Robust rally for second consecutive session helped the benchmark indices reach one-month high levels on March 17 as there was healthy buying in all sectors barring IT. Positive global mood and in-line 0.25% interest rate hike by Federal Reserve along with stable oil prices aided market sentiment.

The BSE Sensex climbed 1,047 points or 1.84 percent to 57,864, while the Nifty50 jumped 312 points or 1.84 percent to 17,287, the highest level since February 17, and formed bullish candle on the daily charts. The index saw robust bullish candle formation for yet another week, indicating bulls having strong upper hand at Dalal Street.

"The last eight trading sessions' rally from the lows of 15,671 added around 1,673 points, leading to two back-to-back strong bullish candles on the weekly charts. This perhaps is hinting at a durable bottom around recent lows of 15,671," said Mazhar Mohammad, Founder & Chief Market Strategist at Chartviewindia.

Based on the 37-day downsloping channel breakout, registered on March 14, a higher target of 17,900 cannot be ruled out, he said.

But due to the sharp rally of the last few sessions, a pause for one or two days, due to profit-booking, cannot be ruled out. The current positive outlook, however, would be negated if the Nifty closes below 16,990. Any dips will remain an opportunity to create fresh longs, said Mohammad.

The broader markets were also seen at bulls' party as the Nifty Midcap 100 and Smallcap 100 indices gained 1.4 percent and 1.2 percent respectively.

The cooling off volatility also supported market sentiment. India VIX, the fear index fell by 6 percent to 22.6 levels on Thursday.

The market was shut on Friday for Holi.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,194, followed by 17,100. If the index moves up, the key resistance levels to watch out for are 17,363 and 17,438.

Banking stocks played a key role in Thursday's rally as the Nifty Bank jumped 680 points or 1.9 percent to 36,429 on Thursday. The important pivot level, which will act as crucial support for the index, is placed at 36,256, followed by 36,084. On the upside, key resistance levels are placed at 36,606 and 36,784 levels.

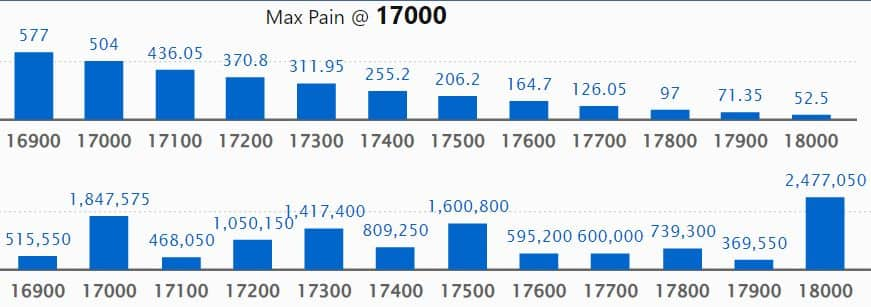

Maximum Call open interest of 24.77 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,000 strike, which holds 18.47 lakh contracts, and 17,500 strike, which has accumulated 16 lakh contracts.

Call writing was seen at 17,300 strike, which added 9.35 lakh contracts, followed by 17,400 strike which added 2.52 lakh contracts, and 18,200 strike which added 2.22 lakh contracts.

Call unwinding was seen at 17,100 strike, which shed 3.18 lakh contracts, followed by 17,000 strike which shed 2.53 lakh contracts and 16,900 strike which shed 1.4 lakh contracts.

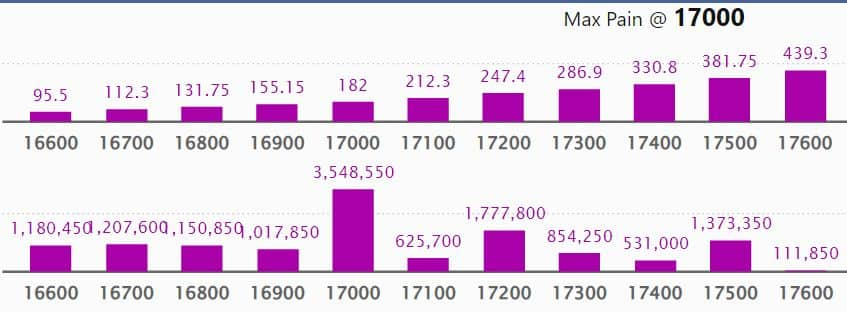

Maximum Put open interest of 45.54 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 16,500 strike, which holds 37.1 lakh contracts, and 17,000 strike, which has accumulated 35.48 lakh contracts.

Put writing was seen at 17,000 strike, which added 12.09 lakh contracts, followed by 17,200 strike, which added 7.33 lakh contracts, and 17,300 strike which added 6.03 lakh contracts.

