The robust rally was broken in last hour of trade and the market ended with moderate losses on June 3, as all sectoral indices, barring IT, closed in red.

The BSE Sensex shed more than 660 points from day's high and closed 49 points lower to 55,769, while the Nifty50 declined 44 points to 16,584 and formed bearish candle on the daily charts, indicating nervousness among market participants.

The broader markets was also caught in the bear trap with the Nifty Midcap 100 and Smallcap 100 indices falling 1.6 percent and 0.86 percent, respectively.

"The Nifty50 witnessed selling pressure as it tested its 200 days exponential moving average (EMA) with an intraday high of 16,793 levels. This sell-off with a bearish candle can be an early indication of short term reversal," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

It was critical that the bulls defend the low of 16,578 levels in the next session to retain their chances of a comeback or weakness may extend to 16,400. The trend will reverse in favour of bears if the Nifty closes below 16,370, the market expert said.

For the time, traders should remain neutral as the market may wait for further cues from the upcoming RBI monetary policy meeting, he said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,503, followed by 16,423. If the index moves up, the key resistance levels to watch out for are 16,729 and 16,875.

Nifty Bank lost 339 points or nearly 1 percent to close at 35,275 on Friday. The important pivot level, which will act as crucial support for the index, is placed at 34,981, followed by 34,686. On the upside, key resistance levels are placed at 35,764 and 36,253 levels.

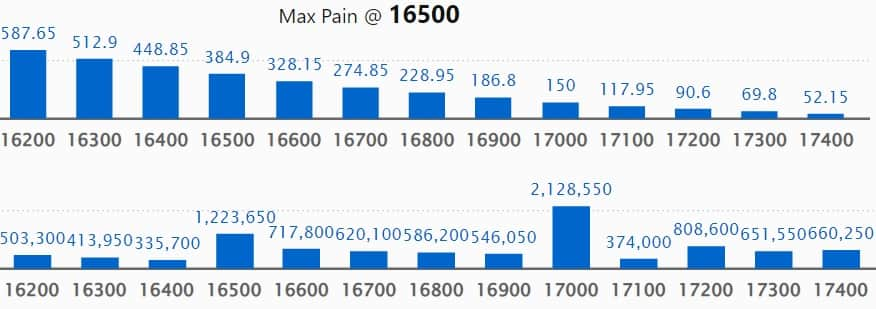

Maximum Call open interest of 23.78 lakh contracts was seen at 17,500 strike, which will act as a crucial resistance level in the June series.

This is followed by 17,000 strike, which holds 21.28 lakh contracts, and 18,000 strike, which has accumulated 17.08 lakh contracts.

Call writing was seen at 16,900 strike, which added 1.2 lakh contracts, followed by 18,000 strike which added 86,800 contracts and 16,800 strike which added 77,400 contracts.

Call unwinding was seen at 16,500 strike, which shed 2.57 lakh contracts, followed by 16,400 strike which shed 1.95 lakh contracts and 16,600 strike which shed 87,750 contracts.

Maximum Put open interest of 39.35 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 30.57 lakh contracts, and 15,000 strike, which has accumulated 23.15 lakh contracts.

Put writing was seen at 16,100 strike, which added 2.67 lakh contracts, followed by 15,600 strike, which added 1.57 lakh contracts and 16,700 strike which added 1.38 lakh contracts.

Put unwinding was seen at 16,400 strike, which shed 1.54 lakh contracts, followed by 16,500 strike which shed 60,250 contracts, and 15,300 strike which shed 59,100 contracts.

