The market remained under pressure for major part of the session, though it attempted many times to reclaim 18,000 mark during the day on November 17. The benchmark indices fell half a percent, weighed by banking & financials, pharma and select metals stocks.

The BSE Sensex fell 314.04 points to close at 60,008.33, while the Nifty50 was down 100.50 points at 17,898.70 and formed bearish candle on the daily charts as the closing was lower than opening levels.

"Nifty has formed a bearish candle on the daily chart with an upper shadow, indicating sustained selling pressure. Nifty has formed a lower high low formation compared to the previous session and indicates that we may see an extended selling pressure ahead of weekly options expiry. Nifty is trading below 20-day SMA (18,019) near-term bearishness," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

According to him, if Nifty sustains below 17,900 then it may slip further towards 17,850-17,750 in the near term, while on the higher side 18,050-18,100 are likely to act as stiff resistance for any pullback in near future.

One should use any pullback towards 18,000 as a selling opportunity with a stop loss of 18,060, Rajesh advised.

The broader markets continued to end mixed for third straight session. The Nifty Midcap 100 index was down 0.67 percent and the Nifty Smallcap 100 index gained 0.13 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,844.37, followed by 17,790.03. If the index moves up, the key resistance levels to watch out for are 17,987.87 and 18,077.03.

Nifty Bank

The Nifty Bank declined 265.50 points to 38,041.60 on November 17. The important pivot level, which will act as crucial support for the index, is placed at 37,863.1, followed by 37,684.6. On the upside, key resistance levels are placed at 38,338.2 and 38,634.8 levels.

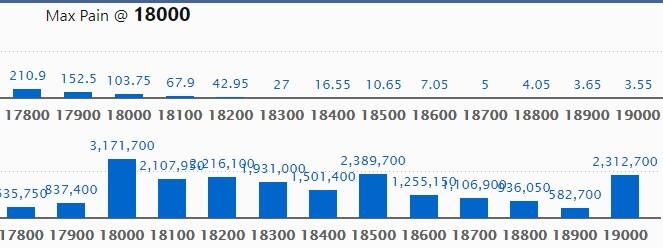

Call option data

Maximum Call open interest of 31.71 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the November series.

This is followed by 18500 strike, which holds 23.89 lakh contracts, and 19000 strike, which has accumulated 23.12 lakh contracts.

Call writing was seen at 18000 strike, which added 9.77 lakh contracts, followed by 18100 strike, which added 6.88 lakh contracts and 18200 strike which added 3.8 lakh contracts.

Call unwinding was seen at 18600 strike, which shed 3.61 lakh contracts, followed by 18400 strike which shed 2.01 lakh contracts and 19000 strike which shed 88,700 contracts.

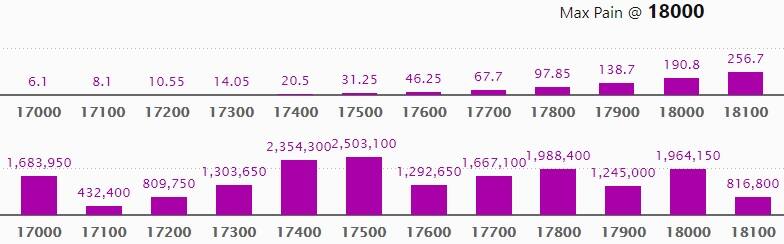

Put option data

Maximum Put open interest of 25.03 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the November series.

This is followed by 17400 strike, which holds 23.54 lakh contracts, and 17800 strike, which has accumulated 19.88 lakh contracts.

Put writing was seen at 17800 strike, which added 1.21 lakh contracts, followed by 17400 strike which added 1.16 lakh contracts and 17300 strike which added 1.09 lakh contracts.

Put unwinding was seen at 17000 strike, which shed 1.22 lakh contracts, followed by 18100 strike which shed 86,500 contracts, and 18300 strike which shed 53,950 contracts.