Put unwinding was seen at 16,000 strike, which shed 2.37 lakh contracts, followed by 16,500 strike which shed 1.65 lakh contracts, and 16,600 strike which shed 81,850 contracts.

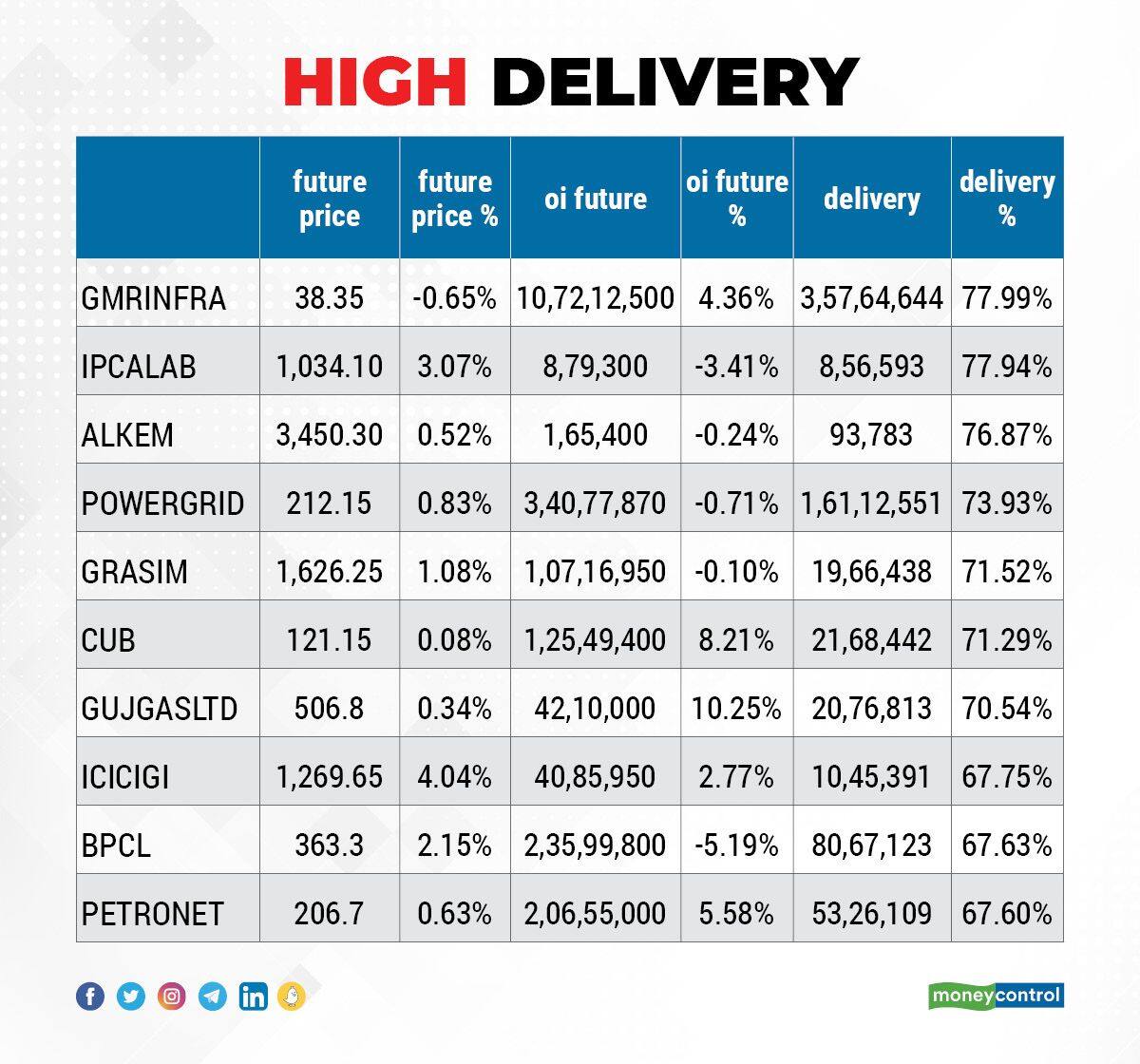

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in GMR Infrastructure, Ipca Laboratories, Alkem Laboratories, Power Grid Corporation, and Grasim Industries among others on Thursday.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including Coromandel International, Whirlpool of India, GNFC, Trent, and United Breweries.

