The market remained rangebound amid volatility throughout session before closing on a flat note on August 25, ahead of expiry of August derivative contracts. Select banks, auto and pharma stocks corrected, whereas select FMCG, IT and metals stocks supported the market.

The BSE Sensex was down 14.77 points at 55,944.21, while the Nifty50 rose 10.10 points to 16,634.70 and formed small bearish candle on the daily charts as the closing was lower than opening levels.

"The daily price action has formed a small bearish candle carrying a long upper shadow indicating profit booking at higher levels. The next higher levels to be watched are around 16,700 levels. Any sustainable move above 16,700 levels may cause momentum towards 16,800 - 16,900 levels," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

On the downside, any violation of an intraday support zone of 16,600 levels may cause profit booking towards 16,500-16,400 levels, he feels.

The broader markets outperformed frontliners as the Nifty Midcap 100 index gained 0.32 percent and Smallcap 100 index rose 0.79 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,597.33, followed by 16,559.96. If the index moves up, the key resistance levels to watch out for are 16,692.23 and 16,749.77.

Nifty Bank

The Nifty Bank fell 125.80 points to close at 35,586.30 on August 25. The important pivot level, which will act as crucial support for the index, is placed at 35,420.44, followed by 35,254.67. On the upside, key resistance levels are placed at 35,831.14 and 36,076.07 levels.

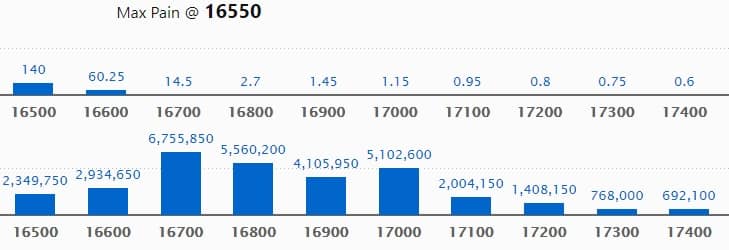

Call option data

Maximum Call open interest of 67.55 lakh contracts was seen at 16700 strike, which will act as a crucial resistance level in the August series.

This is followed by 16800 strike, which holds 55.6 lakh contracts, and 17000 strike, which has accumulated 51.02 lakh contracts.

Call writing was seen at 16700 strike, which added 20.90 lakh contracts, followed by 16800 strike, which added 8.19 lakh contracts and 16900 strike which added 5.92 lakh contracts.

Call unwinding was seen at 16600 strike, which shed 8.73 lakh contracts, followed by 16500 strike which shed 7.91 lakh contracts, and 16400 strike which shed 2.13 lakh contracts.

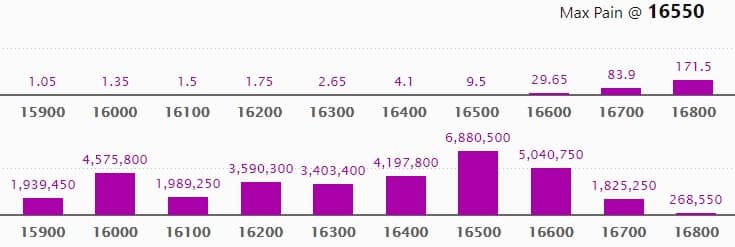

Put option data

Maximum Put open interest of 68.8 lakh contracts was seen at 16500 strike, which will act as a crucial support level in the August series.

This is followed by 16600 strike, which holds 50.4 lakh contracts, and 16000 strike, which has accumulated 45.75 lakh contracts.

Put writing was seen at 16600 strike, which added 14.79 lakh contracts, followed by 16700 strike which added 6.19 lakh contracts, and 16000 strike which added 69,100 contracts.

Put unwinding was seen at 15900 strike, which shed 8.3 lakh contracts, followed by 16300 strike which shed 4.28 lakh contracts and 16100 strike which shed 3.77 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

