The market fell for the fourth consecutive session on March 17 with the benchmark indices falling over a percent each amid selling in banking, financials, auto, metals and pharma counters.

The S&P BSE Sensex declined 562.34 points or 1.12 percent to close at 49,801.62, while the Nifty50 dropped 189.20 points or 1.27 percent to 14,721.30 and formed a bearish candle on the daily charts.

"A long negative candle was formed, that closed below the recent swing low of 14,745 levels. The market is now nearing a lower range of last 14-15 trading sessions at 14,500 levels. This could be a negative indication and a move below 14,450 could open a sharp weakness in the near term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

Shetti feels there is a possibility of an upside bounce from this important cluster support around 14,500-14,450 levels in the next few sessions. "The strength of the market during upside bounce could be important to hold on to a support and show sustainable bounce. Immediate resistance is placed at 14,850," he said.

The broader markets also witnessed steep correction, more than the frontline indices. The Nifty Midcap 100 and Smallcap 100 indices have seen a fall of 2.48 percent and 2.21 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,626.03, followed by 14,530.77. If the index moves up, the key resistance levels to watch out for are 14,886.53 and 15,051.77.

Nifty Bank

The Nifty Bank index plunged 575.30 points or 1.65 percent to 34,229.30. The important pivot level, which will act as crucial support for the index, is placed at 33,870.56, followed by 33,511.93. On the upside, key resistance levels are placed at 34,844.16 and 35,459.13 levels.

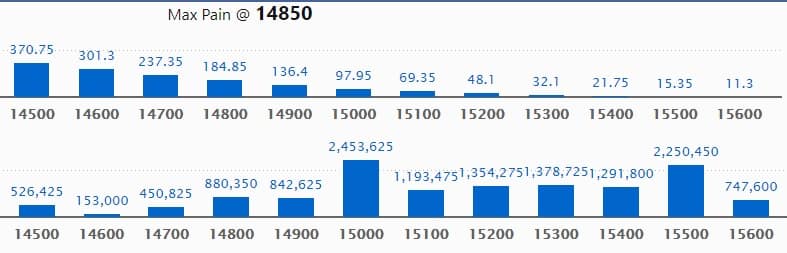

Call option data

Maximum Call open interest of 24.53 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,500 strike, which holds 22.50 lakh contracts, and 15,300 strike, which has accumulated 13.78 lakh contracts.

Call writing was seen at 15,000 strike, which added 6.11 lakh contracts, followed by 14,800 strike which added 3.43 lakh contracts and 14,900 strike which added 3.35 lakh contracts.

Call unwinding was seen at 15,400 strike, which shed 1.66 lakh contracts, followed by 15,600 strike which shed 81,675 contracts and 15,500 strike which shed 45,975 contracts.

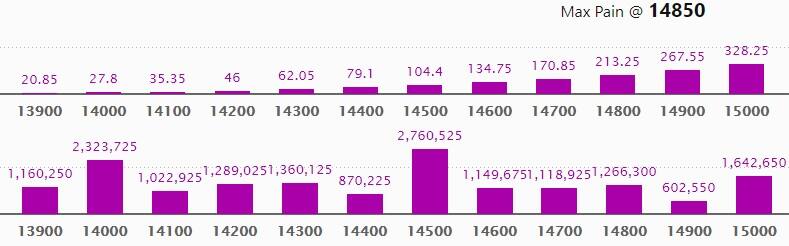

Put option data

Maximum Put open interest of 27.60 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the March series.

This is followed by 14,000 strike, which holds 23.23 lakh contracts, and 15,000 strike, which has accumulated 16.42 lakh contracts.

Put writing was seen at 14,200 strike, which added 2.37 lakh contracts, followed by 14,100 strike, which added 1 lakh contracts and 14,400 strike which added 73,650 contracts.

Put unwinding was seen at 15,000 strike, which shed 1.68 lakh contracts, followed by 14,000 strike which shed 1.66 lakh contracts and 14,800 strike which shed 1.35 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

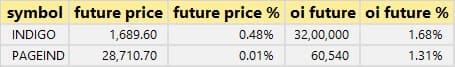

2 stocks saw long build-up

Based on the open interest future percentage, here are the 2 stocks in which a long build-up was seen.

