The market erased all of its previous day's gains as bears took control on October 28 due to weak global cues, amid rising coronavirus infections in US and Europe and uncertainty over the outcome of the US presidential elections.

The Sensex plunged 599.64 points, or 1.48 percent, to close at 39,922.46, dented by banking & financials, IT, FMCG and pharma stocks.

The Nifty fell 159.80 points, or 1.34 percent, to 11,729.60. It formed a bearish candle on the daily charts at its support of 11,700, ahead of the expiry of October futures and options (F&O) contracts on October 29.

"At lower levels, 11,650 is going to act as crucial support for the market. If this support breaks decisively on the downside, then one may expect a sharp downside in the near term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"As of now, the broader high-low range is intact for the market around 12,025-11,700 levels. A sustainable move beyond the range could mean a pick-up in sharp momentum on either side," he added.

The broader markets - the Nifty Midcap and Smallcap indices -- corrected a percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,633.13, followed by 11,536.67. If the index moves up, the key resistance levels to watch out for are 11,877.73 and 12,025.87.

Nifty Bank

The Bank Nifty shed 537 points, or 2.17 percent, to close at 24,232.50 on October 28. The important pivot level, which will act as crucial support for the index, is placed at 23,933.37, followed by 23,634.23. On the upside, key resistance levels are placed at 24,656.17 and 25,079.83.

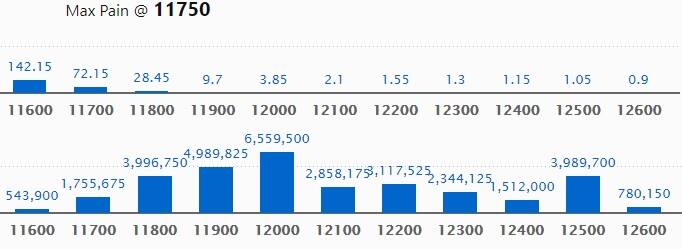

Call option data

Maximum Call OI of 65.59 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the October series.

This is followed by 11,900, which holds 49.89 lakh contracts, and 11,800 strikes, which has accumulated 39.96 lakh contracts.

Call writing was seen at 12,000, which added 21.55 lakh contracts, followed by 11,900, which added 18.99 lakh contracts, and 11,800 strikes, which added 16.7 lakh contracts.

Call unwinding was seen at 12,200, which shed 4.19 lakh contracts, followed by 12,500, which shed 3.73 lakh contracts, and 12,100 strikes, which shed 2.86 lakh contracts.

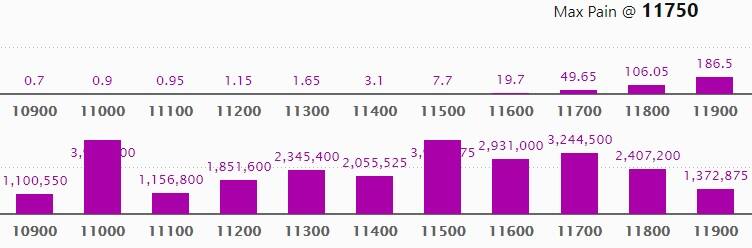

Put option data

Maximum Put OI of 39.35 lakh contracts was seen at 11,500 strike, which will act as crucial support in the October series.

This is followed by 11,000, which holds 39.34 lakh contracts, and 11,700 strikes, which has accumulated 32.44 lakh contracts.

Put writing was seen at 11,600, which added 1.32 lakh contracts, followed by 11,500 strikes, which added 31,950 contracts.

Put unwinding was witnessed at 11,800, which shed 8.61 lakh contracts, followed by 11,100, which shed 5.78 lakh contracts, and 11,900 strikes, which shed 4.85 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

1 stock saw long build-up

Based on OI future percentage, here is the one stock in which long build-up was seen.![]()

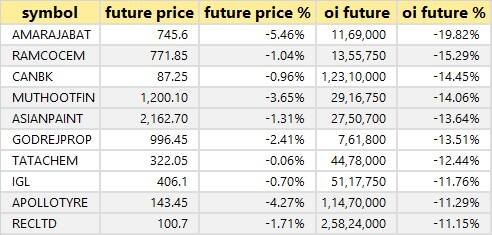

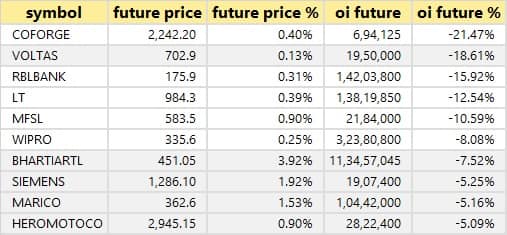

89 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

29 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are top 10 stocks in which short build-up was seen.

