The Indian benchmark indices ended lower on all the three sessions of the holiday curtailed week, with the Nifty slipping below 17,500 on April 13. Soaring inflation, elevated oil prices and correction in banking, financial services and auto stocks weighed on the market on April 13.

The Sensex declined 237 points to 58,339, while the Nifty fell 55 points to 17,476 and formed bearish candles on the daily as well as weekly charts. The Nifty declined 1.7 percent during the week.

"On the daily charts, the index tested its 20-day simple moving average (SMA--17,471) in the last two trading sessions. It is critical that the index stays above 17,440 (around the week's low) on a closing basis to retain sideways bias," Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia said.

If the index fails to hold 17,440, then it can slip to its 200-day moving average whose value is placed at around 17,150.

A sideway consolidation is expected as long as the Nifty defends 17,400, while a close above 17,663 can be considered as an initial sign of strength in the near term, Mohammad said. It would be prudent to remain neutral on the long side till some signs of strength are visible.

In the broader space, the Nifty midcap 100 index declined 0.03 percent and the smallcap 100 gained 0.2 percent on April 13 but both indices lost more than 1 percent during the week.

The market was shut on April 14 on account of Mahavir Jayanti and Dr Baba Saheb Ambedkar Jayanti and on April 15 for Good Friday.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given are the aggregate of three-month data and not of the current month only.

Key support and resistance levels for Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,401 followed by 17,326. If the index moves up, the key resistance levels to watch out for are 17,607 and 17,739.

The Bank Nifty fell 284 points to close at 37,463 on April 13. The important pivot level, which will act as crucial support, is placed at 37,252 followed by 37,040. On the upside, key resistance levels are 37,832 and 38,200.

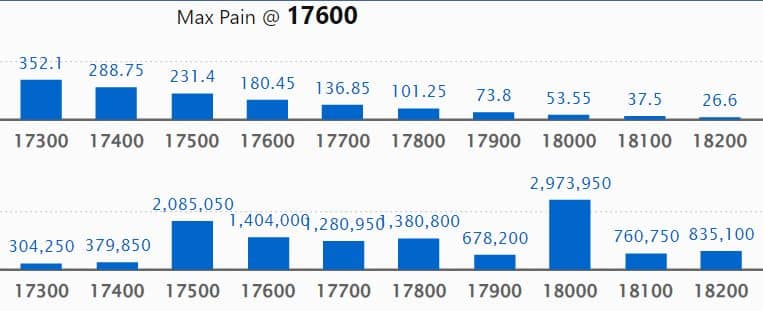

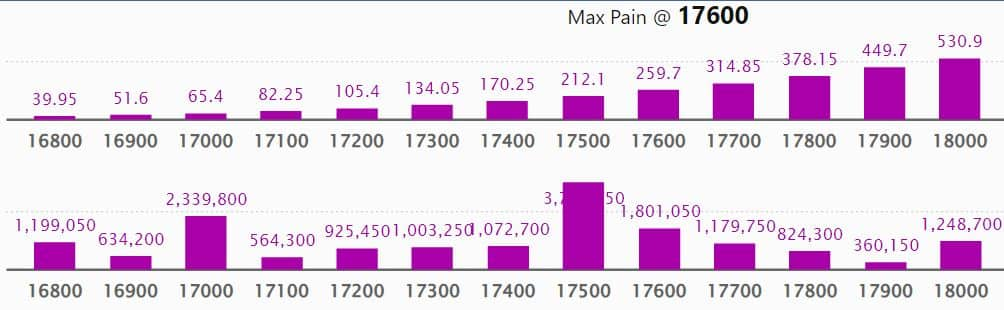

Maximum Call open interest of 29.73 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 17,500 strike, which holds 20.85 lakh contracts, and 19,000 strike, which has accumulated 20.81 lakh contracts.

Call writing was seen at 17,600 strike, which added 4.4 lakh contracts, followed by 17,500 strike, which added 3.21 lakh contracts, and 18,000 strike that added 2.85 lakh contracts.

Call unwinding was seen at 17,800 strike, which shed 1.42 lakh contracts, followed by 18,800 strike that shed 36,550 contracts and 18,600 strike, which shed 16,500 contracts.

Maximum Put open interest of 37.14 lakh contracts was seen at 17,500 strike, which will act as crucial support in the April series. This is followed by 16,500 strike, which holds 24.99 lakh contracts, and 17,000 strike, which has accumulated 23.39 lakh contracts.

Put writing was seen at 17,500 strike, which added 3.85 lakh contracts, followed by 16,500 strike, which accumulated 3.4 lakh contracts and 17,300 strike, which added 1.67 lakh contracts.

