The market caught in bear trap and corrected around a percent on October 6 as the selling was seen across sectors with Metals, Auto, IT and Pharma being major losers amid weak global cues.

The BSE Sensex fell 555.15 points to 59,189.73, while the Nifty50 declined 176.30 points to 17,646 and formed a bearish candle on the daily charts.

"Going by the recent behaviour of the market, the declining move do not last for more than 1 or 2 days. But looking at the broad-based profit booking on Wednesday, it would be interesting to see whether markets stick to their recent pattern or it finally starts giving some extended correction," said Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel Broking.

He further said, "We continue to remain cautious and do not expect Nifty to cross the sturdy wall of 17,900 – 17,950 soon. For the coming session, all eyes will be on global development because any further aberration on that front, would finally validate our recent stance."

As far as levels are concerned, "17,500 – 17,450 would be seen as crucial supports. A violation of lower range would be seen as first sign of weakness. Before the recent highs, 17,750 – 17,850 are to be treated as immediate resistances and the way things panned out on Wednesday, any bounce towards these levels is likely to get sold into," said Chavan who expects the volatility to remain on the higher side. Hence, he advised traders not to trade with aggressive bets.

The broader markets also corrected with the Nifty Midcap 100 and Smallcap 100 indices falling 0.91 percent and 0.83 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,544.6, followed by 17,443.2. If the index moves up, the key resistance levels to watch out for are 17,816 and 17,986.

Nifty Bank

The Nifty Bank slipped 219.40 points to close at 37,521.60 on October 6. The important pivot level, which will act as crucial support for the index, is placed at 37,280.1, followed by 37,038.6. On the upside, key resistance levels are placed at 37,935 and 38,348.4 levels.

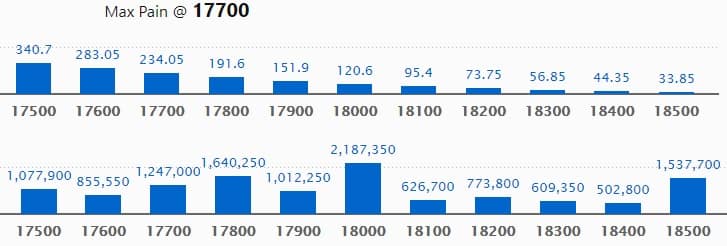

Call option data

Maximum Call open interest of 21.87 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the October series.

This is followed by 17,800 strike, which holds 16.40 lakh contracts, and 18,500 strike, which has accumulated 15.37 lakh contracts.

Call writing was seen at 17,800 strike, which added 3.61 lakh contracts, followed by 17,700 strike, which added 2.12 lakh contracts and 18,200 strike which added 1.18 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 72,600 contracts, followed by 18,300 strike, which shed 34,400 contracts, and 17,500 strike which shed 10,950 contracts.

Put option data

Maximum Put open interest of 33.55 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the October series.

This is followed by 17,500 strike, which holds 27.62 lakh contracts, and 172,00 strike, which has accumulated 15.55 lakh contracts.

Put writing was seen at 17,800 strike, which added 2.91 lakh contracts, followed by 17,700 strike which added 2.81 lakh contracts and 17,200 strike which added 1.28 lakh contracts.

Put unwinding was seen at 18,000 strike, which shed 35,900 contracts, followed by 17,600 strike which shed 21,200 contracts, and 18,400 strike which shed 1,800 contracts.