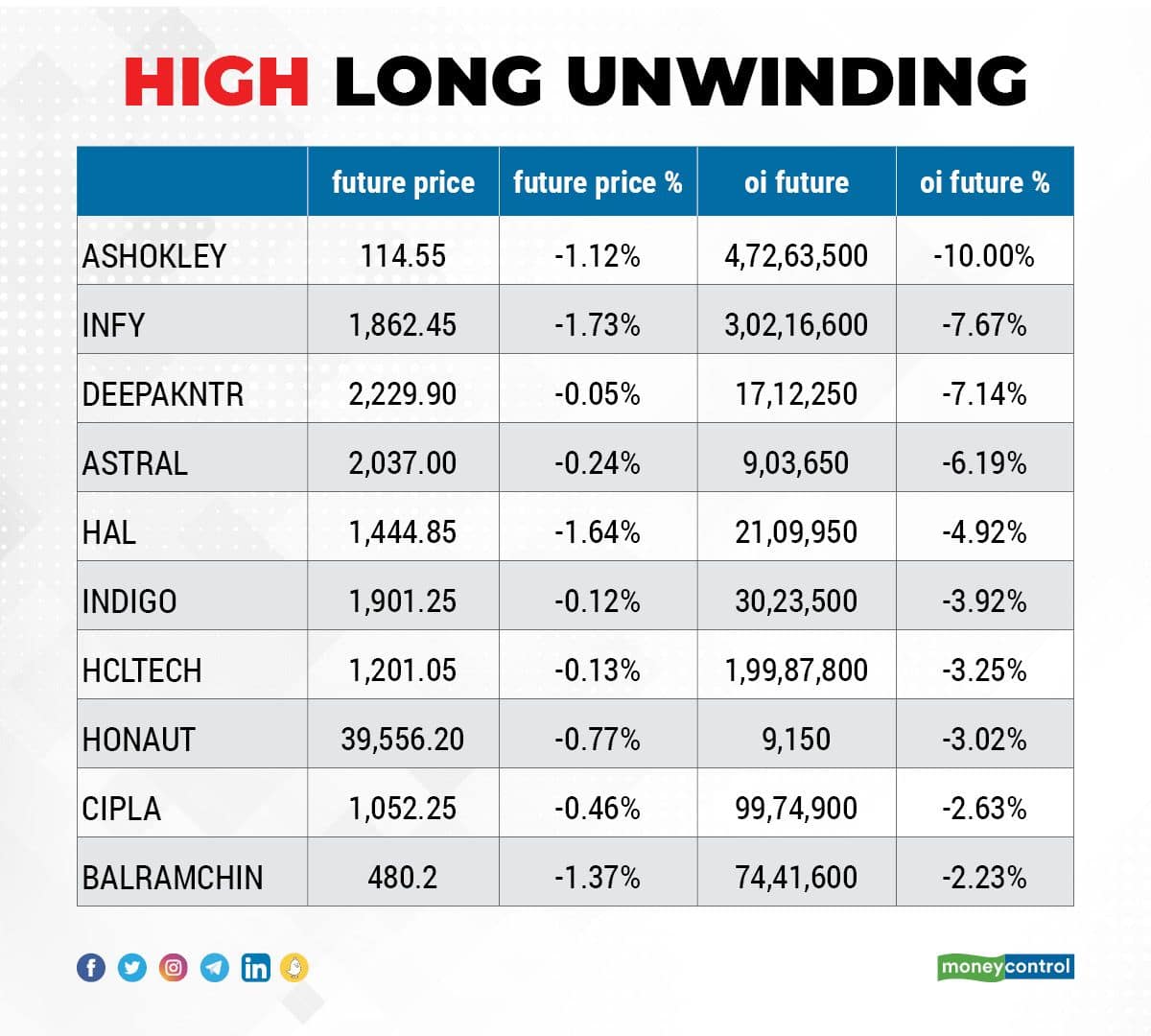

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including Ashok Leyland, Infosys, Deepak Nitrite, Astral, and Hindustan Aeronautics.

