The market staged good recovery in the last hour of trade to close flat on June 2, supported by auto, metals, pharma and select banking stocks. The volatility in the market for last two sessions could be ahead of RBI interest rate decision on Friday.

The BSE Sensex was down 85.40 points at 51,849.48, while the Nifty50 rose 1.30 points to 15,576.20 and formed bullish candle on the daily charts as the closing was higher than opening levels.

"On the daily chart, Nifty continues to form a series of higher Tops and higher Bottom formation indicating sustained strength. The next higher levels to be watched are around 15,600 levels. Any sustainable move above 15,600 levels may cause momentum towards 15,700-15,750 levels," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

"On the downside, any violation of an intraday support zone of 15,500 levels may cause profit booking towards 15,450-15,400 levels," he added.

The broader markets outpaced benchmark indices after witnessing consolidation in last few sessions. The Nifty Midcap 100 and Smallcap 100 indices gained 1.43 percent and 1.31 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,491.5, followed by 15,406.8. If the index moves up, the key resistance levels to watch out for are 15,629.2 and 15,682.2.

Nifty Bank

The Nifty Bank was up 36.55 points at 35,373.75 on June 2. The important pivot level, which will act as crucial support for the index, is placed at 35,157.44, followed by 34,941.07. On the upside, key resistance levels are placed at 35,503.04 and 35,632.27 levels.

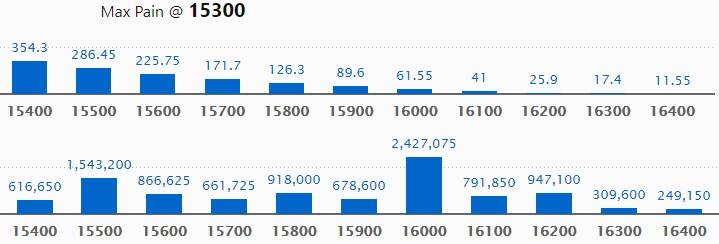

Call option data

Maximum Call open interest of 24.27 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 15,500 strike, which holds 15.43 lakh contracts, and 16,200 strike, which has accumulated 9.47 lakh contracts.

Call writing was seen at 15,700 strike, which added 35,025 contracts, followed by 16,200 strike which added 18,750 contracts, and 15,900 strike which added 15,150 contracts.

Call unwinding was seen at 15,600 strike, which shed 62,025 contracts, followed by 15,300 strike which shed 60,600 contracts, and 16,300 strike which shed 48,600 contracts.

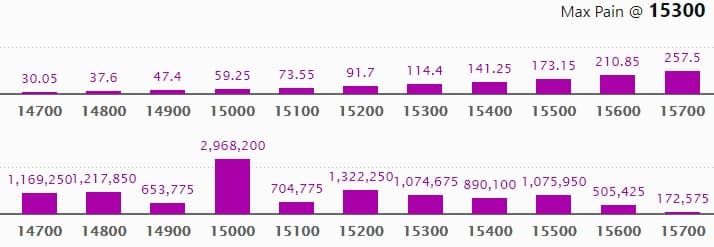

Put option data

Maximum Put open interest of 29.68 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,200 strike, which holds 13.22 lakh contracts, and 14,800 strike, which has accumulated 12.17 lakh contracts.

Put writing was seen at 16,100 strike, which added 1.95 lakh contracts, followed by 15,200 strike which added 1.81 lakh contracts, and 15,100 strike which added 1.49 lakh contracts.

Put unwinding was seen at 15,600 strike which shed 46,575 contracts, followed by 15,500 strike, which shed 41,775 contracts.

