The market extended gains to hit a fresh record high but failed to hold on to those gains due to selling pressure and profit booking in late morning deals, and closed lower on September 1. IT, Metals and select Pharma stocks pulled the market lower.

The BSE Sensex fell 214.18 points to 57,338.21, while the Nifty50 declined 55.90 points to 17,076.30 and formed a bearish candle on the daily charts as the closing was lower than opening levels.

"The daily price action has formed a sizable bearish candle. However, it continues to form a higher High-Low compared to the previous session. On the downside, any violation of an intraday support zone of 17,050 levels may cause profit booking towards 17,000-16,950 levels," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

However, on the upside, he said: "The next higher levels to be watched are around 17,150 levels. Any sustainable move above 17,150 levels may cause momentum towards 17,200-17,300 levels."

But the broader markets outperformed equity benchmarks, as the Nifty Midcap 100 index gained 0.75 percent, and Smallcap 100 index rose 0.34 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,012.27, followed by 16,948.33. If the index moves up, the key resistance levels to watch out for are 17,182.97 and 17,289.73.

Nifty Bank

The Nifty Bank climbed 149.70 points to close at 36,574.30, outperforming benchmark indices on September 1. The important pivot level, which will act as crucial support for the index, is placed at 36,375.03, followed by 36,175.77. On the upside, key resistance levels are placed at 36,885.63 and 37,196.96 levels.

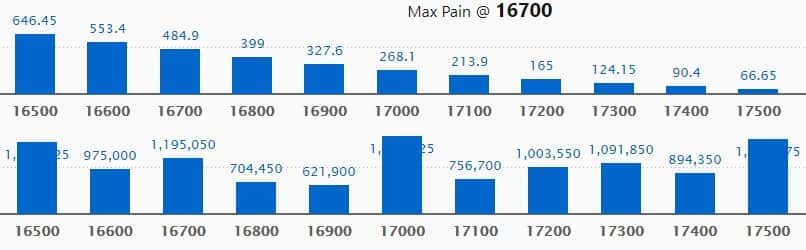

Call option data

Maximum Call open interest of 16.57 lakh contracts was seen at 17000 strike. This is followed by 17500 strike, which holds 16.03 lakh contracts, and 16,500 strike, which has accumulated 15.39 lakh contracts.

Call writing was seen at 17,500 strike, which added 2.97 lakh contracts, followed by 17,200 strike, which added 1.57 lakh contracts and 17,700 strike which added 94,650 contracts.

Call unwinding was seen at 17,000 strike, which shed 1.56 lakh contracts, followed by 16,700 strike, which shed 1.27 lakh contracts, and 16,600 strike which shed 1.26 lakh contracts.

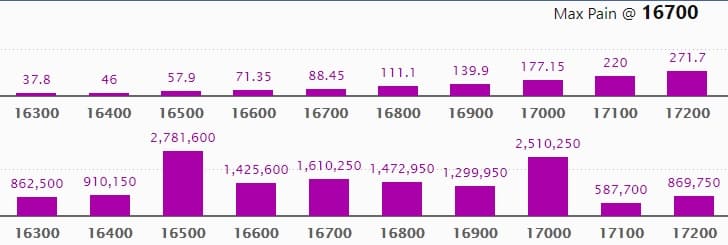

Put option data

Maximum Put open interest of 27.81 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the September series.

This is followed by 17,000 strike, which holds 25.10 lakh contracts, and 16,700 strike, which has accumulated 16.10 lakh contracts.

Put writing was seen at 17,000 strike, which added 3.23 lakh contracts, followed by 16,900 strike which added 2.49 lakh contracts, and 17,100 strike which added 2.31 lakh contracts.

Put unwinding was seen at 16,400 strike, which shed 4.36 lakh contracts, followed by 16,300 strike which shed 3.11 lakh contracts, and 16,500 strike which shed 2 lakh contracts.

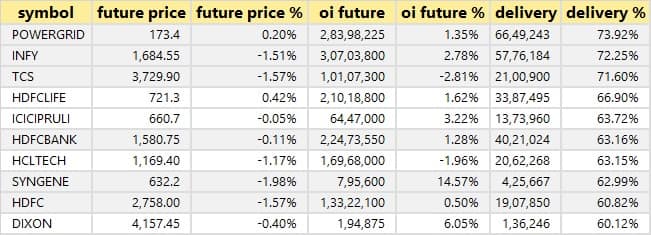

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

62 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

21 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

41 stocks saw short build-up

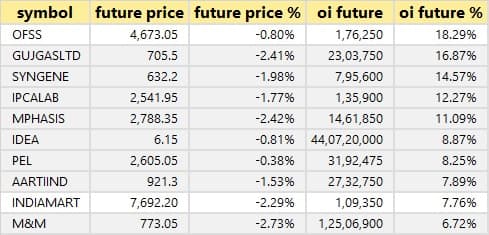

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

49 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

NHPC: State-owned REC sold 6,17,85,467 equity shares in the company at Rs 27.19 per share on the NSE.

(For more bulk deals, click here)

Analysts/Investors Meeting

Affle India: The company's officials will meet Asian Markets Securities (AMSEC) on September 2, Prudential Global (India) on September 3, Spark Capital Advisors on September 6, and Polen Capital on September 7.

Max Ventures and Industries: The company's officials will meet investors and analysts on September 2.

Stocks in News

Eicher Motors: Royal Enfield sales volume declined 9 percent to 50,144 motorcycles in August 2021, against 45,860 motorcycles in August 2020.

Peninsula Land: Dinesh Jain has resigned as Chief Financial Officer of the company.

Mahindra CIE Automotive: ACACIA II Partners LP & Others sold 67,85,291 equity shares in the company via an open market transaction on August 30, reducing shareholding to 4.07 percent from 5.86 percent earlier.

Aashka Hospitals: The company and Vaidehi — Backbone Hospital, Rajkot have agreed to a non-binding Memorandum of Understanding for a tie-up between the two hospitals whereby the management and operations of Vaidehi-Backbone will be integrated with Aashka Hospitals in a phased manner.

Kernex Microsystems (India): Virender Singh & Others acquired over 8.88 lakh equity shares in the company via open market transactions, increasing shareholding to 9.95 percent from 7.11 percent earlier.

Minda Corporation: Subsidiary Spark Minda Green Mobility Systems has signed Shares Subscription and Shareholders Agreement with EVQPOINT Solutions and its promoters and other ancillary agreements with EVQPOINT including Technology Licence Agreement (TLA).

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 666.66 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,287.87 crore in the Indian equity market on September 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for September 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!