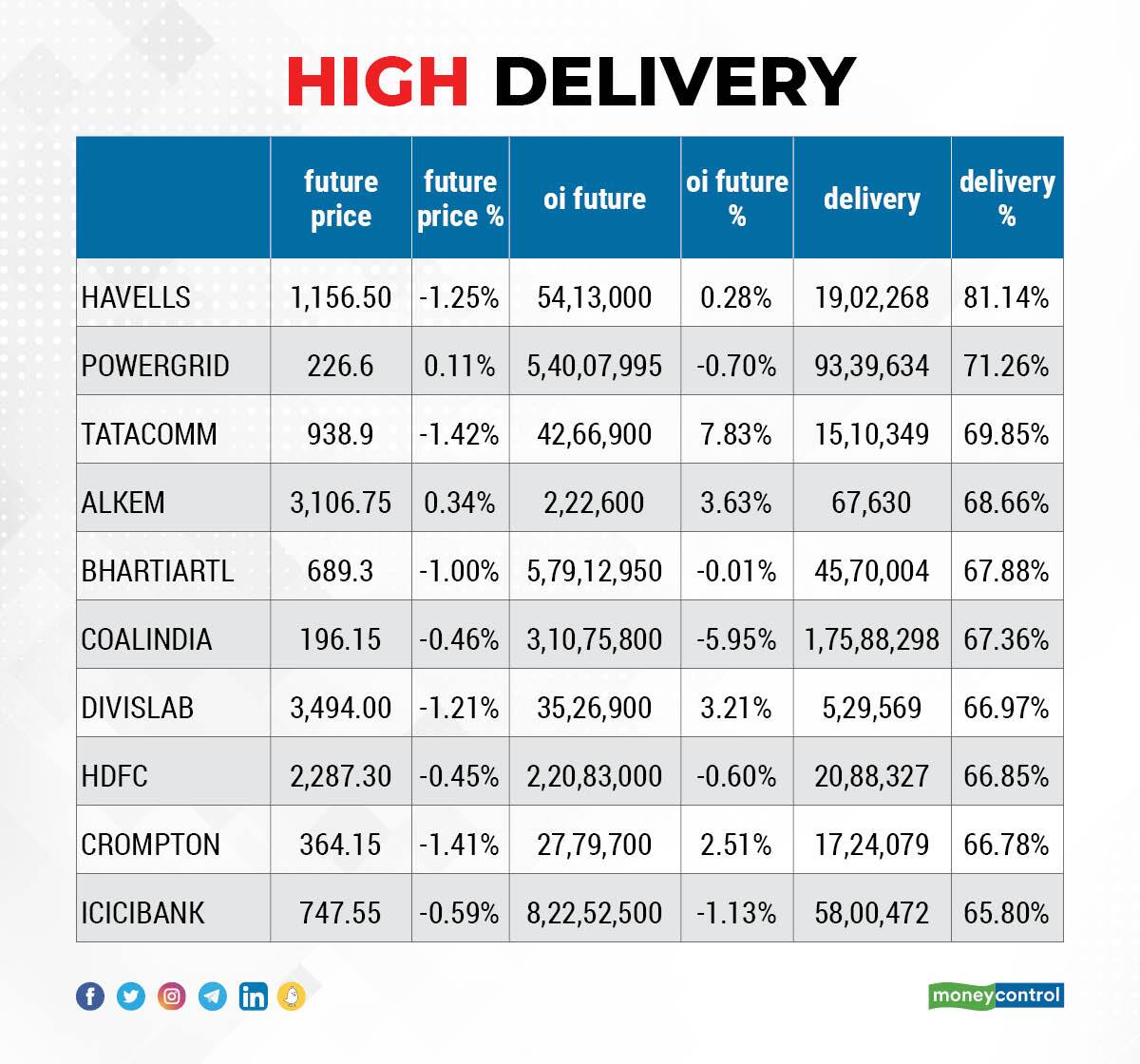

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Havells India, Power Grid Corporation of India, Tata Communications, Alkem Laboratories, and Bharti Airtel, among others.