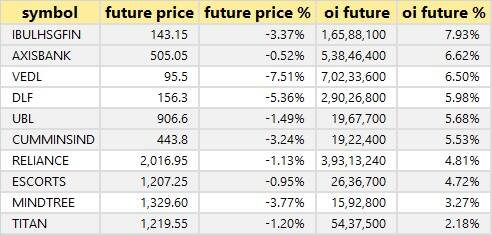

19 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are top 10 stocks in which short-covering was seen.

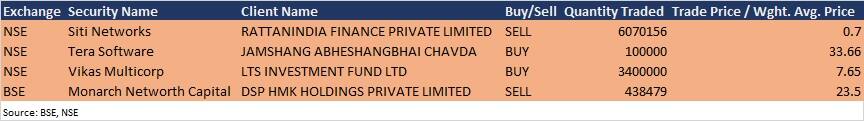

Bulk deals (For more bulk deals, click here)

(For more bulk deals, click here)

Results on October 29

Maruti Suzuki, BPCL, Bank of Baroda, Canara Bank, Havells India, Vodafone Idea, InterGlobe Aviation, Tata Chemicals, TVS Motor Company, AAVAS Financiers, Aegis Logistics, Apollo Pipes, Arvind, Astec Lifesciences, Bajaj Healthcare, Blue Dart Express, Cholamandalam Investment and Finance Company, Coromandel Engineering, Gateway Distriparks, Great Eastern Shipping, Himadri Speciality Chemical, JK Paper, Laurus Labs, Mastek, Mahindra Holidays, MRPL, PTC India Financial Services, Security and Intelligence Services, Shriram Transport Finance, Strides Pharma Science, Surya Roshni, Vaibhav Global, Welspun Corp, Welspun India and Zensar Technologies among 89 companies will declare their quarterly earnings on October 29.

Stocks in the news

RBL Bank reported sharply higher profit at Rs 144.2 crore in Q2 FY21 against Rs 54.3 crore. Net interest income rose to Rs 932.1 crore from Rs 868.7 crore YoY.

Ajanta Pharma will consider a share buyback proposal on November 3.

Larsen & Toubro (L&T) reported higher profit at Rs 5,520.3 crore in Q2 FY21 against Rs 2,527.3 crore. Revenue fell to Rs 31,034.7 crore from Rs 35,328.5 crore YoY.

Axis Bank posted a profit of Rs 1,682.7 crore in Q2 FY21 against a loss of Rs 112.1 crore. Net interest income rose to Rs 7,326.1 crore from Rs 6,101.8 crore YoY.

Can Fin Homes reported a profit of Rs 128.4 crore in Q2 FY21 against Rs 97.62 crore. Revenue increased to Rs 525.8 crore from Rs 500.67 crore YoY.

ICICI Securities reported sharply higher profit at Rs 278 crore in Q2 FY21 against Rs 135 crore. Revenue jumped to Rs 680.6 crore from Rs 417 crore YoY.

PI Industries reported higher profit at Rs 217.6 crore in Q2 FY21 against Rs 123.2 crore. Revenue rose to Rs 1,157.7 crore from Rs 907.4 crore YoY.

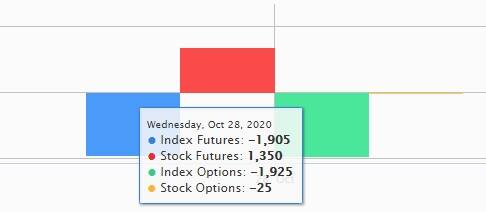

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,130.98 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 1.48 crore in the Indian equity market on October 28, as per provisional data available on the NSE.

Stock under F&O ban on NSETwo stocks - Coforge and Vodafone Idea - are under the F&O ban for October 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!