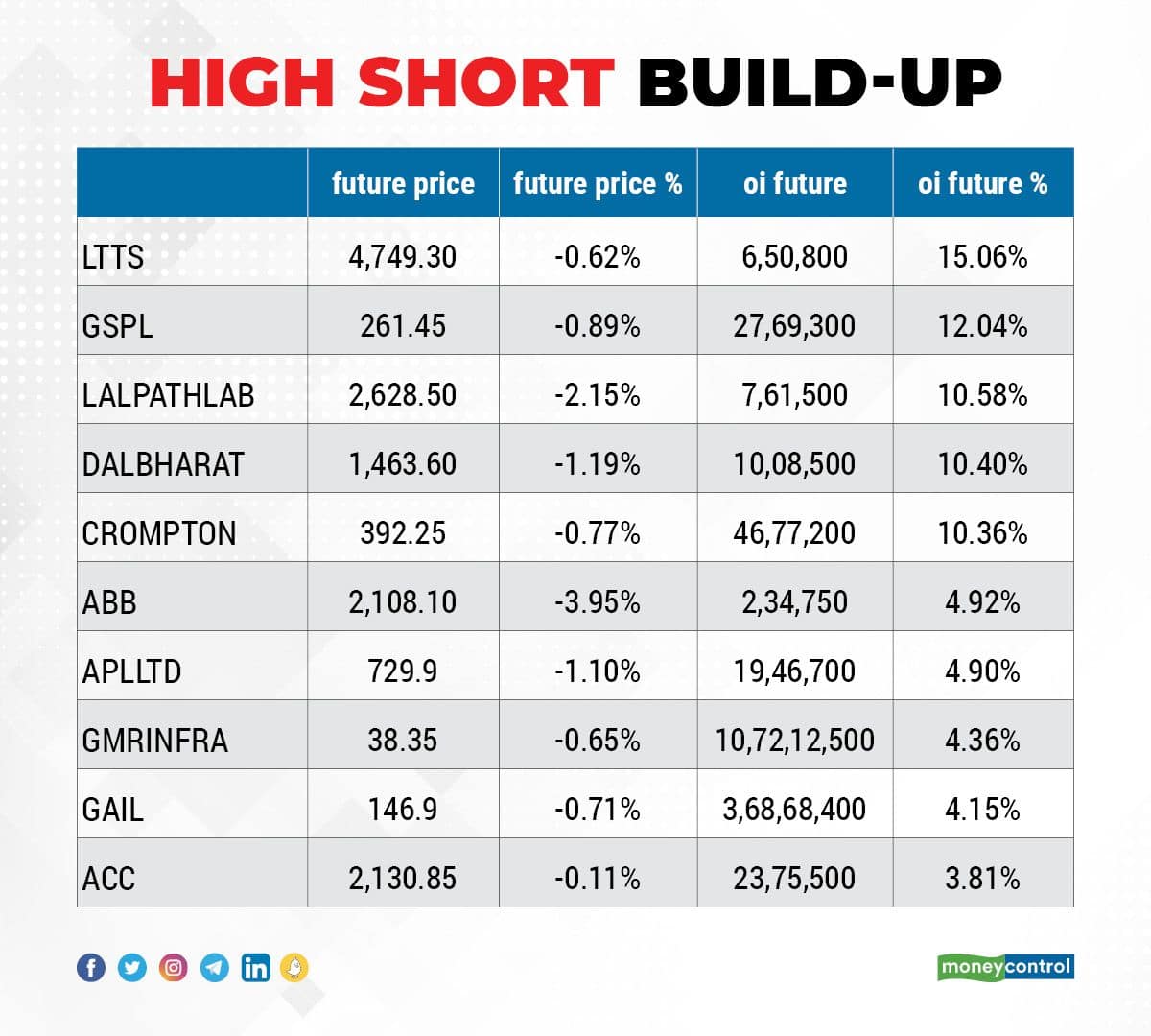

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including L&T Technology Services, Gujarat State Petronet, Dr Lal PathLabs, Dalmia Bharat, and Crompton Greaves Consumer Electricals.

