The market failed to sustain the revival that started at the beginning of the day and lost more than 270 points from day's high on the Nifty50 in the last couple of hours of trade to close with moderate loss on January 28, the first day of February series. Heavy consistent FII selling, caution ahead of the Union Budget and weak global cues weighed on the sentiment.

BSE Sensex was down 76.71 points to close at 57,200.23, while the Nifty50 declined 8.20 points to 17,102 and formed a bearish candle which resembles Shooting Star kind of pattern formation on the daily charts. The index corrected 3 percent during the week, forming a bearish candle on the weekly scale.

"The Nifty50 registered a Shooting Star kind of bearish formation, with the upper shadow hinting that a pull-back attempt might have ended at an intraday high of 17,373. Moreover, on closing basis this still seems to be the lowest close of the current leg of downswing despite last three sessions of pull-back attempt from the recent lows of 16,836," says Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisors, at Chartviewindia.

In the next trading session, he says, if the Nifty50 fails to sustain above the 17,077 levels, then it may initially test 16,836 levels and below that, it can test 200-day moving average placed around 16,604.

"If bulls manage to defend the 17,100 levels in the next session and puts it beyond 17,373, then eventually the consolidation zone can remain between 17,600 and 16,900 levels," Mohammad says.

As market is heading into the major economic events lined up over the next two trading sessions, the trend is likely to remain influenced by those events in the very short term, according to him.

But the broader markets posted stunning performance as the Nifty Midcap 100 index gained 1.5 percent and Smallcap 100 index rose nearly 1 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,994.83, followed by 16,887.77. If the index moves up, the key resistance levels to watch out for are 17,291.23 and 17,480.57.

The Nifty Bank fell 292.70 points to close at 37,689.40 on January 28. The important pivot level, which will act as crucial support for the index, is placed at 37,373.37, followed by 37,057.34. On the upside, key resistance levels are placed at 38,213.57 and 38,737.73 levels.

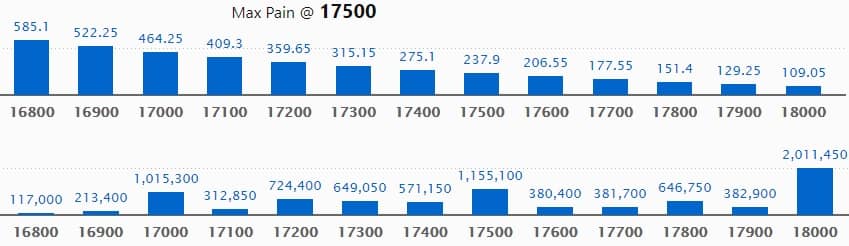

Maximum Call open interest of 20.11 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 17,500 strike, which holds 11.55 lakh contracts, and 17,000 strike, which has accumulated 10.15 lakh contracts.

Call writing was seen at 18,000 strike, which added 3.35 lakh contracts, followed by 17,400 strike which added 2.4 lakh contracts, and 17,200 strike which added 2.22 lakh contracts.

Call unwinding was seen at 16,900 strike, which shed 43,950 contracts, followed by 16,500 strike which shed 17,350 contracts and 17,000 strike which shed 8,950 contracts.

Maximum Put open interest of 37.15 lakh contracts was seen at 16,500 strike, which will act as a crucial support level in the February series.

This is followed by 16,000 strike, which holds 22.93 lakh contracts, and 17,000 strike, which has accumulated 23.18 lakh contracts.

Put writing was seen at 18,000 strike, which added 3.13 lakh contracts, followed by 16,000 strike, which added 3.07 lakh contracts, and 17,900 strike which added 2.71 lakh contracts.

Put unwinding was seen at 17,600 strike, which shed 19,350 contracts, followed by 16,700 strike which shed 16,350 contracts, and 17,700 strike which shed 10,100 contracts.

