The market managed to recover some of its losses in the afternoon but failed to get back into a positive mood with the Nifty50 closing the session below the 11,300 mark. India-China border tensions, correction in Asian peers and likely delay in the COVID-19 vaccine have hit sentiment.

The BSE Sensex was down 171.43 points at 38,193.92, while the Nifty50 declined 39.40 points to 11,278 but formed a bullish candle on the daily charts as closing was higher than opening levels.

"Markets corrected in the recent past and have been consolidating in the range of 11,200-11,500. Trend support for Nifty50 is seen at 11,175 spot levels. As long as 11,175 is held, upside remains open for 11,700/11,900, but if the index breaches 11,175, then it can invite selling pressure. Momentum indicators are negatively tilted and hence recovery is also expected to be gradual," Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities told Moneycontrol.

The selling was led by banking and financials, and select FMCG and IT stocks. The broader markets underperformed frontliners, with the Nifty Midcap index falling half a percent and Smallcap down 1.5 percent.

"Markets are mirroring the global counterparts and we do not notice this scenario changing any time soon," Ajit Mishra, VP - Research at Religare Broking said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 11,209.4, followed by 11,140.8. If the index moves up, the key resistance levels to watch out for are 11,322.4 and 11,366.8.

Nifty Bank

The Bank Nifty corrected for the fifth consecutive session, down 477.40 points or 2.10 percent at 22,267. The important pivot level, which will act as crucial support for the index, is placed at 22,046.73, followed by 21,826.47. On the upside, key resistance levels are placed at 22,520.93 and 22,774.87.

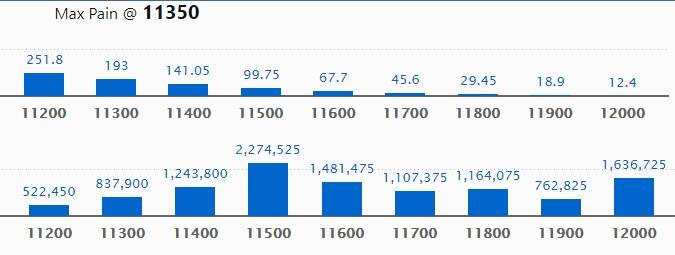

Call option data

Maximum Call open interest of 22.74 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the September series.

This is followed by 12,000 strike, which holds 16.36 lakh contracts, and 11,600 strike, which has accumulated 14.81 lakh contracts.

Call writing was seen at 11,300 strike, which added 3.06 lakh contracts, followed by 11,500, which added 2.58 lakh contracts, and 11,400 strike, which added 2.01 lakh contracts.

Call unwinding was seen at 11,800 strike, which shed 3.59 lakh contracts, followed by 11,700 strike, which shed 38,850 contracts.

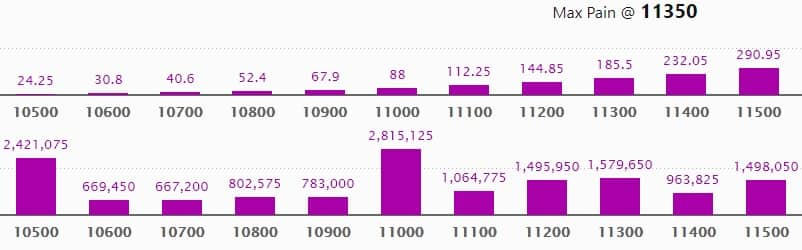

Put option data

Maximum Put open interest of 28.15 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 10,500 strike, which holds 24.21 lakh contracts, and 11,300 strike, which has accumulated 15.79 lakh contracts.

Put writing was seen at 10,500 strike, which added 1.58 lakh contracts, followed by 10,600 strike, which added 46,200 contracts.

Put unwinding was witnessed at 11,300, which shed 2.73 lakh contracts, followed by 11,000 strike which shed 1.67 lakh contracts and 10,700 strike, which shed 1.48 lakh contracts.

