The market continued its consolidation for second consecutive day and closed moderately higher amid mixed global cues on September 30, supported by FMCG, HDFC Group, select IT and pharma stocks.

The BSE Sensex was up 94.71 points at 38,067.93, while the Nifty50 rose 25.10 points to 11,247.50 and formed Doji kind of pattern on the daily charts.

"Nifty witnessed significant volatility in the previous week. It tested critical level of 10,800 and staged a strong bounce back towards 11,250. The broader market sentiment has recovered but not improved significantly and hence we are witnessing lacklustre movements. The undertone remains positive but momentum continues to be missing," Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities told Moneycontrol.

He expects rangebound movement to continue before the market makes a strong directional move.

Nagaraj Shetti, Technical Research Analyst at HDFC Securities, also feels the short term trend of Nifty continues to be rangebound.

"If Nifty fails to show a sustainable upmove above the immediate hurdle of 11,300 levels in the next couple of sessions, then there is a possibility of weakness emerging from the highs. Immediate support is placed at 11,180 and the downside momentum is expected to pick up below this area," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,189.53, followed by 11,131.57. If the index moves up, the key resistance levels to watch out for are 11,300.43 and 11,353.37.

Nifty Bank

The Bank Nifty gained 40.50 points to close at 21,451.80 on September 30. The important pivot level, which will act as crucial support for the index, is placed at 21,203.77, followed by 20,955.73. On the upside, key resistance levels are placed at 21,624.57 and 21,797.33.

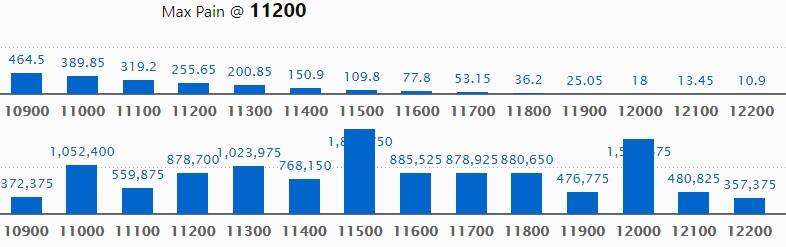

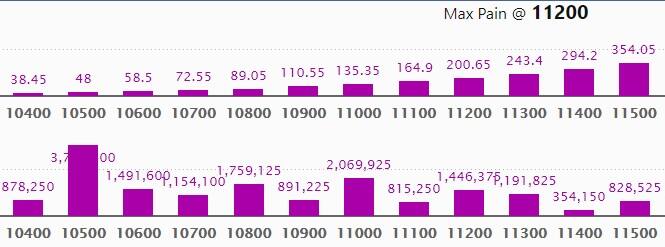

Call option data

Maximum Call open interest of 18.03 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000 strike, which holds 15.99 lakh contracts, and 11,000 strike, which has accumulated 10.52 lakh contracts.

Call writing was seen at 11,200 strike, which added 1.05 lakh contracts, followed by 11,300, which added 75,075 contracts, and 11,700 strike, which added 66,600 contracts.

Call unwinding was seen at 12,200 strike, which shed 23,925 contracts, followed by 12,100 strike, which shed 20,625 contracts and 11,400 strike which shed 20,400 contracts.

Put option data

Maximum Put open interest of 37.88 lakh contracts was seen at 10,500 strike, which will act as crucial support in the October series.

This is followed by 11,000 strike, which holds 20.69 lakh contracts, and 10,800 strike, which has accumulated 17.59 lakh contracts.

Put writing was seen at 10,500 strike, which added 2.9 lakh contracts, followed by 11,000 strike, which added 1.91 lakh contracts and 11,200 strike which added 1.75 lakh contracts.

Put unwinding was witnessed at 10,200 strike, which shed 26,925 contracts, followed by 10,600 strike which shed 10,725 contracts.

