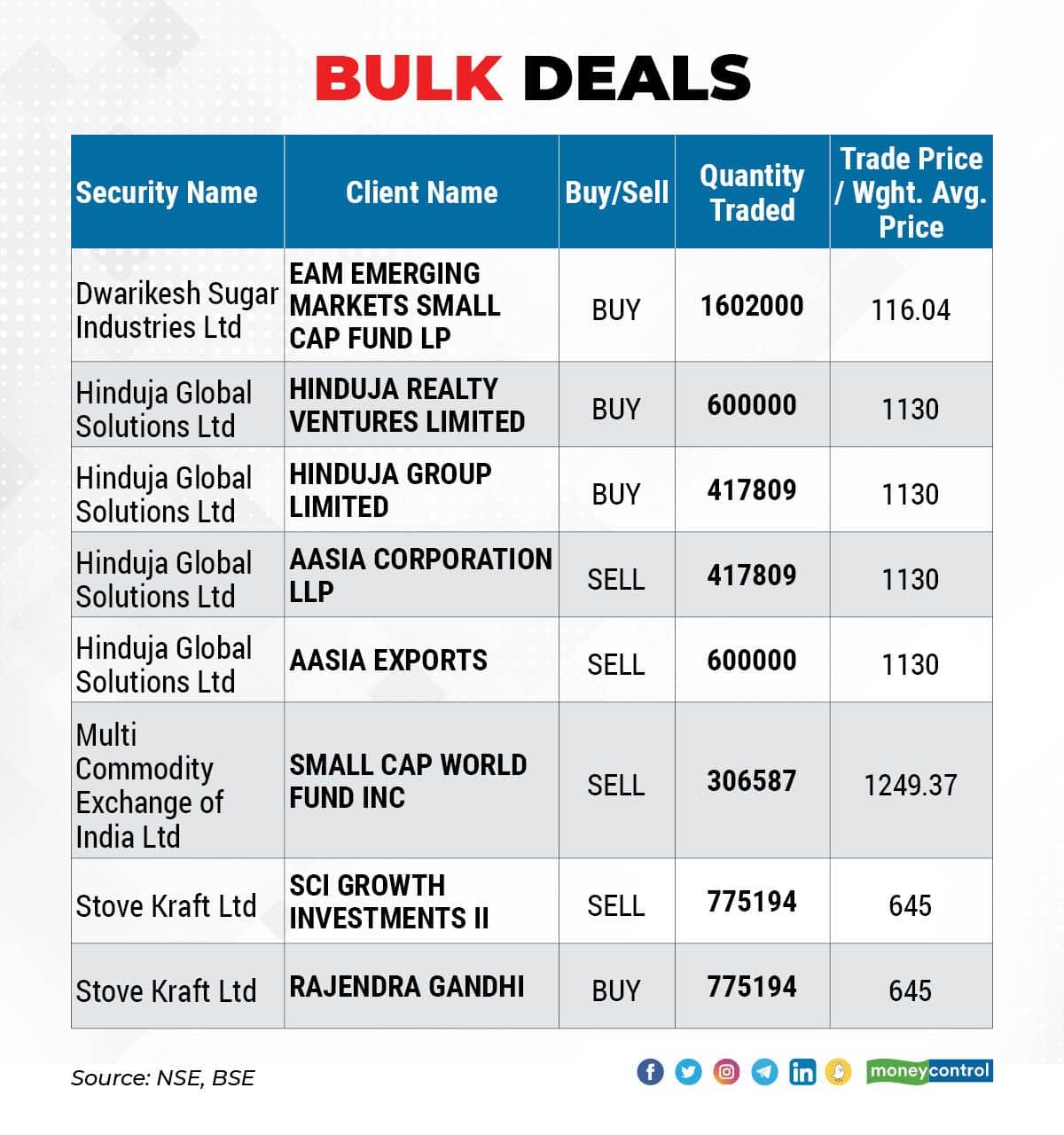

Dwarikesh Sugar Industries: EAM Emerging Markets Small Cap Fund LP acquired 16.02 lakh equity shares in the company via open market transactions. These shares were bought at an average price of Rs 116.04 per apiece.

Multi Commodity Exchange of India: Small Cap World Fund Inc sold 3,06,587 equity shares in the company via open market transactions. These shares were sold at an average price of Rs 1,249.37 per share.

Stove Kraft: SCI Growth Investments II has offloaded 7,75,194 equity shares in the company via open market transactions. However, promoter Rajendra Gandhi was the buyer for those shares. These shares were bought and sold at an average price of Rs 645 per share.

