The market extended losses for a sixth consecutive session with the benchmark indices hitting a new 52-week low on June 17, dragged by auto, FMCG, IT, pharma and oil & gas stocks.

The BSE Sensex fell 135 points to 51,360, while the Nifty50 declined 67 points to 15,293 to form a Doji pattern on the daily charts. During the week, the index corrected 5.6 percent and formed a Bearish Belt Hold pattern on the weekly scale.

"The Nifty50 seems to have marginally breached possible three-month-old channel support. Hence, going forward unless it recovers and sustains above 15,360 levels the trajectory of this market shall remain sideways with a negative bias," Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia said.

If the index slips below 15,183 in the next session, weakness can extend to 14,900. But, as the Nifty has fallen around 1,500 points, from the highs of 16,793, in the last 10 days, most momentum oscillators have not only reached oversold levels but some are displaying positive divergence on the lower time-frames, the market expert said.

Hence, according to him, the next session can belong to bulls but short-term traders should wait for more stability before initiating a trade.

The broader markets underperformed frontline indices, with the Nifty midcap 100 and smallcap 100 indices declining 1.16 percent and 0.8 percent respectively. More than two shares declined for every share rising on the NSE.

The volatility dipped a bit but was still above 20 levels, suggesting volatile swings ahead. India VIX, an indicator of expected volatility, the fear index fell 0.48 percent to 22.76 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support, resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is at 15,184 followed by 15,075. If the index moves up, the key resistance levels will be 15,401 and 15,509.

The Nifty Bank outperformed the broader space on June 17, rising 126 points to close at 32,743. The important pivot level, which will act as crucial support, is placed at 32,392 followed by 32,042. On the upside, key resistances are at 32,992 and 33,240.

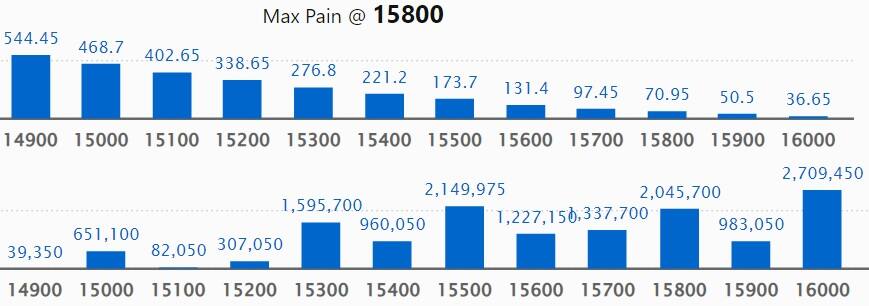

Maximum Call open interest of 27.09 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This was followed by 17,000 strike, which holds 24.53 lakh contracts, and 16,500 strike, which also accumulated 23.11 lakh contracts.

Call writing was seen at 15,300 strike, which added 13.49 lakh contracts followed by 15,800 strike, which added 5.4 lakh contracts, and 15,400 strike that added 4.19 lakh contracts.

Call unwinding was seen at 16,600 strike, which shed 65,550 contracts followed by 16,900 strike that shed 47,400 contracts and 15,900 strike, which shed 41,750 contracts.

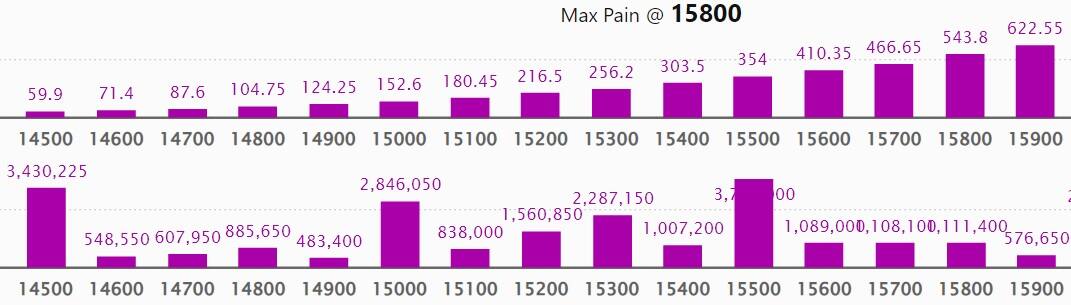

Maximum Put open interest of 37.76 lakh contracts was seen at 15,500 strike. This was followed by 14,500 strike, which holds 34.3 lakh contracts, and 15,000 strike, which accumulated 28.46 lakh contracts.

