The market fell sharply on the back of weak global cues and rising COVID-19 cases in the country, falling over 1.7 percent on March 24 as bears held tight grip over Dalal Street.

The BSE Sensex plunged 871.13 points or 1.74 percent to 49,180.31, while the Nifty50 fell 265.40 points or 1.79 percent to 14,549.40 and formed bearish candle on the daily charts, ahead of expiry of March futures & options contracts on Thursday.

"A long negative candle was formed and this indicate a reversal pattern of the last few sessions upmove. Hence, the formation of high wave type candle pattern of Tuesday has turned out to be a reversal pattern as of now. This is negative indication and signal more downside in coming sessions," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The short term trend of Nifty seems to have reversed down after a small upside bounce. Next lower levels to be watched around 14,350-14,300 in the next few sessions before showing another round of small upside bounce from the lows. Any pullback rally could find resistance around 14,675-14,750," he said.

The broader markets also corrected in line with frontliners as the Nifty Midcap 100 and Smallcap 100 indices declined around 2 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,472.17, followed by 14,394.93. If the index moves up, the key resistance levels to watch out for are 14,689.47 and 14,829.53.

Nifty Bank

The Nifty Bank index tanked 891.15 points or 2.61 percent to close at 33,293.25 on March 24. The important pivot level, which will act as crucial support for the index, is placed at 33,007.53, followed by 32,721.86. On the upside, key resistance levels are placed at 33,774.73 and 34,256.27 levels.

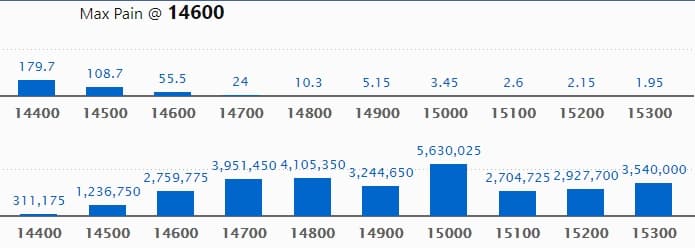

Call option data

Maximum Call open interest of 56.30 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 14,800 strike, which holds 41.05 lakh contracts, and 14,700 strike, which has accumulated 39.51 lakh contracts.

Call writing was seen at 14,700 strike, which added 28.04 lakh contracts, followed by 14,600 strike which added 18.47 lakh contracts and 14,800 strike which added 16.36 lakh contracts.

Call unwinding was seen at 15,200 strike, which shed 2.22 lakh contracts, followed by 14,000 strike which shed 60,000 contracts and 13,700 strike which shed 3,900 contracts.

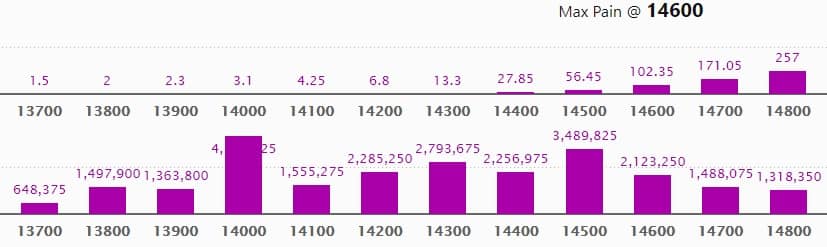

Put option data

Maximum Put open interest of 41.39 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the March series.

This is followed by 14,500 strike, which holds 34.89 lakh contracts, and 14,300 strike, which has accumulated 27.93 lakh contracts.

Put writing was seen at 14,300 strike, which added 2.21 lakh contracts.

Put unwinding was seen at 14,800 strike, which shed 12.57 lakh contracts, followed by 14,700 strike which shed 11.04 lakh contracts and 14,000 strike which shed 8.65 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

4 stocks saw long build-up

Based on the open interest future percentage, here are the 4 stocks in which a long build-up was seen.

108 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

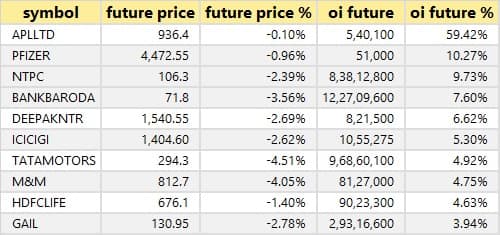

42 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

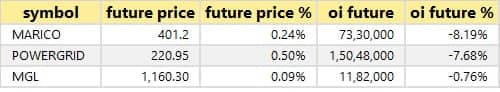

3 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 3 stocks in which short-covering was seen.

