After a day's break, the bears were back in control of the Dalal Street and pulled down the benchmark indices nearly 2 percent as inflation concerns and growth worries came roiled the sentiment on June 10.

The Sensex plunged 1,017 points, or 1.8 percent, to 54,303, while the Nifty corrected 276 points, or 1.7, percent to 16,202 and formed a bearish candle on the daily as well as weekly charts.

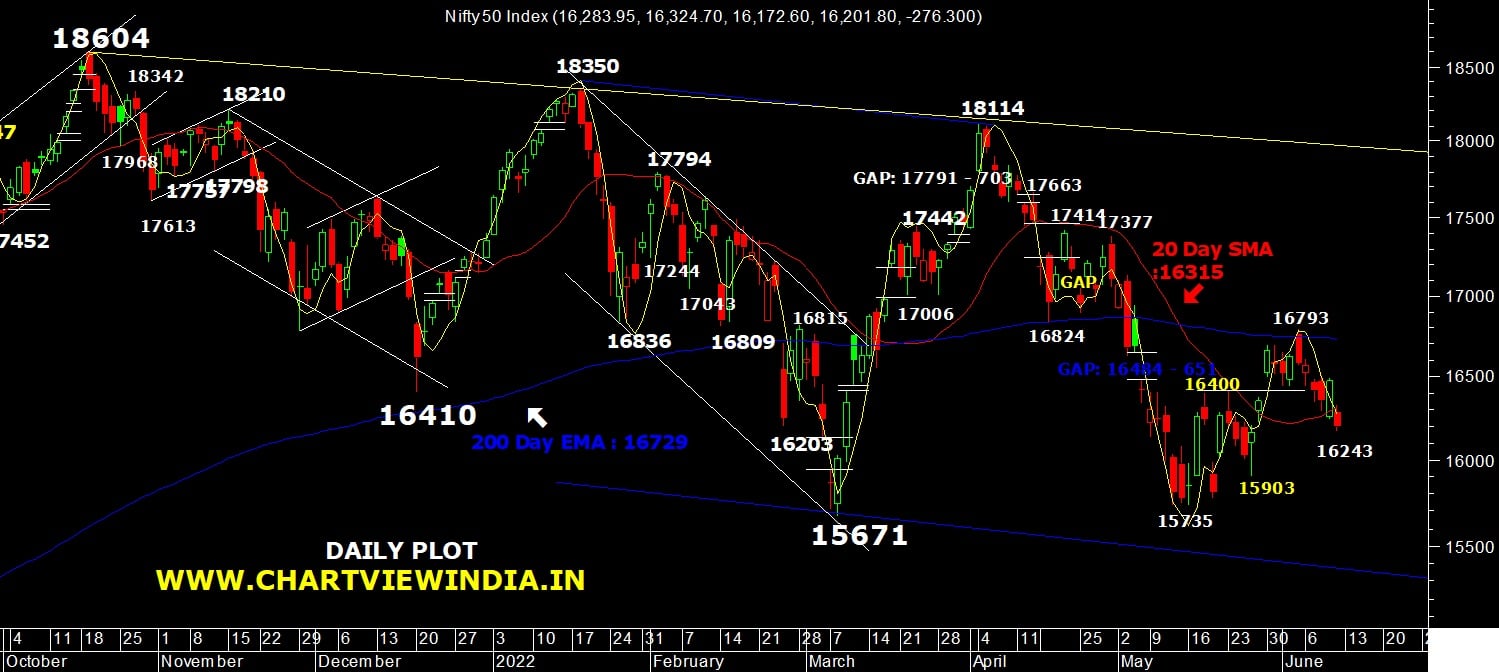

For the week, the index fell 2.3 percent. "The force with which Nifty has fallen on the last day of the week seems to have dissipated the hopes of a pullback attempt. Moreover, a decent bearish candle, as a follow-through to the preceding week’s Shooting Star kind of formation is acting as some sort of confirmation for the resumption of the down move," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

A breach of the 20-day simple moving average (SMA), placed at 16,315, strengthens the bearish sentiment. Hence, the Nifty may initially slide down to the recent lows of 15,900 to 15,735, he said.

For the time, the upside shall remain capped at 16,324, whereas a close above the level may signal sideways consolidation, the market expert said.

