The market snapped a three-day winning streak and fell sharply amid selling pressure across sectors on November 25, especially after hitting a fresh record high intraday, ahead of the expiry of November futures and options contracts on November 26.

The BSE Sensex plunged 694.92 points or 1.56 percent to 43,828.10, while the Nifty50 declined 196.80 points or 1.51 percent to 12,858.40 and formed a Long Black Day or Bearish Engulfing kind of pattern on the daily charts.

"A long negative candle was formed from the new highs and that has engulfed the high low range of previous two sessions. This pattern could be considered as a Bearish Engulfing pattern. Hence, this market action could indicate a reversal type formation at the highs and this needs to be confirmed with more weakness," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"A sharp follow-through weakness is going to be crucial to confirm short term top formation in the market. The Nifty sustaining at the immediate support at 12,800 levels in the next 1-2 sessions could open chances of upside bounce in the market and also more upside in the near term," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,746.13, followed by 12,633.87. If the index moves up, the key resistance levels to watch out for are 13,058.23 and 13,258.07.

Nifty Bank

The Bank Nifty fell sharply by 540.90 points or 1.82 percent to 29,196.40 on November 25. The important pivot level, which will act as crucial support for the index, is placed at 28,819.87, followed by 28,443.33. On the upside, key resistance levels are placed at 29,885.37 and 30,574.33.

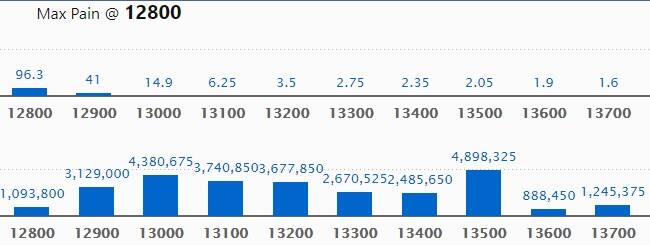

Call option data

Maximum Call open interest of 48.98 lakh contracts was seen at 13,500 strike, which will act as crucial resistance level in the November series.

This is followed by 13,000 strike, which holds 43.80 lakh contracts, and 13,100 strike, which has accumulated 37.40 lakh contracts.

Call writing was seen at 13,100 strike, which added 18.02 lakh contracts, followed by 12,900 strike which added 17.19 lakh contracts and 13,000 strike which added 16.41 lakh contracts.

Call unwinding was seen at 12,700 strike, which shed 1.9 lakh contracts, followed by 13,700 strike which shed 1.41 lakh contracts and 12,500 strike which shed 79,575 contracts.

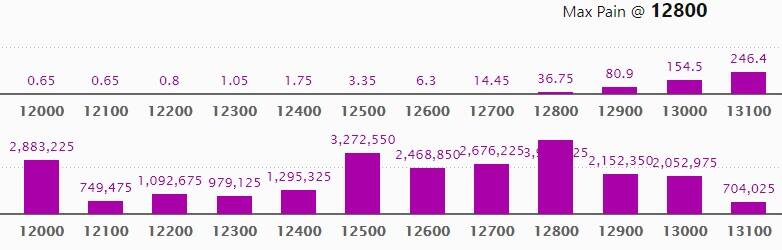

Put option data

Maximum Put open interest of 39.41 lakh contracts was seen at 12,800 strike, which will act as crucial support in the November series.

This is followed by 12,500 strike, which holds 32.72 lakh contracts, and 12,000 strike, which has accumulated 28.83 lakh contracts.

Put writing was seen at 13,100 strike, which added 65,925 contracts, followed by 12,500 strike, which added 60,075 contracts.

Put unwinding was seen at 13,000 strike, which shed 16.58 lakh contracts, followed by 12,900 strike, which shed 12.46 lakh contracts and 12,400 strike, which shed 9.08 lakh contracts.

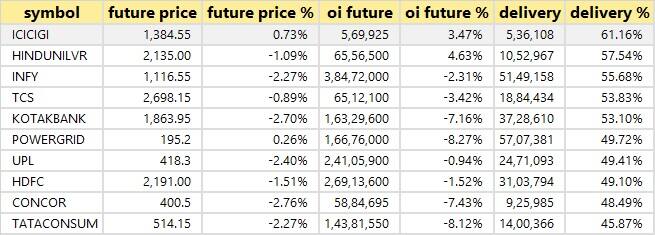

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

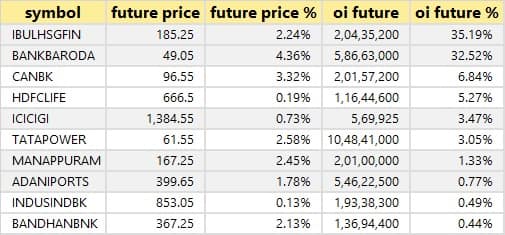

10 stocks saw long build-up

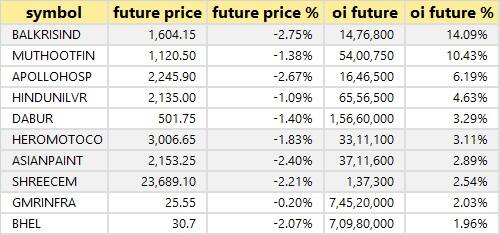

Based on the open interest future percentage, here are the 10 stocks in which long build-up was seen.

