The market snapped a strong two-day winning streak and closed with more than a percent losses on March 31, dented by weak global cues and rising US bond yields.

The BSE Sensex fell 627.43 points or 1.25 percent to 49,509.15, while the Nifty50 declined 154.40 points or 1.04 percent to 14,690.70 and formed bearish candle which resembles inside bar kind of pattern on the daily charts.

"The Nifty index has formed an 'inside day' candlestick pattern indicating indecisiveness amongst the market participants. Nifty is hovering around the 50 DMA (14,775) and any close above the same shall gain some confidence within the bulls," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

He feels the short-term trend of Nifty seems to have reversed after Tuesday's bullish move.

"The next higher levels to be watched are around 14,850-15,100. Any pullback towards 14,620-14,570 (gap area) should be used as a buying opportunity. The daily RSI has turned upward and has given positive crossover to its reference line indicating more bullishness ahead in the near term," Palviya said.

The broader markets - the Nifty Midcap 100 and Smallcap 100 indices - gained 0.4 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,636, followed by 14,581.3. If the index moves up, the key resistance levels to watch out for are 14,779.6 and 14,868.5.

Nifty Bank

The Nifty Bank index corrected 571.20 points or 1.69 percent to 33,303.90 on March 31. The important pivot level, which will act as crucial support for the index, is placed at 33,046.1, followed by 32,788.3. On the upside, key resistance levels are placed at 33,667.4 and 34,030.9 levels.

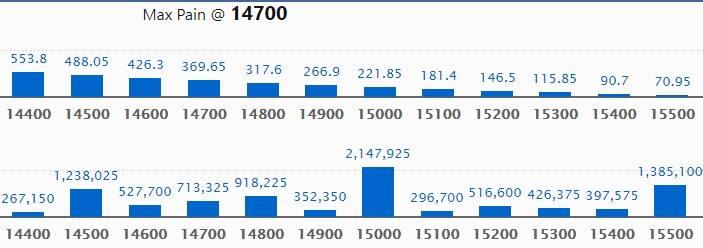

Call option data

Maximum Call open interest of 21.47 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 15,500 strike, which holds 13.85 lakh contracts, and 14,500 strike, which has accumulated 12.38 lakh contracts.

Call writing was seen at 14,800 strike, which added 2.88 lakh contracts, followed by 14,700 strike which added 1.88 lakh contracts and 15,500 strike which added 1.16 lakh contracts.

Call unwinding was seen at 14,500 strike, which shed 66,825 contracts, followed by 15,100 strike which shed 51,900 contracts and 15,200 strike which shed 16,200 contracts.

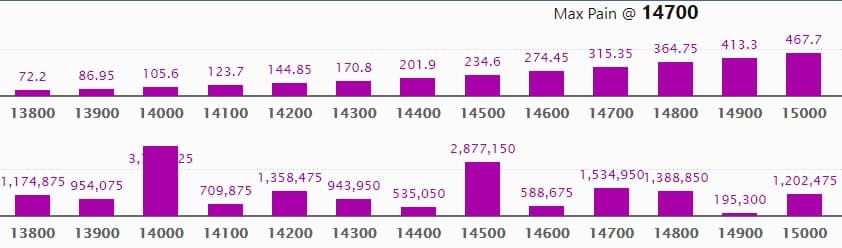

Put option data

Maximum Put open interest of 37.14 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,500 strike, which holds 28.77 lakh contracts, and 14,700 strike, which has accumulated 15.34 lakh contracts.

Put writing was seen at 14,800 strike, which added 2.47 lakh contracts, followed by 13,800 strike which added 1.13 lakh contracts and 14,000 strike which added 89,100 contracts.

Put unwinding was seen at 14,500 strike, which shed 1.1 lakh contracts, followed by 14,400 strike which shed 26,550 contracts and 15,200 strike which shed 13,125 contracts.

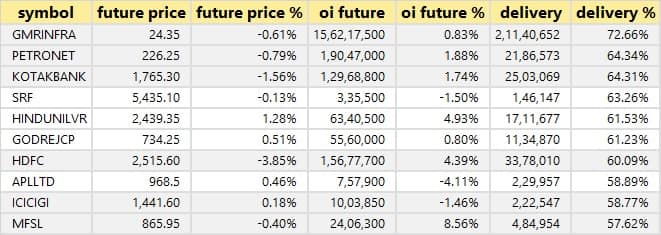

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

47 stocks saw long build-up

An increase in open interest, along with a increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

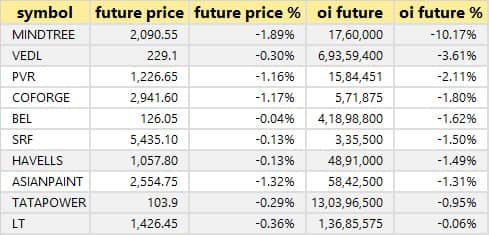

10 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here is the 10 stocks in which long unwinding was seen.

