The market remained volatile throughout the session and finally settled the trade with moderate losses on December 29 ahead of the expiry of December futures and options contracts, snapping a two-day winning streak. However, the broader markets outpaced the benchmark indices, as the Nifty Midcap 100 and Smallcap 100 indices have gained 0.13 percent and 0.59 percent respectively.

The BSE Sensex was down 91 points at 57,806.5, while the Nifty50 fell 20 points to 17,213.6 and formed a Doji kind of pattern on the daily charts.

"Bulls appear to be adopting a cautious stance, ahead of monthly expiry, as the trading range of last two sessions remained extremely narrow with around 100 Nifty points. Moreover, mild selling pressure from the intraday high of 17,286 is witnessed after testing the upper boundary of a 31-day old descending channel," says Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory at Chartviewindia.in.

He further says the first hurdle going forward will remain a close above the said downsloping channel. "In that scenario, strength shall initially expand towards 17,340 levels where 50-day exponential moving average is present, and beyond that, a bigger target around 17,550 can't be ruled out."

However, it remains very critical for the Nifty to sustain above the bullish gap zone of 17,161–17,112 levels, registered on December 28 to retain positive bias as a close below 17,100 should ideally drag down the index into sideways phase, Mazhar says.

For the time being, considering monthly expiry, he advised traders to remain neutral on the index.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,164.9, followed by 17,116.2. If the index moves up, the key resistance levels to watch out for are 17,274.1 and 17,334.6.

Nifty Bank

The Nifty Bank declined 138.40 points to 35,045.40 on December 29. The important pivot level, which will act as crucial support for the index, is placed at 34,831.36, followed by 34,617.33. On the upside, key resistance levels are placed at 35,318.86 and 35,592.33 levels.

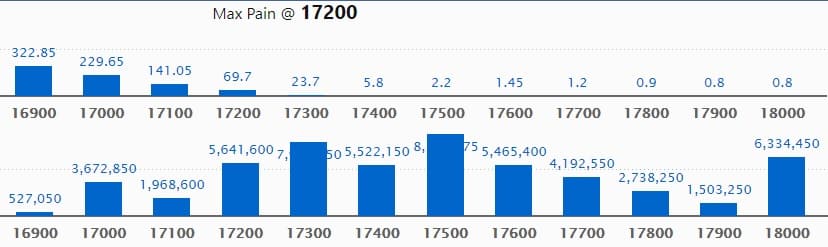

Call option data

Maximum Call open interest of 87.74 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level in the December series.

This is followed by 17300 strike, which holds 79.04 lakh contracts, and 18000 strike, which has accumulated 63.34 lakh contracts.

Call writing was seen at 17300 strike, which added 30.12 lakh contracts, followed by 17500 strike which added 19.83 lakh contracts, and 17400 strike which added 17.72 lakh contracts.

Call unwinding was seen at 18000 strike, which shed 9.46 lakh contracts, followed by 17900 strike which shed 8.8 lakh contracts and 17800 strike which shed 6.39 lakh contracts.

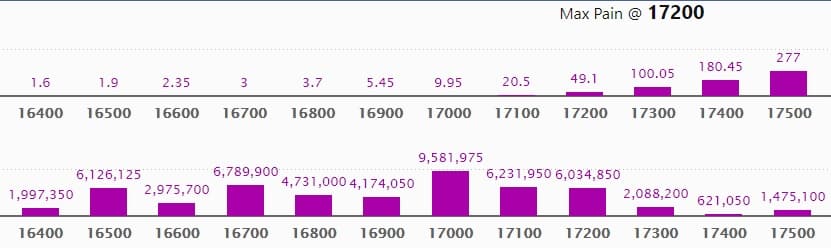

Put option data

Maximum Put open interest of 95.81 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the December series.

This is followed by 16700 strike, which holds 67.89 lakh contracts, and 17100 strike, which has accumulated 62.31 lakh contracts.

Put writing was seen at 16700 strike, which added 32.78 lakh contracts, followed by 17100 strike which added 10.14 lakh contracts and 17200 strike which added 8.36 lakh contracts.

Put unwinding was seen at 16400 strike, which shed 35.42 lakh contracts, followed by 16500 strike which shed 7.93 lakh contracts and 16800 strike which shed 4.18 lakh contracts.

