The market on November 3 extended losses for the second consecutive session with the BSE Sensex falling below the 60,000 mark, dragged by banks, auto, FMCG and pharma stocks. However, metals and real estate stocks bucked the trend.

The BSE Sensex fell 257.14 points to close at 59,771.92, while the Nifty50 declined 59.80 points to 17,829.20 and saw bearish candlestick formation on the daily charts.

"A small negative candle was formed on the daily chart on Wednesday beside the similar negative candle of Tuesday. Technically, this pattern signals rangebound movement in the market with weak bias. The pattern was formed below the crucial resistance of 10-day and 20-day EMA (exponential moving average) around 17,960 levels, as per the concept of change in polarity," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

According to Shetti, the short term trend of Nifty continues to be rangebound with weak bias. "A sustainable move above 18,050 levels is expected to open fresh buying enthusiasm in the market. Any weakness below 17,750 could result in a revisit of important support of 20-week EMA around 17,600 levels," he said.

The broader markets also traded in line with benchmarks. The Nifty Midcap 100 and Smallcap 100 indices fell 0.27 percent and 0.66 percent respectively.

The market on November 4 will open for an hour in the evening for Muhurat Trading.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,728.47, followed by 17,627.73. If the index moves up, the key resistance levels to watch out for are 17,959.37 and 18,089.54.

Nifty Bank

The Nifty Bank plunged 536.30 points or 1.34 percent to close at 39,402.10 on November 3. The important pivot level, which will act as crucial support for the index, is placed at 39,084.6, followed by 38,767.1. On the upside, key resistance levels are placed at 39,939.9 and 40,477.7 levels.

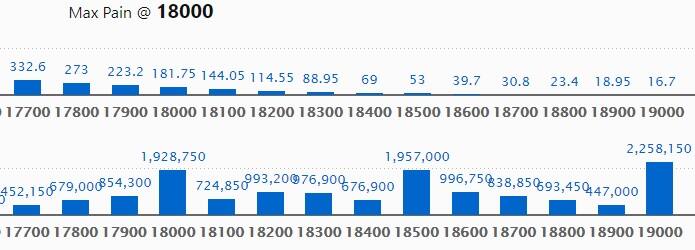

Call option data

Maximum Call open interest of 22.58 lakh contracts was seen at 19000 strike, which will act as a crucial resistance level in the November series.

This is followed by 18500 strike, which holds 19.57 lakh contracts, and 18000 strike, which has accumulated 19.28 lakh contracts.

Call writing was seen at 17900 strike, which added 1.01 lakh contracts, followed by 18100 strike, which added 55,100 contracts and 18700 strike which added 50,550 contracts.

Call unwinding was seen at 18000 strike, which shed 1.73 lakh contracts, followed by 18400 strike which shed 30,600 contracts and 19000 strike which shed 20,200 contracts.

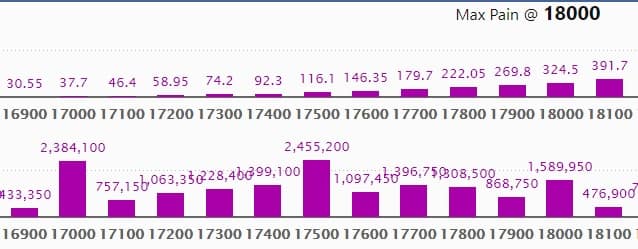

Put option data

Maximum Put open interest of 24.55 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the November series.

This is followed by 17000 strike, which holds 23.84 lakh contracts, and 18000 strike, which has accumulated 15.89 lakh contracts.

Put writing was seen at 17500 strike, which added 2.32 lakh contracts, followed by 17100 strike which added 1.84 lakh contracts and 17300 strike which added 1.59 lakh contracts.