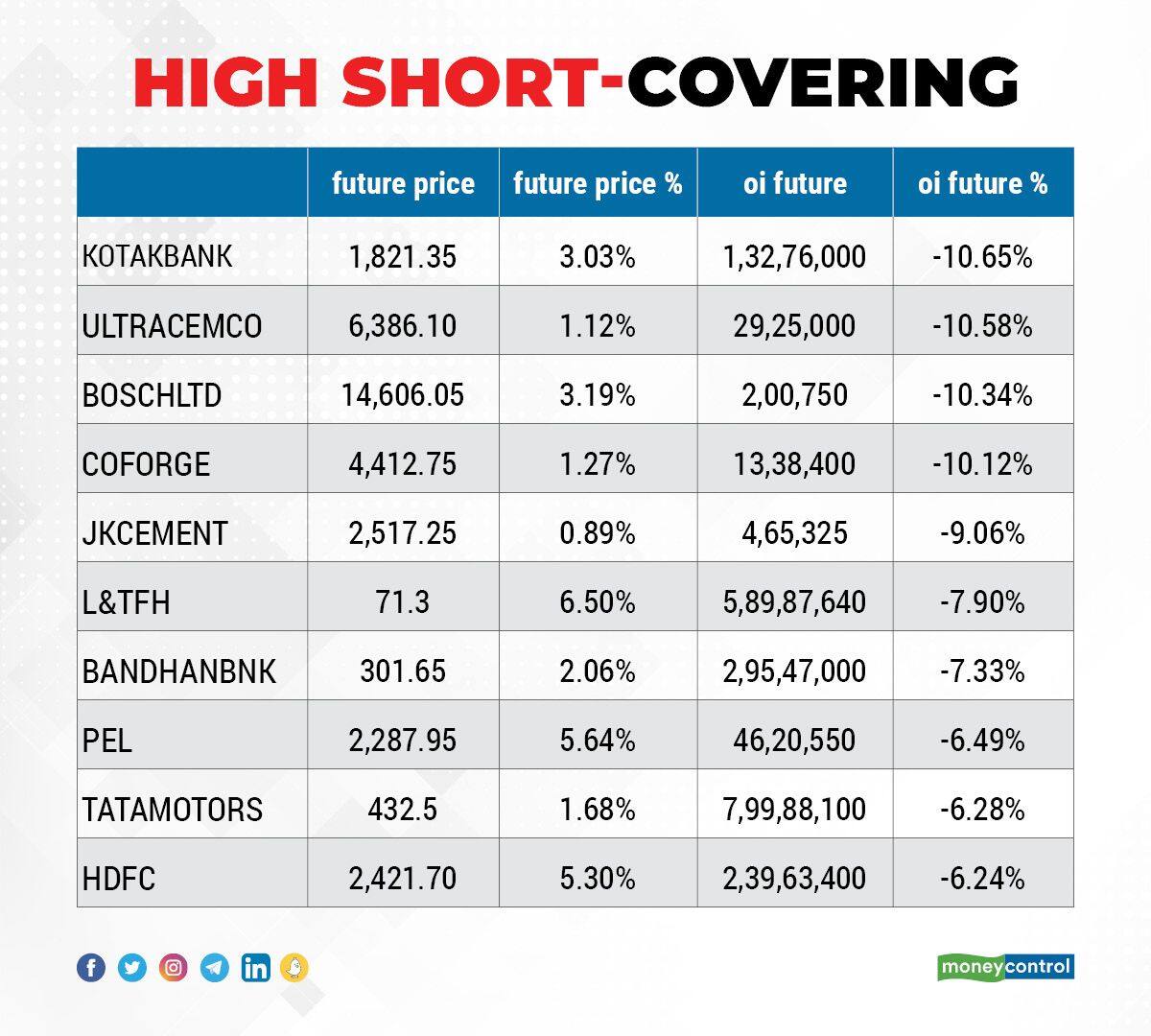

84 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including Kotak Mahindra Bank, UltraTech Cement, Bosch, Coforge, and JK Cement.

