The market snapped a five-day losing streak and rebounded more than six-tenth of a percent on January 25, ahead of expiry of January futures and options contracts, driven by a bit of short covering and value buying in beaten down stocks. However, caution remained amid consistent FII selling, as investors awaited the Budget 2022 next week and the US Federal Reserve's policy meeting outcome tonight.

Benchmark indices had fallen 5.5 percent in previous five consecutive sessions before seeing a bounce back on Tuesday. The BSE Sensex rose 366.64 points to 57,858.15, while the Nifty50 jumped 128.90 points to 17,278 and formed bullish candle on the daily charts.

"A long bull candle was formed on the daily chart with long lower shadow. This positive candle has partially engulfed the long bear candle of Monday on the upside," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Technically, "this indicate a type of 'counter attack bulls' type pattern at the lows. Such formations after a reasonable declines or at the supports are considered as a bottom reversals post confirmation. Hence, a further follow-through upmove from here could open a sizable upside bounce in the market ahead," he says.

He feels the sharp down trend in the market seems to have halted at the important support and the market is now ready to show upside bounce. "A confirmation of bottom reversal as per Tuesday's low is likely to pull Nifty towards the upper 17,800 levels in the near term. Any dips could find support around 17,100 levels."

The broader markets rebounded quite sharply and outperformed benchmark indices. The Nifty Midcap 100 and Smallcap 100 indices gained 1 percent and 0.9 percent, respectively.

The market was shut on Wednesday for Republic Day.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,973.4, followed by 16,668.9. If the index moves up, the key resistance levels to watch out for are 17,445.8 and 17,613.7.

The Nifty Bank surged 759.15 points or 2.05 percent to 37,706.75 on January 25. The important pivot level, which will act as crucial support for the index, is placed at 36,818.67, followed by 35,930.54. On the upside, key resistance levels are placed at 38,191.87 and 38,676.93 levels.

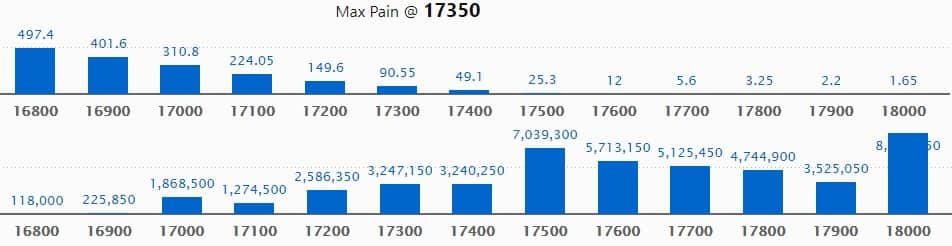

Maximum Call open interest of 86.24 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the January series.

This is followed by 17500 strike, which holds 70.39 lakh contracts, and 17600 strike, which has accumulated 57.13 lakh contracts.

Call writing was seen at 17000 strike, which added 5.68 lakh contracts, followed by 17300 strike which added 4.91 lakh contracts, and 17100 strike which added 2.48 lakh contracts.

Call unwinding was seen at 17500 strike, which shed 13.41 lakh contracts, followed by 17900 strike which shed 11.87 lakh contracts and 18000 strike which shed 10.71 lakh contracts.

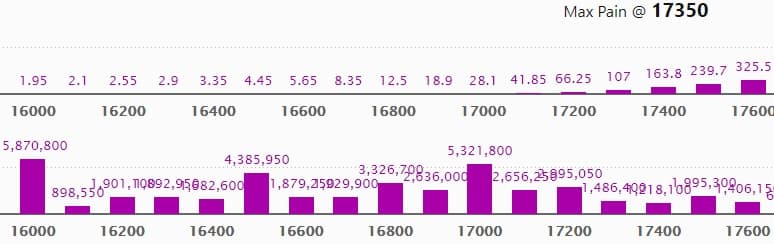

Maximum Put open interest of 58.7 lakh contracts was seen at 16000 strike, which will act as a crucial support level in the January series.