Put unwinding was seen at 16,400 strike, which shed 1.53 lakh contracts, followed by 16,300 strike that shed 1.02 lakh contracts, and 17,800 strike, which shed 83,250 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Honeywell Automation, Navin Fluorine International, Colgate Palmolive, ICICI Bank and Crompton Greaves Consumer Electricals among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, following are the top 10 stocks in which a short build-up was seen:

61 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

Hariom Pipe Industries: Prakash Kumar Chandnani sold 1.56 lakh equity shares in the company through open market transactions at an average price of Rs 225.19 a share. Elara India Opportunities Fund offloaded 1.79 lakh shares at an average price of Rs 220 a share, Societe Generale sold 2 lakh shares at an average price of Rs 225.5, Nomura Singapore offloaded 3.45 lakh shares at an average price of Rs 225.84 and Ketan V Thakkar sold 2.01 lakh shares at an average price of Rs 221.74 a share. However, Niraj Rajnikant Shah acquired 1.43 lakh shares at an average price of Rs 220.68 a share and Spring Ventures bought 2 lakh shares at an average price of Rs 230.6. Hariom Pipe shares rallied 51 percent on its debut day.

Mrs Bectors Food Specialities: Investors Linus Private Limited and GW Crown Pte Ltd exited the company by selling the entire shareholding of 46.13 lakh equity shares at an average price of Rs 305.38 a share and 47.12 lakh shares at Rs 303.26 respectively. However, Blend Fund 2 acquired 10 lakh shares, Unifi AIF Blend Fund bought 4 lakh shares and SBI Mutual Fund purchased 33 lakh shares at an average price of Rs 303 a share. The stock fell 9 percent on April 13.

(For more bulk deals, click here)

Mindtree, Star Housing Finance, Earum Pharmaceuticals, DRC Systems India, Mishtann Foods, Ramsarup Industries, Sheetal Cool Products, SE Power, SM Gold, and Swiss Military Consumer Goods will release quarterly earnings on April 18.

Stocks In News

HDFC Bank: Profit in Q4 grew 22.8 percent to Rs 10,055.2 crore YoY as provisions declined 29.4 percent in the same period. Net interest income rose 10.2 percent to Rs 18,873 crore, with credit growth of 20.8 percent and a deposits growth of 16.8 percent YoY. Asset quality improved with gross non-performing assets falling 9 bps sequentially to 1.17 percent and net NPAs declining 5 bps QoQ to 0.32 percent in the March quarter.

Infosys: The country's second-largest IT services company recorded lower-than-expected earnings growth in March 2022 quarter, with profit falling 2.1 percent sequentially to Rs 5,686 crore on lower-than-expected revenue growth (up 1.3 percent QoQ) and a fall in operating margin, and dollar revenue growth of seven-tenth of a percent QoQ at $4,280 million. However, the revenue growth guidance for the current financial year at 13-15 percent over the previous year exceeded analysts' expectations, with operating profit margin forecast in the range of 21-23 percent.

Windlas Biotech: The company received a certificate of good manufacturing practices (GMP) from the South African Health Products Regulatory Authority. The company had undergone an inspection-audit during September 20-29, 2021. Windlas can now start manufacturing and sell its products in South Africa market. The company also received zero critical observations for its plant-IV at Dehradun after European Union GMP inspection carried out by the National Institute of Pharmacy and Nutrition, Hungary during April 11-13.

UltraTech Cement: Its UAE subsidiary, UltraTech Cement Middle East Investments (UCMEIL), has picked up a 29.39 percent stake in RAK Cement Company for White Cement and Construction Materials PSC (RAKWCT), a listed entity on Abu Dhabi and Kuwait stock exchanges. This is a strategic investment and the acquisition cost will be $101.1 million.

Alkem Laboratories: The pharma company's Taloja unit has been cleared by the US health regulator as the unit has not received “Form 483” after inspection. The US FDA inspected the company's bioequivalence centre at Taloja in Maharashtra during April 11-14.

Tata Power: BlackRock Real Assets, together with Mubadala, will invest Rs 4,000 crore ($525 million) for a 10.53 percent stake in the company's subsidiary Tata Power Renewables. The investment has taken a base equity valuation of the subsidiary to Rs 34,000 crore.

Mahindra & Mahindra: The company has hiked the price of its vehicles by 2.5 percent. The price revision is a result of a continuous increase in prices of key commodities such as steel, aluminium and palladium, the company said.

Jubilant Ingrevia: The company has received CDMO contract worth Rs 270 crore in specialty chemicals business from an "international customer". The contract is for three years. The company will supply two key GMP intermediates for one of the “patented drugs” of the innovator pharmaceutical customer. Commercial supplies of both these products will start from FY23.

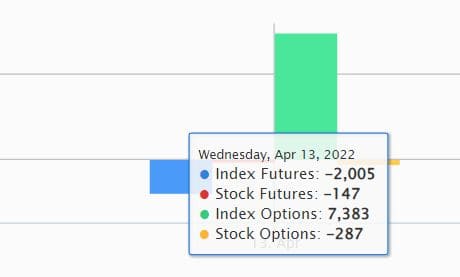

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 2,061.04 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,410.85 crore on April 13, as per NSE provisional data.

Stocks under F&O ban on NSE

One stock—RBL Bank—is under the F&O ban for April 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!