The market snapped four-day winning streak and fell more than half a percent on June 16, dragged by Metals, Pharma, Banking & Financials and Auto stocks.

The BSE Sensex was down 271.07 points at 52,501.98, while the Nifty50 declined 101.80 points to 15,767.50 and formed bearish candle on the daily charts as the closing was lower than opening levels.

"The daily price action has formed a sizable bearish candle forming a lower high-low formation compared to the previous session and has also closed below previous session's low which remains a negative bias," Rajesh Palviya, VP - Technical and Derivative Research, Axis Securities told Moneycontrol.

"On the downside, any violation of an intraday support zone of 15,700 levels may cause profit booking towards 15,650-15,600 levels. However, the next higher levels to be watched are around 15,830 levels. Any sustainable move above 15,830 levels may cause the momentum towards 15,900-15,950 levels," he said.

The broader markets also witnessed selling pressure as the Nifty Midcap 100 index fell 0.93 percent and Smallcap 100 index declined 0.52 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,713.13, followed by 15,658.77. If the index moves up, the key resistance levels to watch out for are 15,851.33 and 15,935.17.

Nifty Bank

The Nifty Bank slipped 244.25 points to 35,003.50 on June 16. The important pivot level, which will act as crucial support for the index, is placed at 34,819.8, followed by 34,636.1. On the upside, key resistance levels are placed at 35,283.61 and 35,563.7 levels.

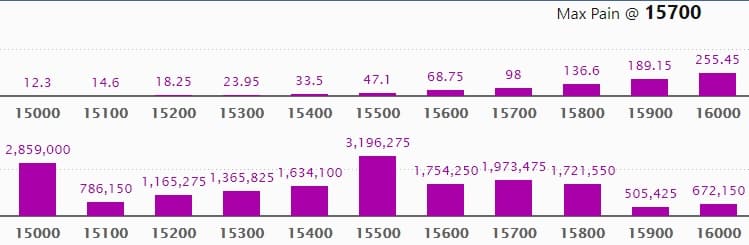

Call option data

Maximum Call open interest of 26.57 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the June series.

This is followed by 16500 strike, which holds 21.01 lakh contracts, and 15800 strike, which has accumulated 21 lakh contracts.

Call writing was seen at 15800 strike, which added 7.38 lakh contracts, followed by 15900 strike which added 6.27 lakh contracts, and 16500 strike which added 2.55 lakh contracts.

Call unwinding was seen at 15500 strike, which shed 37,050 contracts, followed by 15400 strike which shed 23,925 contracts, and 15700 strike which shed 14,175 contracts.

Put option data

Maximum Put open interest of 31.96 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the June series.

This is followed by 15000 strike, which holds 28.59 lakh contracts, and 15700 strike, which has accumulated 19.73 lakh contracts.

Put writing was seen at 15800 strike, which added 2.84 lakh contracts, followed by 15000 strike which added 1.85 lakh contracts, and 15100 strike which added 1 lakh contracts.

Put unwinding was seen at 15700 strike which shed 1.69 lakh contracts, followed by 16000 strike which shed 1.37 lakh contracts and 15900 strike which shed 1.32 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

13 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

64 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

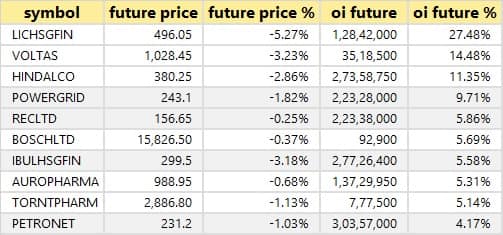

65 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

17 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

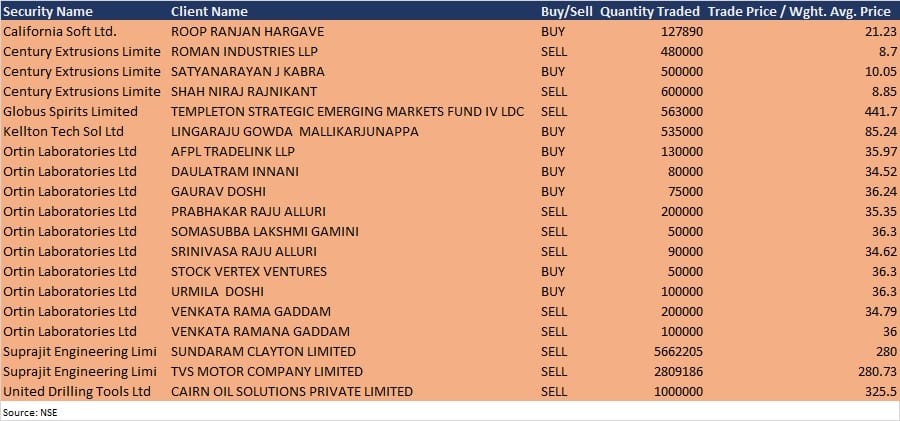

Bulk deals

Globus Spirits: Templeton Strategic Emerging Markets Fund IV LDC continued to offload shares since the last week of May, selling another 5.63 lakh equity shares in Globus Spirits at Rs 441.7 per share, the NSE bulk deals data showed.

