The selling pressure in private banks, FMCG, IT and pharma stocks weighed on the sentiment and pulled the market down on February 17. Weak global cues also dented sentiment.

The S&P BSE Sensex fell 400.34 points to 51,703.83, while the Nifty50 index declined 104.60 points to 15,208.90 and formed a bearish candle on the daily charts.

"A reasonable negative candle was formed on Wednesday as per daily timeframe chart with minor upper and lower shadow. This pattern indicates downward correction in the market with volatility. The Nifty failing to show any upside recovery in the mid to later part of today's session could hint some more weakness in the coming session," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Important support to be watched is around 15,000 and we expect market to show upside bounce from the lows. On the contrary side, a decisive move below the 15,000-mark could open more weakness in the short term," Shetti said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,148.37, followed by 15,087.83. If the index moves up, the key resistance levels to watch out for are 15,291.87 and 15,374.83.

Nifty Bank

The Nifty Bank corrected 187.50 points to close at 36,910.90 on February 17. The important pivot level, which will act as crucial support for the index, is placed at 36,672.93, followed by 36,434.96. On the upside, key resistance levels are placed at 37,240.13 and 37,569.36.

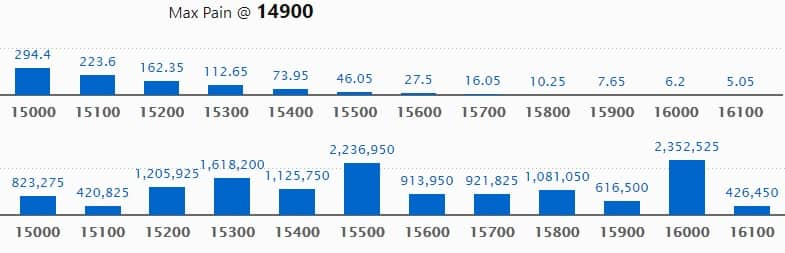

Call options data

Maximum Call open interest of 23.52 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,500 strike, which holds 22.36 lakh contracts, and 15,300 strike, which has accumulated 16.18 lakh contracts.

Call writing was seen at 15,200 strike, which added 5.66 lakh contracts, followed by 15,300 strike which added 4.5 lakh contracts and 15,400 strike which added 3.17 lakh contracts.

Call unwinding was seen at 15,800 strike, which shed 47,475 contracts, followed by 15,900 strike which shed 40,275 contracts and 14,500 strike which shed 13,050 contracts.

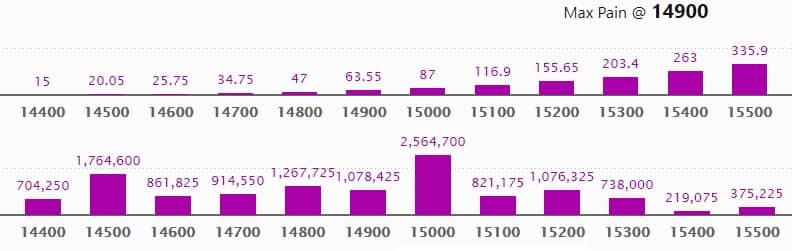

Put option data

Maximum Put open interest of 25.64 lakh contracts was seen at 15,000 strike, which will act as crucial support level in the February series.

This is followed by 14,500 strike, which holds 17.64 lakh contracts, and 14,800 strike, which has accumulated 12.67 lakh contracts.

Put writing was seen at 15,200 strike, which added 3.55 lakh contracts, followed by 15,000 strike, which added 3.24 lakh contracts and 14,900 strike which added 1.82 lakh contracts.

Put unwinding was seen at 15,400 strike, which shed 47,400 contracts, followed by 15,500 strike which shed 4,200 contracts.

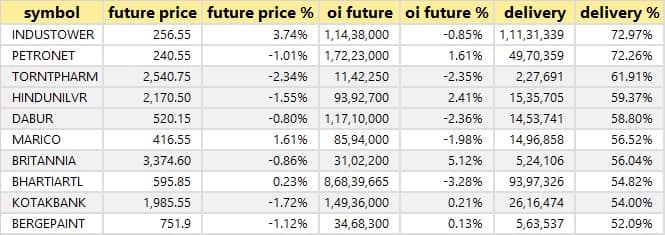

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

25 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

38 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

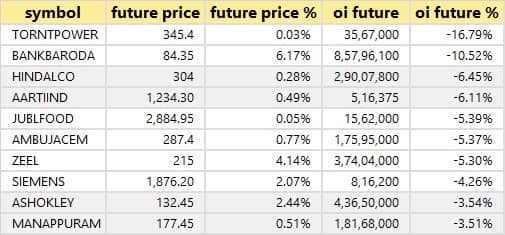

46 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

34 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

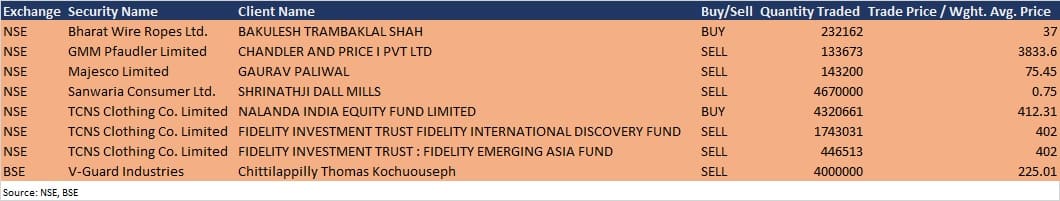

Bulk deals

(For more bulk deals, click here)

Ambuja Cements, Enkei Wheels, RCL Retail, Rollatainers and Twinstar Industries will announce their quarterly earnings on February 18.

Stocks in the news

GAIL: The share buyback to open February 25 and close on March 10.

Jubilant FoodWorks: The company appointed Ashish Goenka as CFO. Earlier Goenka was with Bharti Airtel as Executive VP.

Phillips Carbon Black: The company commissioned two specialty black lines at Palej in Gujarat.

Dish TV India: The company approved raising funds of up to Rs 1,000 crore.

Bharti Airtel: The company to acquire 20% stake in Bharti Telemedia from Lion Meadow Investment Ltd, a Warburg Pincus entity.

NALCO: The company to open its share buyback worth Rs 749.1 crore on February 25 and close on March 10.

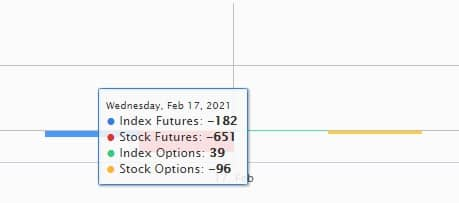

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,008.2 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,283.38 crore in the Indian equity market on February 17, as per provisional data available on the National Stock Exchange (NSE).

Stocks under F&O ban on NSE

Three stocks - Vodafone Idea, Punjab National Bank and SAIL - are under the F&O ban for February 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!