The market gained momentum after early hour volatility and extended gains to close moderately higher on July 14, driven by technology stocks.

The BSE Sensex climbed 134.32 points to 52,904.05, while the Nifty50 rose 41.60 points to 15,854 and formed a small bullish candle on the daily charts.

"The daily price action has formed a bullish candle, forming a higher High-Low compared to the previous session which remains a positive bias. With the current close, the index is approaching its 4-6 weeks multiple resistance zone of 15,900 levels which remains a crucial level to watch for," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further said, "The next higher levels to be watched are around 15,880 levels. Any sustainable move above 15,880 levels may cause momentum towards 15,950-16,000 levels."

On the downside, any violation of an intraday support zone of 15,800 levels may cause profit booking towards 15,700-15,600 levels, he added.

The broader markets also closed in green. The Nifty Midcap 100 and Smallcap 100 indices gained 0.23 percent and 0.45 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,786.37, followed by 15,718.73. If the index moves up, the key resistance levels to watch out for are 15,899.47 and 15,944.93.

Nifty Bank

The Nifty Bank fell 5.10 points to 35,668.30 on July 14. The important pivot level, which will act as crucial support for the index, is placed at 35,467.3, followed by 35,266.4. On the upside, key resistance levels are placed at 35,836.61 and 36,005 levels.

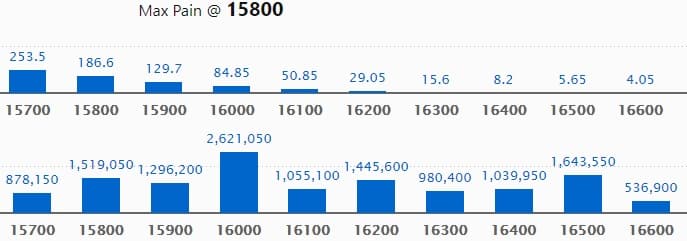

Call option data

Maximum Call open interest of 26.21 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 16.43 lakh contracts, and 15800 strike, which has accumulated 15.19 lakh contracts.

Call writing was seen at 15900 strike, which added 91,650 contracts, followed by 16500 strike which added 75,700 contracts and 16300 strike which added 31,050 contracts.

Call unwinding was seen at 16400 strike, which shed 2.61 lakh contracts, followed by 15800 strike which shed 2.56 lakh contracts, and 16100 strike which shed 2.12 lakh contracts.

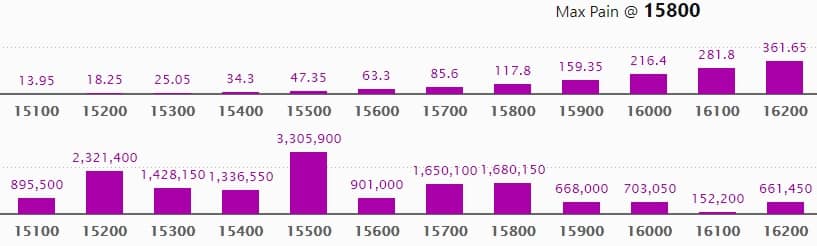

Put option data

Maximum Put open interest of 33.05 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15200 strike, which holds 23.21 lakh contracts, and 15800 strike, which has accumulated 16.80 lakh contracts.

Put writing was seen at 15700 strike, which added 2.95 lakh contracts, followed by 15900 strike which added 2.44 lakh contracts, and 15800 strike which added 1.32 lakh contracts.

Put unwinding was seen at 15600 strike, which shed 90,250 contracts, followed by 15400 strike which shed 77,500 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