Put writing was seen at 15,300 strike, which added 12.18 lakh contracts, followed by 14,000 strike, which added 3.22 lakh contracts and 15,100 strike, which added 2.79 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 4.98 lakh contracts, followed by 15,000 strike, which shed 4.68 lakh contracts, and 15,600 strike, which shed 3.82 lakh contracts.

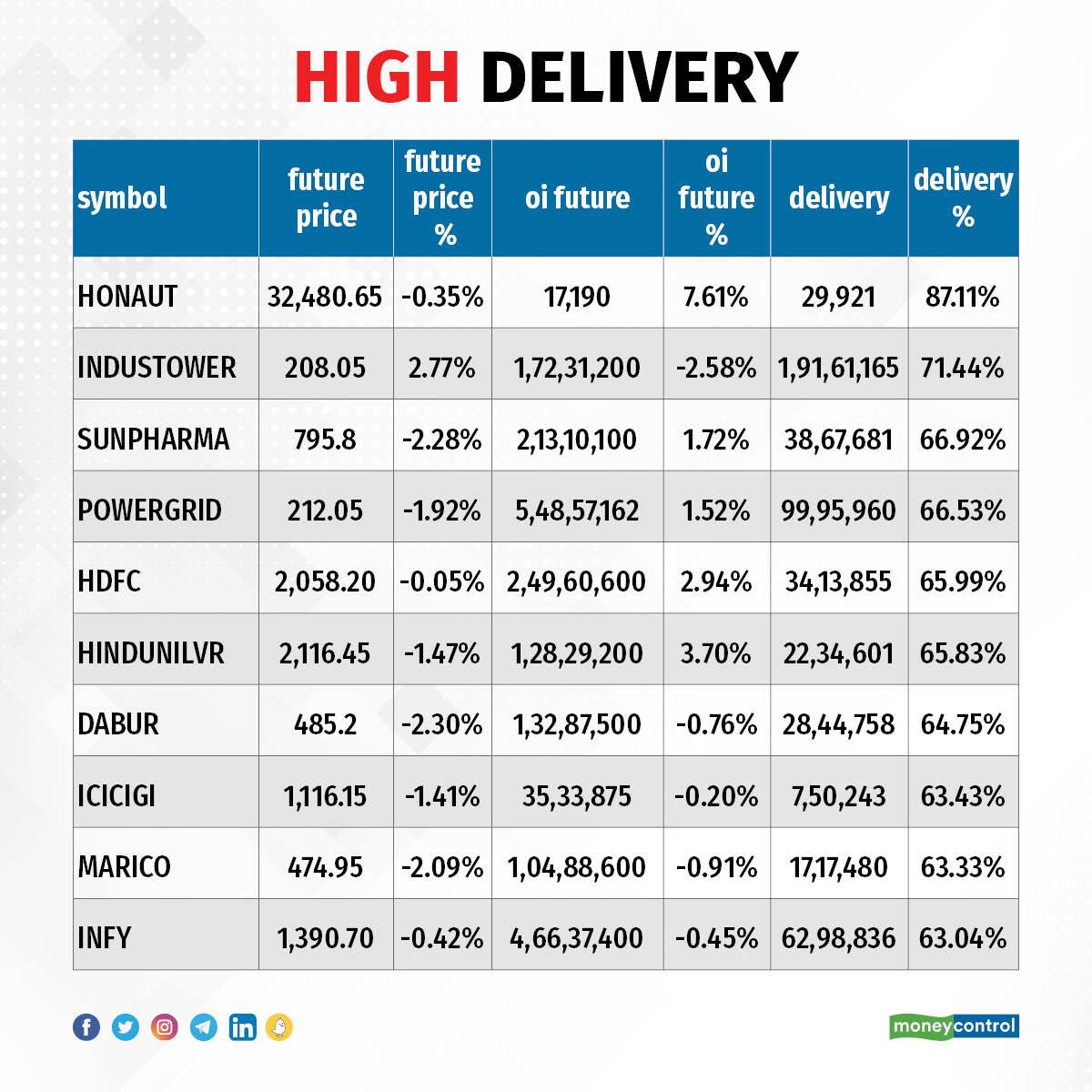

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Honeywell Automation, Indus Towers, Sun Pharma, Power Grid Corporation and HDFC among others.

