The market failed to hold on to gains in the afternoon and corrected for the fifth consecutive session on September 23, ahead of the expiry of September derivative contracts on Thursday. Telecom, metals and select banking and financial stocks pulled the market down but buying in Reliance Industries, Axis Bank, HDFC Bank, HUL and Infosys capped losses.

The BSE Sensex was down 65.66 points at 37,668.42, while the Nifty50 slipped 21.80 points to 11,131.90 and formed a bearish candle on the daily charts.

"Nifty has broken a critical support level of 11,175. It is now expected to witness volatile moves in a small range before a positive setup matures. On the downside support is seen at 10,750-10,800 – these are long term support levels for the index," Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities told Moneycontrol.

"Value buying is suggested for long term investors while traders are expected to keep leveraged positions under check on account of the expected volatility," he said.

Ajit Mishra, VP - Research at Religare Broking expects volatility to remain high on Thursday as well, thanks to the scheduled derivatives expiry of September month contracts. "Indications are in favour of some respite but sustainability would be key."

The broader markets ended mixed with the Nifty Midcap index falling 0.33 percent and Smallcap index gaining 0.01 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,017.63, followed by 10,903.47. If the index moves up, the key resistance levels to watch out for are 11,252.73 and 11,373.67.

Nifty Bank

The Bank Nifty outperformed Nifty50, rising 39.40 points to 21,178.50 on September 23, but formed a bearish candle on the daily charts as closing was lower than opening levels. The important pivot level, which will act as crucial support for the index, is placed at 20,877.97, followed by 20,577.43. On the upside, key resistance levels are placed at 21,422.07 and 21,665.63.

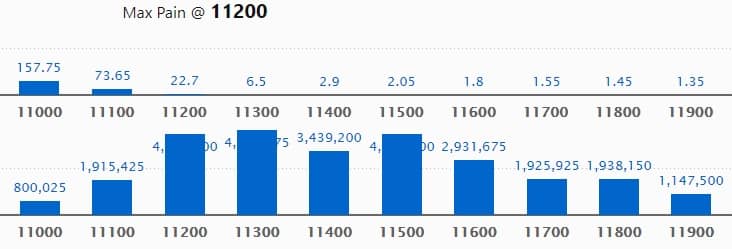

Call option data

Maximum Call open interest of 45.42 lakh contracts was seen at 11,300 strike, which will act as crucial resistance in the September series.

This is followed by 11,200 strike, which holds 43.15 lakh contracts, and 11,500 strike, which has accumulated 43.09 lakh contracts.

Call writing was seen at 11,200 strike, which added 17.19 lakh contracts, followed by 11,100, which added 11.25 lakh contracts, and 11,300 strike, which added 8.65 lakh contracts.

Call unwinding was seen at 11,600 strike, which shed 9.37 lakh contracts, followed by 11,500 strike, which shed 6.4 lakh contracts and 11,800 strike which shed 5.2 lakh contracts.

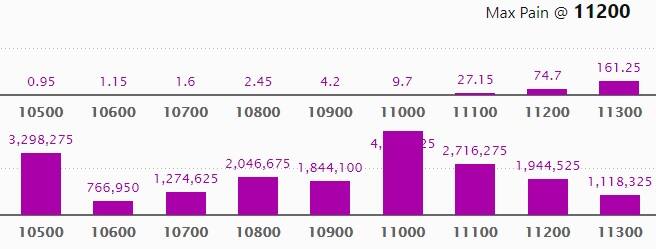

Put option data

Maximum Put open interest of 44.95 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 10,500 strike, which holds 32.98 lakh contracts, and 11,100 strike, which has accumulated 27.16 lakh contracts.

Put writing was seen at 11,000 strike, which added 7.8 lakh contracts, followed by 11,100 strike, which added 5.74 lakh contracts and 10,900 strike which added 3.63 lakh contracts.