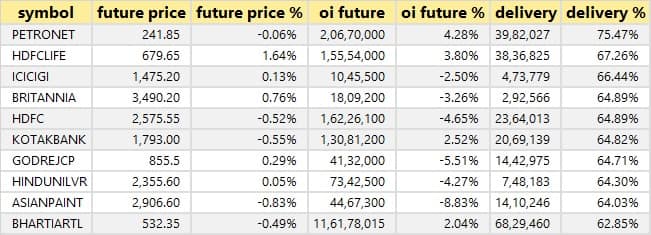

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

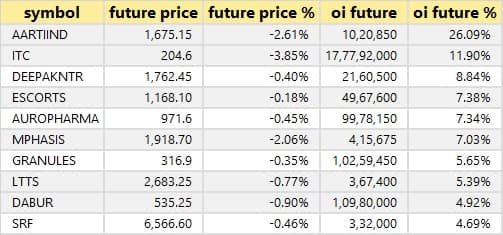

51 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

27 stocks saw long unwinding

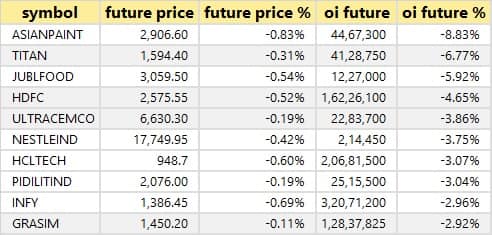

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

16 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

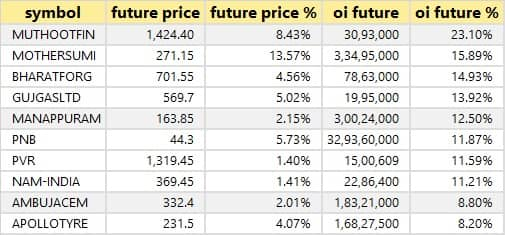

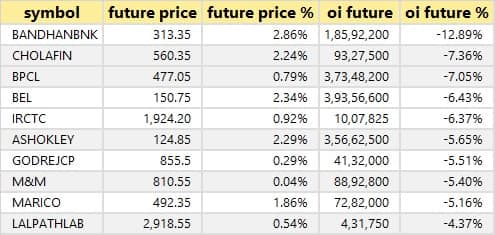

64 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Paushak: Ashish Ramesh Kacholia sold 17,461 equity shares or 0.56 percent of total paid up equity of Paushak at Rs 7,402.40 per share on the BSE, the bulk deals data showed.

Zee Entertainment Enterprises: Singapore-based investment company Integrated Core Strategies Asia Pte Ltd sold 56,62,573 equity shares in media company at Rs 212.63 per share on the NSE, the bulk deals data showed.

Rupa & Company: Investor Lambodar Ferro Alloys sold 5,75,500 equity shares in Rupa & Company at Rs 484.87 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on June 3

Gujarat State Petronet, 7NR Retail, APL Apollo Tubes, Arvind Fashions, Cupid, GTL Infrastructure, Nucleus Software Exports, Oswal Leasing, Quess Corp, Resonance Specialties, Som Distilleries & Breweries, TGV Sraac, and HEM Holdings will release quarterly earnings on June 3.

Stocks in News

Panacea Biotec: The company reported consolidated loss at Rs 54.14 crore in Q4FY21 against Rs 68.39 crore in Q4FY20, revenue rose to Rs 168.27 crore from Rs 125.36 crore YoY.

Muthoot Finance: The company reported higher consolidated profit at Rs 1,023.76 crore in Q4FY21 against Rs 835.77 crore in Q4FY20, total revenue increased to Rs 3,104.5 crore from Rs 2,630.5 crore YoY.

Solar Industries India: FMR LLC and Fidelity International acquired 39,465 equity shares in Solar Industries via open market transaction on May 31, raising stake in the company to 5.02% from 4.98% earlier.

Rossari Biotech: Rossari will acquire Unitop Chemicals, a leading supplier of surfactants, emulsifiers and specialty chemicals, for Rs 421 crore.

Persistent Systems: The company to expand its relationship with IBM to help fuel open hybrid cloud adoption, core IT modernization and digital transformation for customers across the enterprise.

Tata Power Company: Subsidiary Tata Power Solar received EPC orders for Rs 686 crore from NTPC to set up solar PV projects.

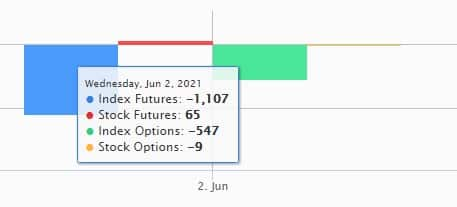

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net acquired shares worth Rs 921.10 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 241.76 crore in the Indian equity market on June 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Bank of Baroda, SAIL, and Sun TV Network - are under the F&O ban for June 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!