The market extended gains for second consecutive session with the benchmark indices rising more than one percent following rally in global counterparts on May 27, the first day of June series. All sectors, barring metals, participated in the run-up with IT being prominent gainers rising 2.5 percent.

The BSE Sensex rallied 632 points to 54,885, while the Nifty50 climbed 182 points to 16,353 and formed a bullish candle, which resembles Hanging Man kind of pattern on the daily charts.

The broader space also joined bull run with the Nifty Midcap 100 and Smallcap 100 indices climbing 1.4 percent each on positive breadth. Nearly three shares advanced for every share declining on the NSE.

The volatility cooled down further to 21.48 levels, declining 5.44 percent which also supported bulls on Friday.

"Albeit bulls made an attempt to recover some of the lost ground, still the index seems to be in a consolidation range as the candle depicted resembles a Hanging Man indicating indecision among market participants. However, a key positive development on the technical charts is the fact that the Nifty closed above 20 days simple moving average (16,277)," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

Interestingly, on weekly charts, the last three candles put together also point towards a sideways consolidation in a larger range of 16,400 and 15,700 levels but with a Hammer kind of formation for the current week. Hence, a close above 16,400 can further expand the upswing toward the 200 days exponential moving average whose value is placed around 16,750 levels, the market expert said.

Contrary to this as of now, it appears that bears will not gain upper hand unless the Nifty closes below 15,700 levels, he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,259, followed by 16,166. If the index moves up, the key resistance levels to watch out for are 16,408 and 16,464.

Banking stocks also supported the market as Nifty Bank rose 518 points or 1.5 percent to close at 35,613 on Friday. The important pivot level, which will act as crucial support for the index, is placed at 35,372, followed by 35,130. On the upside, key resistance levels are placed at 35,775 and 35,936 levels.

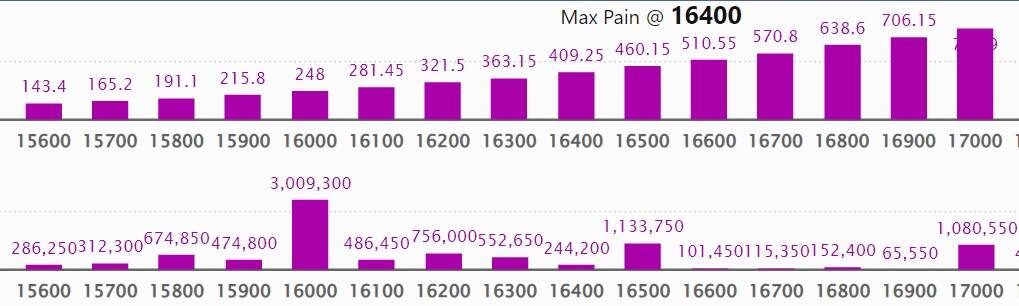

Maximum Call open interest of 22.95 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 17,500 strike, which holds 16.37 lakh contracts, and 16,000 strike, which has accumulated 13.36 lakh contracts.

Call writing was seen at 16,300 strike, which added 3.04 lakh contracts, followed by 17,000 strike which added 2.09 lakh contracts and 17,200 & 17,300 strikes which added 1.01 lakh contracts each.

Call unwinding was seen at 16,000 strike, which shed 94,100 contracts, followed by 16,500 strike which shed 91,550 contracts and 16,100 strike which shed 46,850 contracts.

Maximum Put open interest of 31.67 lakh contracts was seen at 15,500 strike, which will act as a crucial support level in the June series.

This is followed by 16,000 strike, which holds 30.09 lakh contracts, and 15,000 strike, which has accumulated 25.11 lakh contracts.

Put writing was seen at 16,300 strike, which added 3.24 lakh contracts, followed by 15,100 strike, which added 1.9 lakh contracts and 16,200 strike which added 1.82 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 9,750 contracts, followed by 16,800 strike which shed 5,100 contracts, and 17,400 strike which shed 4,350 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in HDFC Bank, Voltas, TCS, Power Grid Corporation of India, and Ipca Laboratories, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Chambal Fertilizers, ABB India, Ramco Cements, and Metropolis Healthcare, in which a long build-up was seen.

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the four stocks - Vedanta, NMDC, City Union Bank, and Tata Steel - in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Cummins India, Ipca Laboratories, Piramal Enterprises, Muthoot Finance, and Polycab India, in which a short build-up was seen.

56 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Atul, Container Corporation of India, Apollo Hospitals Enterprises, Balrampur Chini Mills, and Alkem Laboratories, in which short-covering was seen.