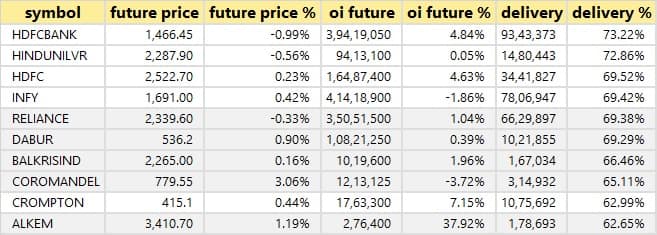

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

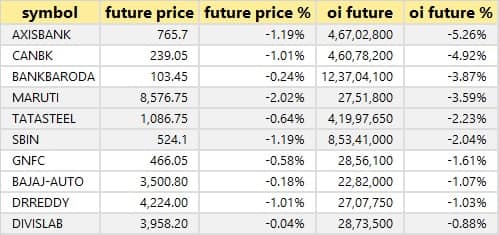

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

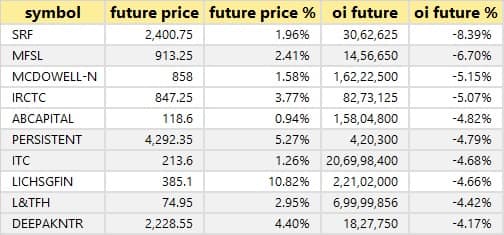

62 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Inventure Growth & Securities: Parth Harilal Rita sold 44.5 lakh equity shares in the company, Shantilal Bhachubhai Rita sold 44.5 lakh shares, Harilal Bachubhai Rita HUF offloaded 83 lakh shares, Harilal Bhachubhai Rita sold 72.5 lakh shares and Jinisha Harilal Rita offloaded 44.5 lakh shares at Rs 4.95 per share on the NSE, the bulk deals data showed.

Ganesha Ecosphere: BOFA Securities Europe SA acquired 1,62,830 equity shares in the company at Rs 624.51 per share, and Rohan Gupta bought 2 lakh shares at Rs 585 per share on the NSE, however, Mcap India Fund sold 5.5 lakh shares at Rs 585 per share on the NSE and 3 lakh shares at Rs 589.54 per share on the BSE, the bulk deals data showed.

Welspun Corp: Cohesion MK Best Ideas Sub Trust bought 14 lakh shares in the company at Rs 178 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 31

Results on January 31: More than 100 companies will release their quarterly earnings on January 31 including Tata Motors, BPCL, HPCL, Indian Oil Corporation, UPL, Sun Pharmaceutical Industries, DLF, Aarti Drugs, ADF Foods, Ajanta Pharma, LT Foods, Dwarikesh Sugar Industries, Edelweiss Financial Services, Exide Industries, GIC Housing Finance, Housing Development & Infrastructure, Hester Biosciences, Infibeam Avenues, Jindal Saw, KEC International, KPIT Technologies, Krsnaa Diagnostics, Navin Fluorine International, Satin Creditcare Network, Shipping Corporation of India, Suven Life Sciences, UCO Bank, Venus Remedies, and Voltamp Transformers.

UltraTech Cement: The company's officials will meet HDFC Life Insurance Company on January 31.

Bharat Electronics: The company's officials will meet investors on January 31, to discuss financial results.

NACL Industries: The company's officials will meet investors on January 31, to discuss financial results.

Arvind: The company's officials will meet Myriad Asset Management on January 31.

Satin Creditcare Network: The company's officials will meet investors and analysts on February 2, to discuss financial results.

ADF Foods: The company's officials will meet investors and analysts on February 2, to discuss financial results.

Sheela Foam: The company's officials will meet investors and analysts on February 3, to discuss financial results.

GE T&D India: The company's officials will meet institutional investors and analysts on February 4, to discuss financial results.

Ujjivan Small Finance Bank: The company's officials will meet investors and analysts on February 7, to discuss financial results.

Alembic Pharmaceuticals: The company's officials will meet investors and analysts on February 10, to discuss financial results.

Stocks in News

Britannia Industries: The company reported lower profit at Rs 369.18 crore in Q3FY22 against Rs 452.64 crore in Q3FY21, revenue increased to Rs 3,574.98 crore from Rs 3,165.61 crore YoY.

SJVN: The company has bagged order to supply 200 MW of solar power in Bihar for 25 years.

IndusInd Bank: The bank reported sharply higher profit at Rs 1,161.27 crore in Q3FY22 against Rs 852.76 crore in Q3FY21, net interest income increased to Rs 3,793.57 crore from Rs 3,406.1 crore YoY.

NTPC: The company recorded higher profit at Rs 4,626.11 crore in Q3FY22 against Rs 3,876.36 crore in Q3FY21, revenue jumped to Rs 33,292.61 crore from Rs 27,526.03 crore YoY.

Marico: The company clocked higher profit at Rs 317 crore in Q3FY22 against Rs 312 crore in Q3FY21, revenue increased to Rs 2,407 crore from Rs 2,122 crore YoY.

L&T: The company recorded lower profit at Rs 2,054.74 crore in Q3FY22 against Rs 2,466.7 crore in Q3FY21, revenue jumped to Rs 39,562.92 crore from Rs 35,596.42 crore YoY.

Fund Flow

Foreign institutional investors (FIIs) net sold shares worth Rs 5,045.34 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 3,358.67 crore in the Indian equity market on January 28, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

As we are in the beginning of February series, not a single stock is under the F&O ban for January 31. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!