It would be prudent to remain neutral on the index for the time, Mohammad said.

The broader markets also saw a correction. The Nifty midcap 100 index declined 0.83 percent and the smallcap 100 index fell 1.1 percent.

The India VIX, which measures the expected volatility in the market, went up by 2.27 percent to 19.58 levels, favouring the bears.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given are the aggregate of three-month data and not of the current month alone.Key support, resistance levels for Nifty

As per the pivot charts, the key support level for the Nifty is 16,141, followed by 16,081. If the index moves up, the key resistance levels to watch out for are 16,293 and 16,385.

The Nifty Bank closed at 34,484, down 602 points, or 1.7 percent, on June 10. The important pivot level, which will act as crucial support for the index, is placed at 34,303, followed by 34,122. On the upside, key resistance levels are placed at 34,709 and 34,933 levels.

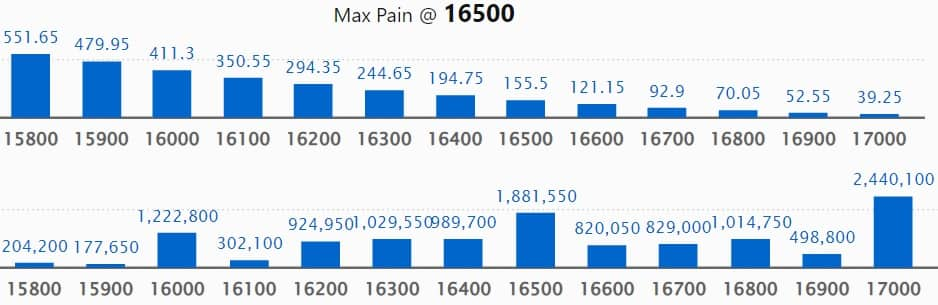

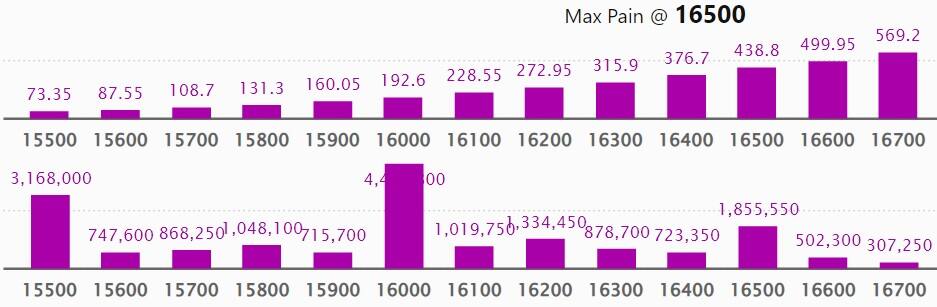

Maximum Call open interest of 24.4 lakh contracts is seen at 17,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 17,500 strike, which holds 18.81 lakh contracts, and 16,500 strike that has also accumulated 18.81 lakh contracts.

Call writing is seen at 16,200 strike, which added 4.23 lakh contracts, followed by 16,300 strike that added 3.21 lakh contracts and 16,800 strike, which added 1.88 lakh contracts.

Call unwinding is seen at 17,300 strike, which shed 1.55 lakh contracts, followed by 17,600 strike that shed 79,650 contracts and 16,900 strike, which shed 56,400 contracts.

Maximum Put open interest of 44.86 lakh contracts seen at 16,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 31.68 lakh contracts, and 15,000 strike, which has accumulated 26.2 lakh contracts.

Put writing seen at 16,200 strike, which added 3.53 lakh contracts followed by 14,900 strike that added 2.53 lakh contracts and 15,000 strike, which added 2.49 lakh contracts.

Put unwinding seen at 16,500 strike, which shed 2.26 lakh contracts, followed by 16,400 strike, which shed 1.82 lakh contracts, and 16,600 strike that shed 85,800 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests investors showing interest in those stocks. The highest delivery was seen in Alkem Laboratories, Balkrishna Industries, Muthoot Finance, ICICI Lombard General Insurance, and Britannia Industries, among others.