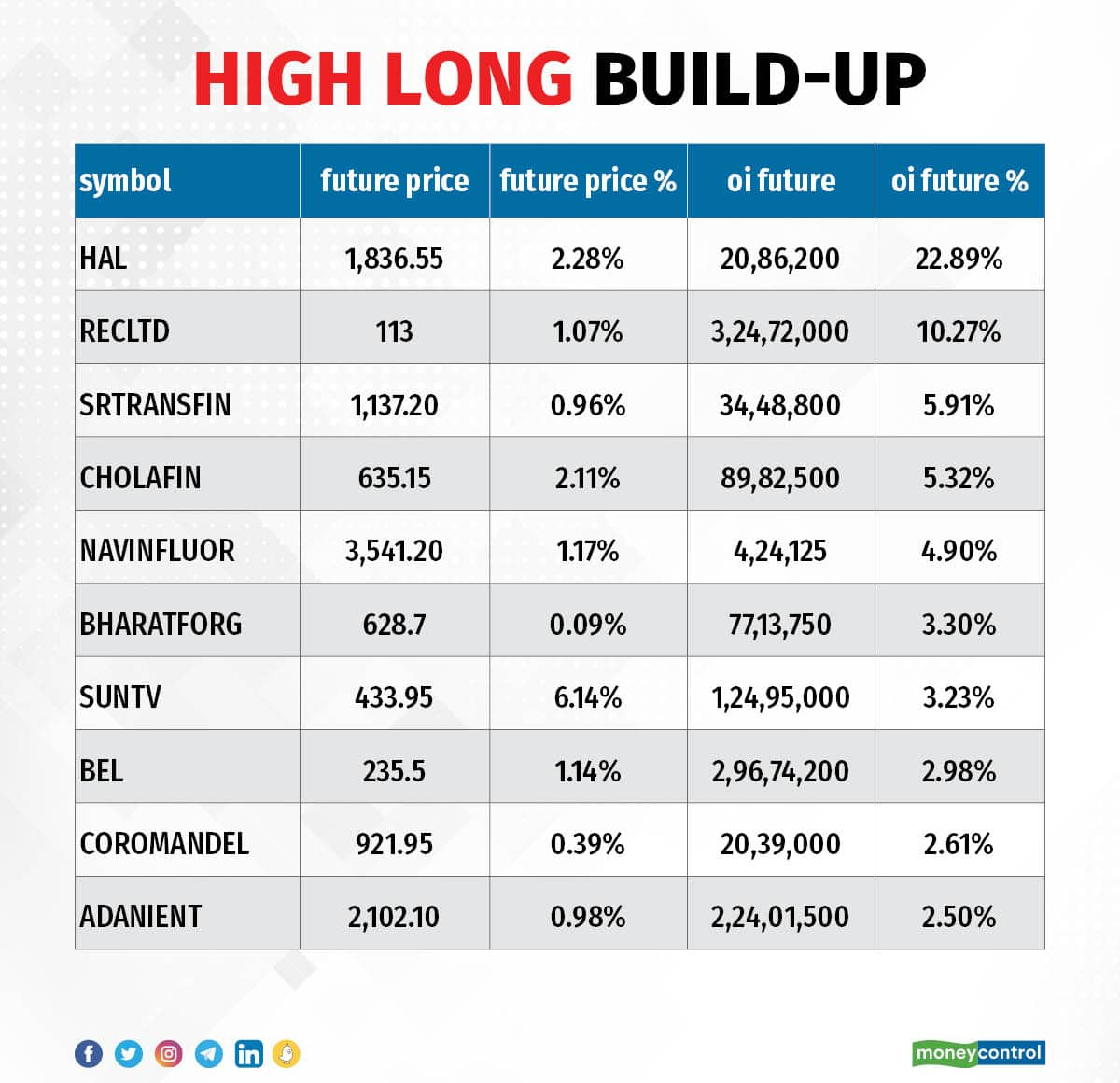

An increase in open interest, along with an increase in price, typically indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

A decline in open interest, along with a decrease in price, broadly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

An increase in open interest, along with a decrease in price, broadly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

A decrease in open interest, along with an increase in price, indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

