The market failed to sustain opening gains and was immediately caught in a bear trap to trade lower throughout the session on July 28, dragged by banks, select auto, power stocks, and Reliance Industries.

The BSE Sensex slipped 135.05 points to close at 52,443.71, while the Nifty50 fell 37.10 points to 15,709.40 ahead of the expiry of July futures and options contracts on July 28, and formed a Hammer pattern on the daily charts.

"Normally, a formation of such Hammer pattern after a reasonable decline or near the crucial supports could act as an upside reversal on the confirmation. Hence, there is a possibility of an upside bounce in the next 1-2 sessions," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

"The Nifty has formed a swing low near the lower end of a broader range movement and we observe lower low formations. This signals a display of high volatility during weakness, and we noticed sharp upside bounces soon after such moves in the past. The expected upside is likely to test the upper resistance of 15,860-15,900 levels in the near term," he added.

The broader markets - the Nifty Midcap 100 and Smallcap 100 indices - fell half a percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,559.43, followed by 15,409.47. If the index moves up, the key resistance levels to watch out for are 15,813.43 and 15,917.47.

Nifty Bank

The Nifty Bank declined 264.55 points to close at 34,532.90 on July 28. The important pivot level, which will act as crucial support for the index, is placed at 34,151.53, followed by 33,770.16. On the upside, key resistance levels are placed at 34,877.93 and 35,222.97 levels.

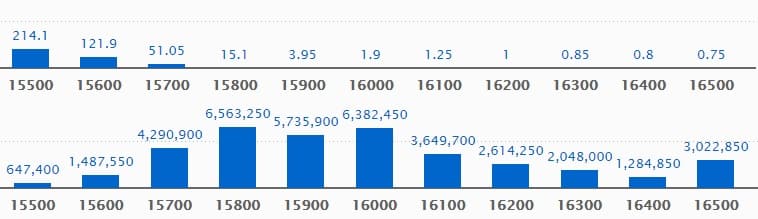

Call option data

Maximum Call open interest of 65.63 lakh contracts was seen at 15800 strike, which will act as a crucial resistance level in the July series.

This is followed by 16000 strike, which holds 63.82 lakh contracts, and 15900 strike, which has accumulated 57.35 lakh contracts.

Call writing was seen at 15700 strike, which added 13.60 lakh contracts, followed by 15600 strike which added 10.29 lakh contracts and 15500 strike which added 1.73 lakh contracts.

Call unwinding was seen at 15900 strike, which shed 13.35 lakh contracts, followed by 16300 strike which shed 12.18 lakh contracts, and 16200 strike which shed 11.02 lakh contracts.

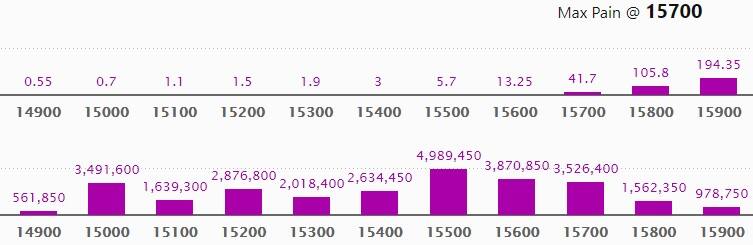

Put option data

Maximum Put open interest of 49.89 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15600 strike, which holds 38.70 lakh contracts, and 15700 strike, which has accumulated 35.26 lakh contracts.

Put writing was seen at 15200 strike, which added 8.53 lakh contracts, followed by 15600 strike which added 8.38 lakh contracts, and 15500 strike which added 8.27 lakh contracts.

Put unwinding was seen at 15000 strike, which shed 22.70 lakh contracts, followed by 15800 strike which shed 17.14 lakh contracts, and 15700 strike which shed 9.79 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

