After suffering losses for two days, the market rebounded during the muhurat trading on November 4, with the Nifty50 closing above 17,900. All sectoral indices, barring metal, participated in the run.

The BSE Sensex settled trade above 60,000 mark, rising 295.70 points to 60,067.62, while the Nifty50 climbed 87.60 points to 17,916.80 and formed bearish candle which resembles Doji kind pattern formation on the daily charts. The index gained 1.4 percent during the week and saw bullish candle pattern formation on the weekly scale.

"We believe 18,050 (20-Day SMA) is going to act as a strong resistance in the near future. We can expect the index to correct further and move towards 17,432 or move sideways as long as the prices are below the 18,050 mark," said Karan Pai, Technical Analyst at GEPL Capital.

He further said, "If the Index manages to breach above the 20-Day SMA, we can assume that the profit booking and the correction has come to an end and the index might resume its up move towards 18,400 and 18,600 and eventually towards the fresh life time highs."

The gains in broader markets were higher compared to benchmarks, as the Nifty Midcap 100 index rose 0.79 percent and Smallcap 100 index climbed 1.3 percent.

The market was shut on November 5 for Diwali Balipratipada.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,895.73, followed by 17,874.67. If the index moves up, the key resistance levels to watch out for are 17,942.73 and 17,968.67.

Nifty Bank

The Nifty Bank rose 171.65 points to close at Rs 39,573.70 on November 4, trading in line with benchmarks. The important pivot level, which will act as crucial support for the index, is placed at 39,480.3, followed by 39,386.9. On the upside, key resistance levels are placed at 39,700.9 and 39,828.1 levels.

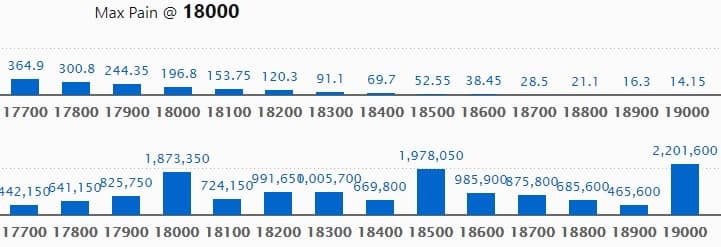

Call option data

Maximum Call open interest of 22.01 lakh contracts was seen at 19000 strike, which will act as a crucial resistance level in the November series.

This is followed by 18500 strike, which holds 19.78 lakh contracts, and 18000 strike, which has accumulated 18.73 lakh contracts.

Call writing was seen at 18700 strike, which added 36,950 contracts, followed by 18300 strike, which added 28,800 contracts and 18500 strike which added 21,050 contracts.

Call unwinding was seen at 19000 strike, which shed 56,550 contracts, followed by 18000 strike which shed 55,400 contracts and 17800 strike which shed 37,850 contracts.

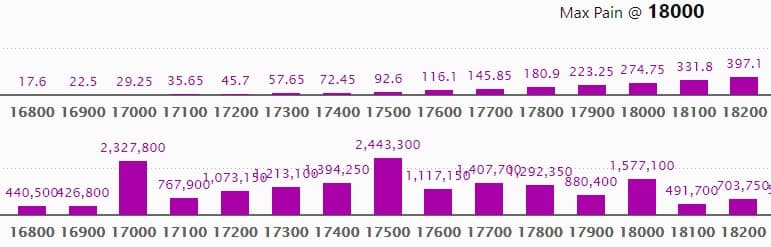

Put option data

Maximum Put open interest of 24.43 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the November series.

This is followed by 17000 strike, which holds 23.27 lakh contracts, and 18000 strike, which has accumulated 15.77 lakh contracts.

Put writing was seen at 17600 strike, which added 19,700 contracts, followed by 18100 strike which added 14,800 contracts and 17900 strike which added 11,650 contracts.

Put unwinding was seen at 17000 strike, which shed 56,300 contracts, followed by 17800 strike which shed 16,150 contracts, and 17300 strike which shed 15,300 contracts.

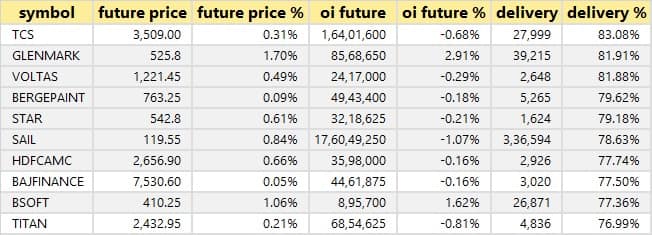

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

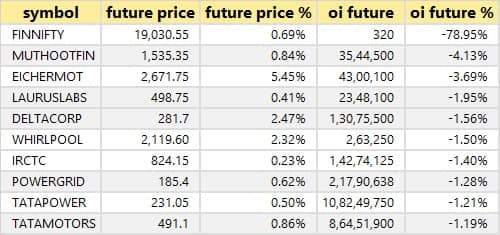

64 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

10 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 10 stocks in which long unwinding was seen.

