The market extended gains for third consecutive session with the Nifty50 closing above 14,800 mark amid March quarter earnings season and ahead of expiry of April futures & options contracts, driven by banking & financials and auto stocks on April 28.

The BSE Sensex surged 789.70 points or 1.61 percent to close at 49,733.84, while the Nifty50 climbed 211.50 points or 1.44 percent to 14,864.50 and formed bullish candle on the daily charts.

"The Nifty50 is approaching the 'multiple resistance' zone of 14,900 which remains a crucial hurdle to watch for. On the hourly chart, the index continues to trend higher forming a higher Top and higher Bottom formation, indicating short term up trend," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

"The next higher levels to be watched are around 14,900 levels. Any sustainable move above 14,900 may cause momentum towards 15,000-15,100 levels," he said.

"On the downside, any violation of an intraday support zone of 14,800 levels may cause profit booking towards 14,700-14,650 levels. The daily strength indicator RSI and the momentum indicator Stochastic both have turned bullish which supports bullish sentiments ahead," he added.

The broader markets also joined the bulls' party, but underperformed frontliners. The Nifty Midcap 100 index rose 1.11 percent and Smallcap 100 index gained 0.64 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,742.93, followed by 14,621.37. If the index moves up, the key resistance levels to watch out for are 14,938.13 and 15,011.77.

Nifty Bank

The Nifty Bank index outpaced the benchmark indices, rising 987.50 points or 3.02 percent to 33,722.80 on April 28. The important pivot level, which will act as crucial support for the index, is placed at 33,116.17, followed by 32,509.54. On the upside, key resistance levels are placed at 34,053.57 and 34,384.33 levels.

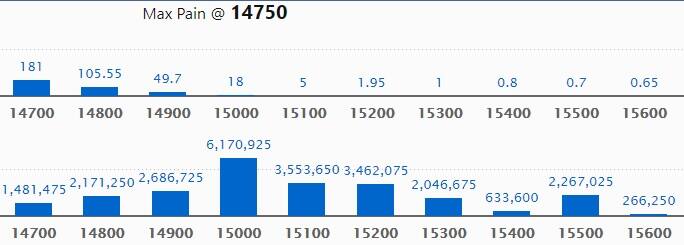

Call option data

Maximum Call open interest of 61.70 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 15,100 strike, which holds 35.53 lakh contracts, and 15,200 strike, which has accumulated 34.62 lakh contracts.

Call writing was seen at 15,100 strike, which added 14.53 lakh contracts, followed by 15,000 strike which added 9.5 lakh contracts and 15,200 strike which added 8.83 lakh contracts.

Call unwinding was seen at 14,800 strike, which shed 13.99 lakh contracts, followed by 14,600 strike which shed 9.81 lakh contracts and 14,700 strike which shed 8.46 lakh contracts.

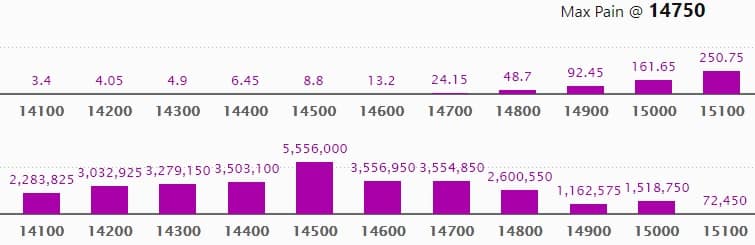

Put option data

Maximum Put open interest of 55.56 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the April series.

This is followed by 14,600 strike, which holds 35.56 lakh contracts, and 14,700 strike, which has accumulated 35.54 lakh contracts.

Put writing was seen at 14,700 strike, which added 25.55 lakh contracts, followed by 14,800 strike which added 18.07 lakh contracts and 14,900 strike which added 9.43 lakh contracts.