Put unwinding was seen at 18000 strike, which shed 2.24 lakh contracts, followed by 16800 strike which shed 26,450 contracts, and 17900 strike which shed 19,100 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

31 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

38 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

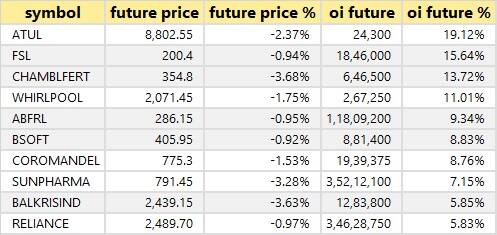

79 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

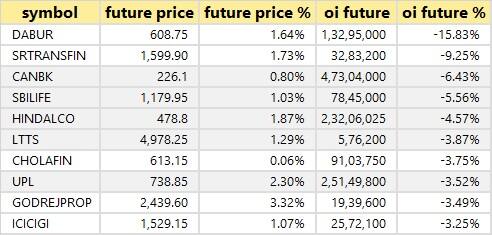

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

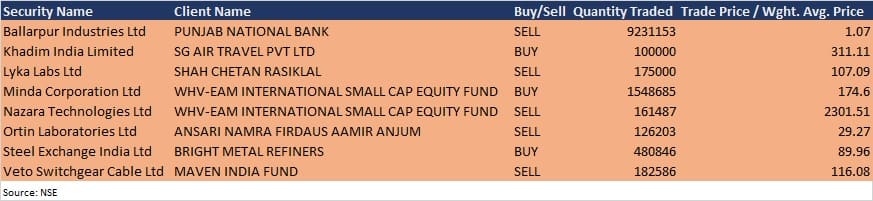

Bulk deals

Minda Corporation: WHV-EAM International Small Cap Equity Fund acquired 15,48,685 equity shares in the company at Rs 174.6 per share on the NSE, the bulk deals data showed.

Nazara Technologies: WHV-EAM International Small Cap Equity Fund sold 1,61,487 equity shares in the company at Rs 2,301.51 per share on the NSE, the bulk deals data showed.

Veto Switchgear Cable: Maven India Fund sold 1,82,586 equity shares in the company at Rs 116.08 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Results Calendar

November 4: Muthoot Finance will release September quarter earnings on November 4.

November 5: Dhanlaxmi Bank, GSS Infotech, and Sun TV Network will release September quarter earnings on November 5.

November 6: Divis Laboratories, Andhra Petrochemicals, Pilani Investment, Selan Exploration Technology, Suven Pharmaceuticals, and TCI Industries will release September quarter earnings on November 6.

Stocks in News

Bata India: The company reported profit at Rs 37 crore in Q2FY22 against loss of Rs 44.4 crore in Q2FY21; revenue jumped to Rs 614.1 crore from Rs 367.8 crore YoY.

Eicher Motors: The company reported higher profit at Rs 373.2 crore in Q2FY22 against Rs 343.3 crore in Q2FY21; revenue increased to Rs 2,249.6 crore from Rs 2,133.6 crore YoY.

Lupin: The company launched an authorised generic version of Antara (Fenoflbrate) in the United States. These capsules are indicated as adjunctive therapy to diet to reduce elevated cholesterol.

Gujarat State Petronet: The company reported lower consolidated profit at Rs 512.6 crore in Q2FY22 against Rs 716.5 crore in Q2FY21; revenue jumped to Rs 4,158.92 crore from Rs 3,027.73 crore YoY.

Gujarat Alkalies and Chemicals: The company reported higher consolidated profit at Rs 74.57 crore in Q2FY22 against Rs 66.05 crore in Q2FY21, revenue jumped to Rs 825.76 crore from Rs 638.25 crore YoY.

Pfizer: The company reported higher profit at Rs 142.95 crore in Q2FY22 against Rs 131.37 crore in Q2FY21. Revenue rose to Rs 636.26 crore from Rs 595.41 crore YoY.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 401.48 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 195.56 crore in the Indian equity market on November 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Punjab National Bank and Escorts - are under the F&O ban for November 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!