The market nosedived further with the BSE Sensex falling way below the 60,000 mark, dragged by selling in all sectors with Auto, IT, Metal and Pharma being the prominent losers on November 18.

The BSE Sensex plunged 433.05 points to close at 59,575.28, while the Nifty50 fell 133.90 points to 17,764.80 and formed a bearish candle on the daily charts, continuing the downtrend for the third consecutive session. The index also saw bearish candle formation on the weekly charts as it was down 1.87 percent during the week.

"A long negative candle was formed on the daily chart with upper and lower shadow. This reflects the extent of decline with high volatility on the day of weekly F&O expiry of Thursday," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

"Nifty is now placed at the edge of the support of ascending trend line, which is connected through previous swing lows at 17,750 levels. This is not a good sign and signals chances of downside breakout of the trend line support in the short term," he pointed out.

Shetti feels that the short term trend of Nifty continues to be weak. "The overall negative chart pattern as per daily and weekly chart shows that the present key support of 17,700 could be broken in the short term and that could open a larger downward correction down to 17,200-17,100 levels in the next few weeks. Any attempt of upside bounce from here could find resistance around 17,850-17,900 levels," he noted.

The correction in broader markets was higher than benchmark indices. The Nifty Midcap 100 index fell 1.44 percent and Smallcap 100 index declined 1.63 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,653.67, followed by 17,542.54. If the index moves up, the key resistance levels to watch out for are 17,910.77 and 18,056.73.

Nifty Bank

The Nifty Bank closed with a loss of 65.30 points at 37,976.25 on November 18. The important pivot level, which will act as crucial support for the index, is placed at 37,738.44, followed by 37,500.67. On the upside, key resistance levels are placed at 38,223.94 and 38,471.67 levels.

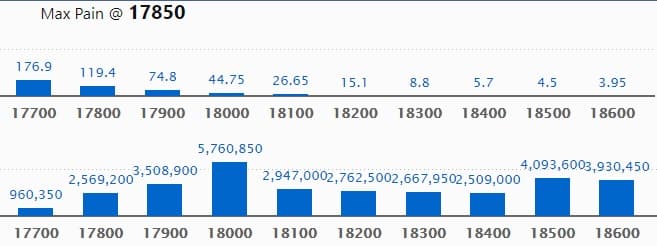

Call option data

Maximum Call open interest of 57.60 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the November series.

This is followed by 18500 strike, which holds 40.93 lakh contracts, and 18600 strike, which has accumulated 39.30 lakh contracts.

Call writing was seen at 18600 strike, which added 2.67 lakh contracts, followed by 17900 strike, which added 26.71 lakh contracts and 18000 strike which added 25.89 lakh contracts.

Call unwinding was seen at 17000 strike, which shed 12,800 contracts.

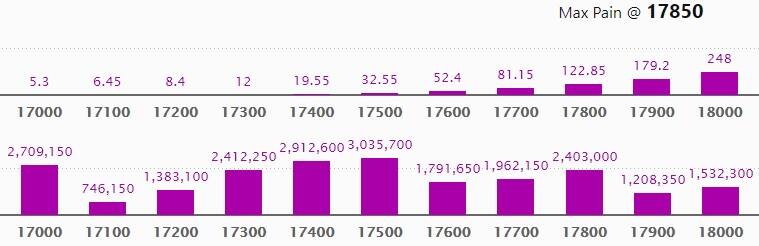

Put option data

Maximum Put open interest of 30.35 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the November series.

This is followed by 17400 strike, which holds 29.12 lakh contracts, and 17000 strike, which has accumulated 27.09 lakh contracts.

Put writing was seen at 17300 strike, which added 11.08 lakh contracts, followed by 17000 strike which added 10.25 lakh contracts and 17200 strike which added 5.73 lakh contracts.

Put unwinding was seen at 18000 strike, which shed 4.31 lakh contracts, followed by 18100 strike which shed 2.08 lakh contracts, and 18200 strike which shed 1.53 lakh contracts.