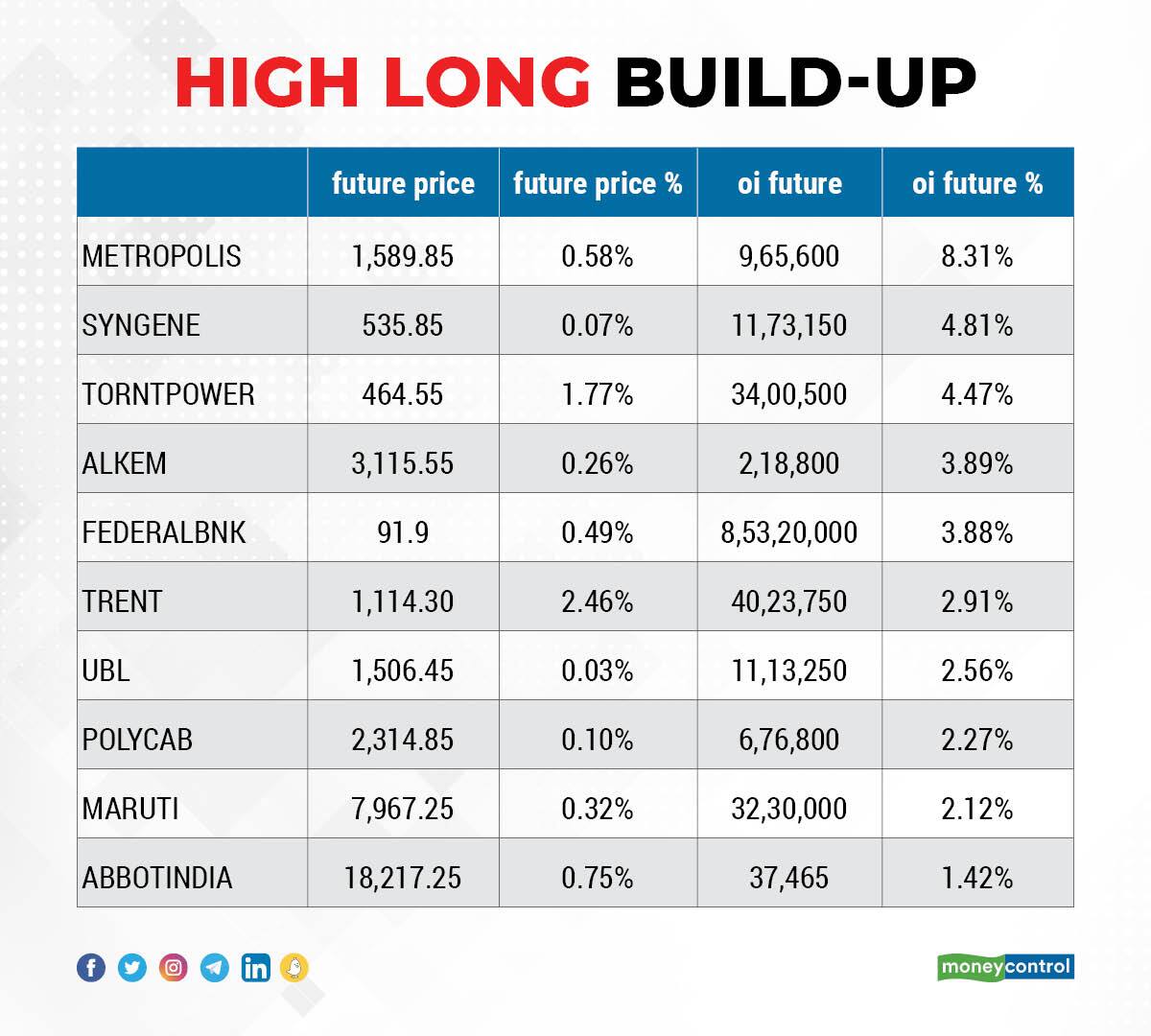

An increase in open interest along with an increase in price mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

