The market rebounded sharply in the second half of the session after a day of steep fall to close with 1.4 percent gains on April 13, driven by banking & financials, auto and metals stocks. The correction in IT stocks, however, limited the upside.

The Sensex rallied 660.68 points, or 1.38 percent, to 48,544.06, while the Nifty climbed 194 points, or 1.36 percent, to 14,504.80 and formed a bullish candle as well as Inside Bar kind of pattern on the daily charts.

"The daily price action has formed a sizable bullish candle but has closed within the previous session's high-low range, indicating sideways trend. 14,785-14,652 (gap area) still remains a crucial resistance zone in the near term," Rajesh Palviya, Head, Technical & Derivatives, Axis Securities said.

"On the daily chart, 20-day and 50-day SMA negative crossover also signals caution at current levels, however, with previous session's low (14,248) the Nifty has tested its 100-day SMA support of 14,265 and sustained above the same. Hence, in the near term, 14,265 levels are an important support zone to watch for," he said.

The broader markets also traded in line with frontline indices, as the Nifty midcap 100 index was up 1.74 percent and smallcap 100 gained 1.26 percent.

The market was shut on April 14 for the birth anniversary of the architect of the Indian Constitution and Dalit icon Dr BR Ambedkar.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks is the aggregate of three-month data and not just the current month.

Key support and resistance levels for Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,343.5 followed by 14,182.2. If the index moves up, the key resistance levels to watch out for are 14,597.5 and 14,690.2.

Nifty Bank

The Nifty Bank index surged 979.60 points, or 3.18 percent, on April 13 to close at 31,771.60. The important pivot level, which will act as crucial support for the index, is placed at 31,034.47 followed by 30,297.34. On the upside, key resistances are at 32,197.07 and 32,622.54.

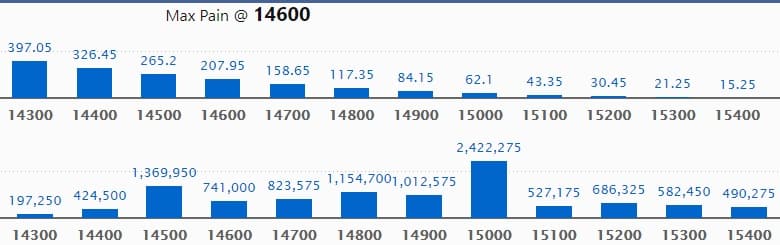

Call option data

Maximum Call open interest of 24.22 lakh contracts was seen at 15,000 strike that will act as a crucial resistance in the April series.

This is followed by 14,500 strike, which holds 13.69 lakh contracts, and 14,800 strike, which has accumulated 11.54 lakh contracts.

Call writing was seen at 14,900 strike, which added 1.92 lakh contracts, followed by 14,800 strike that added 1.15 lakh contracts and 14,700 strike, which added 86,700 contracts.

Call unwinding was seen at 14,500 strike, which shed 97,650 contracts, followed by 15,000 strike that shed 93,900 contracts.

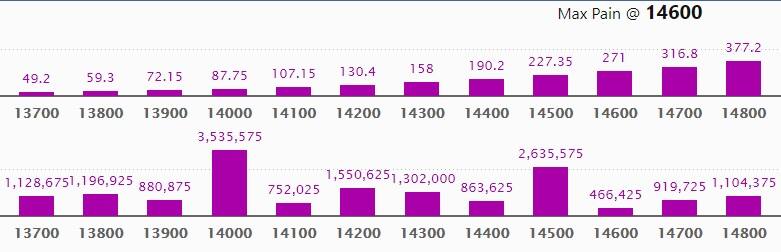

Put option data

Maximum Put open interest of 35.35 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

It is followed by 14,500 strike, which holds 26.35 lakh contracts, and 14,200 strike that accumulated 15.50 lakh contracts.

Put writing was seen at 14,000 strike, which added 4.04 lakh contracts followed by 14,500 strike that added 1.6 lakh contracts and 14,400 strike ,which added 81,075 contracts.

Put unwinding was seen at 13,900 strike, which shed 3.82 lakh contracts, followed by 13,700 strike that shed 1.35 lakh contracts.

