The market reversed all its previous day's gains and fell half a percent on November 24, ahead of expiry of November futures & options contracts, weighed by Auto, FMGC, IT, and select Pharma stocks.

The BSE Sensex corrected 323.34 points to 58,340.99, while the Nifty50 declined 88.30 points to 17,415 and formed bearish candle on the daily charts, indicating further weakness in the market up to 20-week EMA (exponential moving average) around 17,200 levels, experts feel.

"A reasonable negative candle was formed on the daily chart that has partially engulfed previous bull candle. Technically, this pattern signals weak upside bounce in the market. This market action also indicates a chances of Nifty revisiting the recent low of 17,216 levels, before showing another round of minor upside bounce from the lows," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the short term trend of Nifty continues to be down and there is no confirmation of any significant bottom reversal at the lows.

The broader markets showed a mixed trend. The Nifty Midcap 100 index fell 0.4 percent and the Nifty Smallcap 100 index gained 0.63 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,312.54, followed by 17,209.97. If the index moves up, the key resistance levels to watch out for are 17,559.14 and 17,703.17.

Nifty Bank

The Nifty Bank outpaced frontline indices, rising 169.10 points to 37,441.90 on November 24. The important pivot level, which will act as crucial support for the index, is placed at 37,156.03, followed by 36,870.17. On the upside, key resistance levels are placed at 37,809.83 and 38,177.76 levels.

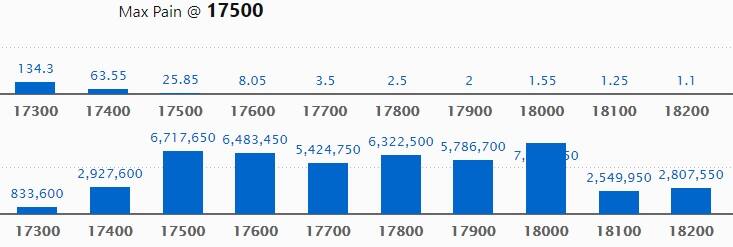

Call option data

Maximum Call open interest of 75.91 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the November series.

This is followed by 17500 strike, which holds 67.17 lakh contracts, and 17600 strike, which has accumulated 64.83 lakh contracts.

Call writing was seen at 17500 strike, which added 22.15 lakh contracts, followed by 17600 strike, which added 20.66 lakh contracts and 17400 strike which added 14.37 lakh contracts.

Call unwinding was seen at 18100 strike, which shed 6.38 lakh contracts, followed by 18000 strike, which shed 3.48 lakh contracts, and 18200 strike which shed 1.63 lakh contracts.

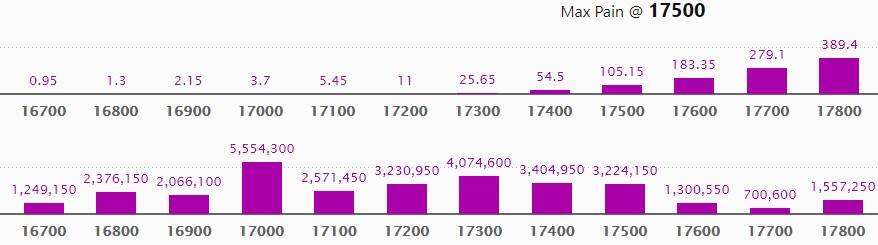

Put option data

Maximum Put open interest of 55.54 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the November series.

This is followed by 17300 strike, which holds 40.74 lakh contracts, and 17400 strike, which has accumulated 34.04 lakh contracts.

Put writing was seen at 17100 strike, which added 6.31 lakh contracts, followed by 17000 strike which added 5.53 lakh contracts and 16800 strike which added 3.86 lakh contracts.

Put unwinding was seen at 17500 strike, which shed 11.17 lakh contracts, followed by 16700 strike which shed 3.2 lakh contracts, and 17800 strike which shed 1.99 lakh contracts.