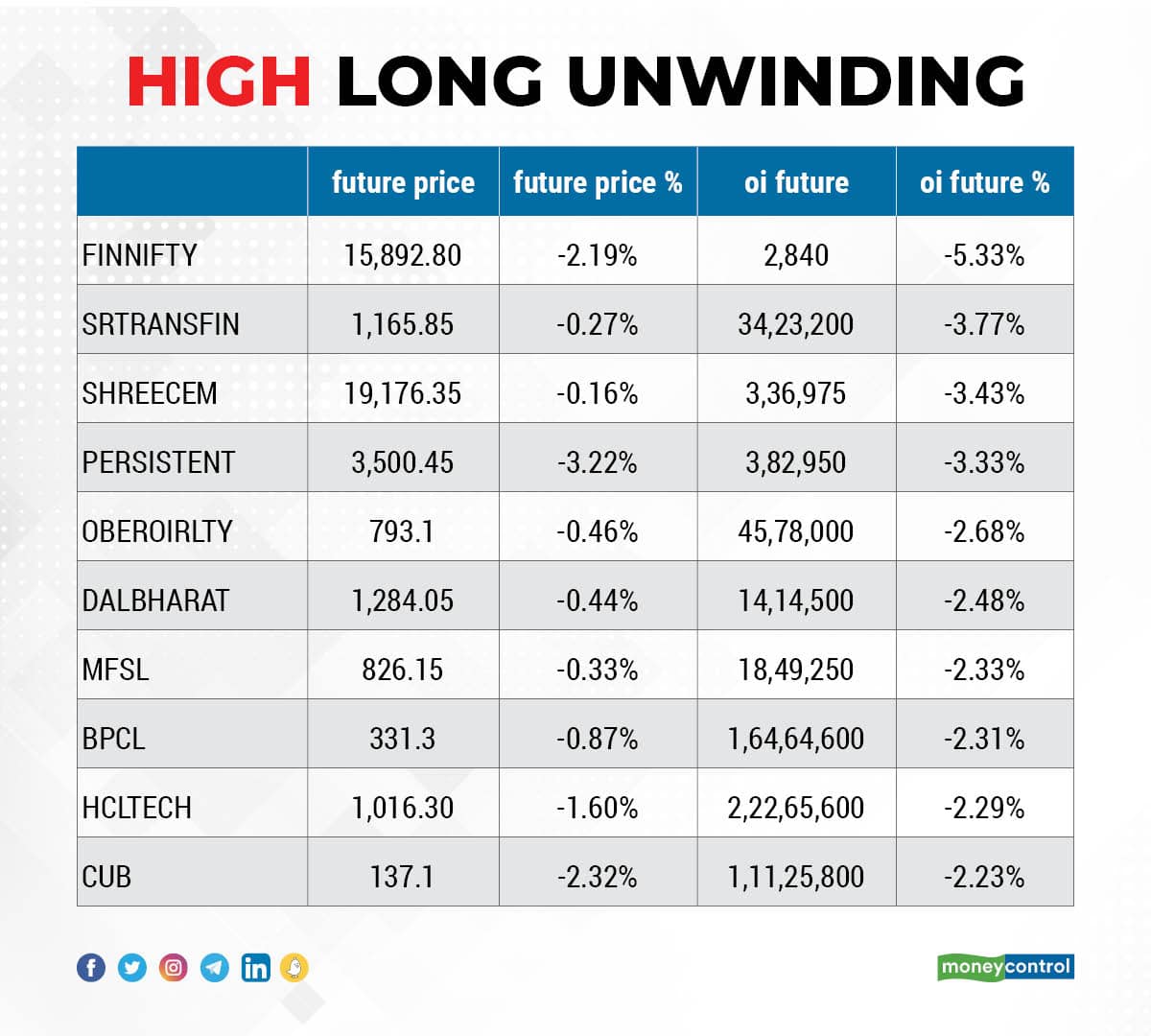

A decline in open interest along with a decrease in price typically indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