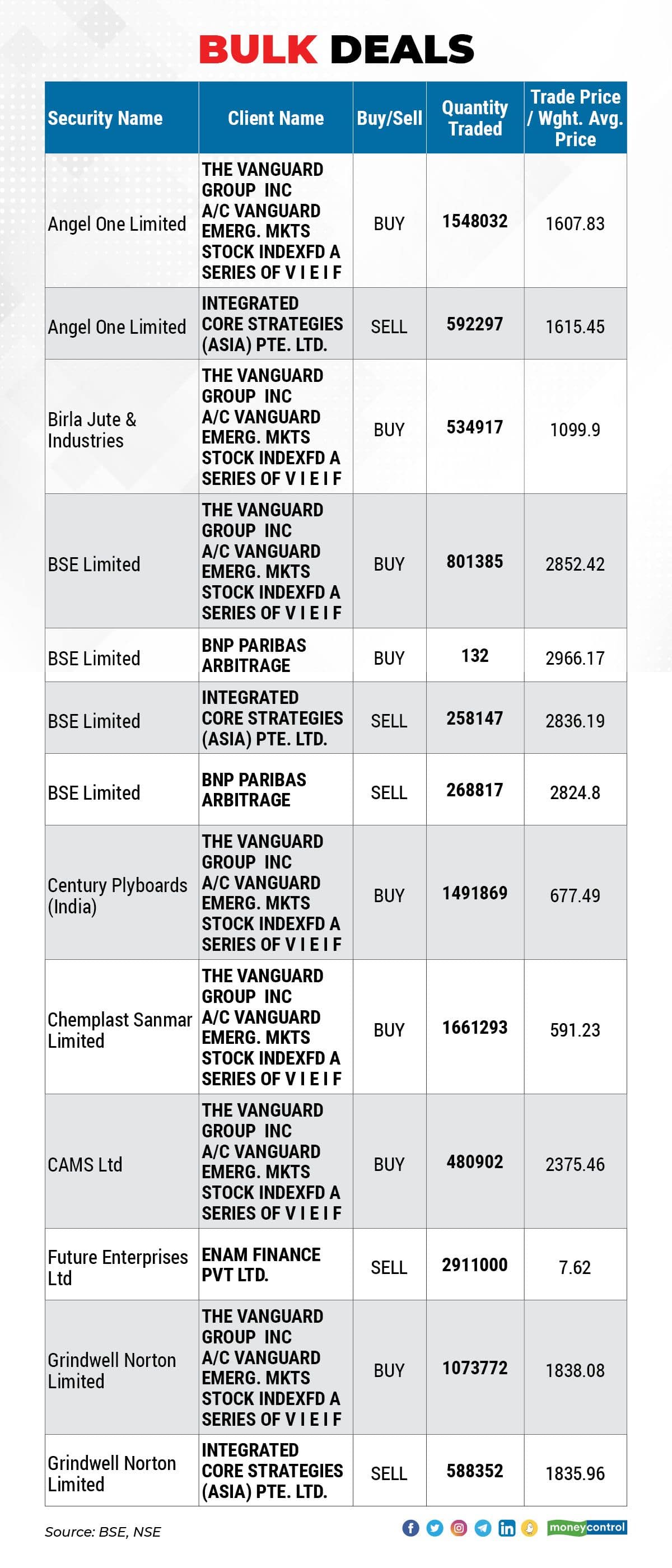

Angel One: American investment advisor The Vanguard Group, Inc-owned Vanguard Emerging Markets Stock Index Fund A Series of VIEIF acquired 15,48,032 equity shares in the brokerage firm via open market transactions, however, Singapore-based investment company Integrated Core Strategies (Asia) Pte Ltd sold 5,92,297 equity shares.

Birla Jute & Industries: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF bought 5,34,917 equity shares in the company via open market transactions.

BSE: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF purchased 8,01,385 equity shares in the company via open market transactions, however, Integrated Core Strategies (Asia) Pte Ltd sold 2,58,147 equity shares.

Century Plyboards (India): Vanguard Emerging Markets Stock Index Fund A Series of VIEIF bought 14,91,869 equity shares in the company via open market transactions.

Chemplast Sanmar: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF purchased 16,61,293 equity shares in the company.

CAMS: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF acquired 4,80,902 equity shares in the company.

Grindwell Norton: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF bought 10,73,772 equity shares in the company, however, Integrated Core Strategies (Asia) Pte Ltd offloaded 5,88,352 equity shares.