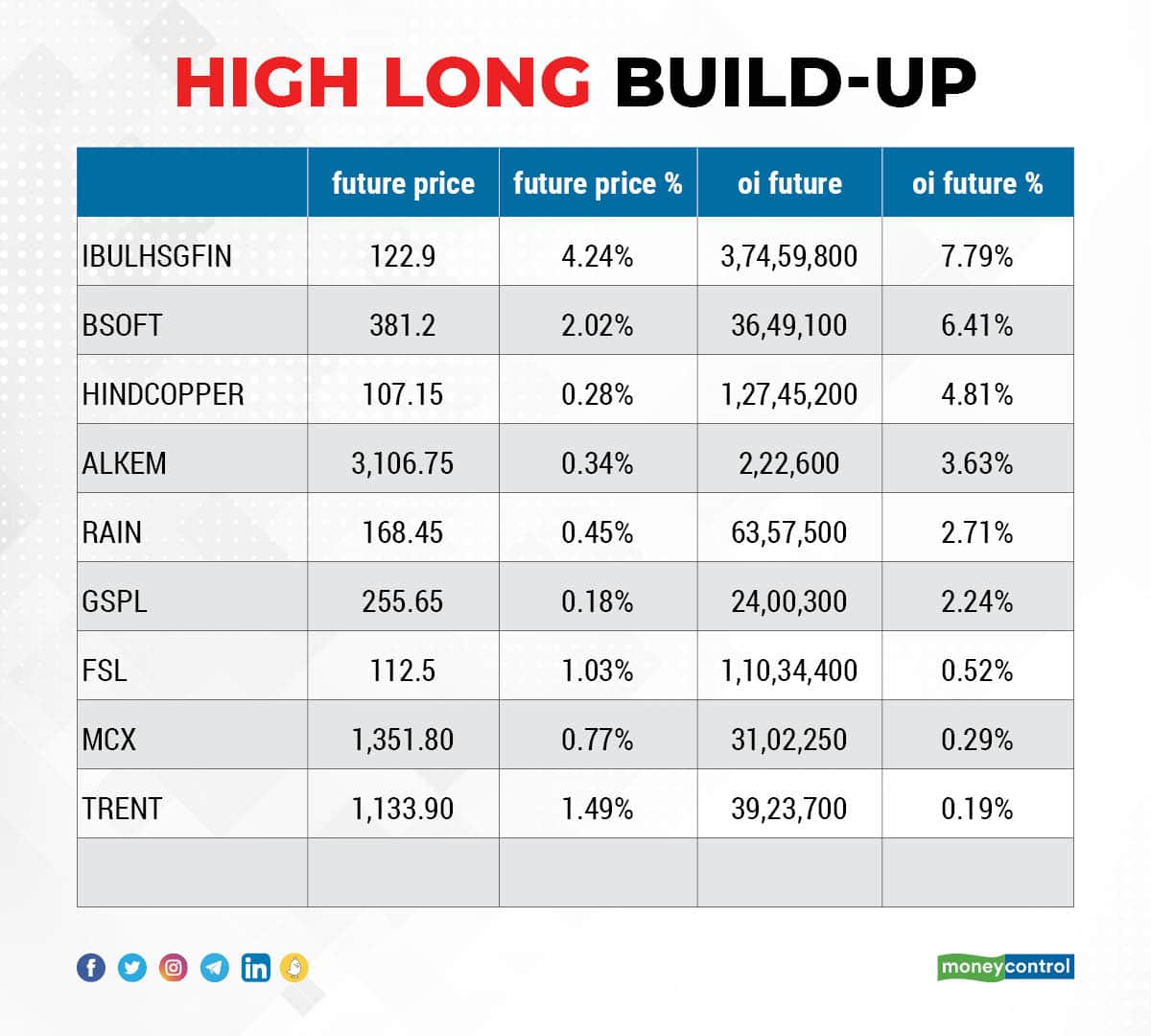

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 9 stocks including Indiabulls Housing Finance, Birlasoft, Hindustan Copper, Alkem Laboratories, Rain Industries, in which a long build-up was seen.

