The market remained highly volatile and finally closed with moderate losses on February 16 as the selling pressure was seen in select banks, auto, IT and metal stocks. The weakness in European markets amid Ukraine-Russia concerns also weighed on the street.

The BSE Sensex was down 145 points at 57,997, while the Nifty50 fell 30 points to 17,322 and formed a bearish candle on the daily charts as the closing was lower than opening levels.

"A small body of negative candle was formed on the daily chart with minor upper and lower shadow. Technically, this pattern signals a formation of a high-wave type candle pattern at the highs. This indicates high volatility in the market and sometimes this pattern act as a downward reversal post confirmation by subsequent weakness," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels that overall the short term uptrend status of the Nifty remains intact and further upmove above 17,490 is expected to pull the index towards immediate resistance of 17,650 levels. "Inability of bulls to sustain the highs could result in another round of downward correction in the market. Immediate support is placed at 17,200 levels," he says.

The broader markets had a mixed close. The Nifty Midcap 100 index fell a third of a percent. However, the Nifty Smallcap 100 index declined 0.7 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support levels for the Nifty are placed at 17,223, followed by 17,124. If the index moves up, the key resistance levels to watch out for are 17,456 and 17,590.

The Nifty Bank dropped 216 points to 37,954 on February 16. The important pivot level, which will act as crucial support for the index, is placed at 37,657, followed by 37,361. On the upside, key resistance levels are placed at 38,356 and 38,758 levels.

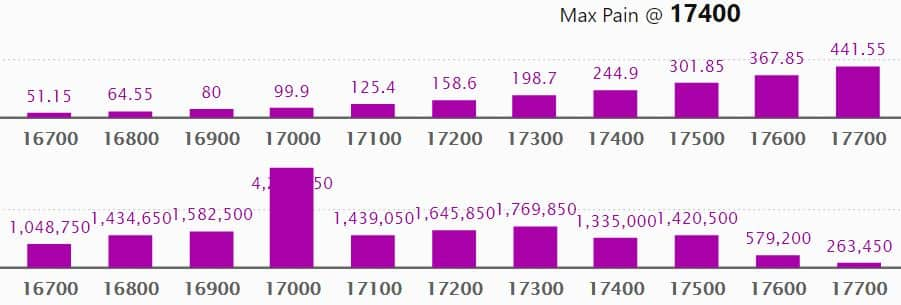

Maximum Call open interest of 29.22 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the February series.

This is followed by 17500 strike, which holds 25.52 lakh contracts, and 17600 strike, which has accumulated 17.99 lakh contracts.

Call writing was seen at 18000 strike, which added 4.77 lakh contracts, followed by 17400 strike which added 4.11 lakh contracts, and 17500 strike which added 3.72 lakh contracts.

Call unwinding was seen at 17000 strike, which shed 1.81 lakh contracts, followed by 17200 strike which shed 1.77 lakh contracts and 17100 strike which shed 1.05 lakh contracts.

Maximum Put open interest of 42.58 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the February series.

This is followed by 16500 strike, which holds 35.51 lakh contracts, and 17300 strike, which has accumulated 17.69 lakh contracts.

Put writing was seen at 17000 strike, which added 10.27 lakh contracts, followed by 17400 strike, which added 6.13 lakh contracts, and 17300 strike which added 5.01 lakh contracts.

Put unwinding was seen at 16600 strike, which shed 3.46 lakh contracts, followed by 16700 strike which shed 52,450 contracts, and 17700 strike which shed 8,650 contracts.

