Stock market rallied for the second consecutive session to clock an all-time high after recouping all its previous three-day losses, on January 20, driven by auto, IT, Metals and PSU bank stocks, and foreign money flow.

The benchmark indices ended at record closing high with the BSE Sensex climbing 393.83 points to 49,792.12, while the Nifty50 jumped 123.50 points to 14,644.70 and formed a bullish candle on the daily charts as closing was higher than opening levels.

"Another long bull candle was formed, which indicates an uptrend continuation pattern. The previous three sessions decline has been retraced completely in the last two sessions. This faster retracement could signal further upside in the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The positive sequence like higher highs and lows continued on the daily chart and Nifty is currently making an attempt to reach higher highs. Previously, the short-term downward corrections have resulted in a sustainable upside for many sessions. Hence, having moved up sharply from the higher bottom in the last two sessions, Nifty is expected to show further upside gradually," he said.

"One may expect further upside for the next few sessions, before encountering a next crucial overhead resistances around 14,800 levels. Immediate support is at 14,550," he added.

The broader markets have also closed in the green with the Nifty Midcap 100 index rising 1 percent and Smallcap 100 index up 0.6 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,552.63, followed by 14,460.57. If the index moves up, the key resistance levels to watch out for are 14,701.63 and 14,758.57.

Nifty Bank

The Nifty Bank gained 118.90 points to close at 32,543.70 on January 20. The important pivot level, which will act as crucial support for the index, is placed at 32,375.27, followed by 32,206.83. On the upside, key resistance levels are placed at 32,659.77 and 32,775.83.

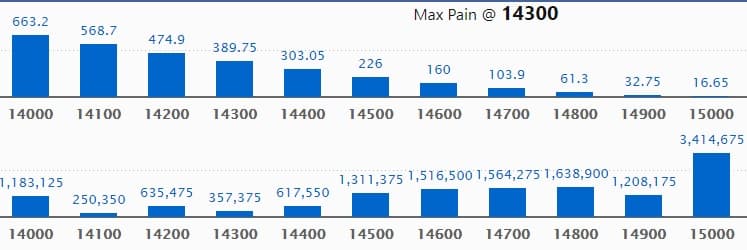

Call option data

Maximum Call open interest of 34.14 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,800 strike, which holds 16.38 lakh contracts, and 14,700 strike, which has accumulated 15.64 lakh contracts.

Call writing was seen at 15,000 strike, which added 4.72 lakh contracts, followed by 15,100 strike which added 2.23 lakh contracts and 15,200 strike which added 2.04 lakh contracts.

Call unwinding was seen at 14,500 strike, which shed 3.85 lakh contracts, followed by 14,400 strike which shed 1.57 lakh contracts and 14,300 strike which shed 1.54 lakh contracts.

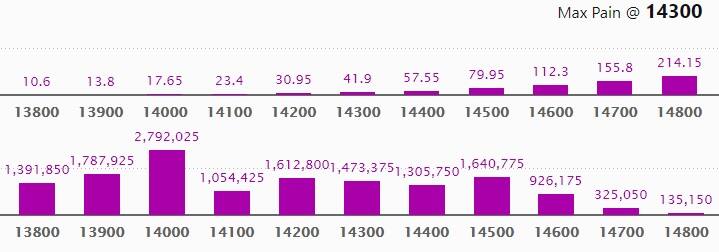

Put option data

Maximum Put open interest of 27.92 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the January series.

This is followed by 13,900 strike, which holds 17.87 lakh contracts, and 14,500 strike, which has accumulated 16.40 lakh contracts.

Put writing was seen at 14,600 strike, which added 4.89 lakh contracts, followed by 14,500 strike, which added 3.85 lakh contracts and 14,300 strike which added 2.35 lakh contracts.

Put unwinding was seen at 14,100 strike, which shed 2.29 lakh contracts, followed by 13,800 strike, which shed 91,725 contracts and 15,000 strike which shed 19,350 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