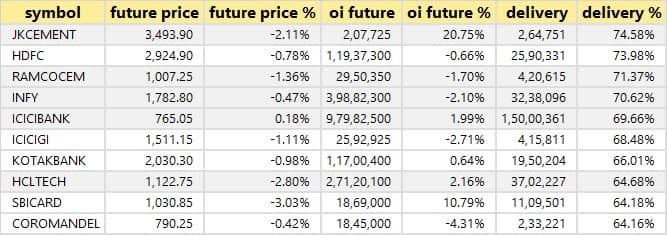

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

12 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

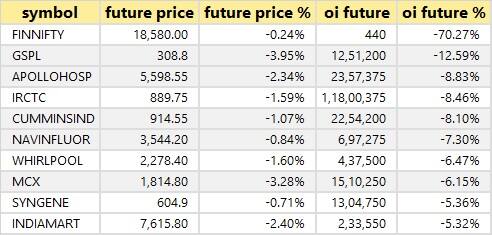

97 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

69 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

11 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

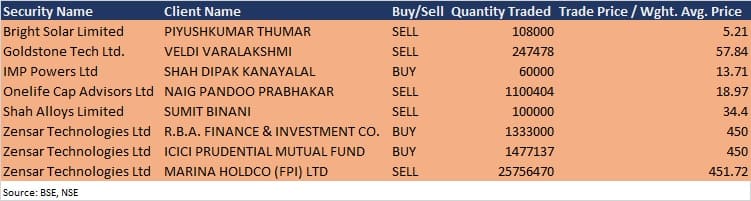

Bulk deals

Zensar Technologies: R.B.A. Finance & Investment acquired 13.33 lakh equity shares in the company at Rs 450 per share, and ICICI Prudential Mutual Fund bought 14,77,137 equity shares in the company at the same price. However, Marina Holdco (FPI) exited by selling 2,57,56,470 equity shares in the company at Rs 451.72 per share on the BSE, the bulk deals data showed.

Onelife Cap Advisors: Promoter Naig Pandoo Prabhakar further sold 11,00,404 equity shares in the company at Rs 18.97 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Cipla: The company's officials will meet Stewart Investors on November 22, and Aikya Investment Management on November 23.

TCI Express: The company's officials will meet Fidelity International on November 22.

Meghmani Organics: The company's officials will meet Sarath Capital Management on November 22.

Sundram Fasteners: The company's officials will meet JP Morgan Asset Management on November 22.

Gulshan Polyols: The company's officials will meet Camelian Capital on November 22, and Unifi Capital on November 23.

Krishna Institute of Medical Sciences: The company's officials will meet Ashmore Investment Management on November 22.

United Breweries: The company's officials will meet Vinay Agarwal & Team on November 22, Kotak Mutual Fund-ESG on November 24, and Wasatch Advisors on November 26.

Asian Paints: The company's officials will meet Marcellus Investment Managers on November 22, and Enam Asset Management on November 23.

Shoppers Stop: The company's officials will meet Blue Coast Capital (a UK-based Fund) on November 22.

Symphony: The company's officials will participate in Motilal Oswal Ideation Conference, 2021, on December 3.

Stocks in News

Motherson Sumi Systems: Ningbo SMR Huaxiang Automotive Mirrors (SMR-NBHX), a 50:50 joint venture in China between Samvardhana Motherson Reflectec and Ningbo Huaxiang Electronic Co (NBHX Trim Group), has completed the acquisition of a 60 percent stake in Nanchang JMCG Mekra Lang Vehicle Mirror Co Ltd.

IRCTC: The Ministry of Railways has withdrawn its decision to terminate all existing contracts of mobile catering (currently kept in abeyance) involving the scope of work of providing cooked food to passengers prepared from base kitchens as per the existing terms and conditions. In a separate release, the ministry has conveyed the decision to resume the services of cooked food in trains.

Cadila Healthcare: Zydus Cadila has received final approval from the USFDA to market Decitabine for injection in the strength of 50 mg/vial single-dose vial. Decitabine is used to treat myelodysplastic syndromes, certain types of blood or bone marrow cancer.

Kesoram Industries: Board approved to raise funds up to Rs 2,500 crore by way of equity, bond, FCCB, ADR, GDR, commercial paper and/or other debt instruments. This fundraising is primarily to retire the company's existing debt and bring down the cost of borrowing.

India Grid Trust: Consortium of IndiGrid 1 and IndiGrid 2 participated in the tariff-based competitive bidding to establish 'Transmission system for evacuation of power from Renewable (RE) projects in Osmanabad area (1 GW) in Maharashtra' on build, own, operate and maintain (BOOM) basis by REC Power Development and Consultancy. The estimated cost for the same is around Rs 170 crore. The company awaits receipt of Letter of Intent.

Amber Enterprises India: The company and its subsidiary IL JIN Electronics India have received approval from the Ministry of Commerce & Industry under the Production-Linked Incentive scheme for white goods (air conditioners).

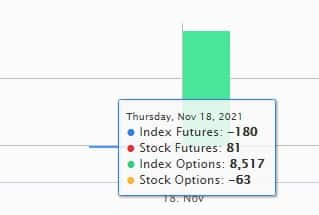

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 3,930.62 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,885.66 crore in the Indian equity market on November 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - BHEL, Escorts, Vodafone Idea, NALCO, SAIL and Sun TV Network - are under the F&O ban for November 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!