The first day of January series started off on a robust note as the Nifty50 registered a triple-digit gains on broad-based buying and positive global cues on December 31.

The BSE Sensex surged 459.50 points to 58,253.82, while the Nifty50 jumped 150 points to 17,354, the highest closing level since December 13, and formed a bullish candle on the daily charts.

"The Nifty50 appears to have registered a decisive breakout from its 32-day-old descending channel with a close above its 50-day exponential moving average. Hence, if it sustains above 17,238 levels, it can head to much higher levels though initial targets remain close to 17,500 where bulls can face stiff resistance and once this hurdle is conquered on a closing basis, a higher target of 17,640 can't be ruled out," says Mazhar Mohammad, Chief Strategist – Technical Research and Trading Advisory, at Chartviewindia.

In between, he feels if the Nifty slips below 17,230 on a closing basis, then the current positive outlook shall fade away by dragging indices into a neutral territory. Therefore, Mazhar Mohammad advised positional traders, who are long, to hold their horses with a stop-loss below 17,230 and even fresh buying can be considered on mild dip close to 17,300.

The broader markets also participated in the rally as the Nifty Midcap 100 and Smallcap 100 indices gained 1.4 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,261.46, followed by 17,168.83. If the index moves up, the key resistance levels to watch out for are 17,423.77 and 17,493.43.

Nifty Bank

The Nifty Bank rallied 418.10 points or 1.19 percent to close at 35,481.70 on December 31. The important pivot level, which will act as a crucial support for the index, is placed at 35,198.04, followed by 34,914.37. On the upside, key resistance levels are placed at 35,681.14 and 35,880.57.

Call Option Data

Maximum Call open interest of 19.87 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 17,500 strike, which holds 19.03 lakh contracts, and 18,500 strike, which has accumulated 10.25 lakh contracts.

Call writing was seen at 17,400 strike, which added 2.75 lakh contracts, followed by 18,200 strike which added 2.55 lakh contracts, and 18,000 strike which added 2.53 lakh contracts.

Call unwinding was seen at 17,200 strike, which shed 1.4 lakh contracts, followed by 17,000 strike which shed 53,100 contracts and 16,900 strike which shed 25,300 contracts.

Put Option Data

Maximum Put open interest of 31.96 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the January series.

This is followed by 16,500 strike, which holds 29.70 lakh contracts, and 17,500 strike, which has accumulated 20.22 lakh contracts.

Put writing was seen at 17,600 strike, which added 3.58 lakh contracts, followed by 16,500 strike, which added 2.98 lakh contracts, and 17,300 strike which added 2.96 lakh contracts.

There was hardly any Put unwinding seen on first day of January series.

Stocks with High Delivery Percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

111 Stocks with Long Build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

4 Stocks with Long Unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the four stocks in which long unwinding was seen.

11 Stocks with Short Build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

64 Stocks with Short-Covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

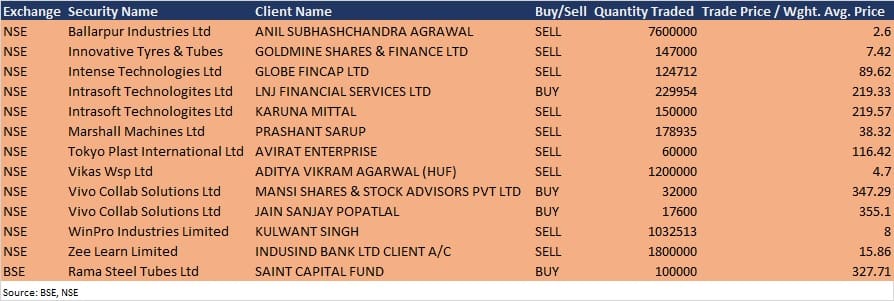

Bulk Deals

Rama Steel Tubes: Foreign investor Saint Capital Fund acquired 1 lakh equity shares in the company at Rs 327.71 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Balrampur Chini Mills: The company's officials will interact with PGIM Mutual Fund on January 3.

TCS: The company's officials will meet investors and analysts on January 12, to discuss quarterly earnings.

Stocks in News

Eicher Motors: Motorcycles sales increased 7 percent to 73,739 units in December 2021, from 68,995 units in December 2020. Commercial vehicle sales increased to 6,154 units during December 2021, up from 4,892 units sold in December 2020.

JTL Infra: The company registered highest sales volume ever of 34,612 metric tonnes in Q3 FY22, increased by 77.39 percent YoY.

Mahindra & Mahindra: Mahindra Auto sold 39,157 vehicles in December 2021, registering a double-digit growth of 11 percent YoY. Tractor sales fell to 16,687 units during December 2021, down from 21,173 units during December 2020.

Maruti Suzuki India: The company posted total sales of 1,53,149 units in December 2021, against 1,60,226 units sold in December 2020.

Likhitha Infrastructure: The company has received orders worth Rs 250 crore, from various city gas distribution companies during the quarter October-December 2021.

Tata Motors: The company sold 1,99,633 vehicles in the domestic and international markets, for Q3 FY22, higher compared to 1,58,218 units during Q3 FY21.

Escorts: The company sold 4,695 tractors in December 2021, down 39.3 percent, compared to 7,733 tractors sold during December 2020.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 575.39 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,165.62 crore in the Indian equity market on December 31, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are in the beginning of January series, there is not a single stock under the F&O ban for January 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!