Put unwinding was witnessed at 11,200 strike, which shed 2.97 lakh contracts, followed by 11,300 strike which shed 2.46 lakh contracts and 11,400 strike which shed 2.41 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

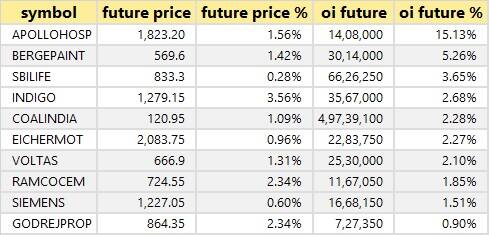

14 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

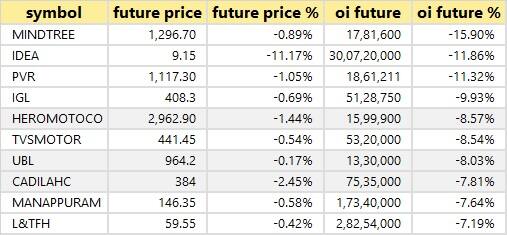

49 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

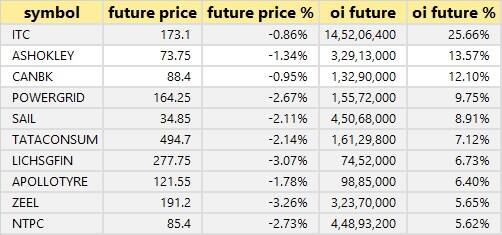

31 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

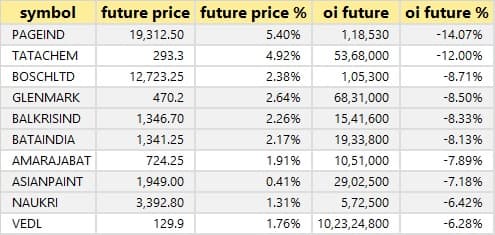

44 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

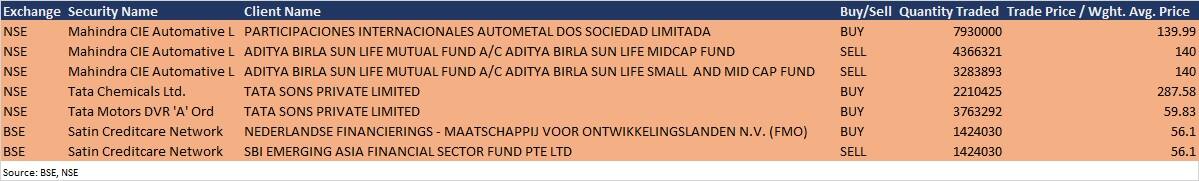

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

SH Kelkar and Company: The company's officials will meet Lucky Investment Managers (virtual meeting) on September 24.

Wonderla Holidays: George Joseph, Joint Managing Director and Satheesh Seshadri, CFO, will be participating in an Investors/ Analysts Conference call on September 25.

Blue Star: The company's representatives will interact with Nomura Securities (Virtual Meeting) on September 24.

PNC Infratech: Officials of the company will be attending the Investor Conference organised by Nomura Financial Advisory & Securities (India) on September 24.

Tube Investments of India: Officials of the company will be meeting institutional investors/analysts (virtual meeting) on September 24.

MM Forgings: Analyst / Institutional meeting by the company will be held on September 24 with Batlivala & Karani Securities India.

CESC: The company intends to attend the Motilal Oswal Ideation Conference 2020, on September 29.

Stocks in the news

Satin Creditcare Network: The board approved the elevation and appointment of Giridhari Behera, National Audit Manager as Chief Risk Officer of the company.

Shree Rama Newsprint: The company is taking necessary steps to resume operations of the paper division after Gujarat Pollution Control Board (GPCB) revoked the closure order.

Future Consumer: The company's 36.6 lakh pledged equity shares held by promoter entity Future Capital Investment invoked.

Jindal Steel & Power: ICRA removed its Rating Watch with Negative Implications on the bank facilities and NCDs, and assigned a Stable outlook.

TCS: The company and Yale University developed secure, private off-grid networking platform using blockchain.

NLC India: The company issued commercial papers to State Bank of India.

Ircon International: The company secured works of a total of 9 road overbridges (ROBs) valuing more than Rs 4OO crore from the Ministry of Railways.

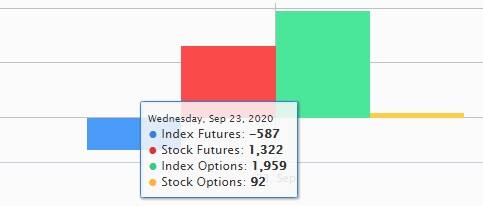

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 3,912.44 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 1,629.23 crore in the Indian equity market on September 23, as per provisional data available on the NSE.

Stock under F&O ban on NSE

One stock -- Indiabulls Housing Finance -- is under the F&O ban for September 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!