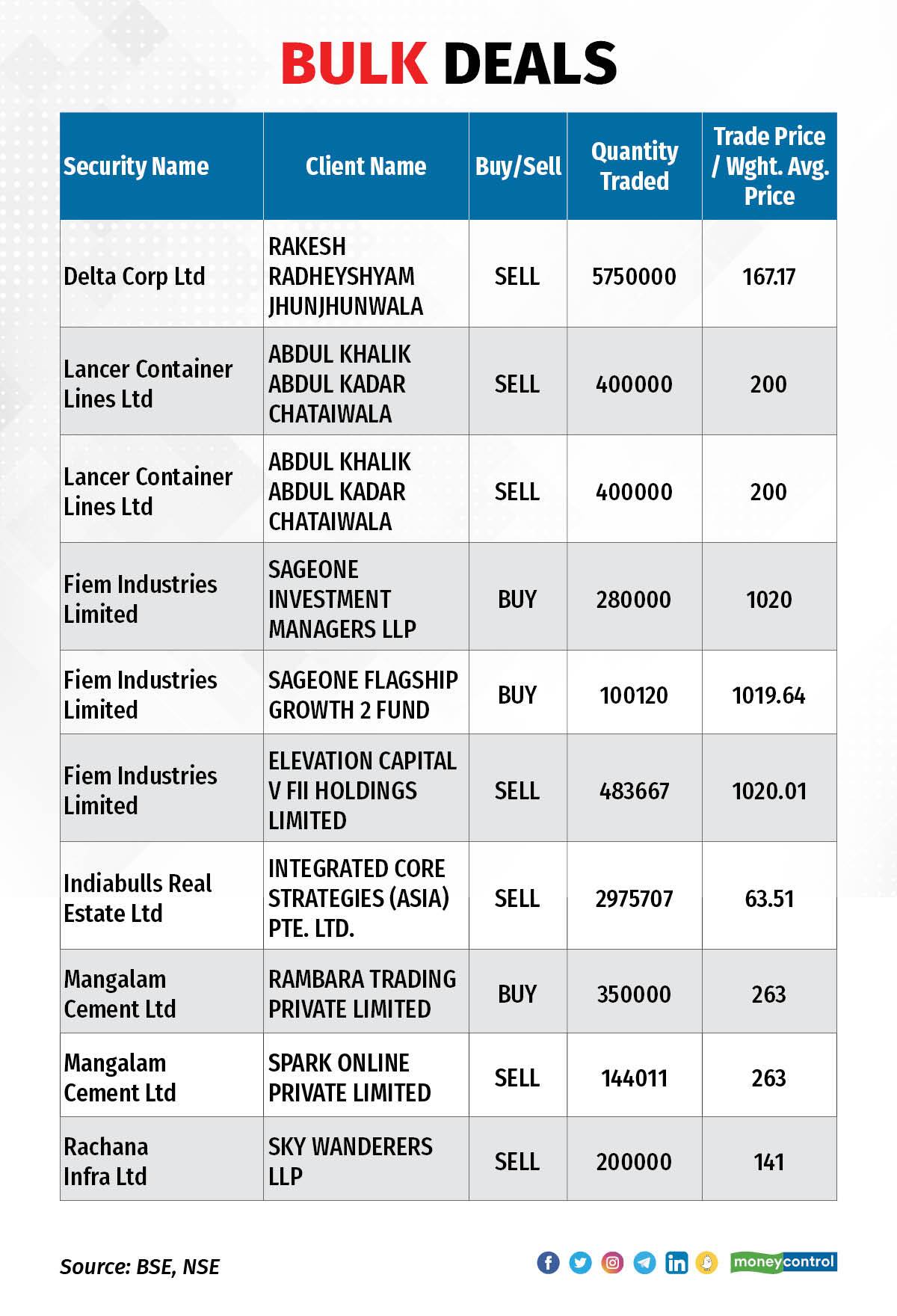

Delta Corp: Ace investor Rakesh Radheyshyam Jhunjhunwala sold 57.5 lakh shares in the company at an average price of Rs 167.17 a share through open market transactions.

Lancer Container Lines: Promoter Abdul Khalik Abdul Kadar Chataiwala sold 8 lakh shares in the company at an average price of Rs 200 a share via open market transactions.

Fiem Industries: Sageone Investment Managers LLP bought 2.8 lakh shares in the company at an average price of Rs 1,020 per share, and Sageone Flagship Growth 2 Fund acquired 1,00,120 shares at an average price of Rs 1,019.64 a share. Elevation Capital V FII Holdings, however, offloaded 4,83,667 shares at an average price of Rs 1,020.01 a share.

Indiabulls Real Estate: Integrated Core Strategies (Asia) Pte Ltd sold 29,75,707 shares in the company at an average price of Rs 63.51 a share through open market transactions.

