The market corrected more than 100 points on the Nifty50 and over 450 points on the BSE Sensex but the sharp recovery in afternoon trade helped benchmark indices close flat on January 14 despite negative sentiment in global peers.

The market closed flat after making a sharp recovery in the afternoon trade on January 14 despite negative global cues.

The BSE Sensex closed 12.3 points down at 61,223, while the Nifty50 declined 2 points to 18,256 and formed a bullish candle on the daily charts as the closing was higher than opening levels.

It formed a bullish candle on the weekly scale too, as the Nifty gained 2.5 percent for the week.

Though the last three trading sessions looked somewhat indecisive with weak intraday moves, a bullish candle on the weekly charts raised hopes of lifetime highs once again, said Mazhar Mohammad, Chief Strategist–Technical Research & Trading Advisory at Chartviewindia.in.

Despite remaining weak for the major part of the trading session on January 14, the Nifty saw buying interest on dip as it entered into the bullish gap zone of 18,128 – 18,081, giving it legitimacy as the critical short-term support.

If it sustains above 18,081, the Nifty can test lifetime highs of 18,600, he said.

A breach of 18,080 on a closing basis can usher in a short-term downtrend, said Mohammad. Short-term traders should buy above 18,300 and look for a target between 18,550 and 18,600, with a stop-loss below the intraday low.

On the broader markets front, the Nifty Midcap 100 index was flat and the Nifty smallcap 100 index gained 0.75 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks is the aggregate of three-month data and not of the current month only.Key support and resistance levels for Nifty

According to pivot charts, the key support levels for the Nifty are placed at 18,154.7 followed by 18,053.6. If the index moves up, the key resistance levels to watch out for are 18,321.9 and 18,388.

Nifty Bank

The Nifty Bank remained under pressure, declining 99.50 points to close at 38,370.40 on January 14. The important pivot level, which will act as crucial support for the index, is at 38,102.77 followed by 37,835.13. On the upside, key resistance levels are 38,543.07 and 38,715.73.

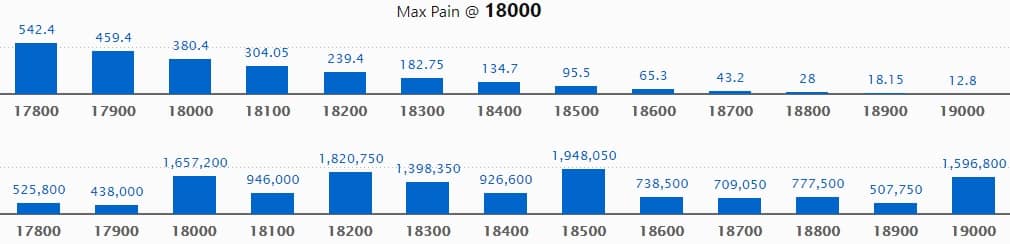

Call option data

Maximum Call open interest of 19.48 lakh contracts was seen at 18,500 strike, which will act as a crucial resistance level in the January series.

This was followed by 18,200 strike, which holds 18.2 lakh contracts, and 18,000 strike, which has accumulated 16.57 lakh contracts.

Call writing was seen at 18,200 strike, which added 5.5 lakh contracts, followed by 18,100 strike, which added 2.6 lakh contracts, and 19,000 strike that added 2.48 lakh contracts.

Call unwinding was seen at 17,900 strike, which shed 76,800 contracts, followed by 18000 strike, which shed 43,050 contracts and 17,700 strike that shed 37,800 contracts.

Put option data

Maximum Put open interest of 27.04 lakh contracts was seen at 18,000 strike, which will act as a crucial support in the January series.

This is followed by 17,500 strike, which holds 24.75 lakh contracts, and 17,200 strike, which has accumulated 16.71 lakh contracts.

Put writing was seen at 18,200 strike, which added 5.9 lakh contracts, followed by 18,100 strike, which added 3.11 lakh contracts, and 18,000 strike that added 2.74 lakh contracts.

Put unwinding was seen at 17,500 strike, which shed 3.91 lakh contracts, followed by 17,200 strike that shed 88,700 contracts and 17300 strike, which shed 52,950 contracts.