This is followed by 17000 strike, which holds 53.21 lakh contracts, and 16500 strike, which has accumulated 43.85 lakh contracts.

Put writing was seen at 16000 strike, which added 14.31 lakh contracts, followed by 16800 strike, which added 8.61 lakh contracts, and 17000 strike which added 8.46 lakh contracts.

Put unwinding was seen at 17500 strike, which shed 10 lakh contracts, followed by 17400 strike which shed 9.31 lakh contracts, and 17600 strike which shed 4.84 lakh contracts.

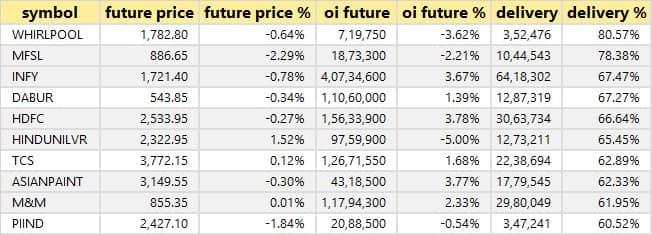

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

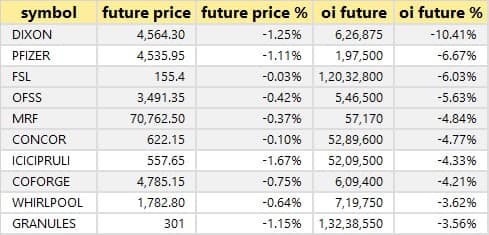

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

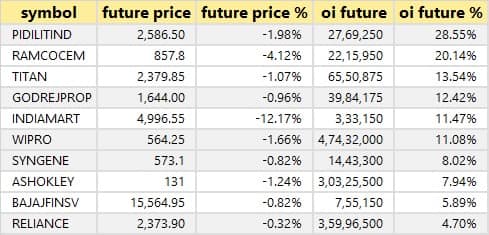

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

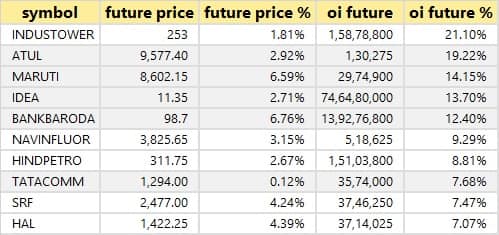

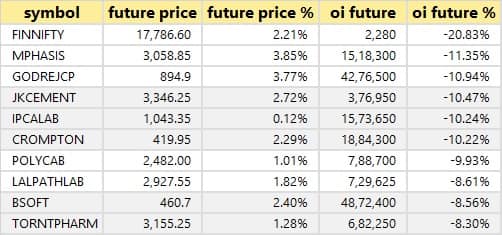

95 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

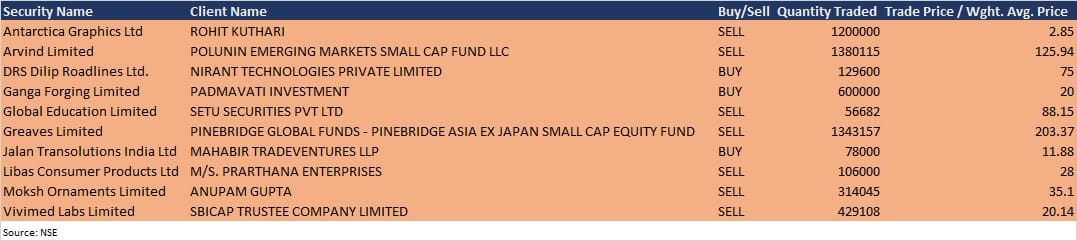

Arvind: Polunin Emerging Markets Small Cap Fund LLC sold 13,80,115 equity shares in the company at Rs 125.94 per share on the NSE, the bulk deals data showed.

