The market fell sharply for second consecutive session with the Nifty50 decisively breaking 18,000 mark as FII selling, rising oil prices and inflation concerns weighed on sentiment.

BSE Sensex plunged 656 points or 1.08 percent to close at 60,098.82, while the Nifty50 declined 175 points or 0.96 percent to 17,938.40 and formed bearish candle on the daily charts.

"The daily price action has formed a sizable bearish candle and closed below the previous session's low representing short-term correction. The current close index has violated the previous gap support near 18,090 - 18,140, indicating negative bias. This profit booking was observed from our mentioned resistance zone of 18,300-18,350 levels," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

Below 17,850 levels, he expects this correction may extend towards 17,700-17,600 levels.

The daily strength indicator RSI (relative strength index) has witnessed a negative crossover from the overbought zone which signals weakness on short-term charts, he says.

However, the broader markets outperformed frontline indices with the Nifty Midcap 100 index falling 0.06 percent and Smallcap 100 index rising 0.01 percent.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,839.13, followed by 17,739.87. If the index moves up, the key resistance levels to watch out for are 18,083.43 and 18,228.46.

The Nifty Bank dropped 168.95 points to close at 38,041.35 on January 19. The important pivot level, which will act as crucial support for the index, is placed at 37,763.57, followed by 37,485.73. On the upside, key resistance levels are placed at 38,324.87 and 38,608.34 levels.

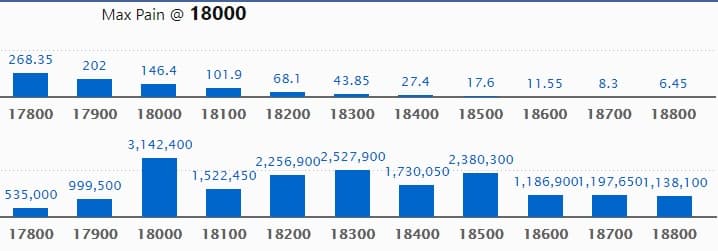

Maximum Call open interest of 31.42 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the January series.

This is followed by 18300 strike, which holds 25.27 lakh contracts, and 18500 strike, which has accumulated 23.80 lakh contracts.

Call writing was seen at 18000 strike, which added 15.36 lakh contracts, followed by 18100 strike which added 6.7 lakh contracts, and 17900 strike which added 5.95 lakh contracts.

Call unwinding was seen at 17600 strike, which shed 27,700 contracts, followed by 17200 strike which shed 17,700 contracts and 17300 strike which shed 7,000 contracts.

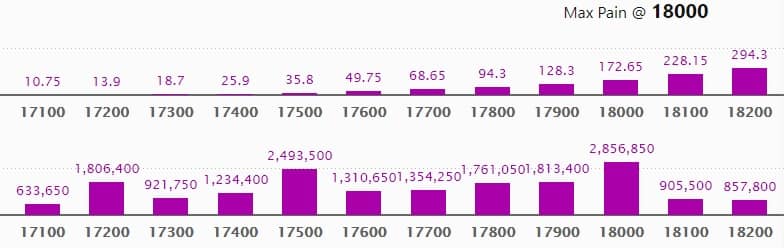

Maximum Put open interest of 28.56 lakh contracts was seen at 18000 strike, followed by 17500 strike, which holds 24.93 lakh contracts, and 17900 strike, which has accumulated 18.13 lakh contracts.

Put writing was seen at 17900 strike, which added 4.91 lakh contracts, followed by 17800 strike, which added 2.45 lakh contracts, and 17700 strike which added 1.75 lakh contracts.

Put unwinding was seen at 18200 strike, which shed 5.1 lakh contracts, followed by 18300 strike which shed 2.67 lakh contracts, and 18100 strike which shed 1.83 lakh contracts.