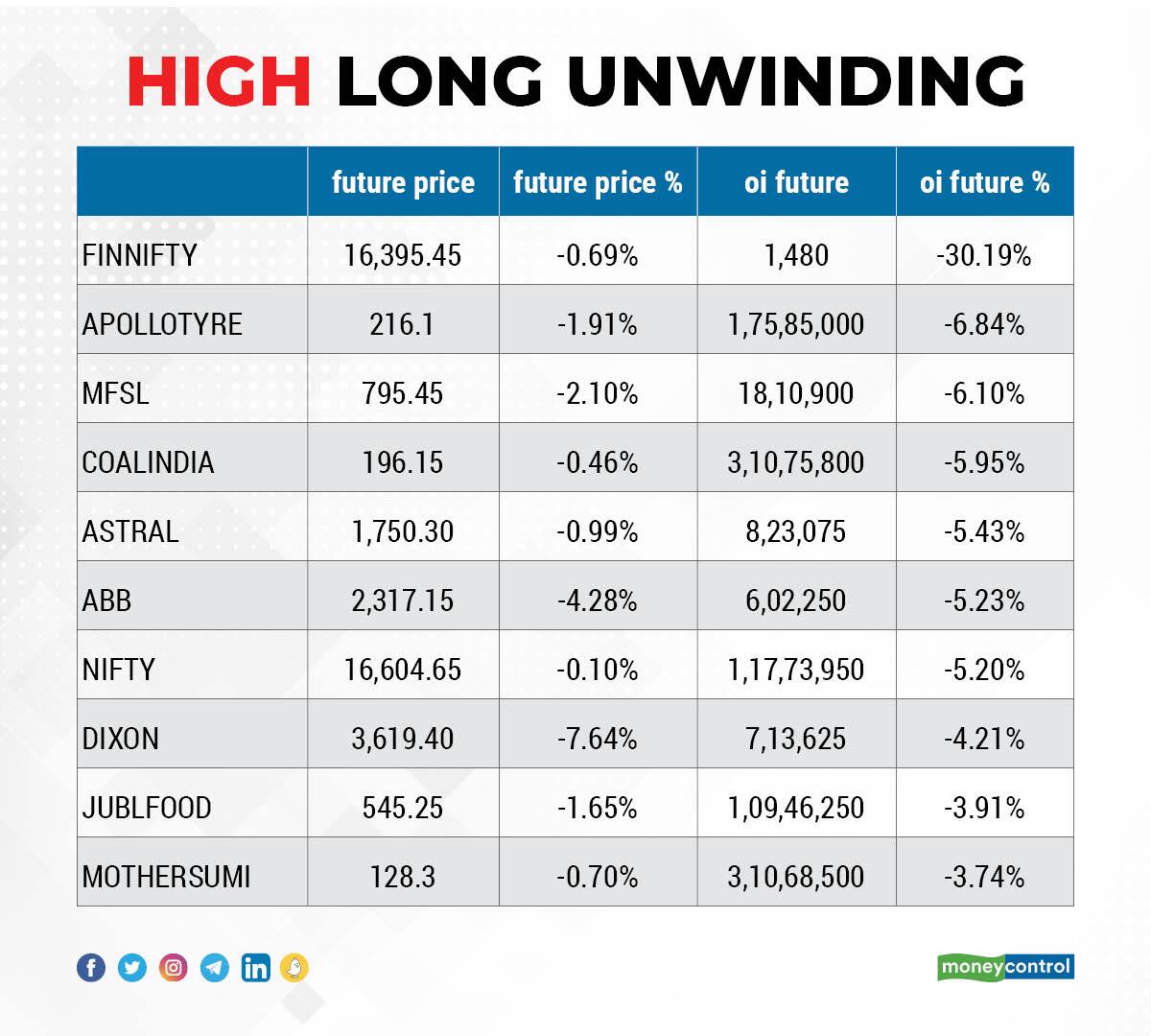

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Apollo Tyres, Max Financial Services, Coal India, and Astral, in which long unwinding was seen.