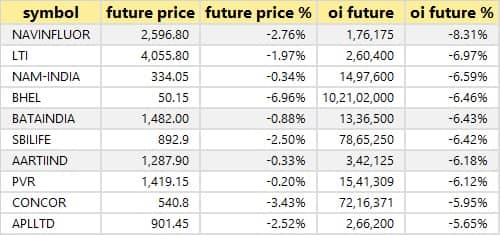

99 stocks saw long unwinding

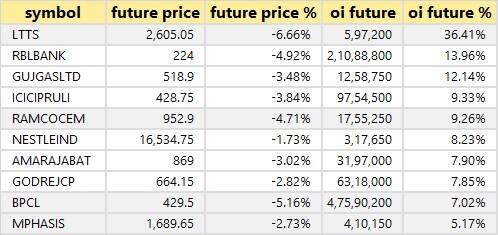

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

54 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

4 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 4 stocks in which short-covering was seen.

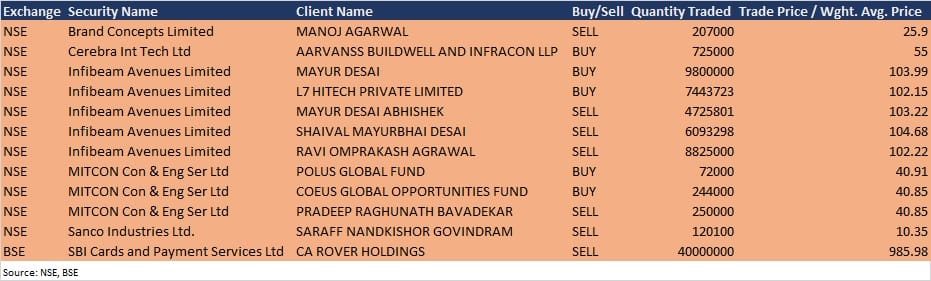

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Magma Fincorp: The company's officials will interact with Think Investment on March 17 and Wellington management on March 18.

Tube Investments of India: The meeting through digital access with an institutional investor is scheduled on March 18.

Ceat: The company's officials will participate in analysts and institutional investors' meet hosted by Axis Securities on March 18.

Vidhi Specialty Food Ingredients: Officials of the company will interact with Analysts/Investors on March 19, March 24 and March 25.

IRCON International: The management of the company will be participating in the institutional investor meeting organised by the Prabhudas Lilladher March 19.

Paisalo Digital: A Committee Meeting is scheduled to be held on March 20 to consider the allotment of convertible warrants on preferential basis, to entities belonging to the promoter group.

Bajaj Finance: The company's officials will interact with Columbia Threadneedle Investments on March 19, Arohi Asset Management and ICICI Prudential Mutual Fund on March 22.

Can Fin Homes: Girish Kousgi, Managing Director & CEO, and Shreekant M Bhandiwad, Deputy Managing Director, of the company will interact with Avendus Capital and Principal Mutual Fund on March 22, Flowering Tree Investment Management, Nippon Mutual Fund and Franklin Templeton Investments on March 23.

Stocks in the news

IRCTC: Indian Railway Catering and Tourism Corporation said there has been no major impact of terminations of mobile catering contracts in the financial year 2020-21.

Bharat Heavy Electricals: State-owned engineering firm BHEL said the company has emerged as the lowest bidder for Rs 10,800 crore fleet mode tender floated by Nuclear Power Corporation of India (NPCIL) for the 6x700 MW Turbine Island package projects.

Satin Creditcare Network: Microfinance institution Satin Creditcare Network in its BSE filing said its promoters have reduced their pledge percentage from 8.90 percent on July 16, 2020, to 3.09 percent as on March 16, 2021.

Indian Metals & Ferro Alloys: Indian Metals & Ferro Alloys said ICRA has upgraded the credit rating on company's long-term and short-term loan facilities from the banks.

HFCL: Optical fiber cable manufacturer HFCL has bagged an order worth Rs 221.16 crore from Uttar Pradesh Metro Rail Corporation.

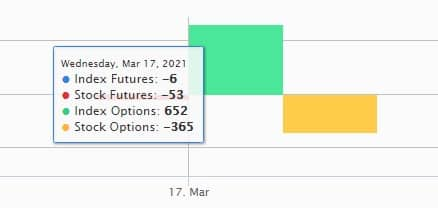

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,625.82 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 562.15 crore in the Indian equity market on March 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Sun TV Network - is under the F&O ban for March 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!