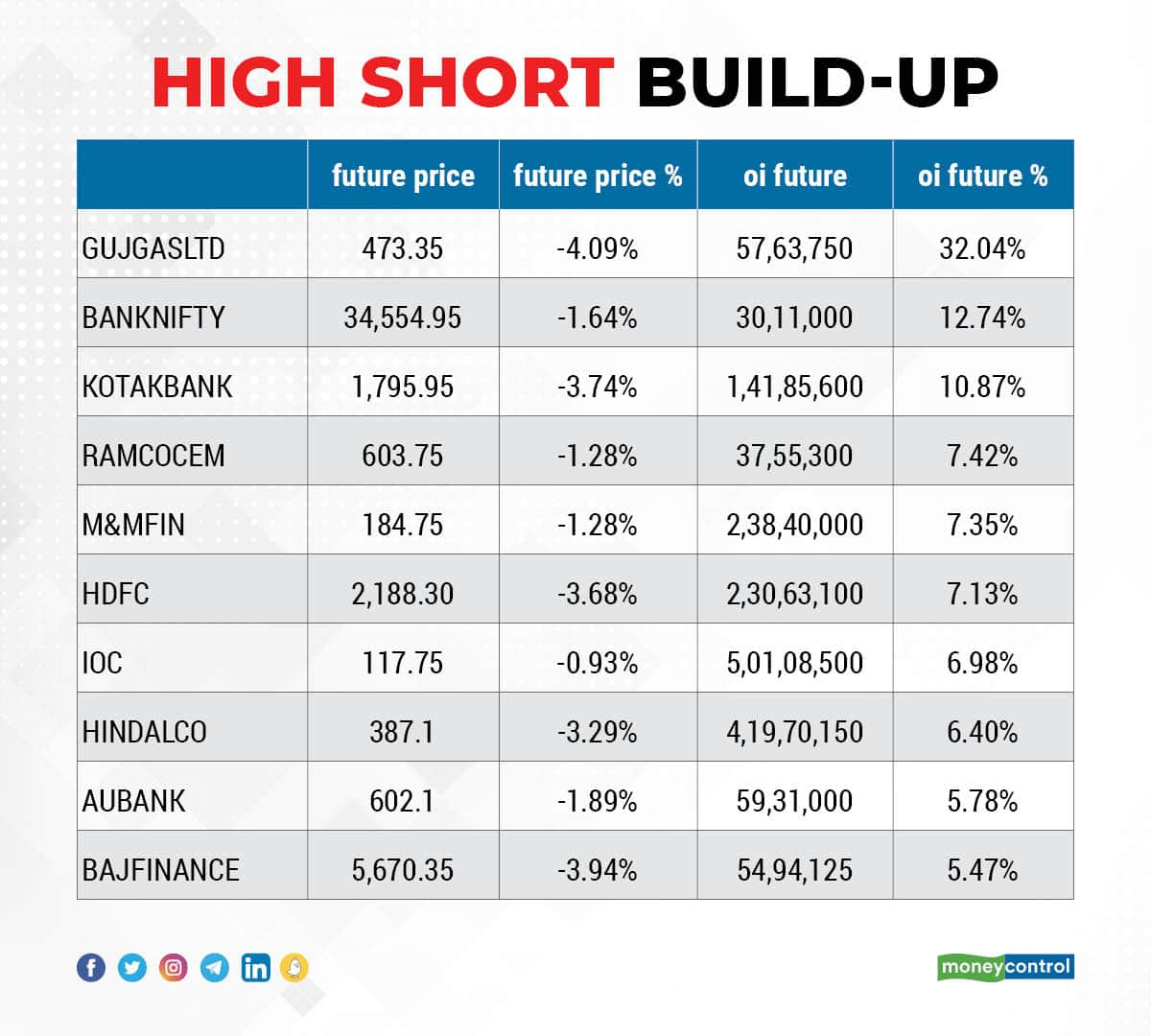

92 stocks saw a short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

29 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

(For more bulk deals, click here)

Investors meetings on June 13

Tata Consumer Products: The company's officials will meet BlackRock.

Tube Investments of India: The company's officials will meet T Rowe Price.

IIFL Finance: The company's officials will meet Abakkus Asset Manager LLP.

Voltas: The company's officials will meet American International Assurance (AlA), Fidelity International Limited (FIL), and Millenium Partners.

Nuvoco Vistas Corporation: The company's officials will meet Citi Research.

GE Power India: The company's officials will meet IIFL Asset Management, Max Life Insurance Company, SBI Mutual Fund, Avendus Capital, DSP Mutual Fund, and Goldman Sachs AMC.

Cipla: The company's officials will participate in BofA India Field Trip.

Axis Bank: The company's officials will participate in BofA India Investor Trip.

Tata Chemicals: The company's officials will attend Kotak India Corporate Day.