(For more bulk deals, click here)

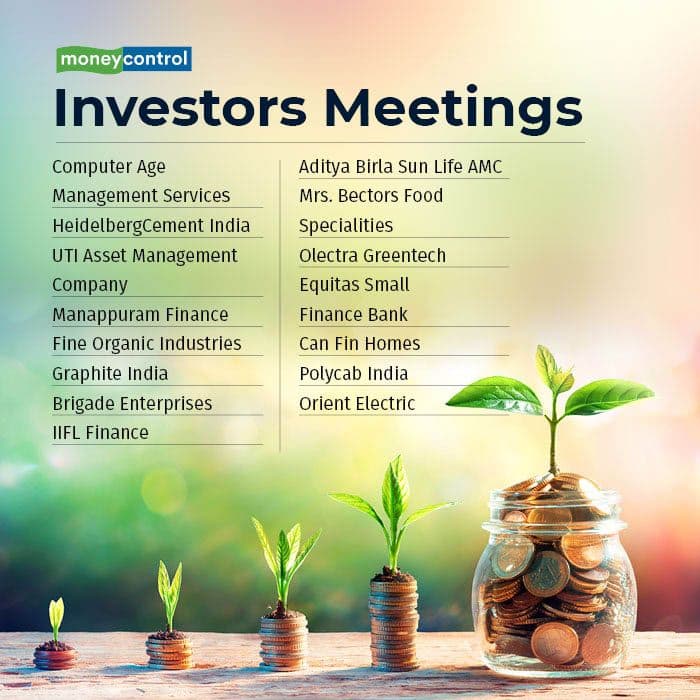

Analysts/Investors Meetings

Computer Age Management Services: The company's officials will meet Duro Capital on March 10; and C World Wide Asset Management on March 17.

HeidelbergCement India: The company's officials will meet FSSA Investment Managers on March 10.

UTI Asset Management Company: The company's officials will meet Kotak Mahindra Asset Management Company on March 10.

Manappuram Finance: The company's officials will attend Elara Capital conference on March 10.

Fine Organic Industries: The company's officials will meet analysts on March 10.

Graphite India: The company's officials will meet Goldman Sachs (Singapore) on March 10.

Brigade Enterprises: The company's officials will meet Eastspring Investments on March 10.

IIFL Finance: The company's officials will meet Hornbill Capital, Motilal Oswal, Infina Finance, Whiteoak Capital, L&T MF, Quantum Advisors, BNP Paribas MF, IDFC MF on March 10.

Mrs Bectors Food Specialities: The company's officials will meet institutional investors on March 10.

Olectra Greentech: The company's officials will meet Jupiter Asset Management on March 10.

Equitas Small Finance Bank: The company's officials will attend IIFL Caravan Conference on March 11.

Can Fin Homes: The company's officials will meet Elara Capital (India) on March 11; B & K Securities India on March 14; and YES Securities (India) on March 17.

Polycab India: The company's officials will attend the AMSEC connect conference on March 15.

Orient Electric: The company's officials will meet Dam Capital Advisors on March 16.

Stocks in News

PNB Housing Finance: The housing finance company has approved fundraising of up to Rs 2,500 crore through a rights issue.

Biocon: CRISIL has placed its 'AA+' rating on the long-term bank facilities of the company on 'Watch with Developing Implications', after the acquisition of biosimilar assets of US-based Viatris Inc by its subsidiary Biocon Biologics for $3.33 billion. The rating on the short term bank facilities has been reaffirmed at 'A1+'.

Gufic Biosciences: The company entered the cancer immunology segment by undertaking research collaboration with Australia-based biotechnology company Selvax Pty Ltd.

NTPC: The state-owned power generation company said 660 MW unit-3 of its subsidiary Nabinagar Power Generating Company has successfully completed trial operation. And consequently the same has been included in the installed capacity of NTPC Group. With this, the total installed capacity of Nabinagar Power Generating Company and NTPC group has become 1,980 MW and 68,567.18 MW, respectively.

Arvind: The company said its operations have fully resumed at the Ankur unit. Operations at the Ankur unit had been disrupted due to disconnection of the effluent discharge connection. As a result, its revenue and EBIDTA have been reduced by approximately Rs 40 crore and Rs 10 crore respectively. The unit had contributed 5 percent of the consolidated revenue and 6 percent of the consolidated EBIDTA of the company for FY21.

Bharti Airtel: The telecom operator has entered into an agreement to acquire a 9 percent equity stake in Avaada CleanTN Project Private Limited, a special purpose vehicle. This SPV is formed for owning and operating the captive power plant.

Fund Flow

Foreign institutional investors (FIIs) remained net sellers to the tune of Rs 4,818.71 crore. However, domestic institutional investors (DIIs) have bought shares worth Rs 3,275.94 crore on March 9, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for March 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!