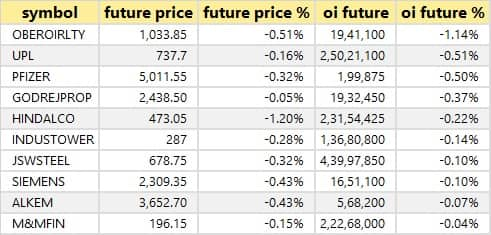

17 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

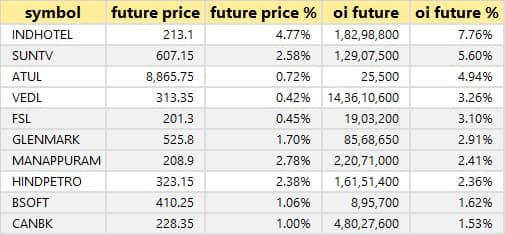

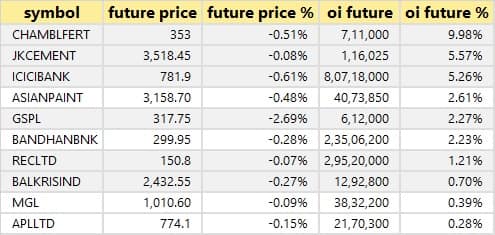

98 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Results Calendar

Results on November 8: Britannia Industries, Aurobindo Pharma, Sobha, 3i Infotech, Action Construction Equipment, Balrampur Chini Mills, Elgi Equipments, GVK Power & Infrastructure, HG Infra Engineering, KRBL, MM Forgings, PTC India Financial Services, Pricol, RSWM, Shankara Building Products, Shyam Metalics and Energy, Talbros Automotive Components, Ujjivan Small Finance Bank, Vijaya Diagnostic Centre, V-Mart Retail, and Wockhardt will release September quarter earnings on November 8.

Analysts/Investors Meeting

IDFC First Bank: The company's officials will attend Credit Suisse India Financials Trip - 2021 on November 8.

Muthoot Finance: The company's officials will meet analysts and investors on November 8, to discuss Q2FY22 results.

RSWM: The company's officials will meet investors on November 9, to discuss financial performance.

Pitti Engineering: The company's officials will meet investors on November 10, to discuss financial results.

Somany Home Innovation: The company's officials will meet investors in earnings conference call on November 11.

General Insurance Corporation of India: The company's officials will meet analysts and investors on November 11, to discuss financial results.

Greenply Industries: The company's officials will meet analysts and investors on November 10.

DFM Foods: The company's officials will meet investors and analysts on November 12, to discuss Q2FY22 results.

Stocks in the News

Gail (India): National Company Law Tribunal (NCLT) has granted approval for acquisition of 26% equity stake of Infrastructure Leasing & Financial Services (IL&FS) Group by Gail (India) in ONGC Tripura Power Company (OTPC).

Dhanlaxmi Bank: The bank reported lower net profit at Rs 3.66 crore in Q2FY22 against Rs 14.01 crore in Q2FY21, net interest income increased to Rs 90.66 crore from Rs 88.66 crore YoY.

Grasim Industries: The company has successfully commissioned Chloromethane (CMS) project at Vilayat Unit, Gujarat, having

capacity of 150 ton per day (TPD) or 50,000 ton per annum (TPA). This will result into an additional annualised revenue of around Rs 400 crore.

NMDC: The company has fixed prices of iron ore. Lump ore price is at Rs 5,950 per ton, and fines rate at Rs 4,760 per ton.

SJVN: The company has bagged 100 MW Grid connected solar PV power project from Punjab State Power Corporation (PSPCL) through tariff based competitive bidding process, on build own and operate (BOO). The tentative cost of construction of this project is Rs 545 crore.

Sun TV Network: The company reported higher consolidated profit at Rs 395.55 crore in Q2FY22 against Rs 335.02 crore in Q2FY21, revenue jumped to Rs 848.67 crore from Rs 768.69 crore YoY.

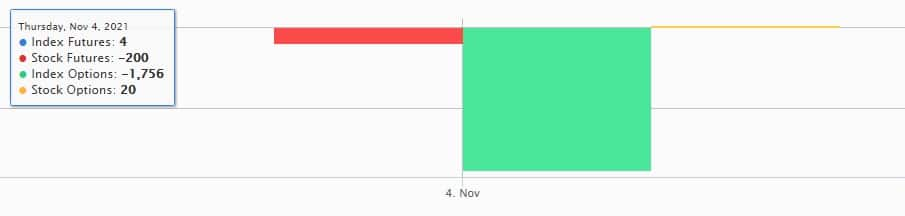

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 328.11 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 38.25 crore in the Indian equity market on November 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Escorts and Punjab National Bank - are under the F&O ban for November 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!