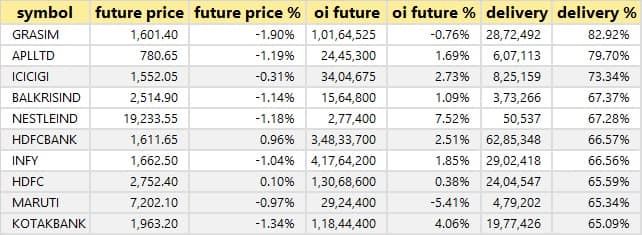

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

11 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

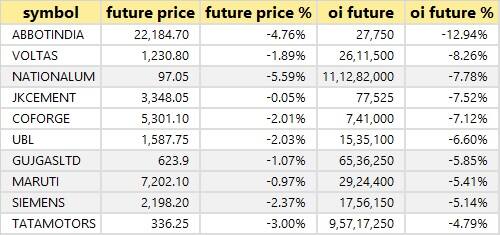

69 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

90 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

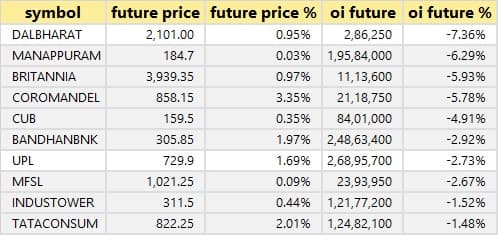

13 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

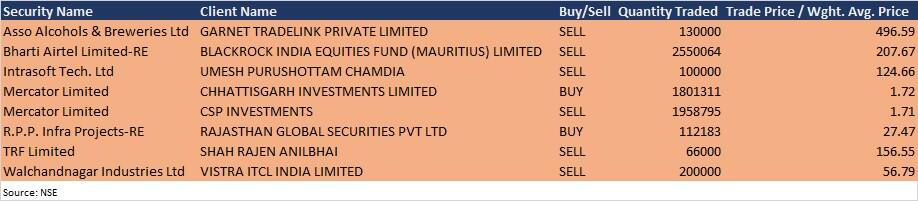

Bulk deals

Bharti Airtel (Rights Entitlement): Blackrock India Equities Fund (Mauritius) sold 25,50,064 equity shares in the company at Rs 207.67 per share on the NSE, the bulk deal data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Heranba Industries: The company's officials will meet Max Life Insurance Company on October 7.

UltraTech Cement: The company's officials will meet analysts in its earnings call on October 18.

Sonata Software: The company's officials will meet analysts in earnings call on October 20.

Stocks in News

Nazara Technologies: The company raised Rs 315 crore from marquee institutional investors. The funds will be utilised to invest in growth initiatives of the company as well as pursue strategic acquisitions in the various business verticals of the company including gamified learning, freemium, skill based real money gaming and esports.

Orissa Minerals Development Company: Life Insurance Corporation of India sold 1.24 lakh equity shares in the company via open market transactions, reducing shareholding to 9.08% from 11.16% earlier.

Ambuja Cements: Life Insurance Corporation of India acquired 3.99 crore equity shares in the company via open market transactions, increasing shareholding to 6.12% from 4.11% earlier.

Titan Company: The company reported strong recovery in demand in Q2FY22. Jewellery business grew by 78% in Q2FY22 YoY and added 13 stores during the quarter, watches & wearables segment registered 73% YoY growth and eye wear business increased by 74 percent YoY in the same period.

NIIT: US-based Sutherland, a leading global digital transformation company, and StackRoute, an NIIT Venture, have entered into a partnership to launch an immersive training program designed to identify the right talent and develop them as high-quality full stack IT professionals, handling critical roles at Sutherland.

Sobha: New sales grew by 50.6 percent to 13.48 lakh square feet in Q2FY22 against 8.9 lakh square feet in Q2FY21. Total sales value increased 50.9% to Rs 1,030.2 crore from Rs 689.9 crore in the same period. The company achieved best-ever quarterly sales volume of 13.5 lakh square feet of super built-up area and average cost of borrowing has further come down during the quarter.

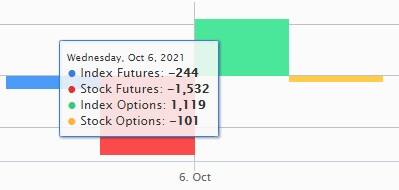

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 802.81 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 998.69 crore in the Indian equity market on October 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Canara Bank, Indiabulls Housing Finance, NALCO, Punjab National Bank, and SAIL - are under the F&O ban for October 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!