The market wiped out gains in the afternoon, but the recovery in last hour of trade helped benchmark indices close in the green for fourth consecutive session on October 21, led by banking and financials, and metals stocks.

The BSE Sensex rose 162.94 points to 40,707.31, while the Nifty50 gained 40.90 points at 11,937.70 and formed small bodied bearish candle which resembles Hanging Man kind of pattern on the daily charts.

"On the daily chart, the market established a 'Hanging Man' structure after correcting to a very harsh but far-reaching level of 11745. This invites a bearishness, however, for that it must be at the top of the rally, which is not the case. It has spent a lot of time between 12,030 and 11,660. The Nifty must do something to keep this momentum going. The Nifty needs to move back to the level of 12,050. Failure to do so could lead to another drop in the 11,750 levels," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

"Stocks related to the core economy are starting to join the race and this would give another push to the Nifty. We could see the levels of 12,250, in case the Nifty crosses 12,050 levels. Support exists at 11,800 and below the level of 11,800. The Nifty could gradually fall to 11,600 levels," he said.

Be level based trader on the day of weekly expiry of Index options, he advised.

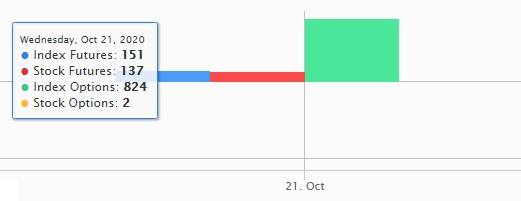

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 11,802.77, followed by 11,667.83. If the index moves up, the key resistance levels to watch out for are 12,045.67 and 12,153.63.

Nifty Bank

The Bank Nifty outperformed the Nifty50, rising 323.20 points, or 1.33 percent, to 24,635 on October 21. The important pivot level, which will act as crucial support for the index, is placed at 24,215.4, followed by 23,795.7. On the upside, key resistance levels are placed at 24,939.2 and 25,243.3.

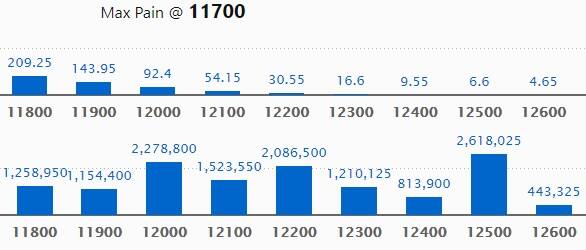

Call option data

Maximum Call open interest of 26.18 lakh contracts was seen at 12,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000 strike, which holds 22.78 lakh contracts, and 12,200 strike, which has accumulated 20.86 lakh contracts.

Call writing was seen at 12,200 strike, which added 2.14 lakh contracts, followed by 12,400 strike which added 1.45 lakh contracts, and 12,500 strike which added 1.21 lakh contracts.

Call unwinding was seen at 11,500 strike, which shed 1.49 lakh contracts, followed by 12,000 strike, which shed 1.11 lakh contracts, and 11,900 strike which shed 71,325 contracts.

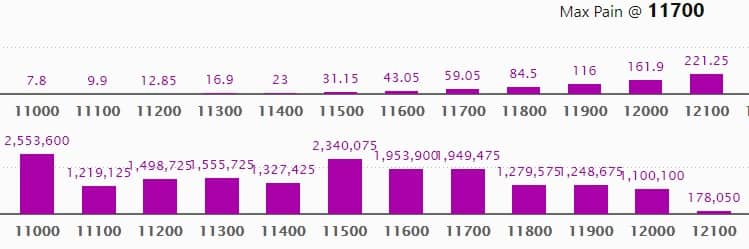

Put option data

Maximum Put open interest of 25.53 lakh contracts was seen at 11,000 strike, which will act as crucial support in the October series.

This is followed by 11,500 strike, which holds 23.40 lakh contracts, and 11,600 strike, which has accumulated 19.53 lakh contracts.

Put writing was seen at 12,000 strike which added 1.43 lakh contracts, followed by 11,900 strike which added 1.41 lakh contracts, and 11,800 strike which added 51,450 contracts.

Put unwinding was witnessed at 11,300 strike, which shed 1.49 lakh contracts, followed by 11,500 strike which shed 1.1 lakh contracts.