Cummins India: The company's officials will meet B&K Securities.

UltraTech Cement: The company's officials will meet Motilal Oswal Asset Management Company.

Indian Energy Exchange: The company's officials will meet Nippon India Mutual Fund.

Radico Khaitan: The company's officials will meet Marval Capital and Dalton Investments.

Crompton Greaves Consumer Electricals: The company's officials will meet Eastspring Singapore and Neuberger Berman.

Safari Industries: The company's officials will meet Franklin Templeton Investments.

Stocks in News

Vedanta: Billionaire Anil Agarwal-owned Vedanta's iron & steel segment has ventured into iron ore mining operations in Liberia, West Africa through its subsidiary Western Cluster (WCL) with the ground-breaking ceremony that was held at the Bomi iron ore mine on June 8. WCL is a wholly-owned subsidiary of Bloom Fountain (BFL) which in turn is a wholly-owned subsidiary of Vedanta. WCL had signed a Mineral Development Agreement with the government of Liberia for three iron ore mining concessions in Bomi, Bea, and Mano in 2011. However, the operations could not be started due to the outbreak of the Ebola epidemic.

IIFL Finance: British International Investment Plc (formerly known as CDC Group Plc) offloaded 1.6 crore equity shares in the company through open market transactions on June 10. With this, its shareholding in the company stands reduced to 3.557 percent from 7.772 percent. However, Max Life Insurance Company acquired 24.6 lakh equity shares in the company and Nomura India Investment Fund Mother Fund bought 44,74,548 shares at an average price of Rs 325.1 a share.

Krishna Institute of Medical Sciences: Mirae Asset Mutual Fund acquired 1,08,472 equity shares in the company through open market transactions on June 9. With this, its shareholding in the company has gone up to 8.236 percent from 8.1 percent.

Lemon Tree Hotels: The company has signed a licence agreement for a 44 -room hotel in Gajuwaka, Visakhapatnam, Andhra Pradesh under its brand "Keys Lite by Lemon Tree Hotels". The hotel is expected to be operational by March 2023. Carnation Hotels Private Limited, a subsidiary and the hotel management arm of the company, will operate this property.

IndInfravit Trust: The company proposes to acquire the entire equity share capital in five special purpose vehicles—three toll-road infrastructure assets (Simhapuri Expressway, Rayalseema Expressway, Mumbai Nasik Expressway) and two annuity infrastructure assets (Kosi Bridge Infrastructure Company, and Gorakhpur Infrastructure Company)—from BIF India Holdings Pte Ltd and Kinetic Holdings I Pte Ltd. Both entities (BIF and Kinetic) are owned by funds managed by Brookfield Asset Management Inc and its affiliates. The payment for the proposed transaction is based on a cumulative gross enterprise value of Rs 8,940.9 crore.

Jammu & Kashmir Bank: The bank said its board has approved the appointment of Pratik D Punjabi as the Chief Financial Officer.

Astron Paper & Board Mill: The company recorded a sharp fall in consolidated profit at Rs 0.32 crore for the quarter ended March 2022 against a profit of Rs 6.8 crore in same period last year, dented by muted revenue and lower other income. Revenue fell to Rs 143.2 crore from Rs 143.8 crore during the same period.

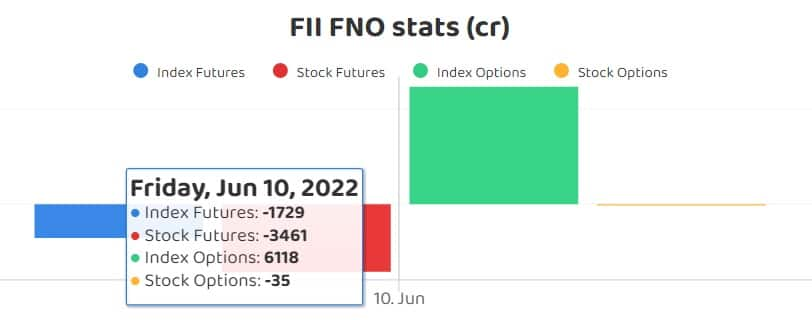

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 3,973.95 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 2,831.07 crore worth of shares on June 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock—Delta Corp—remains under the NSE F&O ban for June 13 as well. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!