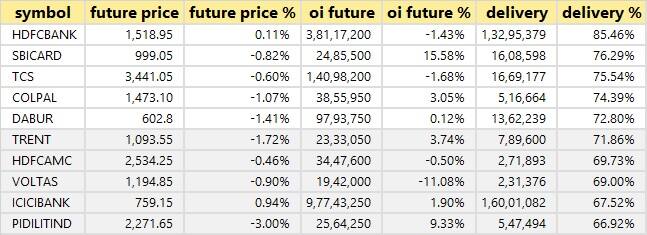

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

14 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

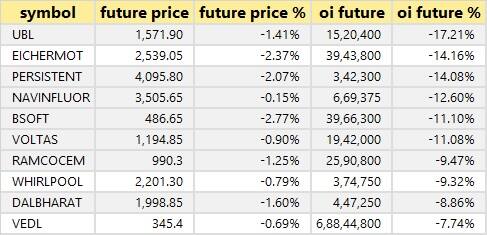

88 stocks saw long unwinding

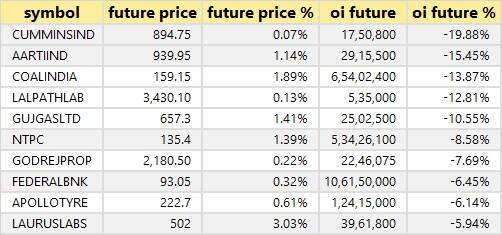

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

47 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

40 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

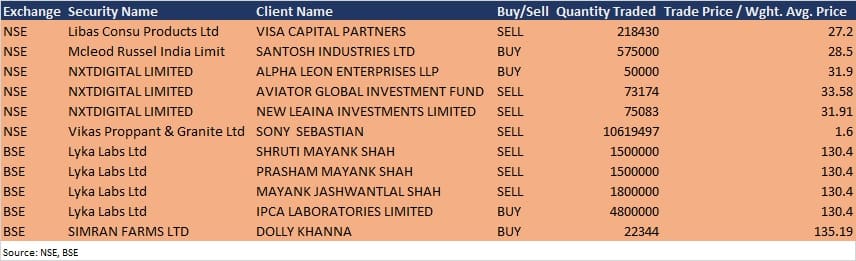

Bulk deals

Lyka Labs: Ipca Laboratories acquired 48 lakh equity shares in the company at Rs 130.4 per share, however, Shruti Mayank Shah & Prasham Mayank Shah sold 15 lakh shares each, and Mayank Jashwantlal Shah offloaded 18 lakh shares at same price on the BSE, the bulk deals data showed.

Simran Farms: Ace investor Dolly Khanna bought 22,344 equity shares in the company at Rs 135.19 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Gokaldas Exports: The company's officials will meet Tata AMC, Seraphic Management, Svan lnvestments, BOI AXA MF, and Dalmus Capital on November 25.

HFCL: The company's officials will meet institutional investors during November 25-30.

Indian Energy Exchange: The company's officials will meet BK Securities on November 25, and ICICI Prudential Life on December 1.

Max Healthcare Institute: The company's officials will interact with GIC (Singapore) on November 25.

United Spirits: The company's officials will meet Axis MF, DSP, IDFC, SBI MF, Tata MF, Sundaram, and Mahindra on November 25.

Krsnaa Diagnostics: The company's officials will meet ICICI Prudential Life Insurance on November 26.

PPAP Automotive: The company's officials will interact with analyst/ investors on November 26.

Sudarshan Chemical Industries: The company's officials will meet Enam Asset Management, & HDFC Mutual Fund on November 26.

BASF India: The company's officials will meet analyst / fund managers on November 29.

Stocks in News

CyberTech Systems and Software: India Rating & Research (Fitch Group) has upgraded the rating of CyberTech Systems from Long-Term Issuer Rating at 'BBB-/Stable/A3' to 'BBB/Stable/A3+'.

Capri Global Capital: The company entered into a co-lending agreement with the Union Bank of India to offer MSMEs loans.

Siemens: The company has recommended a dividend of Rs 8 per equity share for the financial year ended September 2021.

Tube Investments of India: ICRA has reaffirmed the long-term rating at AA+ and the short-term rating at A1+ in respect of the bank fund based and non-fund based limits of the company. The long-term rating has been removed from watch with developing implications and 'Stable' outlook has been assigned.

Grasim Industries: Life Insurance Corporation of India sold 2.02% stake in the company via open market transactions, reducing shareholding to 9.83% from 11.85% earlier.

Pidilite Industries: Subsidiary Madhumala Ventures has agreed to make an investment of Rs 1.56 crore in Constrobot Robotics which is engaged in the business of research, development, manufacturing and trading of robotic equipment and related software to be used in construction activities. The investment would be done through primary and secondary purchase of shares to acquire 19.51% of Constrobot Robotics.

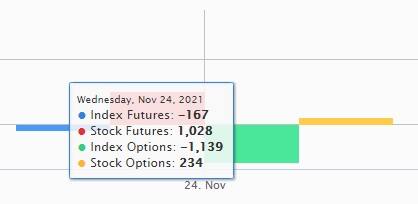

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 5,122.65 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 3,809.62 crore in the Indian equity market on November 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Escorts, and Indiabulls Housing Finance - are under the F&O ban for November 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!