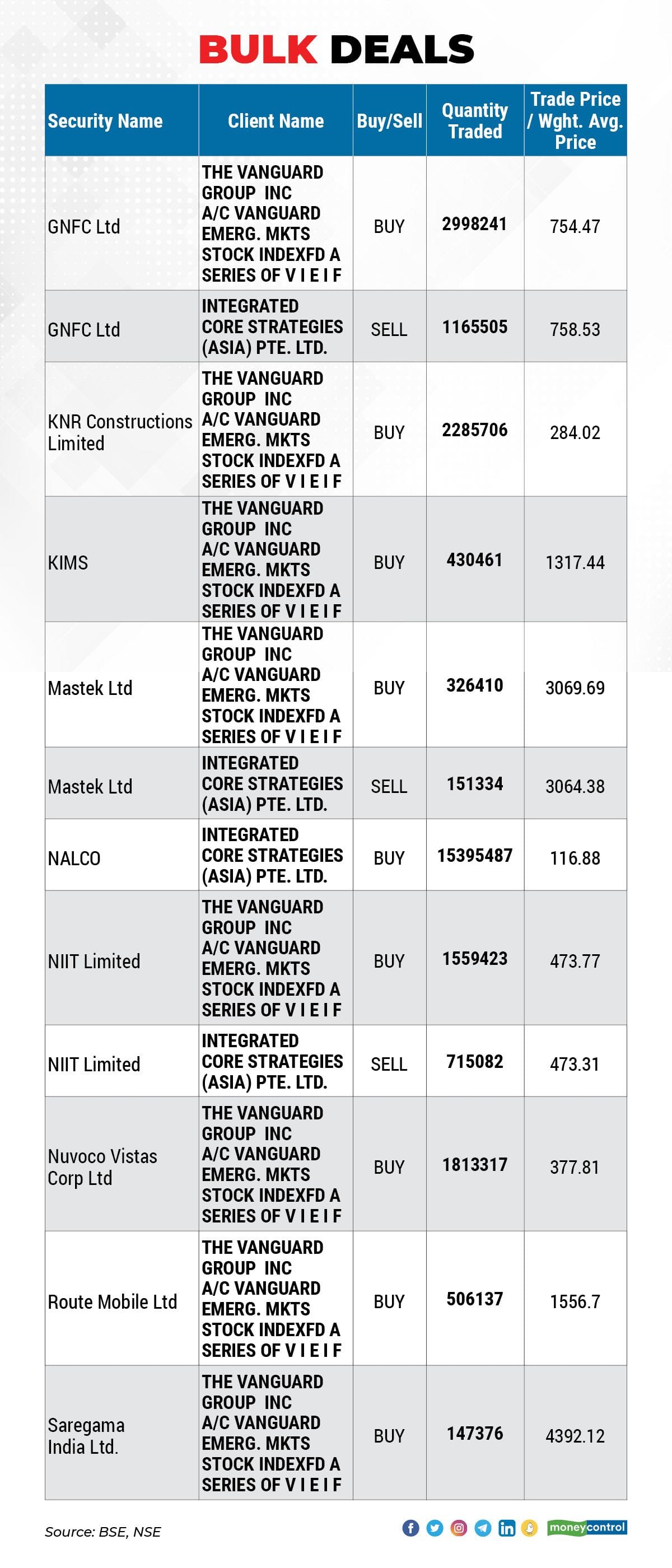

GNFC: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF purchased 29,98,241 equity shares in the company, however, Integrated Core Strategies (Asia) Pte Ltd sold 11,65,505 equity shares.

KNR Constructions: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF bought 22,85,706 equity shares in the company.

KIMS: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF acquired 4,30,461 equity shares in the company.

Mastek: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF bought 3,26,410 equity shares in the company, however, Integrated Core Strategies (Asia) Pte Ltd sold 1,51,334 equity shares.

NALCO: Integrated Core Strategies (Asia) Pte Ltd acquired 1,53,95,487 equity shares in the company.

NIIT: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF purchased 15,59,423 equity shares in the company, however, Integrated Core Strategies (Asia) Pte Ltd offloaded 7,15,082 equity shares.

Nuvoco Vistas Corporation: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF bought 18,13,317 equity shares in the company.

Route Mobile: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF purchased 5,06,137 equity shares in the company.

Saregama India: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF acquired 1,47,376 equity shares in the company.

