The market closed an otherwise volatile session with moderate gains on September 9, but the broader market continued to outshine key benchmarks. Select FMCG, IT and metal stocks led the support to the market, whereas select banks and pharma stocks saw selling pressure.

The BSE Sensex climbed 54.81 points to 58,305.07, while the Nifty50 was up 15.80 points at 17,369.30 and formed bullish candle on the daily charts as the closing was higher than opening levels. The index during the week gained third of a percent and formed Doji kind of candle on the weekly scale.

"Due to lack of follow-through buying interest, benchmark Nifty consolidated in the range of 17,250-17,450 levels. While the medium-term trend is still positive, traders may prefer to book profits near resistance levels due to an overstretched rally," said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

"For the bulls, 17,250 and 17,200 would be key support levels. Above the same, the uptrend formation is likely to continue up to 17,450-17,650 levels. On the flip side, dismissal of 17,200 may fuel further weakness up to 17,100-17,000 levels," he added.

Positional traders can take a contra bet near 17,000 support with a strict stop loss at 16,930, he advised.

On the broader markets front, the Nifty Midcap 100 index was up 0.29 percent and Smallcap 100 index rose 0.64 percent.

The market was shut on Friday for Ganesh Chaturthi.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,321.37, followed by 17,273.53. If the index moves up, the key resistance levels to watch out for are 17,398.37 and 17,427.53.

Nifty Bank

The Nifty Bank fell 85 points to close at 36,683.20 on September 9. The important pivot level, which will act as crucial support for the index, is placed at 36,547.53, followed by 36,411.86. On the upside, key resistance levels are placed at 36,838.03 and 36,992.86 levels.

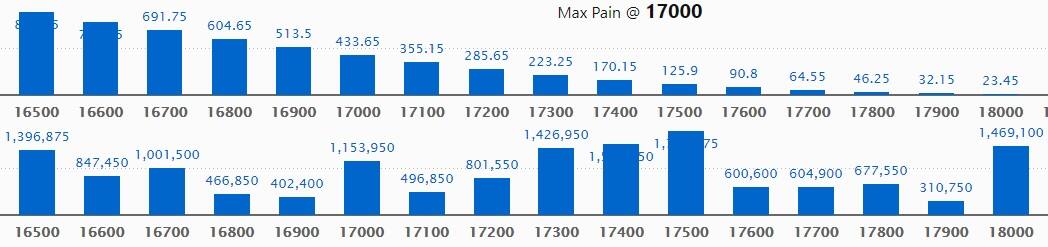

Call option data

Maximum Call open interest of 17.98 lakh contracts was seen at 17500 strike, which will act as a crucial resistance level in the September series.

This is followed by 17400 strike, which holds 15.10 lakh contracts, and 18000 strike, which has accumulated 14.69 lakh contracts.

Call writing was seen at 18000 strike, which added 1 lakh contracts, followed by 18100 strike, which added 48,450 contracts and 17700 strike which added 46,250 contracts.

Call unwinding was seen at 17800 strike, which shed 1.49 lakh contracts, followed by 17100 strike, which shed 13,750 contracts, and 16,600 strike which shed 10,750 contracts.

Put option data

Maximum Put open interest of 42.42 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the September series.

This is followed by 16500 strike, which holds 28.05 lakh contracts, and 17200 strike, which has accumulated 18.36 lakh contracts.

Put writing was seen at 17300 strike, which added 1.43 lakh contracts, followed by 17200 strike which added 1.38 lakh contracts, and 16900 strike which added 1.13 lakh contracts.

Put unwinding was seen at 16700 strike, which shed 32,700 contracts, followed by 17800 strike which shed 2,200 contracts and 16500 strike which shed 675 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

