The market continued to be on a strong footing on February 2, a day after the presentation of Union Budget 2022-23 as the benchmark indices rallied more than 1 percent, thereby extending the gaining streak into the third day.

Most sectors cheered the Budget proposals, and the broader market too joined the party with the Nifty Midcap 100 and Smallcap 100 indices rising 1.18 percent and 1.44 percent, respectively.

The BSE Sensex rallied 695.76 points or 1.18 percent to 59,558.33 while the Nifty50 jumped 203.20 points or 1.16 percent to 17,780 and formed a bullish candle on the daily charts.

"The daily price action has formed a bullish candlestick forming higher high-low compared to the previous session and has closed above the previous session's high indicating further strength. On the hourly charts, the index is trending up, forming a series of higher tops and bottoms, indicating positive bias," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

The bullish gap area formed on February 2 in the range of 17,674-17,622 remains a crucial support zone, says Palviya. "We expected this momentum to continue towards 18,000-18,100 levels in the near term."

Palviya advised short-term traders to hold long positions with a stop-loss of 17,600, which remains an important support zone.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,705, followed by 17,630. If the index moves up, the key resistance levels to watch out for are 17,824.8 and 17,869.6.

The Nifty Bank jumped 825 points or 2.14 percent to 39,330.50 on February 2. The important pivot level, which will act as crucial support for the index, is placed at 38,926.53, followed by 38,522.57. On the upside, key resistance levels are placed at 39,560.53 and 39,790.57 levels.

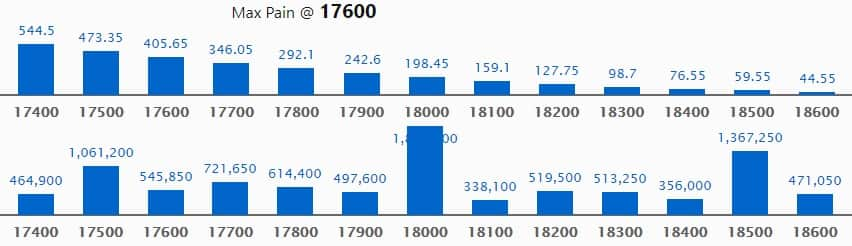

Maximum Call open interest of 18.98 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 18,500 strike, which holds 13.67 lakh contracts, and 17,500 strike, which has accumulated 10.61 lakh contracts.

Call writing was seen at 17,700 strike, which added 1.72 lakh contracts, followed by 18,600 strike which added 1.04 lakh contracts, and 18,200 strike which added 95,350 contracts.

Call unwinding was seen at 17,500 strike, which shed 3.76 lakh contracts, followed by 18000 strike which shed 2.77 lakh contracts and 17,600 strike which shed 2.7 lakh contracts.

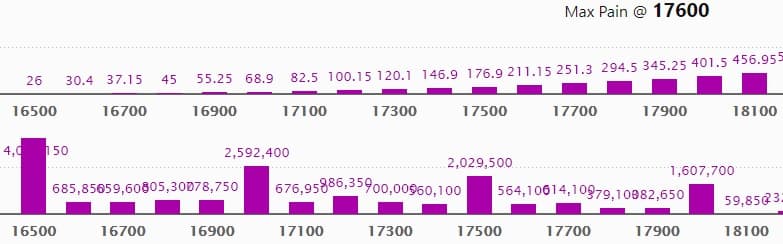

Maximum Put open interest of 40.49 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the February series.

This is followed by 17,000 strike, which holds 25.92 lakh contracts, and 17,500 strike, which has accumulated 20.29 lakh contracts.

Put writing was seen at 17,700 strike, which added 3.94 lakh contracts, followed by 17,200 strike, which added 1.19 lakh contracts, and 16,900 strike which added 93,300 contracts.

Put unwinding was seen at 16,500 strike, which shed 84,750 contracts, followed by 17,000 strike which shed 76,500 contracts, and 16,800 strike which shed 52,950 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