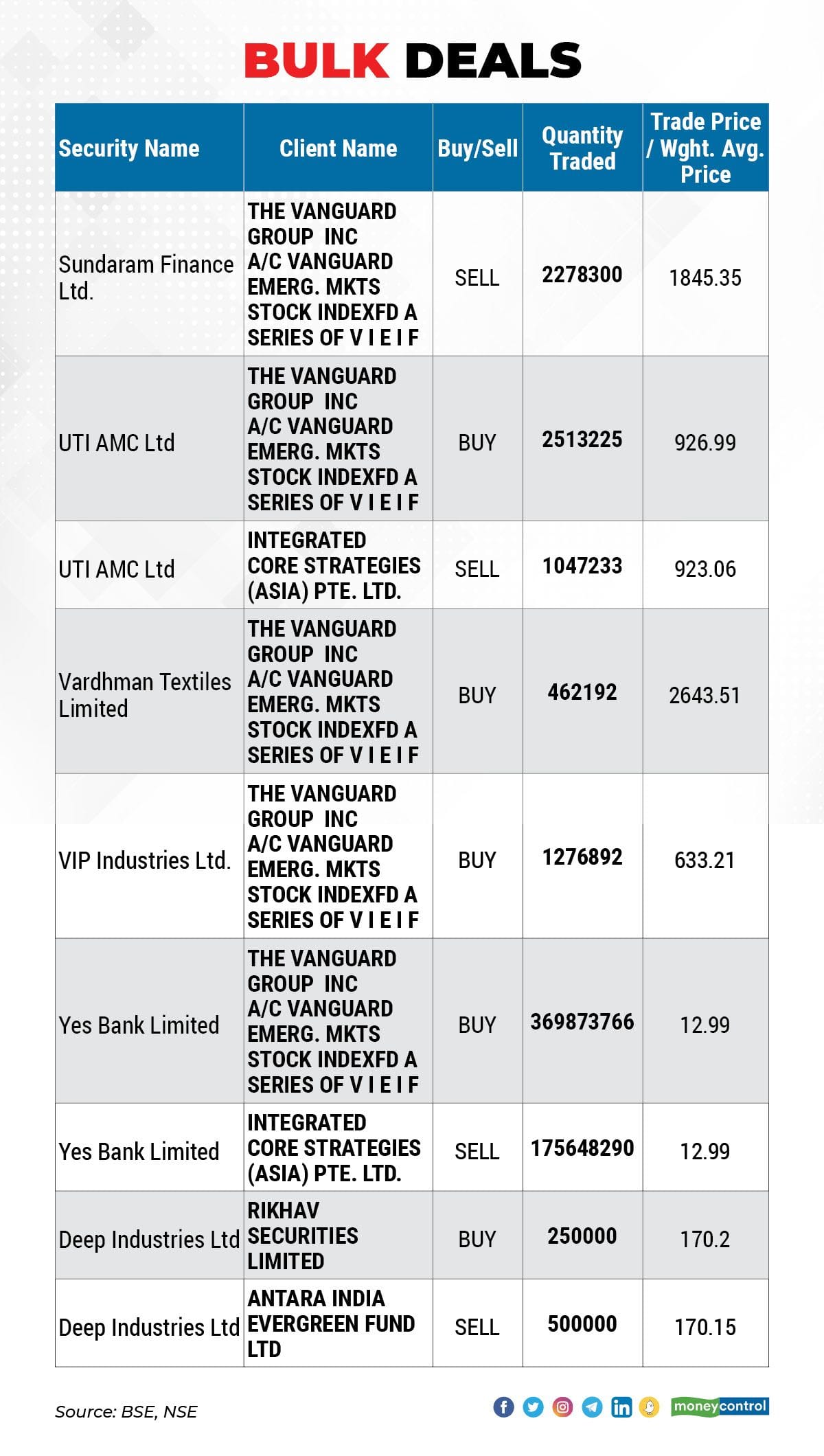

Sundaram Finance: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF sold 22,78,300 equity shares in the company.

UTI AMC: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF bought 25,13,225 equity shares in the company, however, Integrated Core Strategies (Asia) Pte Ltd offloaded 10,47,233 equity shares.

Vardhman Textiles: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF purchased 4,62,192 equity shares in the company.

VIP Industries: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF acquired 12,76,892 equity shares in the company.

Yes Bank: Vanguard Emerging Markets Stock Index Fund A Series of VIEIF bought 36,98,73,766 equity shares in the bank, however, Integrated Core Strategies (Asia) Pte Ltd sold 17,56,48,290 equity shares.

(For more bulk deals, click here)

Analysts/Investors Meetings on March 21

Shriram City Union Finance: The company's officials will meet Mirae Asset Management India.

Can Fin Homes: The company's officials will meet CD Equisearch.

CG Power and Industrial Solutions: The company's officials will meet Karma Capital, Electrum Portfolio Managers, ICICI Prudential Life Insurance, Canara Robeco Mutual Fund, Equirus Securities, and GIC.

Greenlam Industries: The company's officials will meet Nippon MF, and GMO.

IIFL Finance: The company's officials will meet Laburnum Capital, and Omkara Capital.

Bigbloc Construction: The company's officials will meet Yellowstone Equity.

Stocks in News

Cerebra Integrated Technologies: The company has executed a Share Transfer Agreement with a potential purchaser from Dubai for transfer of its entire shareholding of 86.5% in subsidiary Cerebra Middle East FZCO, Dubai. The company would like to focus on E waste management now being the core business of the company. Cerebra will plan expansion in the said area.

KEI Industries: Smallcap World Fund, Inc acquired 6.4 lakh equity shares in the company via open market transactions on March 16. With this, its shareholding in the company stands at 5.02 percent, up from 4.31 percent earlier.

Granules India: The company also received licences from Medicines Patent Pool (MPP) to manufacture and market generic versions of Pfizer's oral treatment nirmatrelvir. This drug will be co-packaged with ritonavir for treatment of COVID-19. The licenses are applicable for both active pharmaceutical ingredients (API) and finished products, in tablet form, of nirmatrelvir; ritonavir.

Gujarat Industries Power Company: The company has stopped power generation from its 145 MW combined cycle power plant, gas-based station-I at Vadodara, due to increasing price of natural gas after the beginning of Ukraine-Russia war. This plant uses natural gas as its fuel for generation of power. The company may resume operations once the gas prices are back to normal levels.

NBCC (India): The company has received a work order from Administration of Union Territory of Ladakh, for providing comprehensive, design, engineering and project management consultant (PMC) services for various works. The estimated cost of the project is Rs 500 crore.

EIH: The board has approved sale of entire shareholding in subsidiary EIH Flight Services, Mauritius for MUR 325 million (Rs 55.2 crore).

HDFC: Subsidiary HDFC Capital Advisors Limited (HCAL) has entered into a share subscription agreement for acquisition of 3,90,666 equity shares of Loyalie IT-Solutions.

Fund Flow

Buying by foreign institutional investors (FIIs) continued for second consecutive session as they have net bought shares worth Rs 2,800.14 crore, while domestic institutional investors (DIIs) have net sold shares worth Rs 678.45 crore on March 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Indiabulls Housing Finance - is under the F&O ban for March 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!