Greaves Cotton: Pinebridge Global Funds - Pinebridge Asia ex-Japan Small Cap Equity Fund sold 13,43,157 equity shares in the company at Rs 203.37 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 27

Results on January 27: Bharat Heavy Electricals, Punjab National Bank, RBL Bank, Canara Bank, Indus Towers, Accelya Solutions India, AIA Engineering, Arvind, Aurionpro Solutions, Birlasoft, CG Power and Industrial Solutions, Chalet Hotels, Coforge, Colgate-Palmolive, Dalmia Bharat, Exxaro Tiles, Fino Payments Bank, GHCL, Gujarat Mineral Development Corporation, Home First Finance Company, HSIL, Laurus Labs, LIC Housing Finance, Mahindra Logistics, CE Info Systems, Motilal Oswal Financial Services, Nippon Life India Asset Management, PSP Projects, Route Mobile, Transport Corporation of India, Vaibhav Global, Wabco India, and Wockhardt will release quarterly earnings on January 27.

Route Mobile: The company's officials will meet investors and analysts on January 27 to discuss financial results.

Fineotex Chemical: The company's officials will meet Kotak Life Insurance, Goldman Sachs Asset Management, and IDFC MF on January 27.

Gokaldas Exports: The company's officials will meet GIC Singapore on January 27.

UltraTech Cement: The company's officials will meet Matthews Asia on January 27.

LIC Housing Finance: The company's officials will meet investors and analysts on January 28 to discuss financial results.

Kirloskar Pneumatic Company: The company's officials will meet investors and analysts on January 28 to discuss financial results.

Great Eastern Shipping: The company's officials will meet investors and analysts on January 28 to discuss financial results.

UPL: The company's officials will meet investors and analysts on January 31 to discuss financial results.

TTK Prestige: The company's officials will meet investors and analysts on February 2 to discuss financial performance.

Triveni Engineering: The company's officials will meet investors and analysts on February 3, to discuss financial results.

Stocks in News

Raymond: The company reported higher profit at Rs 101 crore in Q3FY22 against Rs 22.1 crore in Q3FY21, revenue jumped to Rs 1,843.3 crore from Rs 1,243.4 crore YoY. The company to demerge its real estate operations into subsidiary.

PNC Infratech: The joint venture company has received orders worth Rs 2,337 crore.

Indiabulls Real Estate: The company posted loss at Rs 87 crore in Q3FY22 against profit of Rs 80.6 crore in Q3FY21, revenue fell to Rs 322.8 crore from Rs 721.6 crore YoY.

Macrotech Developers: The company reported higher profit at Rs 286.3 crore in Q3FY22 against Rs 231.7 crore in Q3FY21, revenue jumped to Rs 2,059.4 crore from Rs 1,514.1 crore YoY.

Torrent Pharma: The company clocked lower profit at Rs 249 crore in Q3FY22 against Rs 297 crore in Q3FY21, revenue rose to Rs 2,108 crore from Rs 1,995 crore YoY.

Cipla: The company reported higher profit at Rs 756.88 crore in Q3FY22 against Rs 751.6 crore in Q3FY21, revenue increased to Rs 5,478.86 crore from Rs 5,169 crore YoY.

H G Infra Engineering: The company has been declared as L-l bidder by National Highways Authority of India.

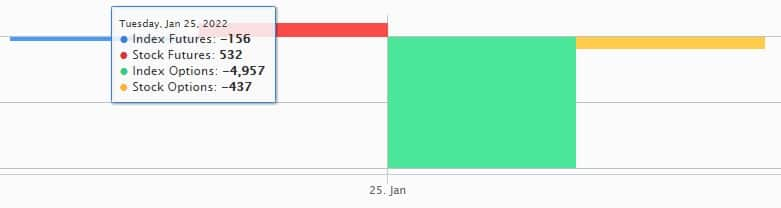

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 7,094.48 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 4,534.53 crore in the Indian equity market on January 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for January 27, the expiry day for January futures & options contracts. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!