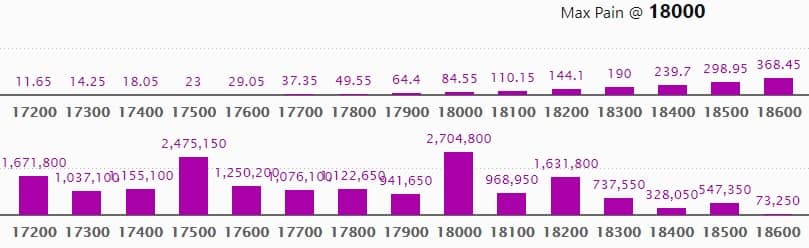

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

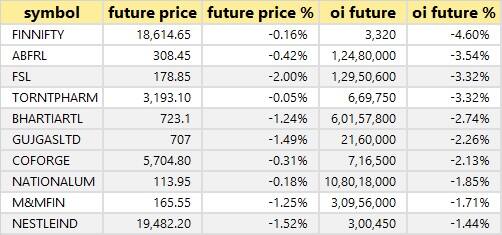

53 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

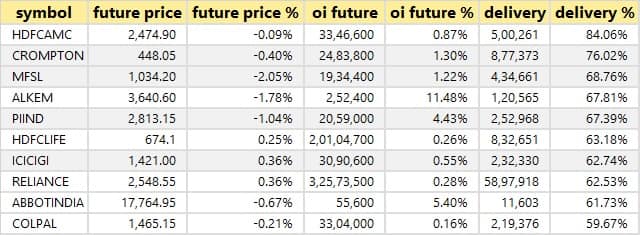

32 stocks saw long unwinding

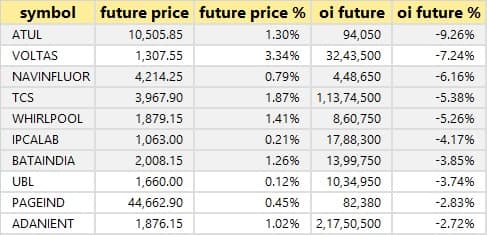

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

74 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

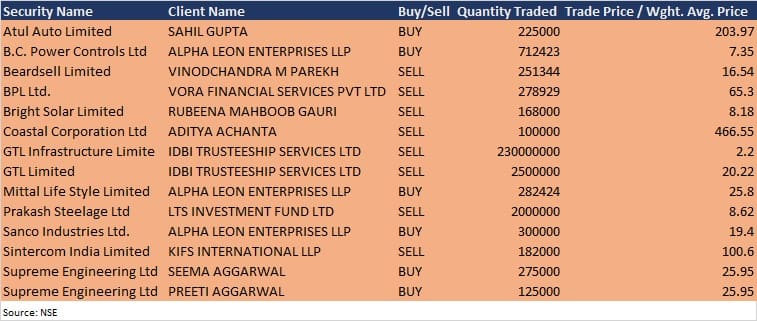

Bulk deals

(For more bulk deals, click here)

Analysts, investors meetings and results on January 17

Results on January 17: UltraTech Cement, Angel One, HFCL, Sonata Software, Tata Steel Long Products, Tatva Chintan Pharma Chem, Advik Capital, Arfin India, Artson Engineering, Bhansali Engineering Polymers, Fineotex Chemical, Goodluck India, Hathway Cable & Datacom, KIC Metaliks, KP Energy, KPI Global Infrastructure, Maharashtra Scooters, Moschip Technologies, Poddar Pigments, Tiger Logistics (India), and Vikas EcoTech will release quarterly earnings on January 17.

Jet Freight Logistics: The company's officials will meet Anand Rathi Financial Services, Equirus Capital, & Philip Capital (India) on January 17.

Tatva Chintan Pharma Chem: The company's officials will meet analysts and investors on January 18 to discuss financial results.

Goodluck India: The company's officials will meet investors and analysts on January 19 to discuss financial results.

South Indian Bank: The company's officials will meet analysts and investors on January 21 to discuss financial results.

Greenpanel Industries: The company's officials will meet investors and analysts on January 24, to discuss financial results.

Stocks in News

HDFC Bank: The bank reported a higher standalone profit at Rs 10,342.2 crore in December 2021 quarter against Rs 8,758.3 crore in the year-ago period. Its net interest income rose to Rs 18,443.48 crore from Rs 16,317.61 crore YoY.

Metro Brands: The company reported a sharply higher consolidated profit at Rs 101.61 crore in December 2021 quarter against Rs 66.32 crore in December 2020 quarter. The company's revenue jumped to Rs 483.77 crore from Rs 304.21 crore YoY.

HSIL: The company has approved the transfer of its business of manufacturing, on contract basis, of sanitaryware, faucets and plastic pipes (PVC and CPVC) and fittings (BPD undertaking) to Brilloca on a slump sale basis for Rs 630 crore.

HCL Technologies: The company reported a profit of Rs 3,442 crore for the December quarter, up 5.4 percent from the previous quarter. The IT firm's revenue came at Rs 22,331 crore, up 8.1 percent QoQ. The company also acquired Starschema, a leading provider of data engineering services, based in Budapest, Hungary.

KPI Global Infrastructure: The company has signed a new long-term power purchase agreement (PPA) for the sale of 3.10 MW (AC) / 4.12 MW (DC) solar power with Cadila Healthcare & Organic Industries under the Independent Power Producer (IPP) segment.

Dalmia Bharat: Dalmia Cement commenced commercial production at its Murli plant in Chandrapur district of Maharashtra, adding 2.9 million tonnes cement capacity.

Oil India: Subsidiary Oil India (USA) Inc, a Texas, USA corporation, divested its entire stake in Niobrara Shale Asset, USA.

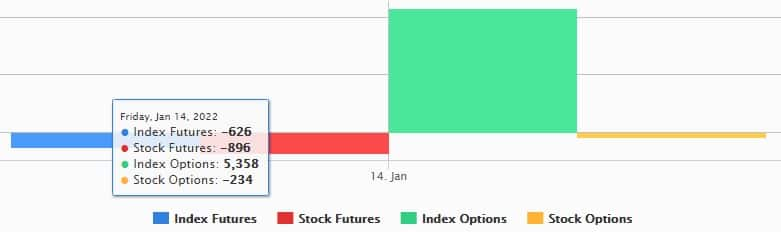

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,598.20 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 371.41 crore in the Indian market on January 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks—Escorts, Indiabulls Housing Finance, Vodafone Idea, and SAIL —are under the F&O ban for January 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!