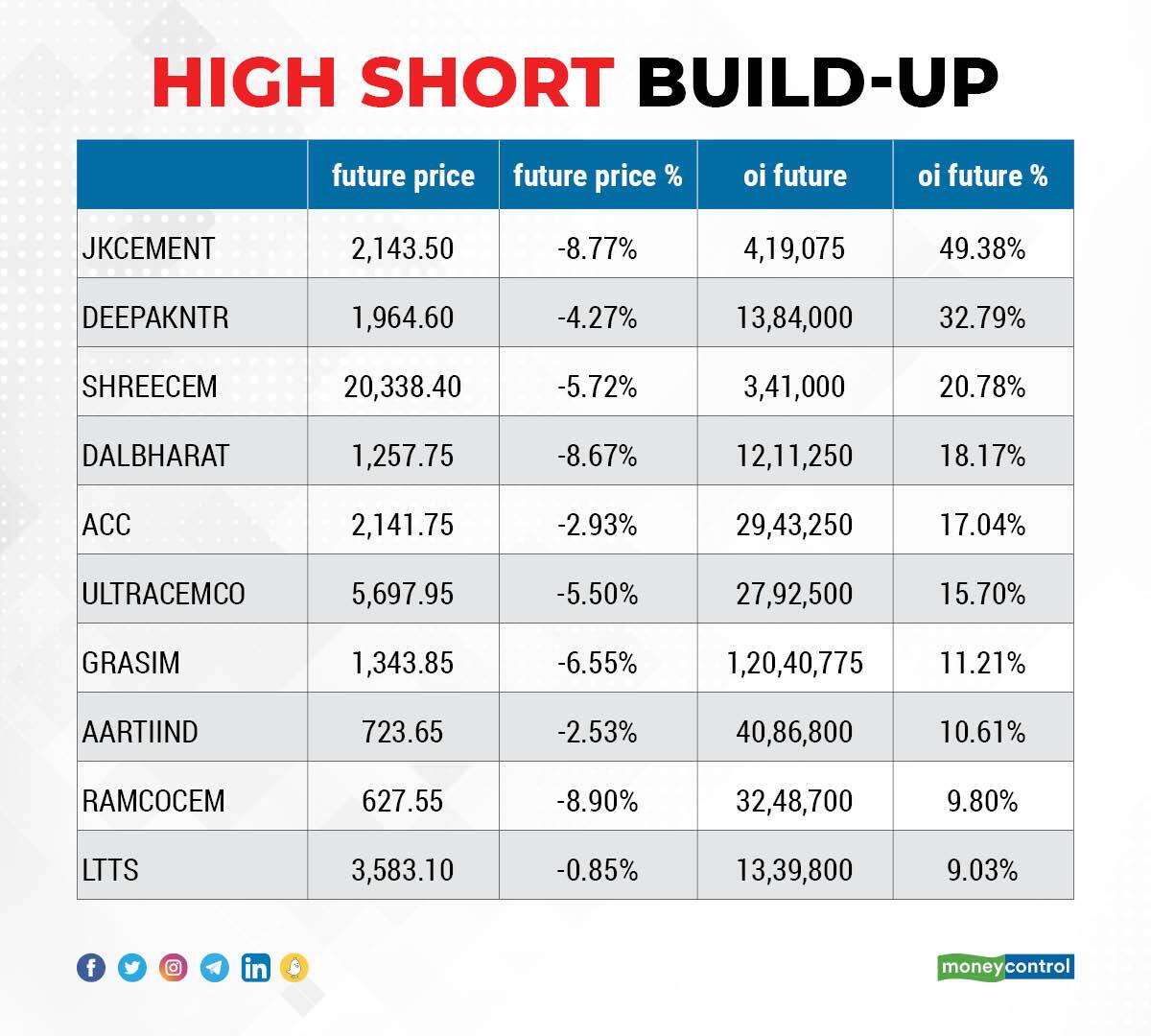

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including JK Cement, Deepak Nitrite, Shree Cements, Dalmia Bharat, and ACC, in which a short build-up was seen.