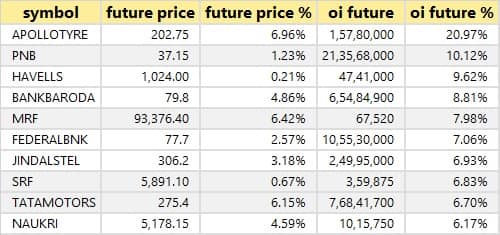

50 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

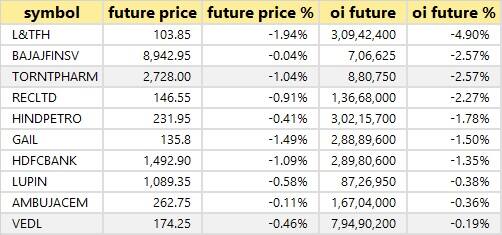

11 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

36 stocks saw short build-up

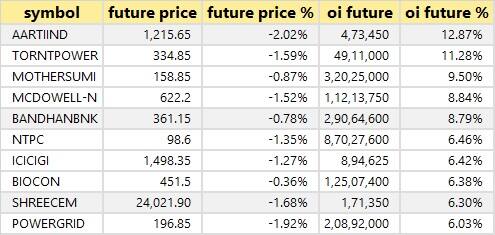

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

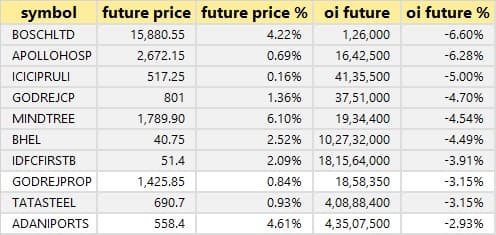

45 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

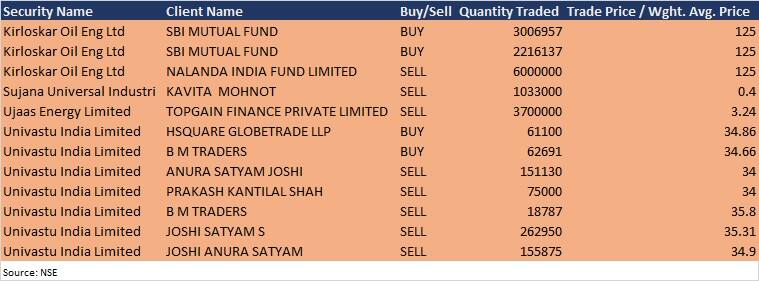

Bulk deals

(For more bulk deals, click here)

Asian Paints, Bajaj Auto, AAVAS Financiers, MCX India, SBI Cards and Payment Services, Bajaj Holdings & Investment, Bandhan Bank, Biocon, Cyient, Genus Power Infrastructures, Indo Count Industries, Indian Energy Exchange, IIFL Securities, JBF Industries, Jindal Steel & Power, JK Tyre & Industries, Kajaria Ceramics, Kirloskar Pneumatic, Man Industries, Mphasis, Music Broadcast, Reliance Power, Saregama India, South Indian Bank, SRF, Supreme Petrochem, Westlife Development, Zensar Technologies and Zicom Electronic Security Systems are among 57 companies to announce their quarterly earnings on January 21.

Stocks in the news

L&T Technology Services: The company reported profit at Rs 186.1 crore in Q3FY21 against Rs 165.5 crore in Q2FY21, revenue rose to Rs 1,400.7 crore from Rs 1,313.8 crore QoQ.

Axis Bank: Competition Commission of India (CCI) has approved the acquisition of stake in Max Life Insurance by Axis Bank, Axis Capital and Axis Securities.

Aditya Birla Fashion: Competition Commission of India approved Flipkart's 7.8 percent stake buy in Aditya Birla Fashion.

Havells India: The company reported sharply higher profit at Rs 350.1 crore in Q3FY21 against Rs 200.6 crore in Q3FY20, revenue jumped to Rs 3,175.2 crore from Rs 2,273.3 crore YoY.

Phillips Carbon Black: The company reported sharply higher consolidated profit at Rs 125.44 crore in Q3FY21 against Rs 70.06 crore, revenue at Rs 769.4 crore against Rs 768.65 crore YoY.

Bajaj Finance: The company reported consolidated profit at Rs 1,146 crore in Q3FY21 against Rs 1,614 crore, revenue fell to Rs 4,296 crore from Rs 4,535 crore YoY.

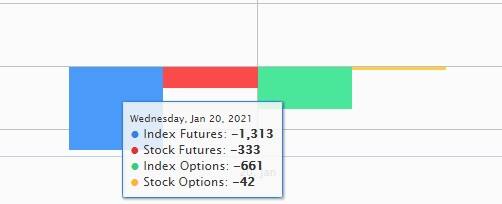

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,289.05 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 864.62 crore in the Indian equity market on January 20, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Vodafone Idea, SAIL and Sun TV Network - are under the F&O ban for January 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!