91 stocks saw long unwinding

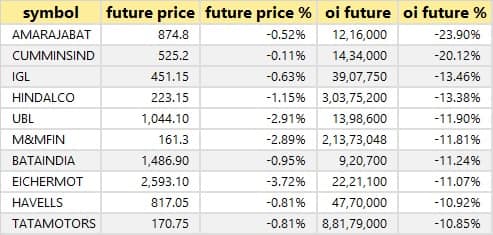

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

20 stocks saw short build-up

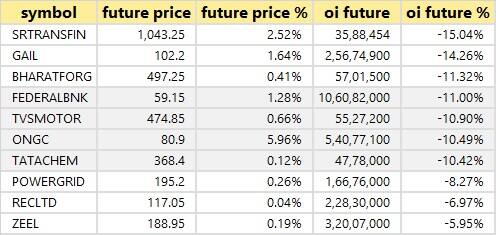

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

18 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

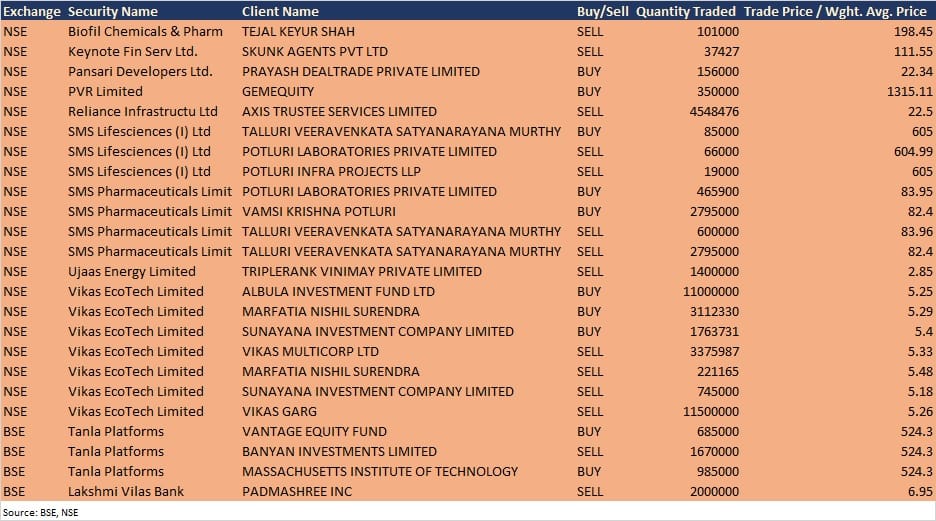

Bulk deals

(For more bulk deals, click here)

Analysts Meets/Board Meetings

Matrimony.com: The company will be meeting investors/analysts on November 26.

Can Fin Homes: Girish Kousgi, Managing Director & CEO and Shreekant M Bhandiwad, Deputy Managing Director will meet B&K Securities on November 27.

Stocks in the news

Lakshmi Vilas Bank: The bank will be merged with DBS Bank India with effect from November 27, and its shares will be written off and de-listed from same date. Hence, its moratorium will now be lifted on November 27 against December 16 earlier.

Future Consumer: Rajnikant Sabnavis resigned as CEO.

Siemens: The company reported profit at Rs 330.2 crore in Q4FY20 compared to Rs 333.9 crore, revenue fell to Rs 3,546.8 crore from Rs 3,894.4 crore YoY. The company recommended a dividend of Rs 7 per share of Rs 2 each for the financial year ended September 2020.

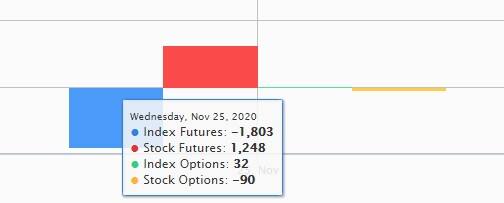

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 24.2 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,840.33 crore in the Indian equity market on November 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Canara Bank, Indiabulls Housing Finance, NALCO, SAIL and Tata Motors- are under the F&O ban for November 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!