The selling pressure started off on October 19 intensified further on October 20 with the BSE Sensex falling 456 points to 61,260 and the Nifty50 correcting 152 points to 18,266.60. Auto, FMCG, Metal, Pharma, and IT stocks pulled the market down.

The Nifty50 formed a bearish candle on the daily charts as the closing was lower than opening levels. The selling pressure was seen more in broader markets than benchmarks for the second consecutive session as the Nifty Midcap 100 and Smallcap 100 indices were down more than 2 percent each.

"A long bear candle was formed on the daily chart, which indicates a sharp reversal in the market. The recent swing high of 18,604 could now be considered as a short term top formation for the Nifty," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the short term trend of Nifty continues to be negative and there is a possibility of some more weakness in the next 1-2 sessions before showing any convincing upside bounce from the lows. "Important lower support is placed around 18,150-18,100 levels," Shetti observed.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 18,164.5, followed by 18,062.4. If the index moves up, the key resistance levels to watch out for are 18,413.5 and 18,560.4.

Nifty Bank

The Nifty Bank fell 22.30 points to close at 39,518.20 on October 20. The important pivot level, which will act as crucial support for the index, is placed at 39,282.47, followed by 39,046.73. On the upside, key resistance levels are placed at 39,764.27 and 40,010.34 levels.

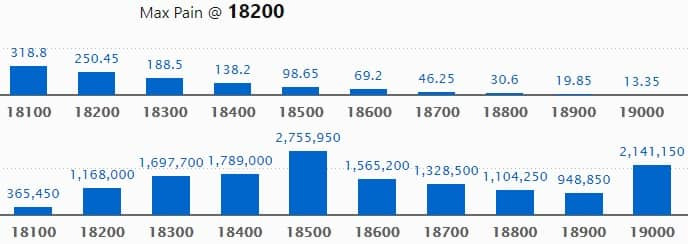

Call option data

Maximum Call open interest of 27.55 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level in the October series.

This is followed by 19000 strike, which holds 21.41 lakh contracts, and 18400 strike, which has accumulated 17.89 lakh contracts.

Call writing was seen at 18300 strike, which added 7.94 lakh contracts, followed by 18400 strike, which added 6.58 lakh contracts and 18500 strike which added 6.31 lakh contracts.

Call unwinding was seen at 17800 strike, which shed 71,800 contracts, followed by 18000 strike, which shed 69,750 contracts, and 18100 strike which shed 67,850 contracts.

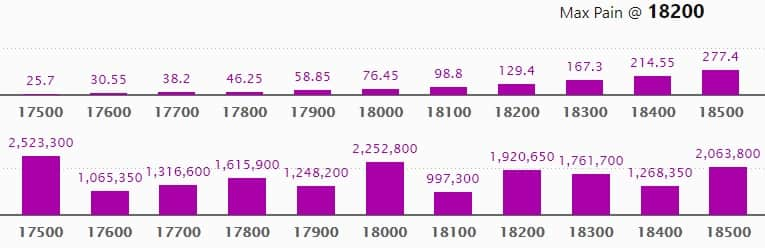

Put option data

Maximum Put open interest of 25.23 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the October Series.

This is followed by 18000 strike, which holds 22.52 lakh contracts, and 18500 strike, which has accumulated 20.63 lakh contracts.

Put writing was seen at 18200 strike, which added 1.83 lakh contracts, followed by 17500 strike which added 93,600 contracts and 17900 strike which added 38,100 contracts.

Put unwinding was seen at 18500 strike, which shed 7.65 lakh contracts, followed by 18400 strike which shed 6.14 lakh contracts, and 18300 strike which shed 4.6 lakh contracts.

