The market remained under selling pressure on December 15 with the BSE Sensex falling more than 300 points, ahead of the outcome of two-day Federal Reserve meeting scheduled to be announced tonight.

The BSE Sensex fell 329 points or 0.57 percent to 57,788.03, while the Nifty50 declined 103.50 points to 17,221.40 and formed a bearish Engulfing pattern on the daily charts.

"Nifty started off the session on a very flattish note and moved lower after facing rejection near the 20-day SMA (simple moving average - 17,343). The session finally ended with a bearish Engulfing Pattern," says Karan Pai, Technical Analyst at GEPL Capital.

"Looking at the way prices are facing rejection near the 20-day SMA, we feel a break below the daily low of 17,192 will push the prices lower towards the 17,050-mark. We would recommend a stop loss of 17,280 for this trade setup," he added.

The broader markets were also under pressure as the Nifty Midcap 100 and Smallcap 100 indices fell 0.58 percent and 0.39 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,158.66, followed by 17,095.93. If the index moves up, the key resistance levels to watch out for are 17,317.66 and 17,413.93.

Nifty Bank

The Nifty Bank slipped 104.40 points to 36,789.55 on December 15. The important pivot level, which will act as crucial support for the index, is placed at 36,660.7, followed by 36,531.8. On the upside, key resistance levels are placed at 37,001 and 37,212.4 levels.

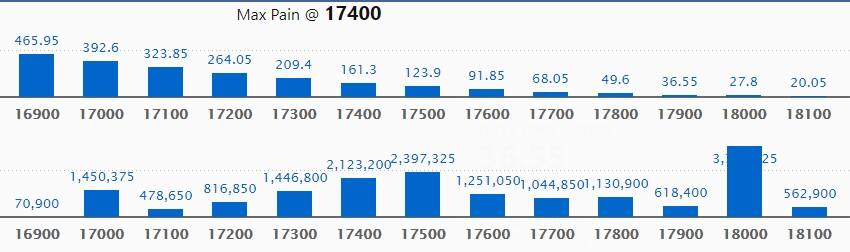

Call option data

Maximum Call open interest of 37.96 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17,500 strike, which holds 23.97 lakh contracts, and 17,400 strike, which has accumulated 21.23 lakh contracts.

Call writing was seen at 17,600 strike, which added 1.94 lakh contracts, followed by 17,500 strike which added 1.47 lakh contracts, and 17,000 strike which added 79,950 contracts.

Call unwinding was seen at 17,900 strike, which shed 99,100 contracts, followed by 17,800 strike which shed 58,000 contracts and 17,700 strike which shed 25,100 contracts.

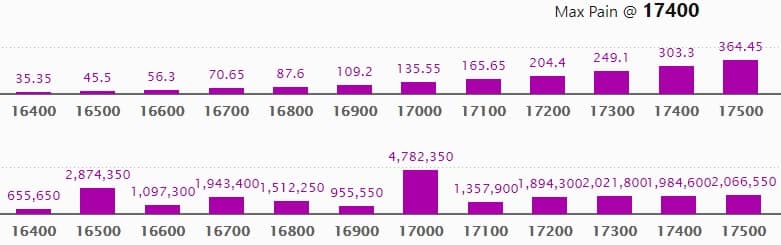

Put option data

Maximum Put open interest of 47.82 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the December series.

This is followed by 16,000 strike, which holds 29.48 lakh contracts, and 16,500 strike, which has accumulated 28.74 lakh contracts.

Put writing was seen at 17,200 strike, which added 50,650 contracts, followed by 16,700 strike which added 32,150 contracts and 16,600 strike which added 23,350 contracts.

Put unwinding was seen at 17,300 strike, which shed 2.4 lakh contracts, followed by 17,000 strike which shed 1.64 lakh contracts and 17,400 strike which shed 1.36 lakh contracts.