Put unwinding was seen at 14,300 and 14,100 strikes, which shed 2.98 lakh contracts each, followed by 14,400 strike which shed 1.67 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

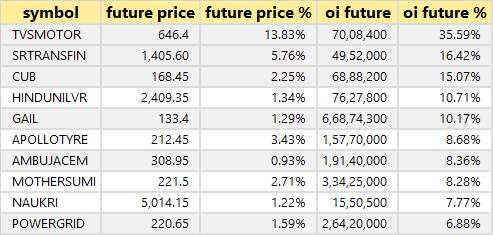

40 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

25 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

28 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

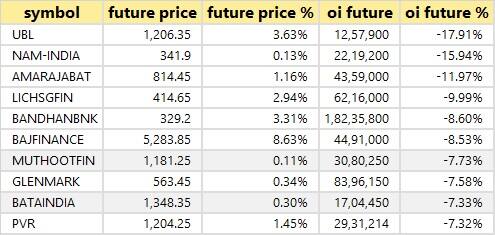

64 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

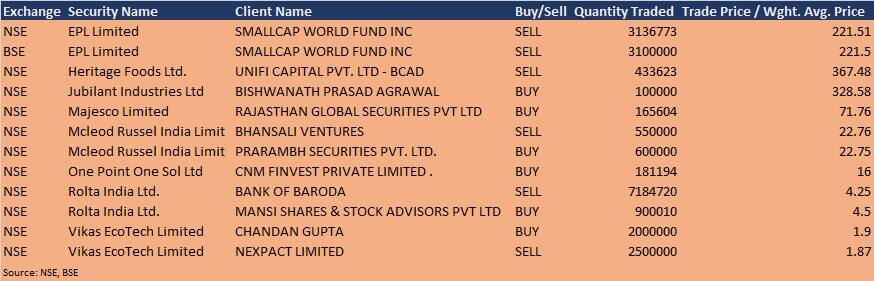

Bulk deals

(For more bulk deals, click here)

Results on April 29

Hindustan Unilever, Bajaj Auto, Titan Company, Ambuja Cements, Aavas Financiers, Aptech, Agro Tech Foods, AU Small Finance Bank, Bajaj Holdings & Investment, Cigniti Technologies, Coromandel International, Dalmia Bharat, Embassy Office Parks REIT, Equitas Small Finance Bank, Exide Industries, Franklin Industries, Gangotri Textiles, Geetanjali Credit and Capital, IndiaMART InterMESH, Inox Leisure, Jay Bharat Maruti, Kirloskar Pneumatic, L&T Finance Holdings, Laurus Labs, Bank of Maharashtra, Mahindra CIE Automotive, Mahindra Logistics, Motilal Oswal Financial Services, Persistent Systems, Rain Industries, Southern Latex, Shriram Transport Finance, Sterlite Technologies, Tata Coffee, VTM and Zensar Technologies will release quarterly earnings April 29.

Stocks in News

Tata Communications: The company posted profit at Rs 299.23 crore in Q4FY21 against loss at Rs 274.99 crore in Q4FY20, revenue fell to Rs 4,073.25 crore from Rs 4,397.89 crore YoY.

Security and Intelligence Services (India): The company reported profit at Rs 102.2 crore in Q4FY21 against loss of Rs 3.9 crore in Q4FY20, revenue increased to Rs 2,445.2 crore from Rs 2,209.7 crore YoY.

KSB: The company reported higher profit at Rs 43.9 crore in Q4FY21 against Rs 10.9 crore in Q4FY20, revenue jumped to Rs 381.6 crore from Rs 257 crore YoY.

Bombay Dyeing & Manufacturing Company: The company reported loss at Rs 166.74 crore in Q4FY21 against profit at Rs 48.57 crore in Q4FY20, revenue rose to Rs 497 crore from Rs 313.1 crore YoY.

GHCL: The company reported higher profit at Rs 104.19 crore in Q4FY21 against Rs 79.89 crore in Q4FY20, revenue rose to Rs 813.82 crore from Rs 733.17 crore YoY.

KPIT Technologies: The company reported profit at Rs 47.04 crore in Q4FY21 against Rs 42.97 crore in Q3FY21, revenue rose to Rs 540.3 crore from Rs 517.2 crore QoQ.

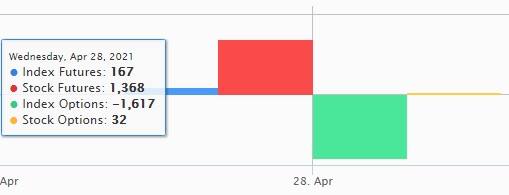

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 766.02 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 436.20 crore in the Indian equity market on April 28, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for April 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!