17 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

68 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

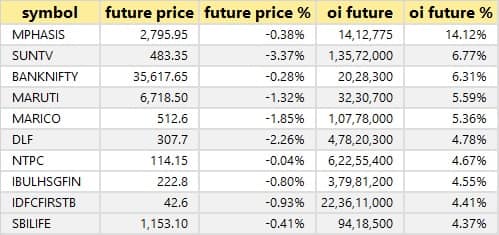

31 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

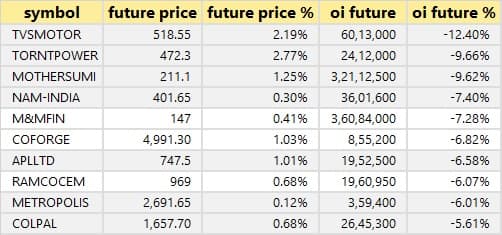

47 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

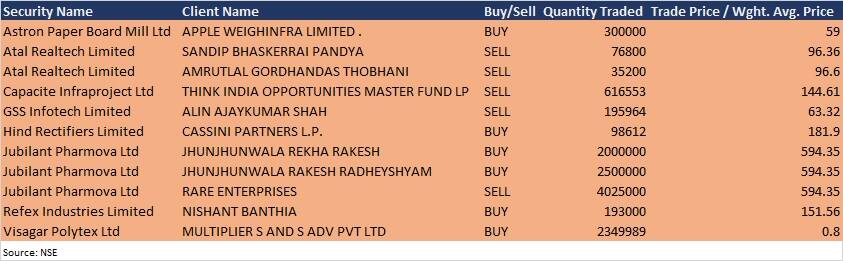

Bulk deals

Capacite Infraprojects: Think India Opportunities Master Fund LP sold 6,16,553 equity shares (0.9%) in the company at Rs 144.61 per share on the NSE, the bulk deals data showed.

GSS Infotech: Investor Alin Ajaykumar Shah sold 1,95,964 equity shares (1.15%) in the company at Rs 63.32 per share on the NSE, the bulk deals data showed.

Hind Rectifiers: Cassini Partners L P bought 98,612 equity shares in the company (0.59%) in the company at Rs 181.9 per share on the NSE, the bulk deals data showed.

Jubilant Pharmova: Rakesh Radheyshyam Jhunjhunwala and his wife Rekha Rakesh Jhunjhunwala net bought 4.75 lakh equity shares in the company at Rs 594.35 per share on the NSE, the bulk deals data showed. Rekha Rakesh Jhunjhunwala acquired 20 lakh equity shares and Rakesh Radheyshyam Jhunjhunwala bought 25 lakh shares in the company, but his firm Rare Enterprises sold 40.25 lakh equity shares at same price.

(For more bulk deals, click here)

Analysts/Investors Meeting

Ambuja Cements: The company's officials will meet Kotak on August 26.

UltraTech Cement: The company's officials will meet SBI Mutual Fund, Kotak Mutual Fund, UNPRI, Martin Currie Investment Management, Sumitomo Mitsui, and Axiom International on August 26.

Graphite India: The company's officials will meet Pinpoint Asset Management, and DSP Investment Managers on August 26.

Allcargo Logistics: The company's officials will meet Theleme Partners on August 26, and Ventura Securities on August 27.

Dodla Dairy: The company's officials will meet investors on August 26, in Axis Capital 2021 Rising Stars Conference.

Birlasoft: The company's officials will meet Investors Group on August 27.

Antony Waste Handling Cell: The company's officials will meet analysts and investors on August 26 and 27.

Manappuram Finance: The company's officials will meet Enam AMC on August 26, and analysts & investors at DART India Virtual Conference on August 27.

PI Industries: The company's officials will meet Ambit Capital on August 26, and ICICI Prudential AMC on September 6.

CESC: The company's officials will meet investors in Systematix Indian Power Utilities conference on August 31, and in Elara India Dialogue 2021 conference on September 7.

Stocks in News

Kaveri Seed Company: The company approved the buyback of equity shares up to Rs 120 crore at a price up to Rs 850 per share.

Procter & Gamble Hygiene & Health Care: The company reported profit at Rs 48.98 crore in Q4FY21 against Rs 69.21 crore in Q4FY20, revenue rose to Rs 786.6 crore from Rs 634.53 crore YoY. The company has recommended a final dividend of Rs 80 per equity share (nominal value of Rs 10 each), for the financial year ended June 30, 2021.

BKM Industries: The company has sold 13,83,103 equity shares in BKM Industries via open market transaction, reducing shareholding to 5.29% from 7.4% earlier.

Chemplast Sanmar: SBI Fund Management acquired 53.07 lakh equity shares in the company via open market transaction, increasing shareholding to 8.25% from 4.89% earlier. Mirae Asset Investment Managers (India) bought 29.56 lakh equity shares in the company via open market transaction, raising stake to 6.84% from 4.97% earlier.

Max Healthcare Institute: The company approved an additional investment of Rs 50 crore by way of subscription towards Rights Issue of equity shares of Alps Hospitals.

Olectra Greentech: Promoter entity Trinity Infraventures sold 10.8 lakh equity shares in the company via open market transaction, reducing shareholding to 0.22% from 1.53% earlier.

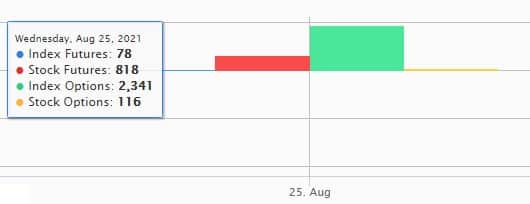

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,071.83 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 151.39 crore in the Indian equity market on August 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Vodafone Idea, NALCO, NMDC, and SAIL - are under the F&O ban for August 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!