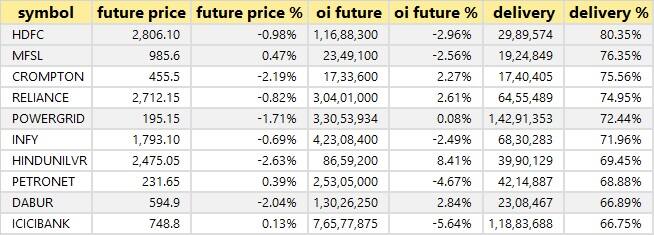

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

16 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

68 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

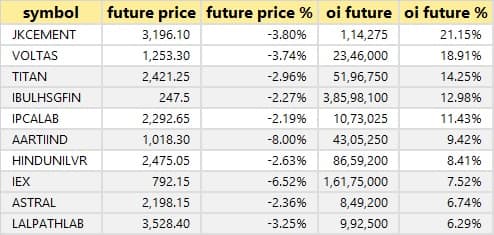

71 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

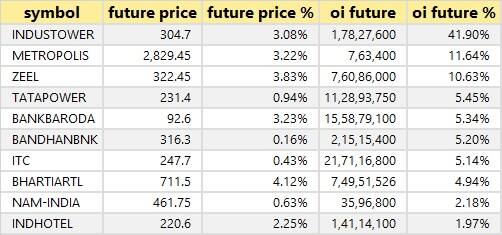

28 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

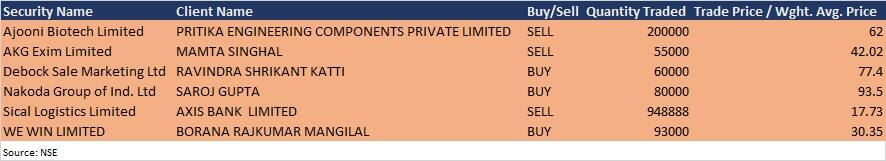

Bulk Deals

(For more bulk deals, click here)

Analysts/investors meeting and results calendar

Results on October 21: Asian Paints, JSW Steel, Biocon, 63 Moons Technologies, Agro Tech Foods, Borosil Renewables, Can Fin Homes, CG Power and Industrial Solutions, Container Corporation of India, ICICI Lombard General Insurance Company, IDBI Bank, Indian Energy Exchange, IIFL Securities, Indian Hotels, IndiaMART InterMESH, Duncan Engineering, Gateway Distriparks, Heritage Foods, Jubilant Industries, Lemon Tree Hotels, LIC Housing Finance, Bank of Maharashtra, Mphasis, Music Broadcast, Rane Engine Valve, Sasken Technologies, South Indian Bank, Sterlite Technologies, Tanla Platforms, Trident, TVS Motor Company, and VST Industries will release September quarter earnings on October 21.

Brigade Enterprises: The company's officials will meet Ambit Capital on October 21 and Daga's family office on October 22.

TCI Express: The company's officials will meet analysts and investors on October 22, to discuss financial results.

CSB Bank: The company's officials will meet institutional investors and analysts on October 25, to discuss financial results.

Orient Electric: The company's officials will meet analysts and investors on October 25, to discuss financial results.

Arvind: The company's officials will meet analysts and investors on October 27, to discuss financial performance.

KEI Industries: The company's officials will meet analysts and institutional investors on October 28.

KEC International: The company's officials will meet analysts and investors on October 28, to discuss financial results.

Escorts: The company's officials will meet analysts and investors on October 29, to discuss earnings performance.

Transport Corporation of India: The company's officials will meet analysts and investors on October 29, to discuss financial results.

RPG Life Sciences: The company's officials will meet analysts and investors on November 1 post-financial results.

Stocks in News

Angel One: The company reported higher consolidated profit at Rs 134.2 crore in Q2FY22 against Rs 74.5 crore in Q2FY21, revenue jumped to Rs 527.34 crore from Rs 309.85 crore YoY.

Varroc Engineering: HDFC Asset Management Company acquired 0.58 percent stake in the company via open market transactions on October 19, increasing shareholding to 5.11 percent from 4.53 percent earlier.

INEOS Styrolution India: Nippon Life India Trustee sold 50,000 equity shares in the company via open market transactions on October 18, reducing shareholding to 2.97 percent from 3.26 percent earlier.

L&T Finance Holdings: The company reported lower consolidated profit at Rs 224.03 crore in Q2FY22 against Rs 265.12 crore in Q2FY21, revenue fell to Rs 3,051.82 crore from Rs 3,408.10 crore YoY.

Tata Communications: The company reported higher consolidated profit at Rs 425.38 crore in Q2FY22 against Rs 384.48 crore in Q2FY21, revenue fell to Rs 4,174 crore from Rs 4,401 crore YoY.

Prince Pipes and Fittings: South Asia Growth Fund II Holdings LLC sold 22.12 lakh equity shares in the company via open market transactions, reducing shareholding to 3.65 percent from 5.66 percent earlier.

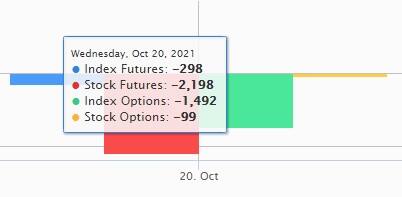

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,843.09 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,680.73 crore in the Indian equity market on October 20, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Ten stocks - Amara Raja Batteries, Escorts, Vodafone Idea, IRCTC, L&T Finance Holdings, NALCO, Punjab National Bank, SAIL, Sun TV Network and Tata Power - are under the F&O ban for October 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!