(For more bulk deals, click here)

Investor meetings on June 20

Larsen & Toubro, Aurobindo Pharma: Officials of the companies will attend BNP Paribas India Virtual Investors Days.

Timken India: Officials of the company will meet Nippon India.

Krsnaa Diagnostics: Officials of the company will meet KR Choksey and Safe Enterprise.

Meghmani Finechem: Officials of the company will meet Dimensional Fund Advisors.

PI Industries: Officials of the company will meet Emkay Global Financial Services.

Tata Chemicals: Officials of the company will meet Franklin Templeton Investments.

Radico Khaitan: Officials of the company will meet Kotak Mahindra MF.

Axis Bank: Officials of the company will attend HSBC's 6th Annual Asia Credit Conference.

Tata Motors: Officials of the company will meet Canada Pension Plan Investment Board.

Gland Pharma: Officials of the company will meet Kotak Life Insurance.

Stocks in News

Alkem Laboratories: The company received Form 483 with three observations after inspection of its US unit. The US Food and Drug Administration (FDA) inspected of the company's manufacturing facility at St Louis from June 6 to June 17, 2022.

Vadilal Industries: The company, through its subsidiary Vadilal Industries USA Inc, has acquired KKC. The subsidiary signed a stock purchase agreement with ice-cream parlour operator Krishna Krupa Corporation, USA (KKC) for a subscription of shares, which would result in the subsidiary holding up to 100 percent voting rights in KKC. The cost of acquisition is $0.25 million.

Aurobindo Pharma: Aurobindo acquired a 51 percent stake in GLS Pharma, which operates in the oncology business and has a manufacturing facility in Hyderabad. The acquisition cost for a 51 percent stake is Rs 28.05 crore.

Dilip Buildcon: Dilip Buildcon's joint venture company RBL-DBL has been declared as the L-1 bidder for the Surat Metro Rail Project in Gujarat. The order is worth Rs 1,061 crore. The company also received the completion certificate for two road projects in Karnataka.

Nazara Technologies: The company has decided to make a further strategic investment of up to Rs 20.1 crore in material subsidiary Absolute Sports by acquiring shares of promoter Porush Jain and up to Rs 10 crore in Brandscale Innovations by subscribing to optionally convertible debentures in one or more tranches.

Galaxy Surfactants: The SBI Mutual Fund sold 1 lakh equity shares in the company via open market transactions on June 16. With this, its shareholding in the company has been reduced to 2.98 percent from 3.27 percent.

Indian Hume Pipe Company: The company secured a work order of Rs 110 crore from the Public Health Engineering Department (PHED), Rajasthan. The order is for a cluster water supply project Package-VII of Chambal Bhilwara Water Supply Project Phase II of Jahajpur-Kotri Tehsils of district Bhilwara under Jal Jeevan Mission (JJM) with operation and maintenance for 10 years. The project is to be completed within 15 months.

Engineers India: The company has won three separate projects from specialised chemicals, sunrise and infrastructure sectors. It will provide consulting services and the estimated order value of these projects is approximately Rs 80 crore.

Fund Flow

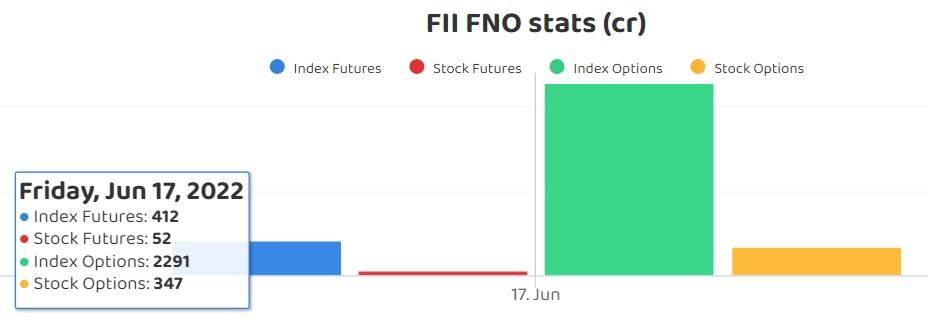

Foreign institutional investors (FIIs) net sold Rs 7,818.61 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers to the tune of Rs 6,086.92 crore worth of shares on June 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks—Indiabulls Housing Finance, RBL Bank, and Delta Corp— remain under the NSE F&O ban for June 20 as well. Securities in the ban period include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!