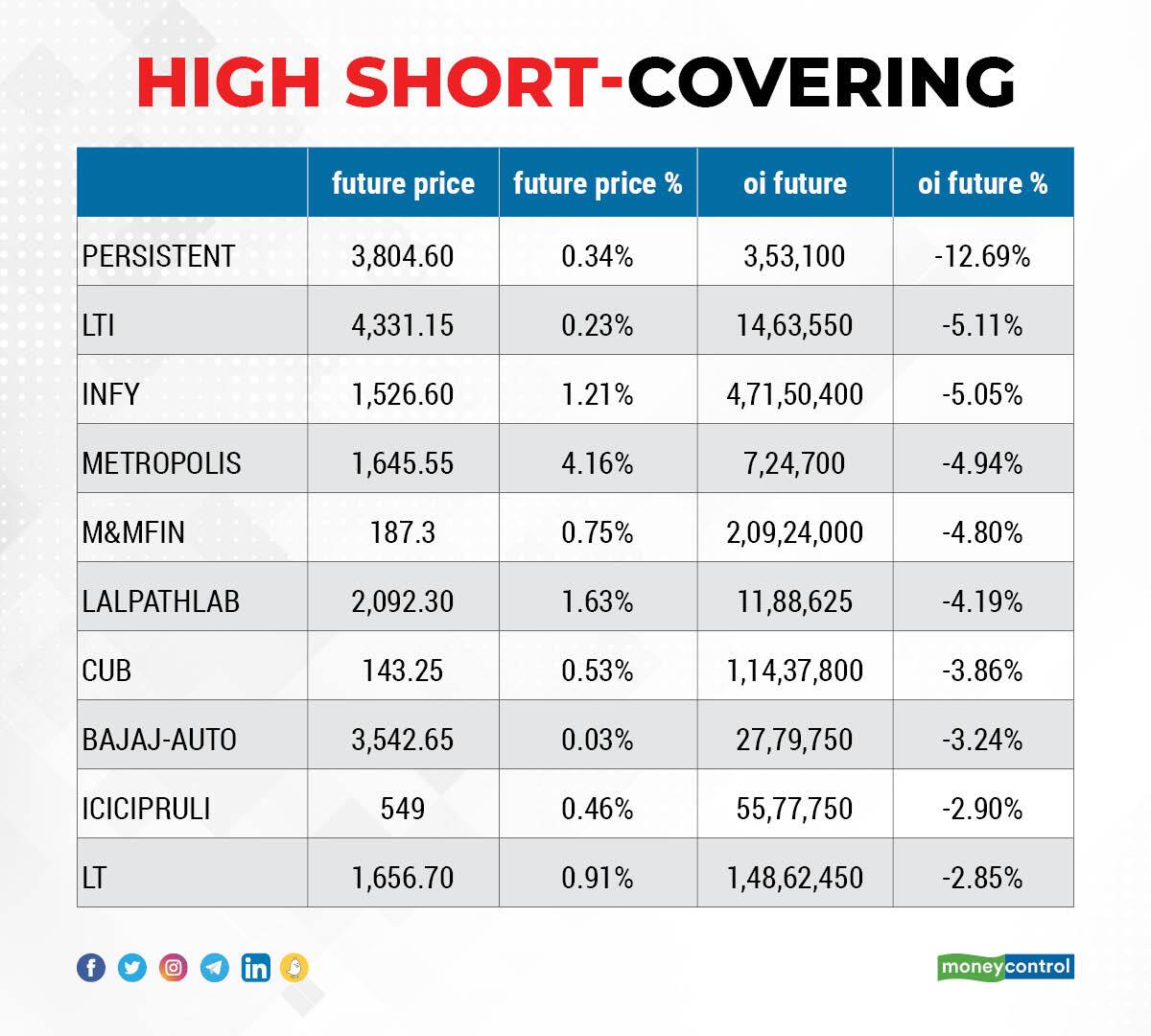

25 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Persistent Systems, L&T Infotech, Infosys, Metropolis Healthcare, and M&M Financial, in which short-covering was seen.