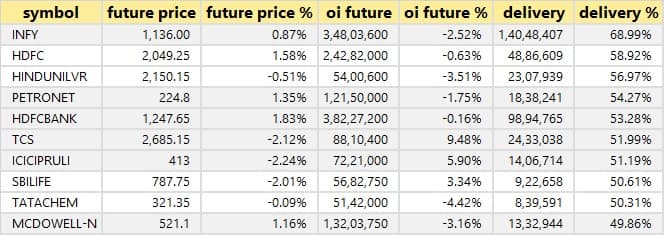

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

25 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

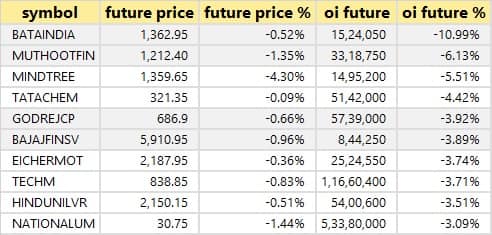

30 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

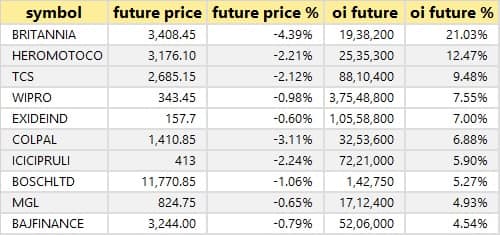

30 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which short build-up was seen.

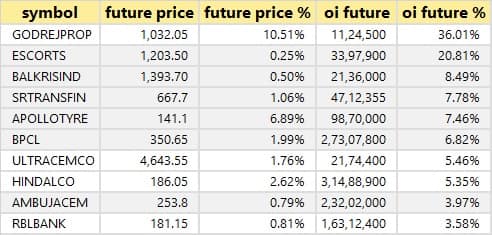

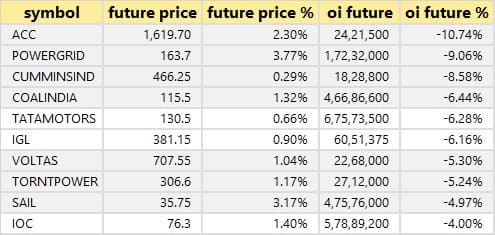

50 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

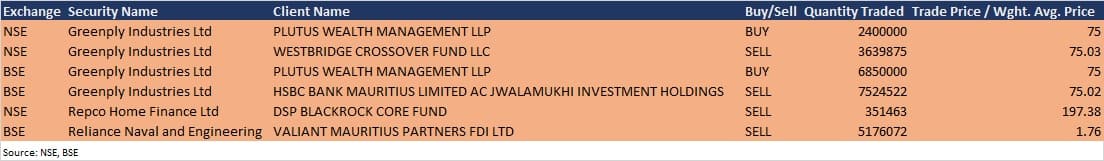

Bulk deals

(For more bulk deals, click here)

Results on October 22

Asian Paints, Bajaj Auto, Bharti Infratel, HDFC Asset Management Company, SBI Cards and Payment Services, Hexaware Technologies, Indian Bank, Biocon, Alembic Pharmaceuticals, 3i Infotech, Automobile Corporation of Goa, Allsec Technologies, Asahi Songwon Colors, Bajaj Holdings & Investment, Coforge, Crompton Greaves Consumer Electricals, Gokaldas Exports, L&T Finance Holdings, MIC Electronics, Mphasis, Pricol, Music Broadcast, Reliance Power, Sterlite Technologies, Subros, Tube Investments of India, and UCO Bank are among 48 companies to announce quarterly earnings on October 22.

Stocks in the news

Tejas Networks: The company reported profit at Rs 4.53 crore in Q2FY21, against the loss of Rs 4.38 crore in the year-ago period. Revenue increased to Rs 110 crore from Rs 87.42 crore YoY.

National Peroxide: The company reported profit at Rs 22.33 crore in Q2FY21, against Rs 5.78 crore in the year-ago period. Revenue rose to Rs 53.88 crore from Rs 54.78 crore YoY.

Bajaj Finserv: The company reported profit at Rs 986 crore in Q2FY21, against Rs 1,204 crore in the year-ago period. Revenue rose to Rs 15,052 crore from Rs 14,224 crore YoY.

Chennai Petroleum Corporation: The company reported profit at Rs 291.80 crore in Q2FY21, against the loss of Rs 213.64 crore in the year-ago period. Revenue fell to Rs 9,732.90 crore from Rs 12,191.97 crore YoY.

KPIT Technologies: The company reported profit at Rs 27.15 crore in Q2FY21, against Rs 24.22 crore in the last quarter. Revenue fell to Rs 485.5 crore from Rs 492.7 crore QoQ.

DLF: The company inked an anchor deal with Standard Chartered GBS for upcoming project DLF Downtown, Taramani, Chennai.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,108.48 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,633.53 crore in the Indian equity market on October 21, as per provisional data available on the National Stock Exchange (NSE).

Stock under F&O ban on NSE

Seven stocks - BHEL, Canara Bank, Indiabulls Housing Finance, Vodafone Idea, Mindtree, NALCO and Punjab National Bank - are under the F&O ban for October 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!