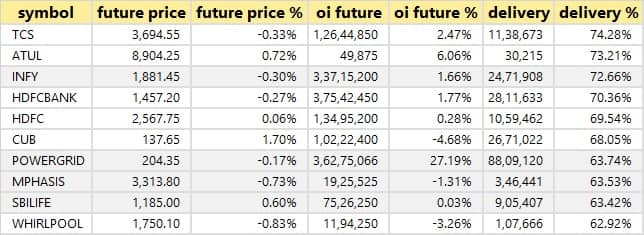

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

22 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

79 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

35 stocks saw short build-up

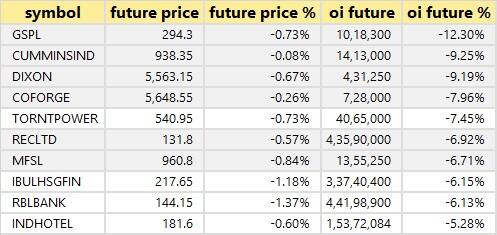

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

50 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

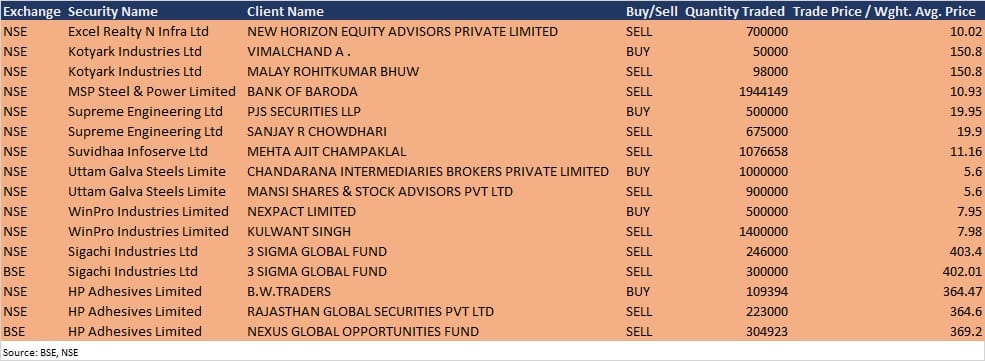

Bulk deals

Sigachi Industries: Foreign investor 3 Sigma Global Fund sold nearly half of its stake in the company, selling 2.46 lakh equity shares at Rs 403.4 per share on the NSE, and offloading 3 lakh equity shares at Rs 402.01 per share on the BSE, the bulk deals data showed.

HP Adhesives: Foreign investor Nexus Global Opportunities Fund exited the company by selling 3,04,923 equity shares in the company at Rs 369.2 per share on the BSE, the bulk deals data showed. BW Traders bought 1,09,394 equity shares in the company at Rs 364.47 per share. However, Rajasthan Global Securities sold 2.23 lakh shares at Rs 364.6 per share on the NSE.

(For more bulk deals, click here)

Analysts/Investors Meeting

GMM Pfaudler: The company's officials will interact with analysts and investors on December 30.

Somany Home Innovation: The company's officials will interact with Edelweiss Financial Services and Nirmal Bang on December 30.

Balrampur Chini Mills: The company's officials will meet HDFC MF on December 30.

PSP Projects: The company's officials will meet IDFC AMC on December 30.

GRP: The company's officials will meet investors and analysts on December 30.

Stocks in News

Varun Beverages: The company has incorporated a new entity 'Varun Beverages RDC SAS' in the Democratic Republic of Congo to carry on the business of manufacturing, selling, trading and distribution of carbonated and non-carbonated beverages.

Bharat Petroleum Corporation: Life Insurance Corporation of India acquired a 2.019 percent stake in the company via open market transactions, increasing shareholding to 7.03 percent from 5.01 percent earlier.

Kimia Biosciences: The company has been validated for the supply of pharmaceutical raw material (Bilastine) to Bangladesh by the Government of Bangladesh. This certificate of source validation is valid for 3 years from the date of issue.

Deep Industries: The company has received a letter of award from GSPC LNG (GLL) for the hiring of gas compression services at GSPC LNG Terminal, Mundra, Gujarat, for a period of 5 years. The total estimated value of the contract is approximate Rs 44.40 crore.

KPI Global Infrastructure: The company has received confirmation of the order for executing a solar power project of 10 MWDC capacity from Colourtex Industries, Surat under the 'captive power producer (CPP)' segment.

IRB Infrastructure Developers: The company has raised Rs 5,346.6 crore as it has approved allotment of 25,24,50,000 equity shares at a price of Rs 211.79 per share to Cintra INR Investments BV and Bricklayers Investment Pte Ltd.

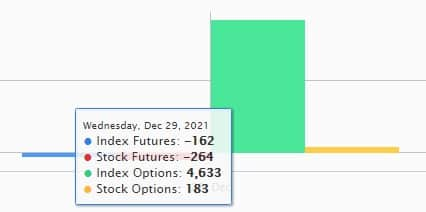

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 975.23 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,006.93 crore in the Indian equity market on December 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Indiabulls Housing Finance, Vodafone Idea, and RBL Bank - are under the F&O ban for December 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!