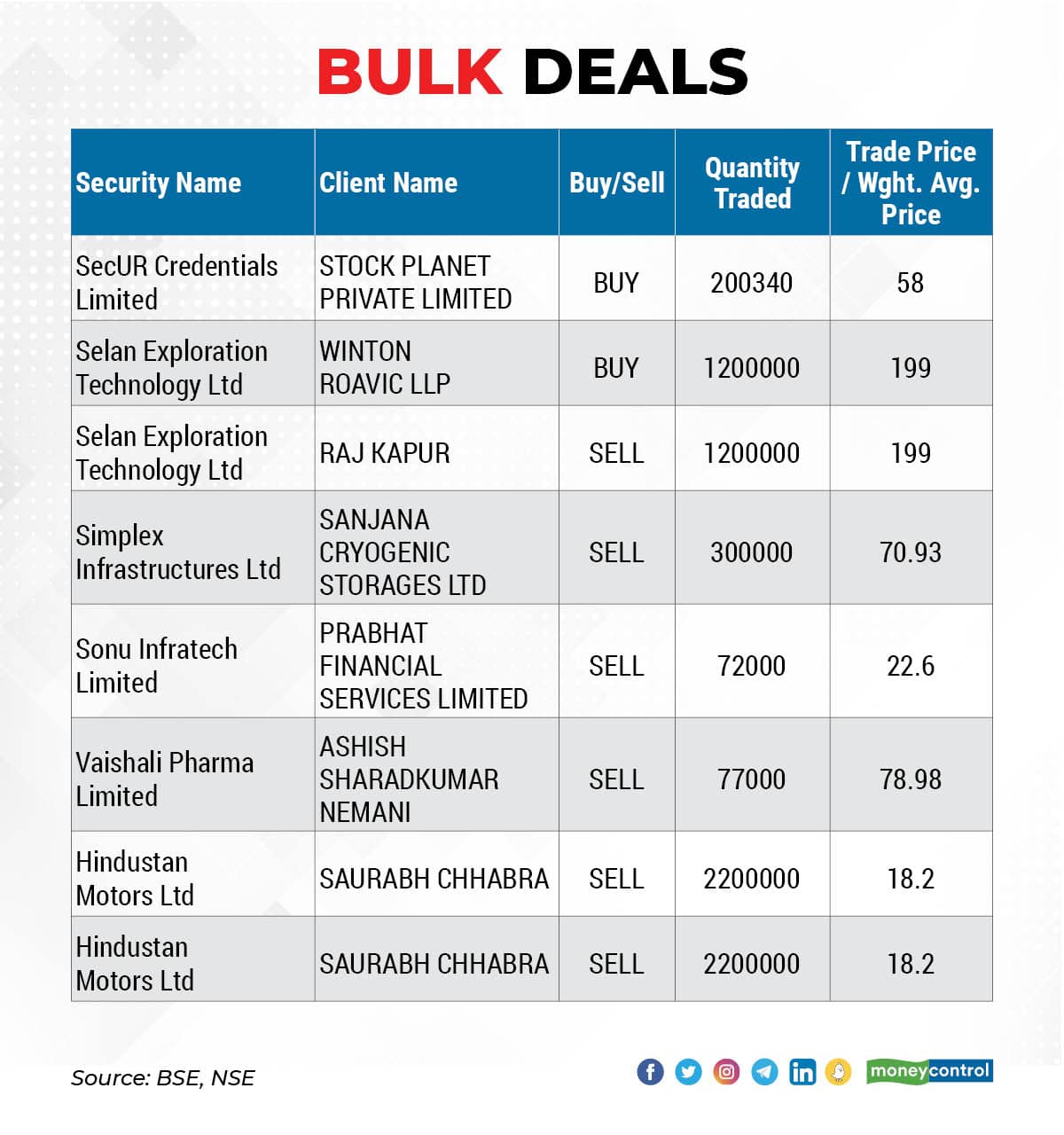

(For more bulk deals, click here)

Investors Meetings on June 6

Cummins India: The company's officials will meet First State Investments.