33 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

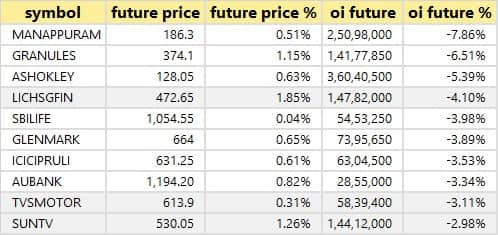

32 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

54 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

40 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

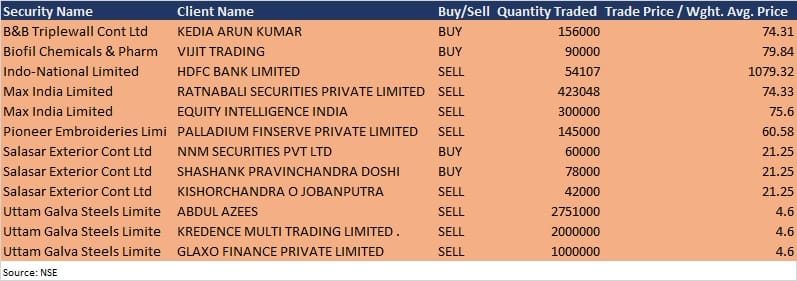

Bulk deals

Max India: Equity Intelligence India sold 3 lakh equity shares in the company at Rs 75.6 per equity shares on the NSE, and Ratnabali Securities offloaded 4,23,048 equity shares in the company at Rs 74.33 per share, the bulk deals data showed.

(For more bulk deals, click here)

Results on July 15, and Analysts/Investors Meeting

Results on July 15: Wipro, Angel Broking, Avantel, Aditya Birla Money, Cyient, Ganesh Housing Corporation, Larsen & Toubro Infotech, Onward Technologies, Rama Paper Mills, Rollatainers, Tata Elxsi, and Tata Steel Long Products will release quarterly earnings on July 15.

Somany Home Innovation: The company's officials will meet MK Ventures in a call organised by Motilal Oswal Financial Services on July 15.

Globus Spirits: The company's officials will meet Svan Investments on July 15.

HDFC Life Insurance Company: The company's officials will meet analysts and investors on July 19 to discuss the financial results.

Polycab India: The company's officials will meet investors and analysts on July 22 to discuss the un-audited financial results.

Stocks in News

Infosys: The company reported higher profit at Rs 5,195 crore in Q1FY22 against Rs 5,076 crore in Q4FY21. Revenue rose to Rs 27,896 crore from Rs 26,311 crore QoQ.

L&T Technology Services: The company reported higher profit at Rs 216.2 crore in Q1FY22 against Rs 194.5 crore in Q4FY21; revenue rose to Rs 1,518.4 crore from Rs 1,440.5 crore QoQ.

Vikas Lifecare: The company acquired a 22.04 percent stake in Advik Laboratories.

5paisa Capital: The company reported higher consolidated profit at Rs 7.19 crore in Q1FY22 against Rs 2.8 crore in Q1FY21. Revenue rose to Rs 60.08 crore from Rs 42.33 crore YoY.

Marico: The company entered into Share Subscription Agreement and Shareholders Agreement with Apcos Naturals, to make a strategic investment by acquiring 60 percent of equity shares and compulsorily convertible preference shares (CCPS) of Apcos Naturals. Marico will acquire 52.4 percent stake in the company by July 31.

Tinplate Company of India: The company reported profit at Rs 68.62 crore in Q1FY22 against loss of Rs 6.9 crore in Q1FY21. Revenue jumped to Rs 866.3 crore from Rs 379.76 crore YoY.

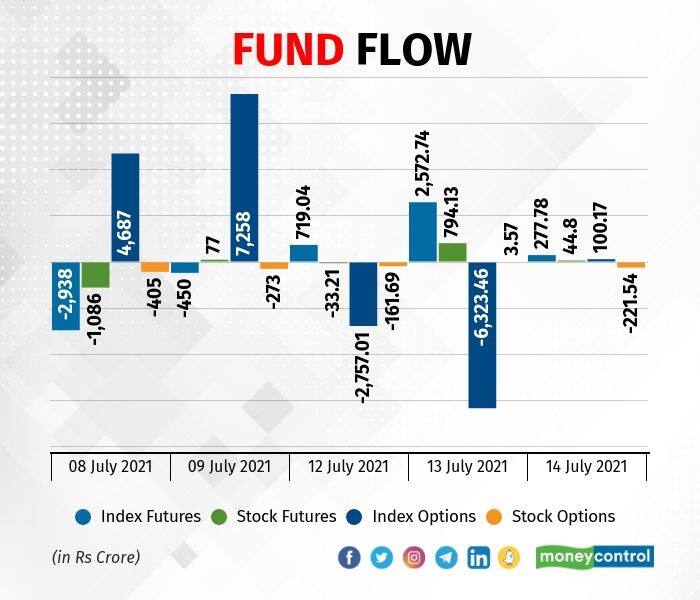

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,303.95 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,335.91 crore in the Indian equity market on July 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Eight stocks - Granules India, Indiabulls Housing Finance, Vodafone Idea, NALCO, NMDC, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for July 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!