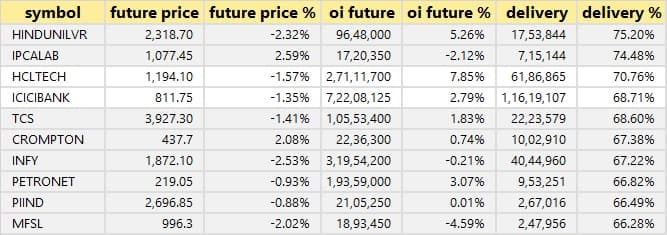

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

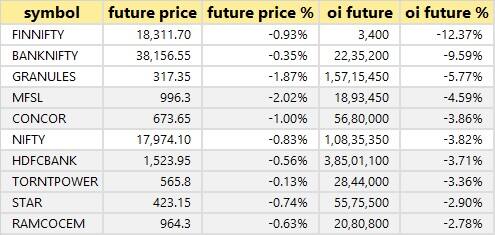

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

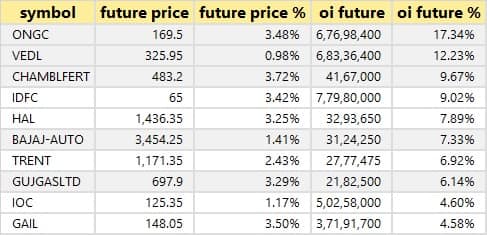

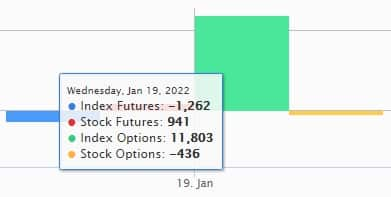

50 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

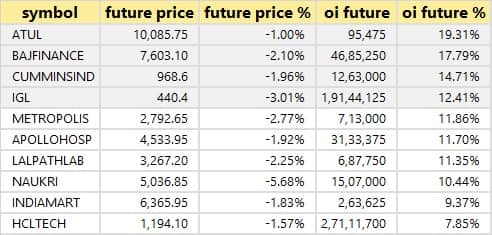

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 20

Results on January 20: Hindustan Unilever, Biocon, Asian Paints, Bajaj Finserv, Havells India, Persistent Systems, PNB Housing Finance, Agro Tech Foods, Bajaj Holdings & Investment, Century Textiles & Industries, Container Corporation Of India, Cyient, Datamatics Global Services, Hatsun Agro Product, Lyka Labs, Bank Of Maharashtra, Mphasis, Reliance Industrial Infrastructure, Sasken Technologies, Shoppers Stop, South Indian Bank, Vimta Labs and VST Industries are going to announce their quarterly numbers on January 20.

Rallis India: The company's officials will meet analysts and investors on January 20.

Sterling and Wilson Renewable Energy: The company's officials will meet investors and analysts on January 20.

Sanghi Industries: The company's officials will meet Invesco Mutual Fund, and K M Visaria Family Trust on January 20.

Sobha: The company's officials will meet institutional investor/analyst on January 20.

Stocks in News

Larsen & Toubro Infotech: The company's profit rose 11% at Rs 612.5 crore in Q3FY22 versus Rs 551.1 crore Q3FY21 and revenue was up 9.8% at Rs 4,137.6 crore versus Rs 3,767 crore, QoQ.

Bajaj Auto: The company reports 22% YoY decline in net profit at Rs 1,214.19 crore in Q3FY22 against Rs 1,556.28 crore in Q3FY21, while total revenues from operations rose 1.25% to Rs 9,021.65 crore against Rs 8,909.88 crore YoY.

Tata Communications: The company's net profit down 7% at Rs 395.21 crore in Q3FY22 against Rs 425.38 crore in Q3FY21 and revenue was up at Rs 4,184.89 crore versus Rs 4,174.02 crore, QoQ.

Rallies India: The company reports 30% fall in consolidated net profit of Rs 39.56 crore in Q3FY22 versus Rs 56.49 crore in Q3FY21, and revenue was down 13 percent at Rs 628.08 crore aainst Rs 727.80 crore, QoQ.

Nandan Denim: ICRA has upgraded the long term rating to BBB/positive from BBB-/stable and short term rating has been upgraded to A3+ from A3.

HCL Technologies: The company appointed Prabhakar Appana as Senior Vice President and the Global Head of its AWS Ecosystem Business Unit.

Jet Airways: Kuldeep Sharma resigned as company secretary and compliance officer of the company.

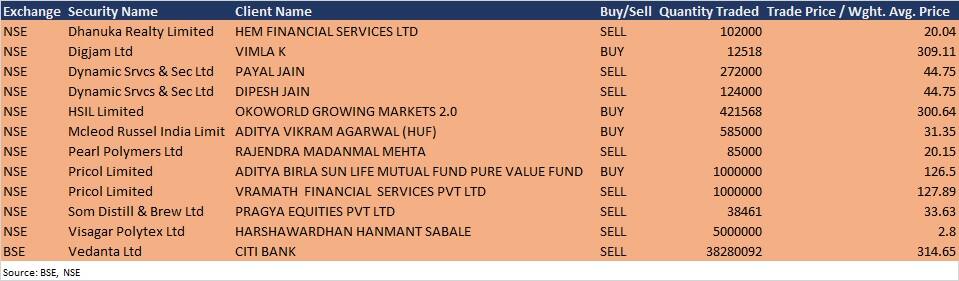

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,704.77 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 195.07 crore in the Indian equity market on January 19, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - BHEL, Escorts, Granules India, Indiabulls Housing Finance, Vodafone Idea, and SAIL - are under the F&O ban for January 20. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!