13 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

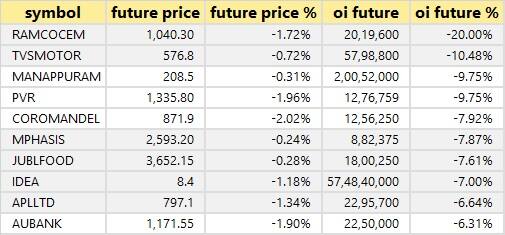

66 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

39 stocks saw short build-up

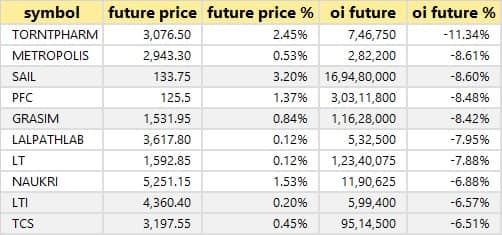

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

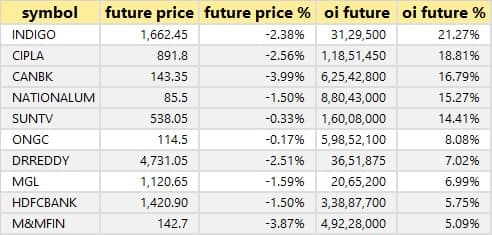

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

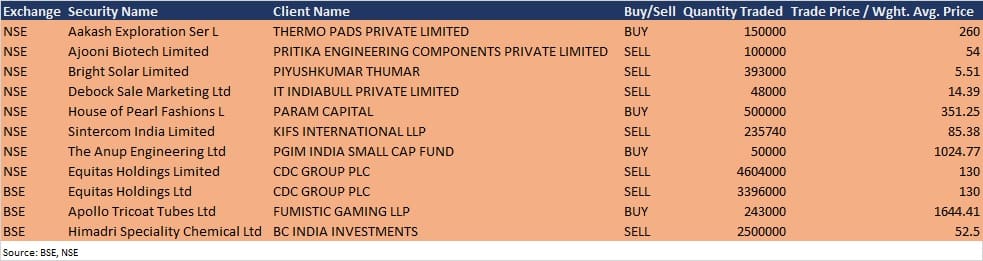

Bulk deals

Anup Engineering: PGIM India Small Cap Fund acquired 50,000 equity shares in the company at Rs 1,024.77 per share on the NSE, the bulk deals data showed.

Equitas Holdings: CDC Group Plc sold 46,04,000 equity shares in the company at Rs 130 per share on the NSE, and 33,96,000 shares at the same price on the BSE, the bulk deals data showed.

Apollo Tricoat Tubes: Fumistic Gaming LLP bought 2.43 lakh equity shares in the company at Rs 1,644.41 per share on the BSE, the bulk deals data showed.

Himadri Speciality Chemical: BC India Investments continued to offload shares in the company, selling 25 lakh shares at Rs 52.5 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on July 29, and Analysts/Investors Meeting

Results on July 29: Tech Mahindra, Colgate-Palmolive (India), AAVAS Financiers, ADF Foods, Aegis Logistics, Ajanta Pharma, CCL Products, Container Corporation of India, Dhanuka Agritech, Dwarikesh Sugar Industries, Eris Lifesciences, Future Retail, GHCL, Home First Finance Company India, Indus Towers, JK Lakshmi Cement, Jindal Stainless (Hisar), Jyothy Labs, Laurus Labs, LIC Housing Finance, Mahindra Holidays & Resorts India, Motilal Oswal Financial Services, Oberoi Realty, Parag Milk Foods, Punjab & Sind Bank, PVR, Raymond, Shoppers Stop, Shriram City Union Finance, TVS Motor Company, Union Bank of India, Vaibhav Global, and Welspun Corp will release quarterly earnings on July 29.

United Breweries: The company's officials will meet analysts and investors on July 29 to discuss unaudited financial results.

Share India Securities: The company's officials will meet analysts and investors on July 30 to discuss the unaudited financial results.

Solar Industries India: The company's officials will meet analysts and investors on July 30 to discuss the unaudited financial results.

Sunteck Realty: The company's officials will meet analysts and investors on August 2 to discuss the Q1 FY2022 results and business updates.

Emami: The company's officials will meet analysts and investors on August 2 to discuss unaudited financial results.

Ajmera Realty & Infra India: The company's officials will meet analysts and investors on August 3 to discuss unaudited financial results.

HIL: The company's officials will meet analysts and investors on August 5 to discuss unaudited financial results.

Brigade Enterprises: The company's officials will meet analysts and investors on August 6 to discuss financial and operational performance.

Alkem Laboratories: The company's officials will meet analysts and investors on August 6 for discussing unaudited financial results.

Sandhar Technologies: The company's officials will meet analysts and investors on August 9 to discuss the financial performance.