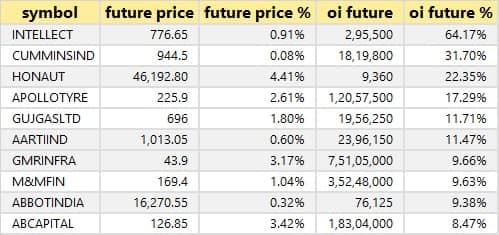

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

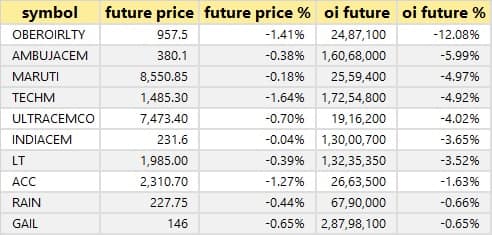

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

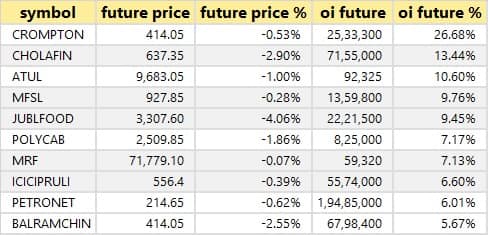

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

69 stocks witnessed short-covering

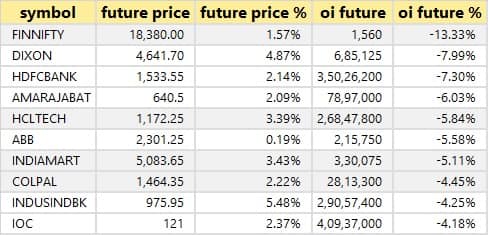

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

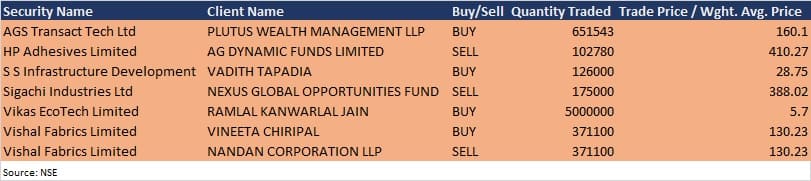

AGS Transact Technologies: Plutus Wealth Management LLP acquired 6,51,543 equity shares in the company at Rs 160.1 per share on the NSE, the bulk deals data showed.

HP Adhesives: AG Dynamic Funds sold 1,02,780 equity shares in the company at Rs 410.27 per share on the NSE, the bulk deals data showed.

Sigachi Industries: Nexus Global Opportunities Fund sold 1.75 lakh shares in the company at Rs 388.02 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on February 3

Results on February 3: ITC, Titan Company, Lupin, Aavas Financiers, Aditya Birla Capital, Adani Power, Adani Transmission, Barbeque-Nation Hospitality, Brigade Enterprises, Cadila Healthcare, Coromandel International, Dishman Carbogen Amcis, Emami, GAIL (India), Godrej Properties, HCC, HG Infra Engineering, India Pesticides, JK Tyre & Industries, Jubilant Industries, Kalyan Jewellers India, Lux Industries, NESCO, Pfizer, PI Industries, Prince Pipes and Fittings, Radico Khaitan, Rolex Rings, Sigachi Industries, SIS, Sumitomo Chemical India, Torrent Power, Varun Beverages, Welspun India, and Westlife Development will release their quarterly earnings on February 3.

CG Power and Industrial Solutions: The company's officials will meet Capital Research Global Investors on February 3.

Symphony: The company's officials will meet IIFL AMC on February 3.

Supreme Industries: The company's officials will meet analysts and institutional investors on February 3.

Muthoot Capital Services: The company's officials will meet investors on February 3 to discuss financial results.

Deep Industries: The company's officials will meet investors and analysts on February 4 to discuss financial results.

Expleo Solutions: The company's officials will meet investors and analysts on February 4 to discuss financial results.

Redington (India): The company's officials will meet analysts and investors on February 8 to discuss financial results.

S H Kelkar and Company: The company's officials will meet analysts and investors on February 8 to discuss financial results.

Hindustan Unilever: The company's officials will attend Edelweiss India Conference 2022 on February 8.

Renaissance Global: The company's officials will meet investors and analysts on February 9 to discuss financial performance.

Stocks in News

Zee Entertainment Enterprises: The company reported lower consolidated profit at Rs 298.98 crore in Q3FY22 against Rs 398.01 crore in Q3FY21, revenue fell to Rs 2,130.44 crore from Rs 2,756.93 crore YoY.

Tata Consumer Products: The company reported higher consolidated profit at Rs 265.05 crore in Q3FY22 against Rs 218.17 crore in Q3FY21, revenue jumped to Rs 3,208.38 crore from Rs 3,069.56 crore YoY.

Triveni Engineering & Industries: The company clocked consolidated profit of Rs 130.12 crore in Q3FY22 against Rs 94.66 crore in Q3FY21, revenue rose to Rs 1,235.44 crore from Rs 1,123.08 crore YoY.

Timken India: The company reported sharply higher profit at Rs 69.8 crore in Q3FY22 against Rs 37.2 crore in Q3FY21, revenue jumped to Rs 510 crore from Rs 383 crore YoY.

Punjab National Bank: HSBC Insurance (Asia Pacific) Holdings to acquire bank's stake in Canara HSBC OBC Life Insurance Company.

Apollo Tyres: The company reported lower consolidated profit at Rs 223.54 crore in Q3FY22 against Rs 443.8 crore in Q3FY21, revenue jumped to Rs 5,707.47 crore from Rs 5,194.66 crore YoY.

Cupid: The company has received an allocation for 2022-2023 from the South African Government for supply of male condoms worth Rs 31.94 crore and female condoms worth Rs 68.70 crore.

Bharat Dynamics: The company signed contract worth Rs 3,131.82 crore, for supply of Konkurs-M anti-tank missiles to Indian Army.

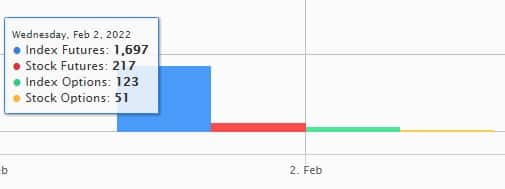

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 183.60 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 425.96 crore in the Indian equity market on February 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for February 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!