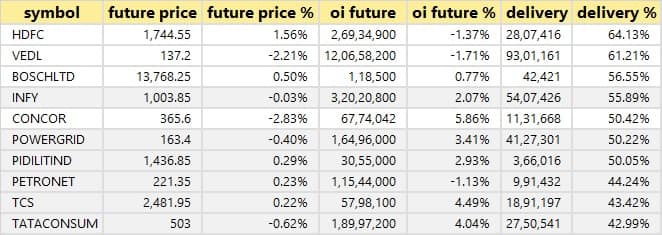

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

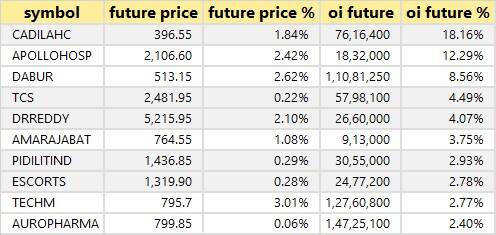

30 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

27 stocks saw long unwinding

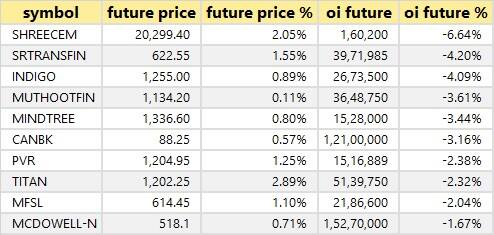

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

50 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

28 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

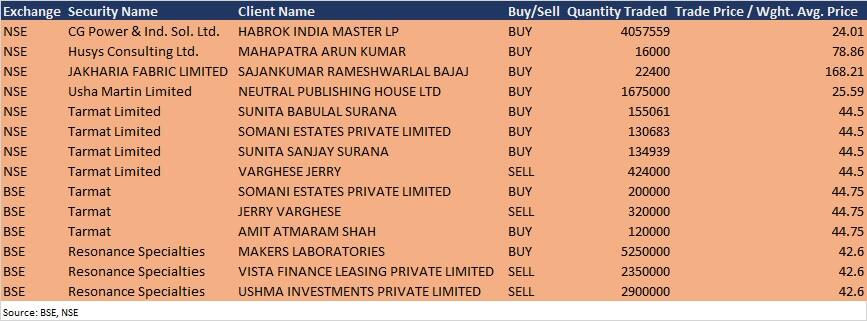

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Affle India: Company's officials will meet Flowering Tree Investment Management, Aberdeen Standard Investments and Franklin Templeton on October 1 via conference call, and HSBC Securities on October 2, and C Worldwide Asset Management on October 6.

Cyient: Company to consider September quarter results on October 15.

Ramco Systems: Company to consider September quarter results on November 3.

Dabur India: Company to consider September quarter results on November 3.

Kansai Nerolac Paints: Company to consider September quarter results on November 3.

Paisalo Digital: Company may consider and approve issuances of debt securities during October.

New India Assurance Company: 101st Annual General Meeting is scheduled to be held on October 29 via Video Conference.

Stocks in the news

Chemcon Speciality Chemicals: Company to debut on October 1 after finalising issue price at Rs 340 per share.

Computer Age Management Services: Company to list shares on October 1, issue price fixed at Rs 1,230 per share.

Sunflag Iron & Steel: CRISIL reaffirmed long term credit rating at A-/Stable and short term at A2+.

Nagarjuna Fertilizers and Chemicals: Company reported loss at Rs 85.33 crore in Q1FY21 against loss of Rs 113.2 crore YoY, revenue from operations increased to 464.5 crore from Rs 347 crore YoY.

Lupin: Company launched cancer drug Lapatinib tablets in the US.

Sobha: Company sold entire contribution of 43.13% in CVS Techzone LLP.

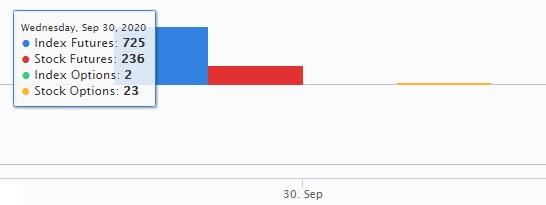

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 712.48 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 409.47 crore in the Indian equity market on September 30, as per provisional data available on the NSE.

Stock under F&O ban on NSE

One stock - Vedanta - is under the F&O ban for October 1. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!