Stocks in News

Apollo Hospitals Enterprise: Sands Capital Management LLC acquired 2.2 percent stake in the company via an open market transaction on July 27, increasing shareholding to 9 percent from 7 percent earlier.

Jubilant Ingrevia: East Bridge Capital Master Fund sold 2.23 percent equity stake in the company via an open market transaction on July 26, reducing shareholding 3.38% from 5.61% earlier.

Mahanagar Gas: The company reported sharply higher profit at Rs 204.08 crore in Q1FY22 against Rs 45.25 crore in Q1FY21, revenue jumped to Rs 666.85 crore from Rs 277.47 crore YoY.

WABCO India: The company reported profit at Rs 21.38 crore in Q1FY22 against loss of Rs 31.36 crore in Q1FY21, revenue jumped to Rs 491.91 crore from Rs 165.96 crore YoY.

JK Agri Genetics: The company reported higher profit at Rs 23.04 crore in Q1FY22 against Rs 19.20 crore in Q1FY21, revenue rose to Rs 131.56 crore from Rs 123.62 crore YoY.

Route Mobile: The company reported higher consolidated profit at Rs 34.32 crore in Q1FY22 against Rs 26.93 crore in Q1FY21, revenue jumped to Rs 377.52 crore from Rs 309.61 crore YoY.

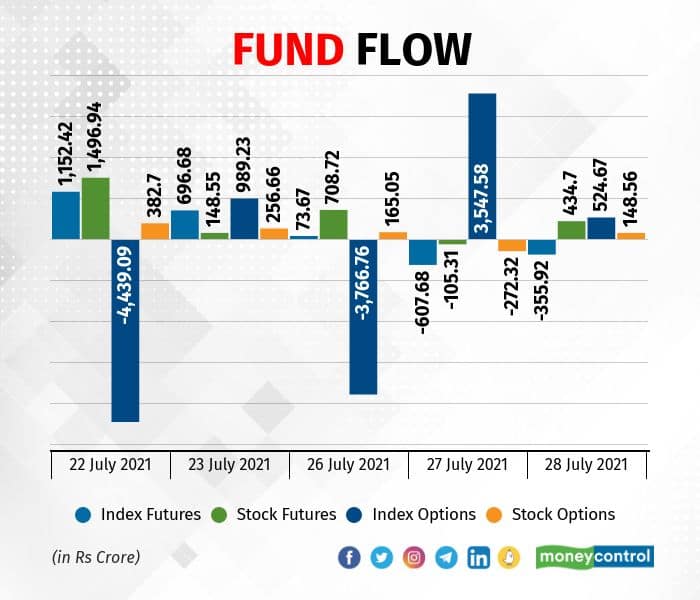

Fund flow

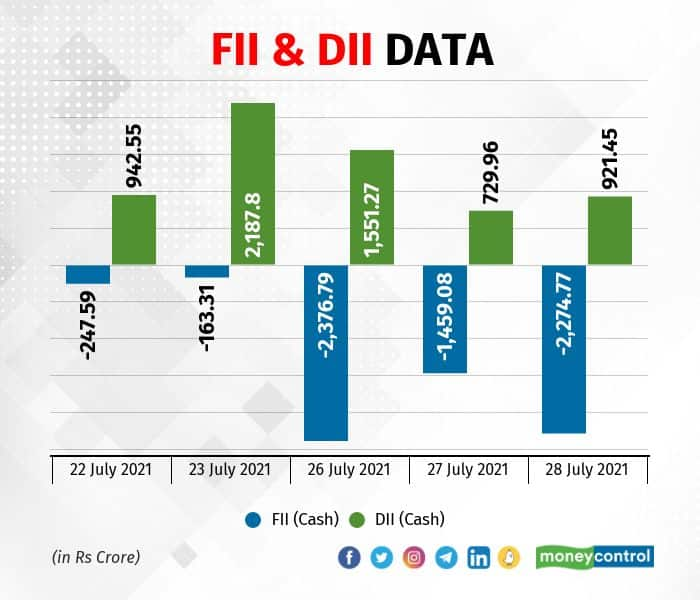

FII and DII data

Stocks under F&O ban on NSE

Two stocks - Vodafone Idea, and Sun TV Network - are under the F&O ban for July 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!