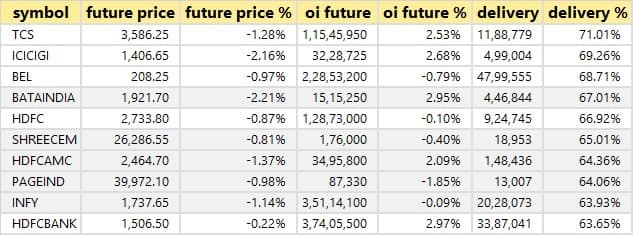

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

15 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

61 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

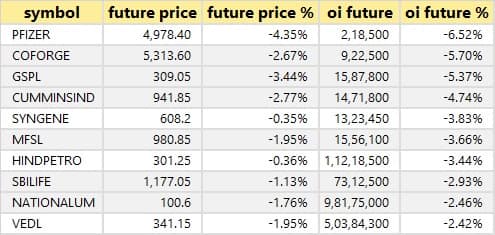

88 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

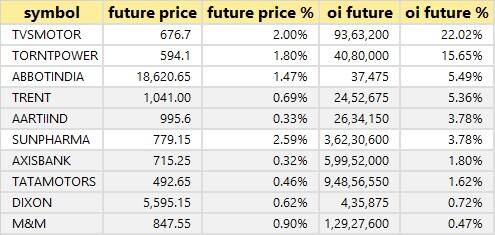

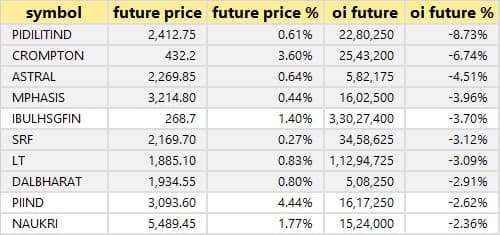

26 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

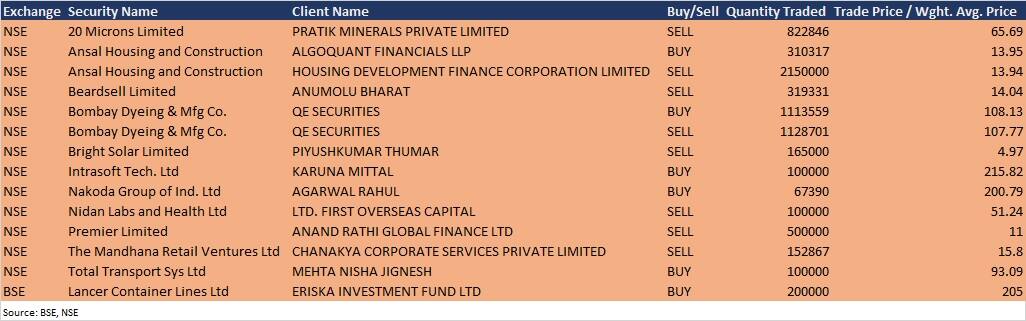

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

Asian Paints: The company's officials will meet Wellington Management on December 16, and Morgan Stanley Investment Management on December 20.

Nuvoco Vistas Corporation: The company's officials will meet Torq Capital and Kotak Securities on December 16.

Infibeam Avenues: The company's officials will meet analysts and institutional investors on December 16.

Max Financial Services: The company's officials will meet Fidelity Management Research on December 16.

Emmbi Industries: The company's officials will meet Edha Wealth LLP on December 16.

Kamdhenu: The company's officials will meet analysts and investors on December 16.

Ramkrishna Forgings: The company's officials will meet Green Lantern Capital on December 16.

Birlasoft: The company's officials will meet analysts and institutional investors on December 16.

Stocks in News

Adani Ports and Special Economic Zone: The company has signed Share Purchase Agreement with Adani Transmission for divestment of 100% equity stake of MPSEZ Utilities (MUL).

Vakrangee: The company partnered with Pharmeasy to provide online medicines & healthcare services across its platform.

Wipro: The company will acquire LeanSwift Solutions, a Florida, US-headquartered system integrator of Infor Products whose service capabilities include ERP, e-commerce, digital transformation, supply chain, warehouse management systems, business intelligence and integrations.

Cipla: The company has acquired up to 33% of partnership interest in Clean Max Auriga Power LLP. This agreement is in line with the company’s commitment to enhance the share of renewable power source in its operation and to comply with regulatory requirement for being a captive user under electricity laws.

Jubilant Industries: After the permission from National Capital Region and Adjoining Areas (Commission), subsidiary Jubilant Agri and Consumer Products has restarted manufacturing operations of its Sahibabad plant.

Sun Pharma: Its subsidiary has received final approval from US FDA for its abbreviated new drug application (ANDA) for generic Amphotericin B Liposome for injection.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 3,407.04 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,553.01 crore in the Indian equity market on December 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Escorts, Indiabulls Housing Finance and Vodafone Idea - will be under the F&O ban for December 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!