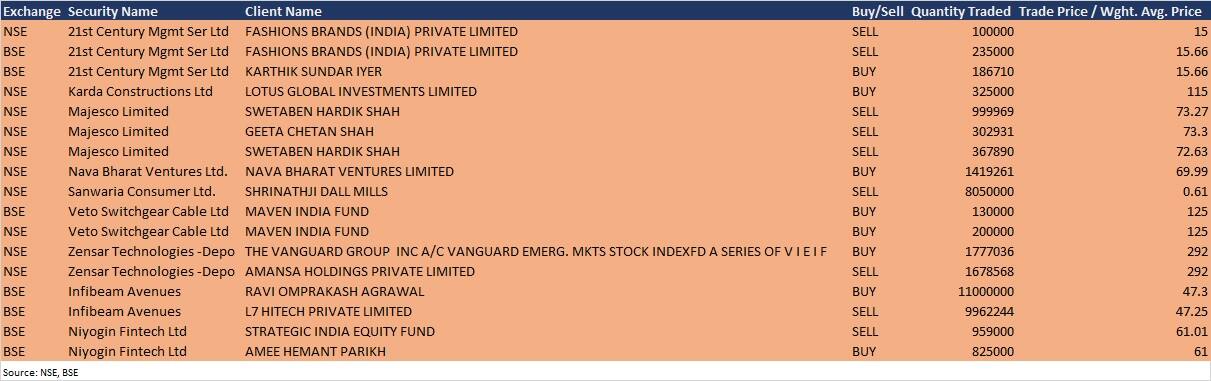

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

United Spirits: Analysts'/institutional investors' meetings to be held on March 25 and March 26.

Eicher Motors: The company's officials will interact with Sharekhan and JP Morgan India on March 25.

Mahindra Lifespace Developers: The company's officials will interact with UBS Securities India on March 26.

Tube Investments of India: The company's officials will interact with institutional investors/analysts on March 26 and March 31.

Hindalco Industries: The company's officials will participate in the ESG CXO e-Series virtual conference organised by Edelweiss Securities on March 25.

Stocks in the news

Jubilant FoodWorks: Jubilant Foodworks has entered into an exclusive master franchise and development agreement with PLK APAC Pte Ltd, a subsidiary of Restaurant Brands International Inc. The agreement will help the company to develop, establish, own and operate, and to license franchisees to develop, establish, own and operate, Popeyes Restaurants in India, Bangladesh, Nepal and Bhutan.

Time Technoplast: Time Technoplast has received information from the promoter group of the company for substantial reduction in their pledge of equity shares of the company held by them. "The pledge of shares has reduced from 9.55% of paid up capital to only 4.22%. It may be recalled, at some point in time the total pledged shares used to be around 18%," the company said in its BSE filing.

Pokarna: Pokarna Engineered Stone, wholly owned subsidiary of Pokarna, has started commercial production at its second state-of-the-art quartz surface manufacturing facility, with effect from March 24. The plant is located at Mekaguda village in Telangana.

Vakrangee: Vakrangee has entered into a partnership agreement with TransUnion CIBIL (TUCIBIL), one of the India's largest credit information company regulated by Reserve Bank of India. The agreement will help the company drive financial inclusion by providing easy access to CIBIL score and report to consumers through Nextgen Vakrangee Kendra network.

Wabco India: ZF International UK will sell 17,17,388 equity shares or 9.05% stake in Wabco India through the offer for sale on March 25 and March 26. The company will also sell additional 17,17,387 equity shares or 9.05% stake in the company through offer for sale on same days. The floor price for the sale is fixed at Rs 5,450 per share.

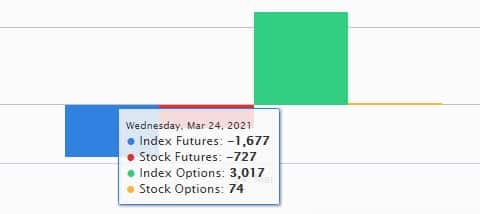

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,951.90 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 612.80 crore in the Indian equity market on March 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Vodafone Idea - is under the F&O ban for March 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!