Paradeep Phosphates: Goldman Sachs Funds - Goldman Sachs India Equity Portfolio acquired 41,32,211 equity shares in the company via open market transactions at an average price of Rs 45.95 per share.

(For more bulk deals, click here)

Life Insurance Corporation of India, Jubilant Foodworks, Sun Pharma, Aurobindo Pharma, Campus Activewear, IRCTC, Coffe Day Enterprises, LT Foods (Daawat), Dilip Buildcon, DCM Shriram Industries, Delhivery, Dhampur Sugar, Dhani Services, Dish TV, Dixon Technologies, Dredging Corporation of India, Eureka Forbes, Jindal Steel & Power, Lux Industries, Mazagon Dock Shipbuilders, Mawana Sugar, Mcleod Russel, Medplus Health, Natco Pharma, Prudent Corporate Advisory Services, Radico Khaitan, Stove Kraft, and Wockhardt will be in focus ahead of March quarter earnings.

Stocks in News

Adani Defence Systems and Technologies, a wholly owned subsidiary of Adani Enterprises, has signed definitive agreement to acquire 50 percent stake in General Aeronautics. Adani Defence Systems and Technologies Limited shall leverage its military drone and AI/ML capabilities and work with General Aeronautics for providing end to end solutions for agriculture sector. General Aeronautics provides robotic drones and drone based solutions for crop protection services, crop health, precision- farming and yield monitoring using artificial intelligence and analytics for the agricultural sector.

Arvind Fashions' Q4 revenue rose 34 percent YoY to Rs 917 crore as compared to Rs 685 crore, led by a strong bounce back in demand and strong footfalls, reflected in 20 percent like to like (LTL) growth in February-March 2022. The company reported a marginal profit of Rs 1 crore as compared to a loss of Rs 45 crore during the same period last year.

TCI Express' Q4 profit fell 15.6 percent YoY to Rs 35.93 crore, compared to Rs 42.57 crore in the prior year period. The regional restrictions due to COVID, impacted the performance of the company. However, revenue for the quarter improved by 7.3 percent to Rs 300 crore as compared to Rs 280 crore last year. The company recommended a dividend of Rs 2.00 per equity share of Rs 1 each for the financial year ended March 31, 2022.

Welspun Corp's Q4 profit slumped 30.4 percent year-on-year to Rs 263.5 crore as compared to a profit of Rs 379 crore in the year ago period, due to higher global energy prices and rise of commodity prices. Revenue for the quarter dipped marginally by 1.2 percent on year to Rs 2,011 crore as compared to Rs 2,035 crore a year ago. The company has recommended a final dividend of Rs 5 per share for FY22.

HUDCO's Q4 consolidated net profit jumped 42 percent YoY to Rs 746.85 crore for the March ending quarter as compared to Rs 526.28 crore during the same period last year, aided by lower finance costs and impairment credit. Revenue for the housing development company remained flat with a marginal decline of 1.8 percent to Rs 1,727 crore as compared to 1,759 crore during the prior year period.

Sun TV Network's Q4 consolidated net profit fell 16 percent to Rs 410 crore as compared to Rs 488 crore due to higher operating and other expenses. The revenue for the quarter inched higher by 7 percent to Rs 857 crore compared to Rs 803 crore during the prior year period.

FSN E-Commerce (Nykaa) Q4 profit fell 33 percent YoY to Rs 413 crore compared to Rs 616 crore last year, due to steep rise in marketing and other operating expenses. Revenue came in higher by 55 percent on year to Rs 3,774 crore.

JSW Steel's consolidated Q4 profit declined 23 percent YoY to Rs 3,234 crore as against Rs 4,198 crore during the prior year period due to surge in cost of raw materials, power & fuel, other expenses and inventory costs. Consolidated revenue rose 74 percent on-year to Rs 46,895 crore as compared to a net revenue of Rs 26,934 crore registered in the year-ago quarter. The company has recommended a dividend of Rs 17.35 per equity share of Rs 1 each for the year ended 31 March 2022.

United Spirits' Q4 consolidated profit fell 12 percent YoY to Rs 178.6 crore compared to Rs 203 crore earned during the same period last year, due to higher raw material and marketing expenses. Revenue remained flat with a marginal growth of 1.2 percent to Rs 7,767 crore as compared to Rs 7,678 crore last year.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,943.10 crore, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 2,727.47 crore worth of shares on May 27, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not put any stock under the F&O ban for May 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!