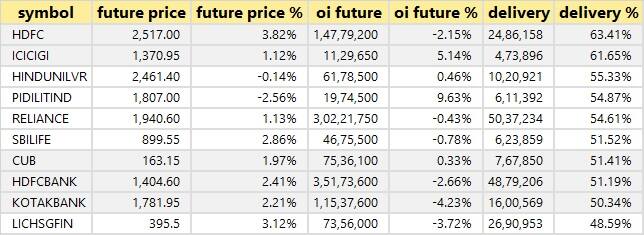

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

50 stocks saw a long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

12 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are Top 10 stocks in which long unwinding was seen:

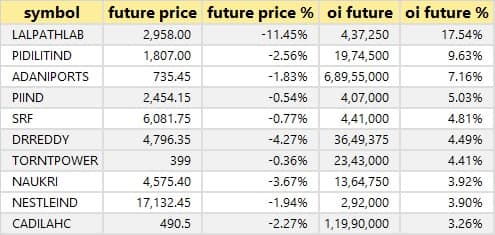

21 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

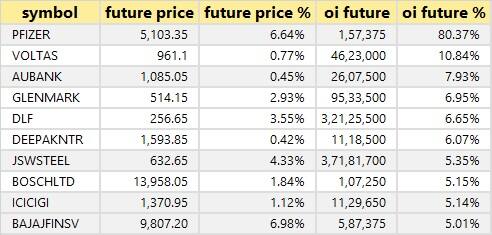

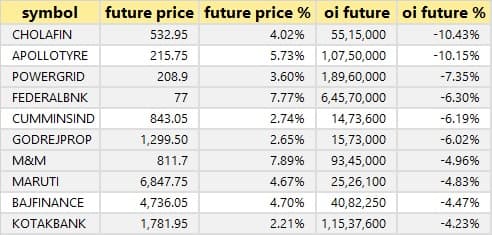

76 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

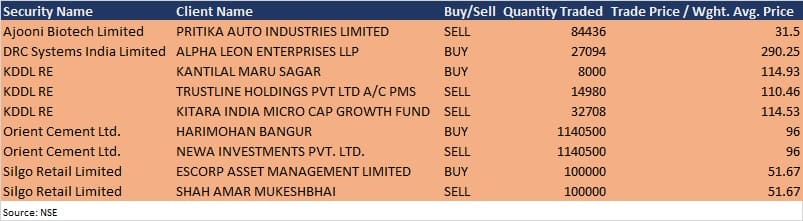

Bulk deals

(For more bulk deals, click here)

Results on April 15

Wipro, Blue Blends (India), Hathway Bhawani Cabletel & Datacom and Tinplate Company of India will release quarterly numbers on April 15.

Stocks in News

Motherson Sumi Systems: Moody’s Investors Service revised the company's rating outlook to 'stable' from 'negative' while affirming the Ba1 corporate family rating to Motherson Sumi Systems. The improved outlook with the affirmed rating reflects the sustainability of earnings and de-leveraging witnessed in the last two quarters despite growth challenges due to the global pandemic, the company said in its BSE filing.

JSW Steel: The company's subsidiary JSW Steel Italy S.r.l has completed the acquisition of 30.73 percent equity share capital of GSI Lucchini S.p.A. In December 2020, a share purchase agreement had been executed between subsidiary JSW Steel Italy S.r.l. and Industrial Development Corporation, South Africa, for acquiring 30.73 percent share capital of GSI for 1 million euro.

5paisa Capital: The company approved fresh capital raise of Rs 250.87 crore through preferential issue of equity shares and warrants at Rs 500 per share to a set of marquee investors, promoters and the promoter group.

Shipping Corporation of India: Shipping Corporation of India (SCI) has appointed M/s Corporate Professionals Capital Private Limited as the consultant for undertaking demerger, hive off or transfer of SCI's non- core assets and "assets held for sale".

UPL: The Supreme Court of Queensland in Australia has dismissed a class action litigation against Advanta Seeds Pty Ltd, UPL's subsidiary in Australia. "This class action, funded by a UK-based litigation funder, alleged that seeds sold by Advanta in 2010/2011 to certain growers in Queensland and News South Wales region of Australia, were contaminated," the company said in its BSE filing.

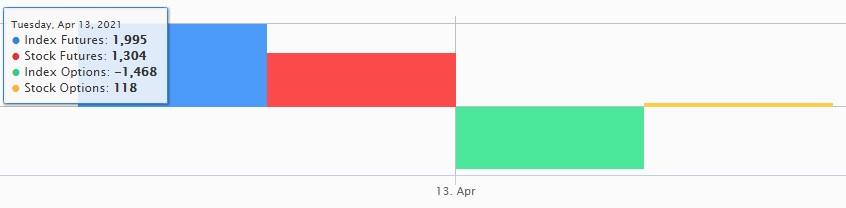

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 730.81 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 243.80 crore in the Indian equity market on April 13, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for April 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!