45 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

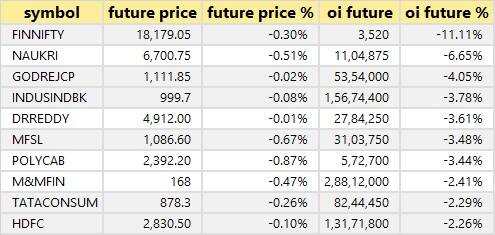

38 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

48 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

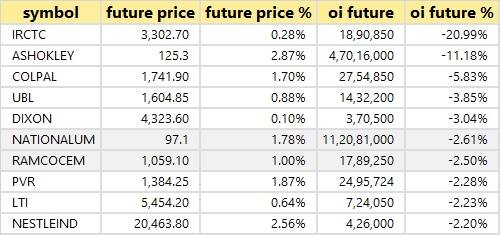

39 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

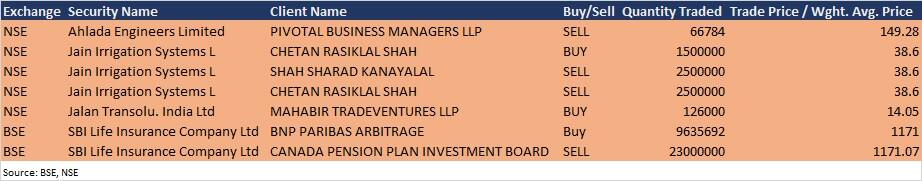

Bulk deals

SBI Life Insurance Company: Canada Pension Plan Investment Board has offloaded 2.3 crore equity shares in SBI Life at Rs 1,171.07 per equity share, whereas BNP Paribas Arbitrage acquired 96,35,692 equity shares at Rs 1,171 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

DCM Shriram: The company's officials will meet investors in Ashwamedh - Elara India Dialogue 2021 on September 13.

Poonawalla Fincorp: The company's officials will meet Acacia Partners on September 13.

Indus Towers: The company's officials will meet investors in Annual CITIC CLSA Flagship Investors' Forum 2021 (Asia) on September 13 and September 14.

PNB Housing Finance: The company's officials will meet investors in Ashwamedh - Elara India Dialogue 2021 on September 13, and Motilal Oswal Annual Global Investor Conference on September 14.

Dabur India: The company's officials will meet investors in Motilal Oswal Annual Global Investor Conference on September 13.

Polycab India: The company's officials will meet Sharekhan, HSBC, and Mobius Capital on September 13.

Jindal Steel & Power: The company's officials will meet investors in Motilal Oswal Annual Global Investor Conference on September 14.

Tatva Chintan Pharma Chem: The company's officials will meet JM Financial Services on September 14.

Pidilite Industries: The company's officials will meet investors in Motilal Oswal 17th Annual Global Investor Conference 2021 on September 14, in Capital World Investors on September 20, and in IIFL's US / UK virtual conference on September 24.

Phillips Carbon Black: The company's officials will meet institutional investors on September 14 and September 17.

Stocks in News

Arvind SmartSpaces: The company raises Rs 85 crore from HDFC Capital Affordable Real Estate Fund-1 (H-CARE 1) and promoters at a price of Rs 124 per share.

JMC Projects (India): CARE has upgraded the rating of long term bank facilities & non-convertible debentures of the company as 'AA-'; Stable from 'A+'; Stable. Further, it has upgraded the rating of short term bank facilities of the company as 'A1+' from 'A1'.

Hinduja Global Solutions: Crown Commercial Services (CCS) Framework renewed the company's approval to supply contact centre and business services solutions on the CCS Framework in the UK.

Reliance Infrastructure: The company won arbitration award against Delhi Metro Rail Corporation (DMRC). The Supreme Court directed DMRC to pay damages of Rs 2,950 crore plus interest upto the date of payment to Reliance Infrastructure promoted Delhi Airport Metro Express Private Limited (DAMEPL). The proceeds from the arbitral award will be utilized for debt reduction.

Prakash Industries: The company has been declared as successful bidder in respect of Bhaskarpara Coal Mine in the 12th tranche of auction of coal mines.

Dilip Buildcon: Subsidiary Bangalore Malur Highways has received the financial closure from the National Highways Authority of India.

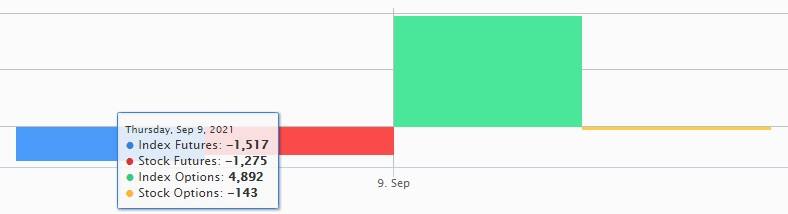

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 423.44 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 704.21 crore in the Indian equity market on September 9, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Indiabulls Housing Finance, IRCTC and NALCO - are under the F&O ban for September 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!