56 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

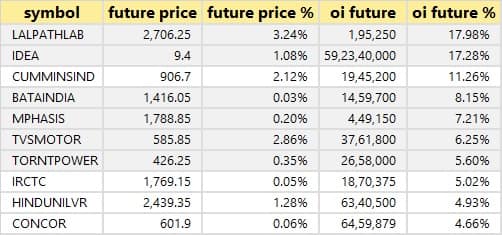

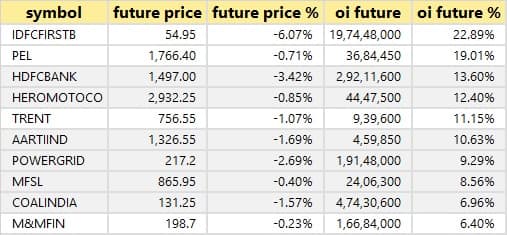

46 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

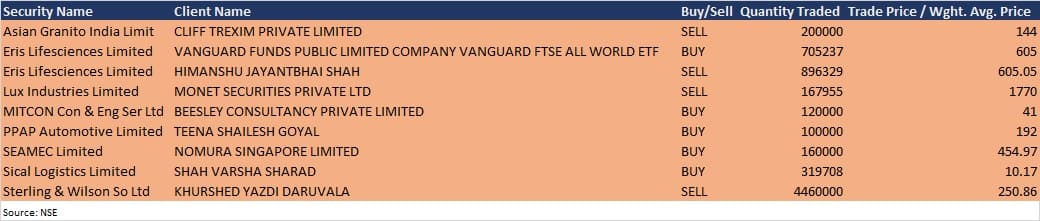

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

HDFC Life Insurance Company: The meeting of the board of directors of the company is scheduled on April 26 to consider the audited standalone and consolidated financial results for the quarter and year ended March 31, 2021.

ICICI Securities: The meeting of the board of directors of the company is scheduled on April 21 to consider the audited financial results of the company for the quarter and financial year ended March 31, 2021.

TCS: TCS will hold earnings conference call for the quarter ended March 31, 2021 on April 12.

Novartis India: Board will consider FY21 results & final dividend on May 20.

Stocks in the news

Indian Overseas Bank: The PSU bank in its BSE filing said it had received a capital infusion of Rs 4,100 crore from Government of India towards contribution of Central Government in the preferential allotment of equity shares of the bank during the Financial Year 2020-21, as government's Investment.

Central Bank of India: The PSU bank had entered into a binding agreement to divest its entire equity stake in Cent Bank Home Finance to Centrum Housing Finance in December 2020. The long stop date for the same share purchase agreement being March 31, 2021 has been lapsed. Therefore the said binding agreement stand rescinded with effect from April 1, 2021, said the bank in its BSE filing.

Sunteck Realty: Mumbai-based property developer Sunteck Realty has secured around 7 acre land parcel at Borivali (West). The company will develop a luxury residential project and JLL India was the exclusive transaction partner for the joint venture, said Sunteck in its BSE filing, adding it is expected to generate a project topline of around Rs 1,750 crore over the next 4-5 years.

NHPC: The power company in its BSE filing said it had completed the formalities for takeover of Rangit Stage-IV HE Project (120 MW) by remitting Rs 165 crore to Jalpower Corporation (JPCL) for distribution to the creditors. JPCL is now a wholly owned subsidiary company of NHPC.

Adani Green Energy: Adani Green Energy in its BSE filing said it had completed acquisition of 100% of the share capital and all the securities of Surajkiran Renewable Resources from Skypower Southeast Asia III Investments and Skypower Southeast Asia Holdings 2 Ltd.

Likhitha Infrastructure: Likhitha Infrastructure in its BSE filing said it had received orders worth Rs 200.22 crore from various oil & gas distribution Companies during the March quarter 2021. One order worth Rs 169.47 crore is for cross-country pipeline laying and related works, while the second of Rs 30.75 crore is for city gas distribution pipeline and related works.

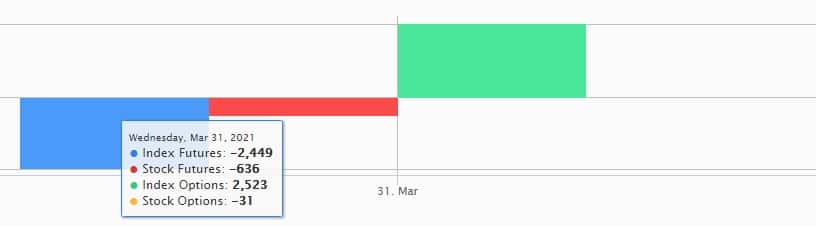

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,685.91 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,081.52 crore in the Indian equity market on March 31, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for April 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!