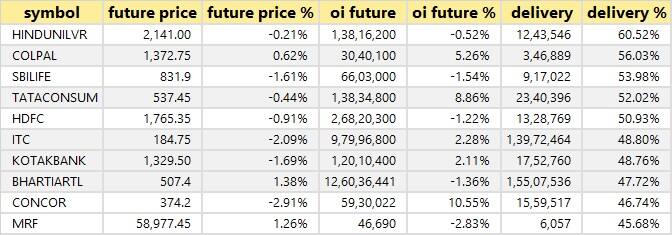

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

30 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

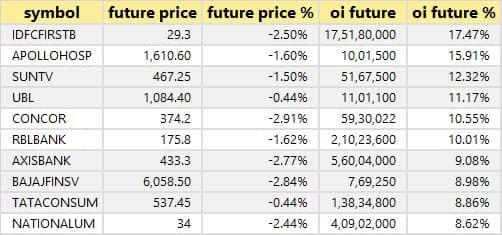

27 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

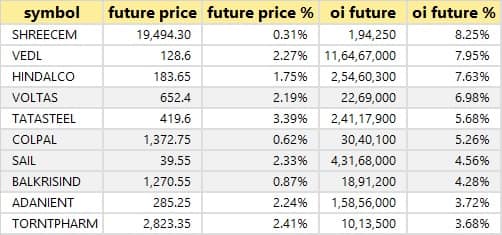

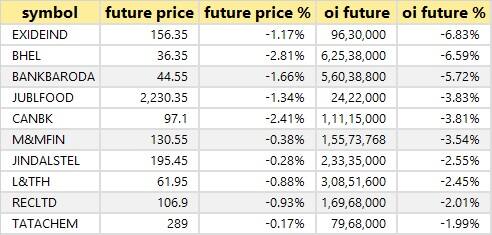

41 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

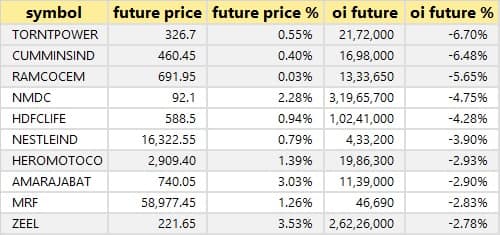

38 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Escorts India: Victory Emerging Markets Small Cap Fund acquired 8,03,003 shares in the company at Rs 1,165.44 per share on the NSE.

Reliance Industrial Infrastructure: Share India Securities bought 1,37,803 shares in the company at Rs 387.65 per share on the NSE.

Transport Corporation of India: HDFC Mutual Fund acquired 8,64,000 shares in the company at Rs 215 per share. However, Himalaya Finance and Investment Company sold 10,45,664 shares in the company at Rs 215 per share on the NSE.

Zicom Electronic Security: General Insurance Corporation of India sold 2,09,057 shares in the company at Rs 2.2 per share on the NSE.

(For more bulk deals, click here)

Earnings on September 10

Hindustan Aeronautics, Goa Carbon, Jammu & Kashmir Bank, Bafna Pharmaceuticals, Commercial Engineers & Body Builders, Datamatics Global Services, Dhunseri Tea & Industries, Hindustan Copper, Jay Bharat Maruti, Jaypee Infratech, Kellton Tech Solutions, Mirc Electronics, Nova Iron & Steel, Sintex Industries, SRG Housing Finance, Mandhana Retail Ventures, Visa Steel among 72 companies to announce quarterly earnings on September 10.

Stocks in the news

Bharat Dynamics: DIPAM Secretary said the company's offer for sale concluded and received a total subscription at around 2.34 crore shares worth Rs 770 crore.

Indiabulls Housing Finance: Company set floor price for QIP at Rs 206.7 per share and book building for QIP issue opened on September 9. The company is also looking for partial divestment in OakNorth Bank, in one or more tranches, to boost CRAR and to grow loan book.

Elgi Equipments: Pari Washington India Master Fund Ltd & Pari Washington Investment Fund acquired 4,709 shares in the company. The current stake stood at 9.5 percent.

Ashapura Minechem: Promoter entity Ashapura Industrial Finance raised stake in the company to 14.68 percent from 14.63 percent earlier.

Adani Power: Promoter entity Adani Tradeline LLP released 1 crore pledged shares.

Adani Transmission: Promoters Gautam S Adani / Rajesh S Adani (on behalf of SB Adani Family Trust) and Adani Tradeline LLP released a pledge on 4,49,56,300 equity shares and 94,60,000 shares respectively.

Syngene International: The company received ICMR approval for HiMedia-Syngene's COVID-19 antibody test kit, ELISafe 19.

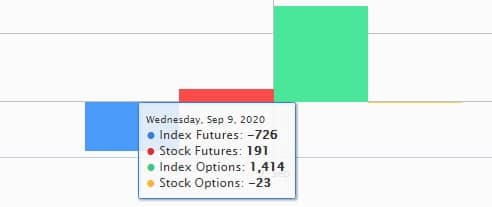

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 959.09 crore, while domestic institutional investors (DIIs) net offloaded shares worth Rs 263.97 crore in the Indian equity market on September 9, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Seven stocks -- Bank of Baroda, BHEL, Canara Bank, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power and Punjab National Bank -- are under the F&O ban for September 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!