Clean Science and Technology: The company's officials will attend Axis Capital Investor Meet, and will meet Motilal Oswal.

Tata Consumer Products: The company's officials will meet RBC Global Asset Management (UK), and Ninety One.

CSB Bank: The company's officials will attend YES Securities' High Conviction Ideas Conference.

Sona BLW Precision Forgings: The company's officials will participate in Nomura Investment Forum Asia 2022.

Voltas: The company's officials will meet Batlivala & Karani Securities India.

JSW Energy: The company's officials will participate in Investec India - New & Renewable Energy Conference.

Asian Paints: The company's officials will meet Deutsche Investment Management, and attend Nomura Investment Virtual Forum Asia 2022.

Dr Lal PathLabs: The company's officials will meet Motilal Oswal Asset Management Company.

UltraTech Cement: The company's officials will meet MFS lnvestment Management.

Max India: The company's officials will meet New Port Capital, Ripple Wave Equity Advisors LLP, KR Choksey Shares & Securities, Mytemple Capital Advisors LLP, Dalai & Broacha Stock Broking, Accendo Capital, and SBI Cap Securities.

Axis Bank: The company's officials will attend Nomura Investment Forum Asia 2022.

Stocks in News

Ujjivan Small Finance Bank: The company said the board on June 8 will consider the proposal for raising of funds by way of issuance of debt securities on a private placement basis, in one or more tranches.

RattanIndia Power: Vibhav Agarwal has resigned as Managing Director of the company due to his personal reasons. Hence he also ceased to be Key Managerial Personnel of the company on June 3. Asim Kumar De, Whole Time Director of the company, has assigned additional responsibilities to discharge the functions which were earlier assigned to Managing Director, for interim period, till the time a new Managing Director is appointed by the company.

V-Guard Industries: SBI Mutual Fund through its several schemes acquired 59,171 equity shares in the company via open market transactions on June 2. With this, its shareholding in the company stands increased to 9.04 percent, up from 9.027 percent earlier.

Poonawala Fincorp: Sebi revoked the securities market ban imposed on Abhay Bhutada, Managing Director of Poonawalla Finance, in a case pertaining to alleged insider trading activities in the shares of Magma Fincorp (which is now known as Poonawalla Fincorp). After conducting a detailed investigation in the matter, Sebi found that "Abhay Bhutada had not communicated UPSI (unpublished price sensitive information)." (PTI)

Prudent Corporate Advisory Services: Promoter group - Niketa Sanjay Shah & PACs - acquired 2.6 lakh equity shares in the company via open market transactions on June 3. With this, promoters shareholding in the company stands increased to 58.44 percent, up from 57.81 percent earlier.

Adani Transmission: The company has signed Share Purchase agreement with Essar Power to acquire its 100 percent stake in Essar Power Transmission Company (EPTCL). The acquisition is in line with the company's value added growth strategy through organic as well as inorganic growth opportunities. The acquisition cost is Rs 1,913 crore.

Savita Oil Technologies: The company in its BSE filing said the board on June 21 will consider the sub-division of equity shares of the company.

Valiant Organics: The company informed exchanges about an incidence of blast in reactor in chlorination section of its plant at GIDC, Sarigam, Gujarat. The incident has taken place on June 3. There has been no loss to human life, however, minor injury reported to one person, who is under medical treatment.

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 3,770.51 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 2,360.51 crore worth of shares on June 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not put any stock under its F&O ban segment for June 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!