Kellton Tech Solutions: Lingaraju Gowda Mallikarjunappa acquired 5.35 lakh equity shares in Kellton Tech at Rs 85.24 per share, the NSE bulk deals data showed.

Ortin Laboratories: AFPL Tradelink LLP acquired 1.3 lakh equity shares in Ortin at Rs 35.97 per share, Daulatram Innani bought 80,000 equity shares at Rs 34.52, Gaurav Doshi purchased 75,000 equity shares at Rs 36.24 per share, Urmila Doshi acquired 1 lakh shares at Rs 36.3 per share, and Stock Vertex Ventures bought 50,000 shares at Rs 36.3 per share. However, investors Venkata Rama Gaddam sold 2 lakh equity shares in Ortin at Rs 34.79 per share, Venkata Ramana Gaddam offloaded 1 lakh shares at Rs 36 per share, Prabhakar Raju Alluri sold 2 lakh shares at Rs 35.35 per share, Somasubba Lakshmi Gamini sold 50,000 shares at Rs 36.3 per share, and Srinivasa Raju Alluri dumped 90,000 shares at Rs 34.62 per share, the NSE bulk deals data showed.

Suprajit Engineering: Investors Sundaram Clayton and TVS Motor Company sold almost all their stake in the company, selling 56,62,205 equity shares at Rs 280 per share and 28,09,186 shares at Rs 280.73 per share, the NSE bulk deals data showed.

United Drilling Tools: Investor Cairn Oil Solutions sold 10 lakh equity shares in the company at Rs 325.5 per share, the NSE bulk deals data showed.

(For more bulk deals, click here)

Results on June 17 and Analysts/Investors Meeting

Results on June 17: Power Grid Corporation, Natco Pharma, Jammu & Kashmir Bank, DB Corp, Basant Agro Tech, Gyscoal Alloys, Global Vectra Helicorp, HealthCare Global Enterprises, Hindustan Media Ventures, IFB Agro Industries, Indostar Capital Finance, Khadim India, Kingfa Science, Nava Bharat Ventures, Novartis India, Power Mech Projects, Royal Orchid Hotels, Siel Financial Services, and Tube Investments of India will release quarterly earnings on June 17.

Infibeam Avenues: The company's officials will meet IndGrowth Capital, Seraphic Investment Managers, Akash Ganga Investments, Mehta Group, MK Ventures, KRChoksey PMS, and Ambika Fincorp on June 17.

Himatsingka Seide: The company's officials will meet Analysts and Investors in virtual Investor Conference organised by Batlivala & Karani Securities India on June 17.

Orient Electric: The company's officials will meet Carnelian Capital on June 17.

Blue Star: The company's officials will meet analysts/investors in Jefferies India Industrial Summit Conference Virtual Investor Conference on June 17.

NACL Industries: The company's officials will meet analysts/investors in S-Ancial's Capital Market Outreach Conference on June 17.

Advanced Enzyme Technologies: The company's officials will meet analysts/investors in S-Ancial's Capital Market Outreach Conference on June 17.

Endurance Technologies: The company's officials will meet a group of Analysts / Institutional Investors on June 18.

West Coast Paper Mills: The company's officials will meet analysts/investors in Emerging India MIDCAP Virtual Conference - 4th IDEATION SERIES" organized by PhillipCapital India, on June 18.

Shoppers Stop: The company's officials will meet fund manager & analyst of GeeCee Holdings on June 24.

Shoppers Stop: The company's officials will meet fund manager of Enam AMC on June 25.

Stocks in News

ISGEC Heavy Engineering: The company received an order for the fabrication of above ground piping spools from Tata Projects, India for one of the projects of national importance.

Nureca: The company reported consolidated profit at Rs 3.89 crore in Q4FY21 against Rs 2.38 crore in Q4FY20, revenue fell to Rs 31.84 crore from Rs 32.96 crore YoY.

Wipro: The company signed partnership with Exaware, to develop advanced engineering solutions that foster innovation in the networking industry, streamline 5G technology upgrades, and open the door to future 6G compatibility.

LG Balakrishnan & Bros: HDFC Asset Management Company acquired 2 percent stake in the company via open market transaction on June 14, increasing shareholding to 7.29% from 5.29% earlier.

Greenply Industries: Mirae Asset Investment Managers (India) acquired 0.576% equity stake in the company via open market transaction on June 14, raising shareholding to 5.45% from 4.87% earlier.

CESC: The company reported consolidated profit at Rs 429 crore in Q4FY21 against Rs 378 crore in Q4FY20, revenue jumped to Rs 2,890 crore from Rs 2,621 crore YoY. The company approved a proposal for sub-division of existing 1 equity share of nominal value of Rs 10 each to be sub-divided into 10 equity shares of nominal value of Re 1 each.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 870.29 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 874.20 crore in the Indian equity market on June 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Adani Ports, BHEL, Canara Bank, Escorts, NALCO, and Punjab National Bank - are under the F&O ban for June 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!