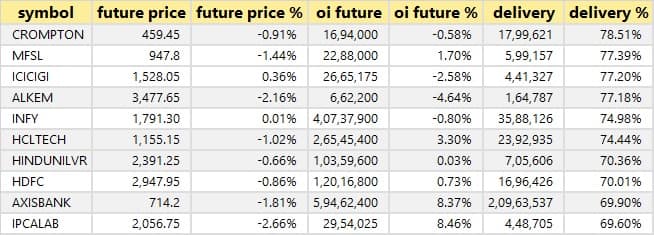

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

26 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

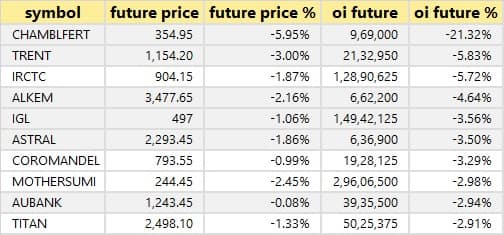

54 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

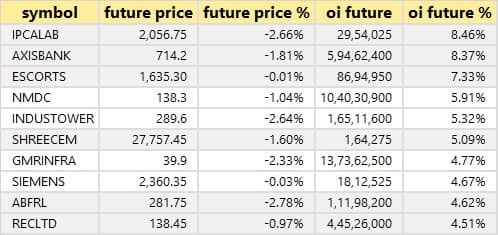

76 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

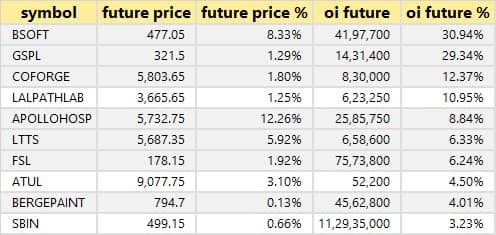

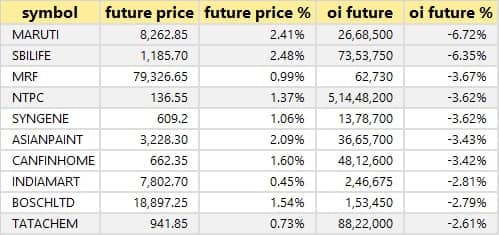

33 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

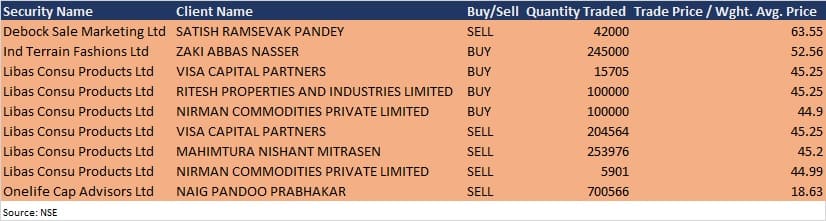

Bulk deals

Onelife Capital Advisors: Promoter Naig Pandoo Prabhakar further sold 7,00,566 equity shares in the company at Rs 18.63 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Arvind Fashions: The company's officials will meet SBI Life Insurance, and Nippon India MF on November 18.

Tata Power: The company's officials will meet eight investors including ITI Mutual Fund, Ambit Investment Advisors, and Ambika Fincap in Centrum Conference on November 18.

Welspun India: The company's officials will meet Batlivala & Karani Securities on November 18.

Speciality Restaurants: The company's officials will meet TrustLine Holdings on November 18.

KEI Industries: The company's officials will meet investors and analysts in a meeting organissed by Batlivala & Karani Securities India on November 18.

UltraTech Cement: The company's officials will meet nine investors including AIA Group, Skale Investments, & Oaktree Capital Management, in Morgan Stanley's Virtual Asia Pacific Summit - on November 18-19.

Voltamp Transformers: The company's officials will participate in B & K Securities Periscope Conference on November 18.

Wipro: The company to hold virtual Investor Day on November 19.

Asian Paints: The company's officials will participate in the virtual conference with Centrum on November 19.

Mangalam Organics: The company's officials will meet analysts and investors on November 20.

Stocks in News

Paytm operator One 97 Communications: The company will make a debut on the bourses on November 18. The issue price has been fixed at Rs 2,150 per share.

Sapphire Foods: The company will list its shares on the bourses on November 18. The issue price has been fixed at Rs 1,180 per share.

Zomato: Zomato UK, step down subsidiary of the company, has been dissolved effective from November 16, 2021.

Kalpataru Power Transmission: ICICI Prudential Asset Management Company acquired 0.19% stake in the company via open market transactions on November 16, increasing shareholding to 5.18% from 4.99% earlier.

Jindal Drilling & Industries: The company has acquired an offshore jack-up rig 'Jindal Supreme' from Venus Drilling Pte. Ltd. for $16.75 million. The rig is currently operating under contract with Oil and Natural Gas Corporation (ONGC).

The Phoenix Mills: CPP Investments has completed its first tranche of investment in Plutocrat Commercial Real Estate Private Limited (PCREPL), a wholly-owned subsidiary of the company, on private placement basis and by way of secondary acquisition of equity shares held by the company in PCREPL aggregating to Rs 787 crore.

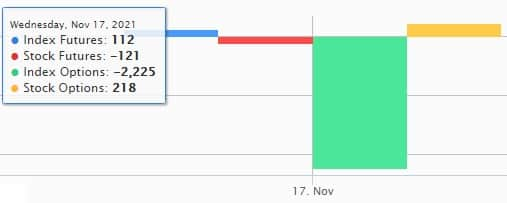

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 344.35 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 61.14 crore in the Indian equity market on November 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - BHEL, Indiabulls Housing Finance, IRCTC, NALCO, SAIL and Sun TV Network - are under the F&O ban for November 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!