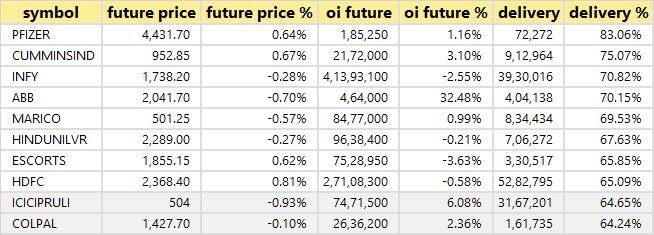

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

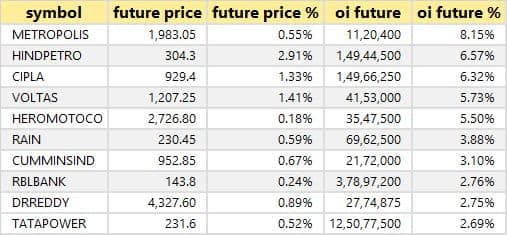

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

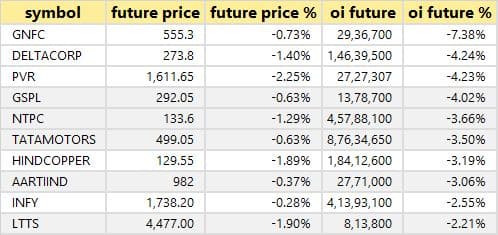

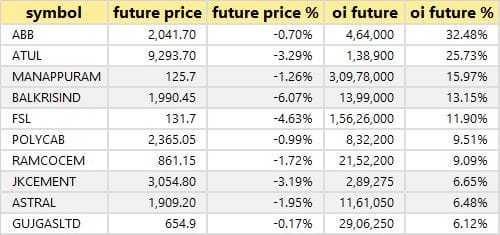

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

33 stocks witnessed short-covering

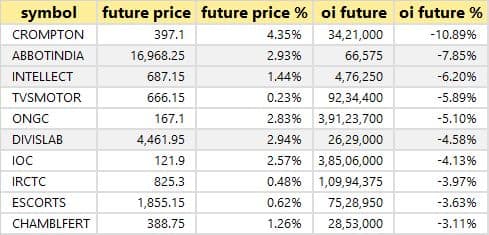

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

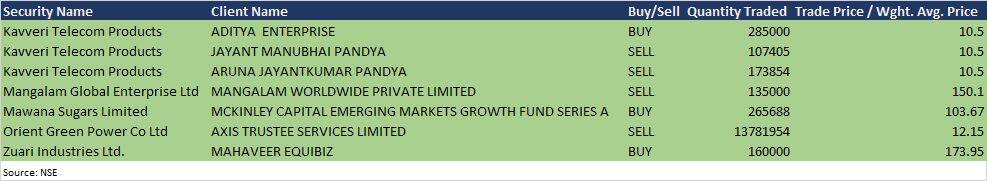

Mawana Sugars: Mckinley Capital Emerging Markets Growth Fund Series A acquired 2,65,688 equity shares in the company via open market transactions, at an average price of Rs 103.67 per share on the NSE, as per the bulk deals data.

(For more bulk deals, click here)

Analysts/Investors Meetings; and Results on February 17

Results on February 17: Ambuja Cements, Nestle India and Veritas (India) will release quarterly earnings on February 17.

UltraTech Cement: The company's officials will meet SBI Life Insurance on February 17.

Tube Investments of India: The company's officials will meet DSP Mutual Fund on February 17.

Aditya Birla Sun Life AMC: The company's officials will attend IIFL's 13th Enterprising India Global Investors Conference, on February 17.

Visaka Industries: The company's officials will meet Sunidhi Securities & Finance on February 17.

Syngene International: The company's officials will meet Edelweiss AMC on February 17.

CRISIL: The company's officials will meet Edelweiss on February 21; Global Equity Portfolio Management, Wellington, HK on February 22; and Pari Washington Company Advisors on February 23.

Mahindra CIE Automotive: The company's officials will meet analysts and investors on February 23, to discuss financial results.

IIFL Finance: The company's officials will meet First State Sentier on February 28.

Stocks in News

Kalpataru Power Transmission: The company on February 19 will consider the proposal for reorganisation.

Tata Consultancy Services: The company announced a partnership with MATRIXX Software to offer a comprehensive next-gen subscription management platform for communication service providers.

Wipro: The company received a five-year contract to drive transformation for ABB's information systems digital workplace services. The agreement, worth over $150 million, will help ABB's information systems deliver enhanced, consumer-grade digital experiences for its 1,05,000 employees in over 100 countries.

Infosys: The company has been named a foundational partner for the launch of Google Cloud Cortex Framework. Infosys will help clients accelerate digital transformation and power new business capabilities with its market-leading data, analytics and AI expertise. The company will take advantage of Google Cloud Cortex Framework, along with its strong experience in SAP and Google Cloud ecosystems, to deliver better business outcomes.

Best Agrolife: Subsidiary Best Crop Science (previously known as Best Crop Science LLP) has received a licence for indigenous manufacturing of spiromesifen technical, from Central Insecticides Board and Registration Committee.

Southern Petrochemicals: Consolidated profit of the company in Q3FY22 grew significantly by 832 percent year-on-year to Rs 59.6 crore compared to Rs 6.4 crore in Q3FY21. Consolidated revenue grew by 15 percent to Rs 492 crore from Rs 427 crore during the same period.

Compuage Infocom: The company received approval from the board of directors for fundraising up to Rs 50 crore through a rights issue.

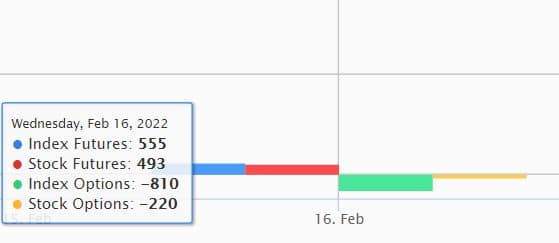

Fund Flow

Foreign institutional investors (FIIs) have made net selling of Rs 1,890.96 crore worth of shares, whereas domestic institutional investors (DIIs) have net bought Rs 1,180.14 crore worth of shares in the Indian equity market on February 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Escorts, Indiabulls Housing Finance, and SAIL - are under the F&O ban for February 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!